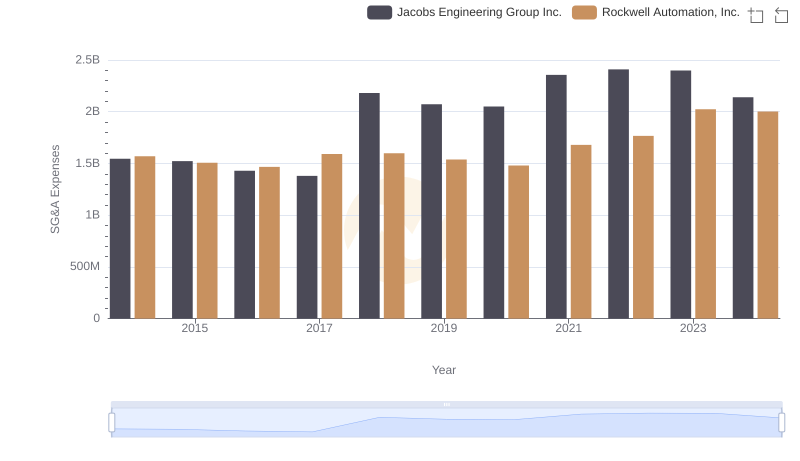

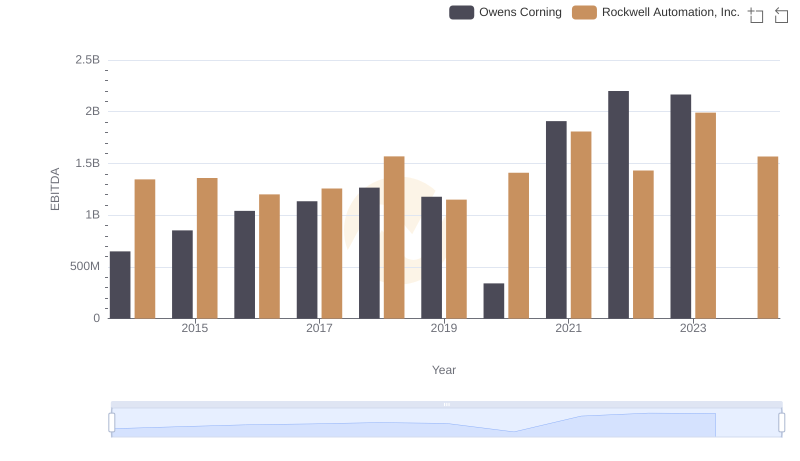

| __timestamp | Owens Corning | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 487000000 | 1570100000 |

| Thursday, January 1, 2015 | 525000000 | 1506400000 |

| Friday, January 1, 2016 | 584000000 | 1467400000 |

| Sunday, January 1, 2017 | 620000000 | 1591500000 |

| Monday, January 1, 2018 | 700000000 | 1599000000 |

| Tuesday, January 1, 2019 | 698000000 | 1538500000 |

| Wednesday, January 1, 2020 | 664000000 | 1479800000 |

| Friday, January 1, 2021 | 757000000 | 1680000000 |

| Saturday, January 1, 2022 | 803000000 | 1766700000 |

| Sunday, January 1, 2023 | 831000000 | 2023700000 |

| Monday, January 1, 2024 | 2002600000 |

Cracking the code

In the ever-evolving landscape of industrial giants, understanding operational costs is crucial. Over the past decade, Rockwell Automation, Inc. and Owens Corning have showcased distinct trends in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Rockwell Automation consistently outpaced Owens Corning, with SG&A expenses peaking at approximately $2 billion in 2023, marking a 29% increase from 2014. In contrast, Owens Corning's expenses grew by 71% over the same period, reaching around $831 million in 2023. This divergence highlights Rockwell's steady growth and Owens Corning's more dynamic expansion. Notably, 2024 data for Owens Corning remains elusive, leaving room for speculation on future trends. As these companies navigate the complexities of the global market, their financial strategies offer valuable insights into operational efficiency and competitive positioning.

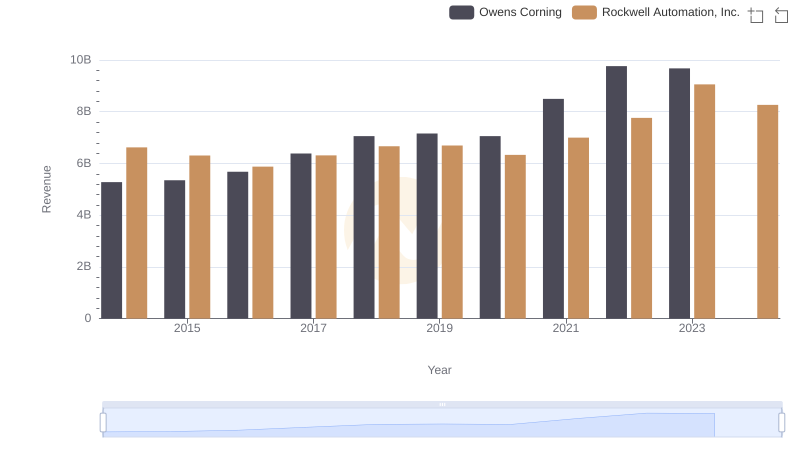

Who Generates More Revenue? Rockwell Automation, Inc. or Owens Corning

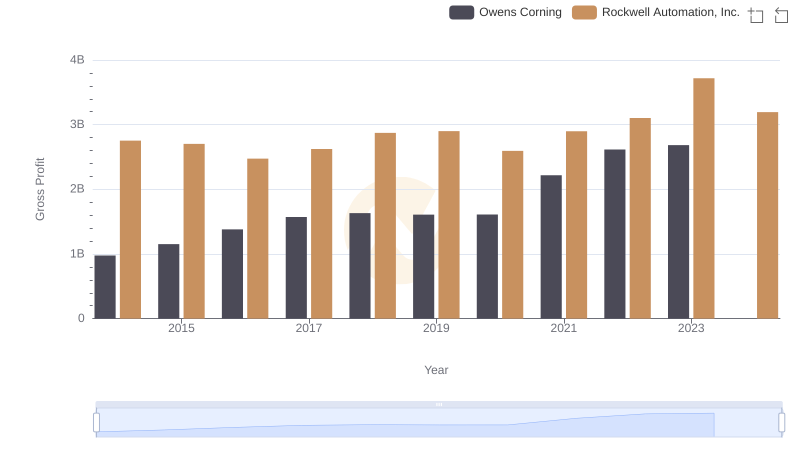

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Owens Corning

Rockwell Automation, Inc. vs Jacobs Engineering Group Inc.: SG&A Expense Trends

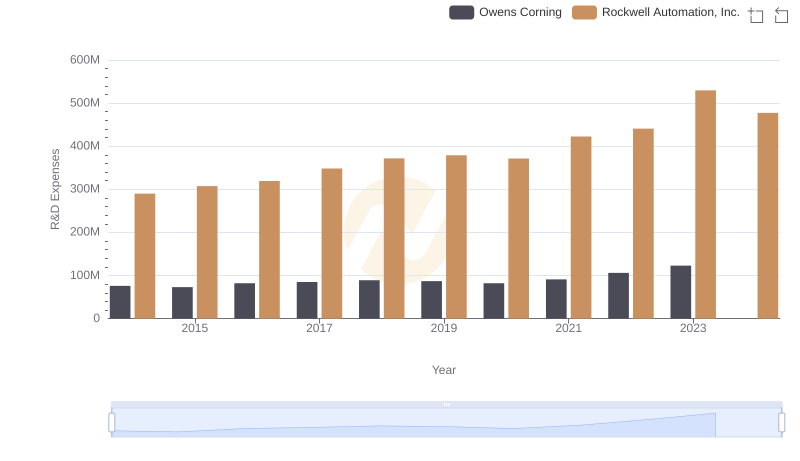

R&D Spending Showdown: Rockwell Automation, Inc. vs Owens Corning

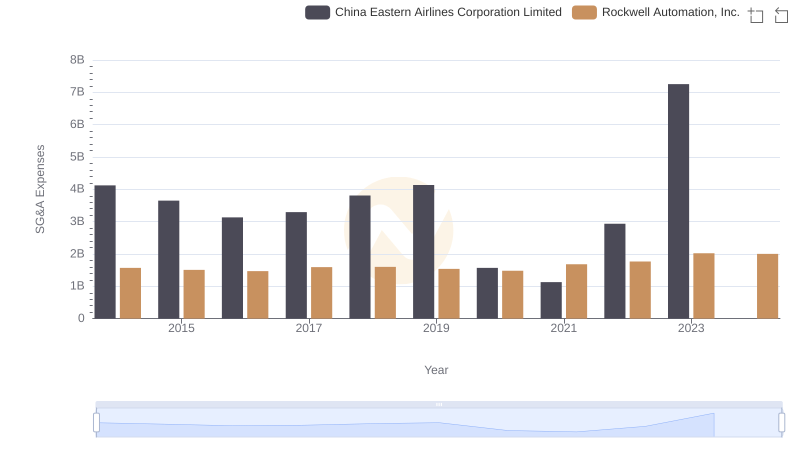

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs China Eastern Airlines Corporation Limited

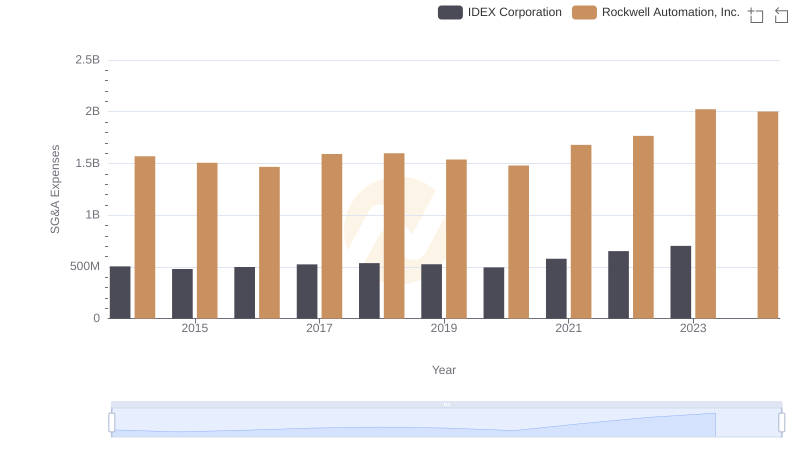

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs IDEX Corporation

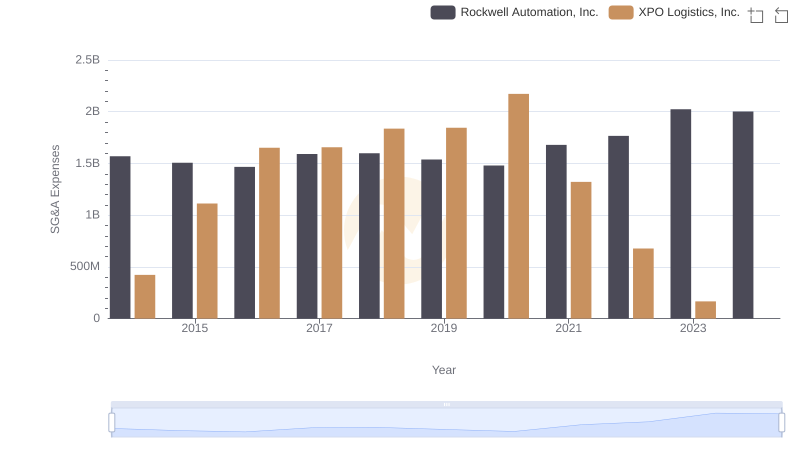

Rockwell Automation, Inc. or XPO Logistics, Inc.: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Expeditors International of Washington, Inc.

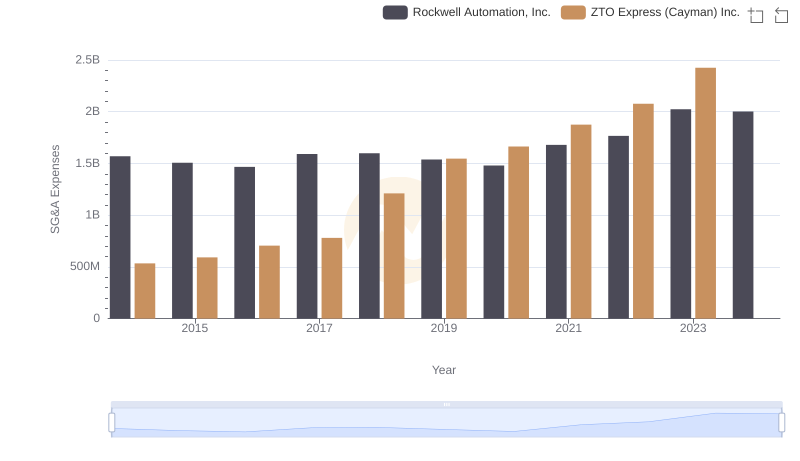

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or ZTO Express (Cayman) Inc.

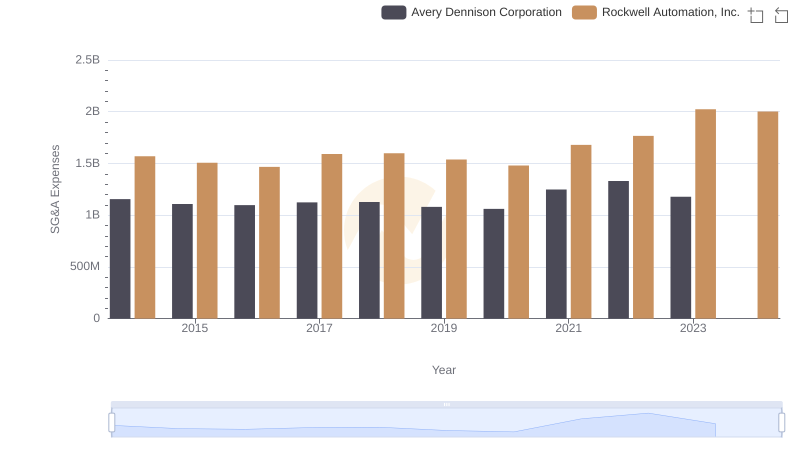

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Avery Dennison Corporation Trends and Insights

EBITDA Analysis: Evaluating Rockwell Automation, Inc. Against Owens Corning