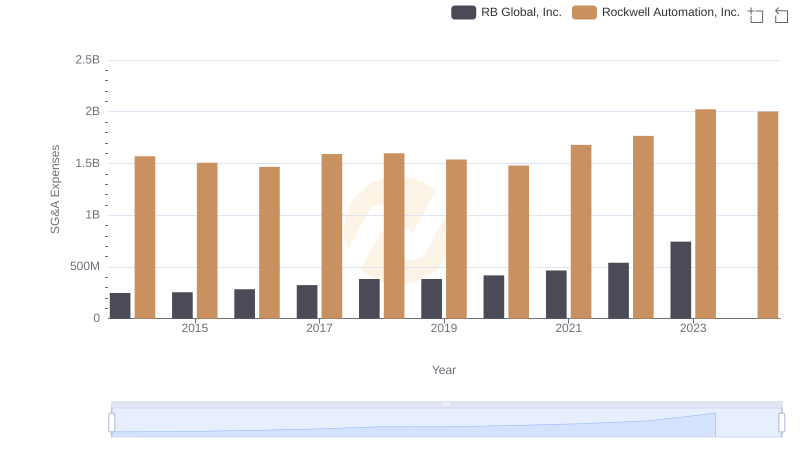

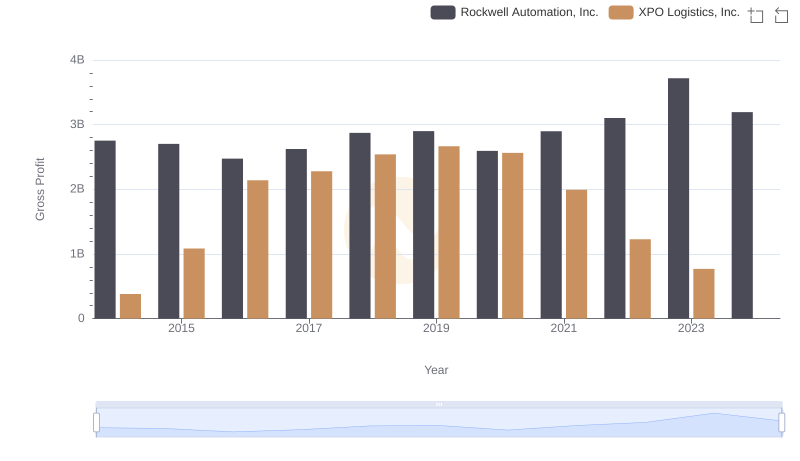

| __timestamp | Rockwell Automation, Inc. | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1570100000 | 422500000 |

| Thursday, January 1, 2015 | 1506400000 | 1113400000 |

| Friday, January 1, 2016 | 1467400000 | 1651200000 |

| Sunday, January 1, 2017 | 1591500000 | 1656500000 |

| Monday, January 1, 2018 | 1599000000 | 1837000000 |

| Tuesday, January 1, 2019 | 1538500000 | 1845000000 |

| Wednesday, January 1, 2020 | 1479800000 | 2172000000 |

| Friday, January 1, 2021 | 1680000000 | 1322000000 |

| Saturday, January 1, 2022 | 1766700000 | 678000000 |

| Sunday, January 1, 2023 | 2023700000 | 167000000 |

| Monday, January 1, 2024 | 2002600000 | 134000000 |

Unleashing the power of data

In the competitive landscape of industrial automation and logistics, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Rockwell Automation, Inc. and XPO Logistics, Inc. have shown contrasting trends in their SG&A management from 2014 to 2023. Rockwell Automation has consistently maintained a steady increase in SG&A expenses, peaking at approximately $2 billion in 2023, reflecting a 29% rise from 2014. In contrast, XPO Logistics experienced a volatile trajectory, with expenses surging to their highest in 2020, before plummeting by over 90% by 2023. This dramatic shift could indicate strategic restructuring or cost-cutting measures. While Rockwell's gradual increase suggests stable growth, XPO's fluctuations highlight the dynamic nature of the logistics industry. Understanding these trends provides valuable insights into each company's operational strategies and financial health.

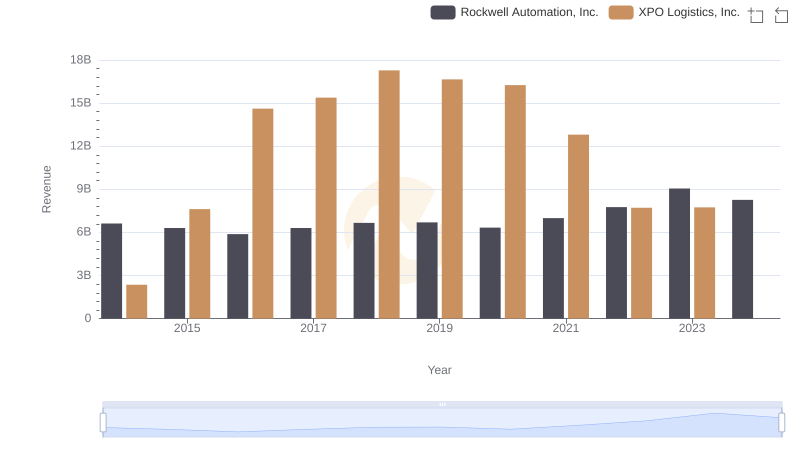

Revenue Showdown: Rockwell Automation, Inc. vs XPO Logistics, Inc.

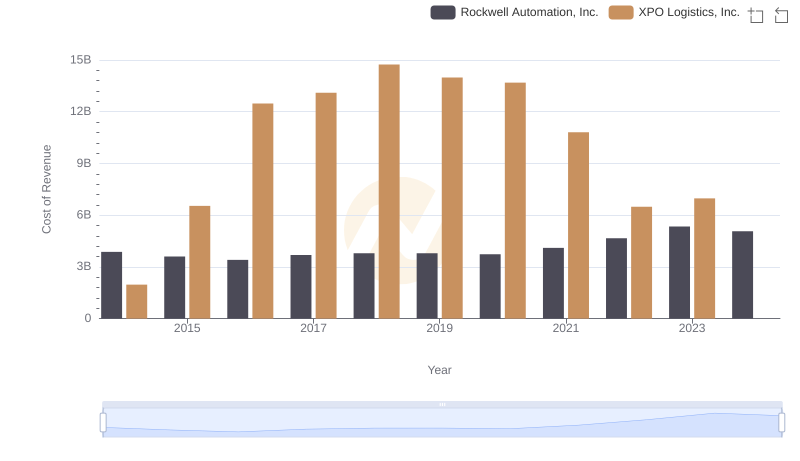

Cost of Revenue: Key Insights for Rockwell Automation, Inc. and XPO Logistics, Inc.

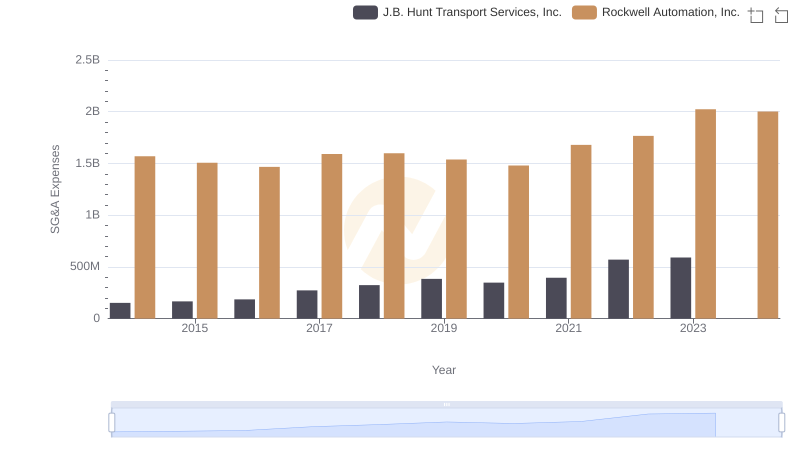

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs J.B. Hunt Transport Services, Inc.

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and RB Global, Inc.

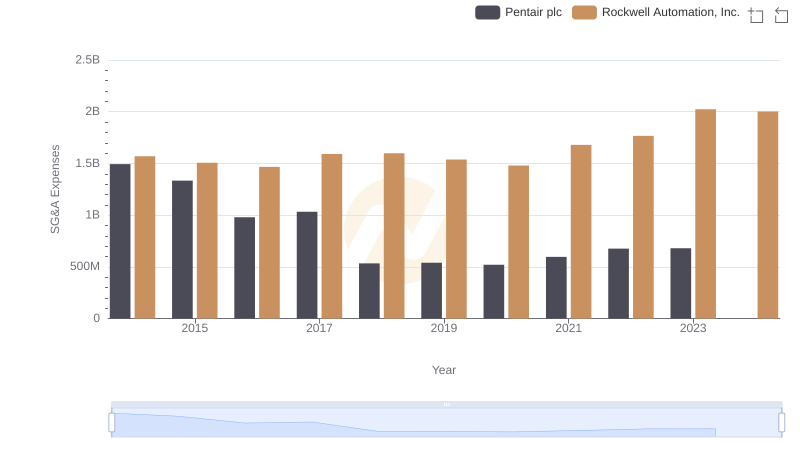

Rockwell Automation, Inc. vs Pentair plc: SG&A Expense Trends

Gross Profit Trends Compared: Rockwell Automation, Inc. vs XPO Logistics, Inc.

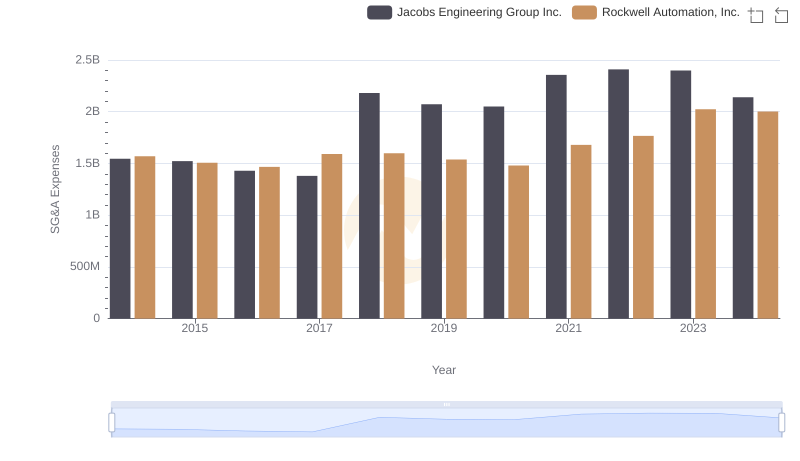

Rockwell Automation, Inc. vs Jacobs Engineering Group Inc.: SG&A Expense Trends

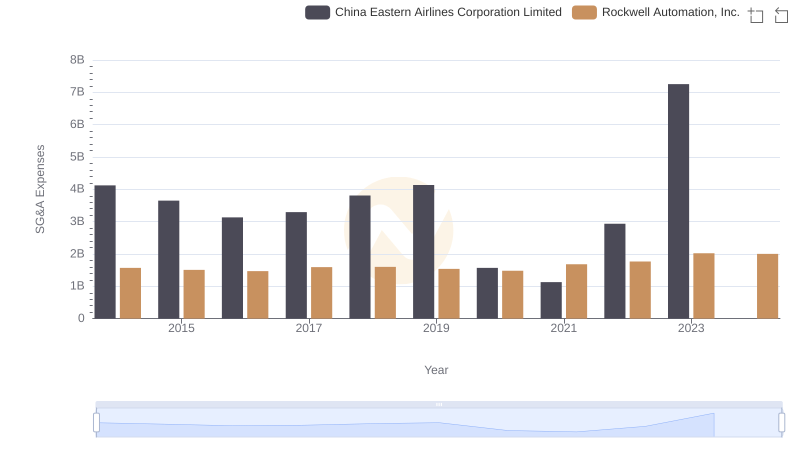

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs China Eastern Airlines Corporation Limited

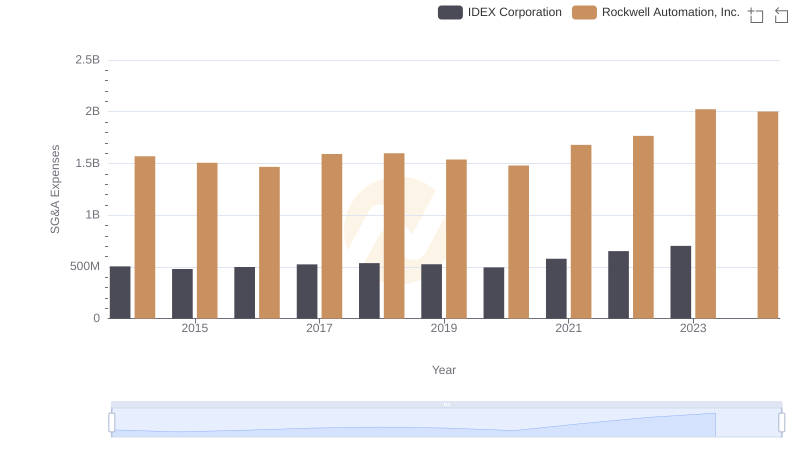

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs IDEX Corporation

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Expeditors International of Washington, Inc.

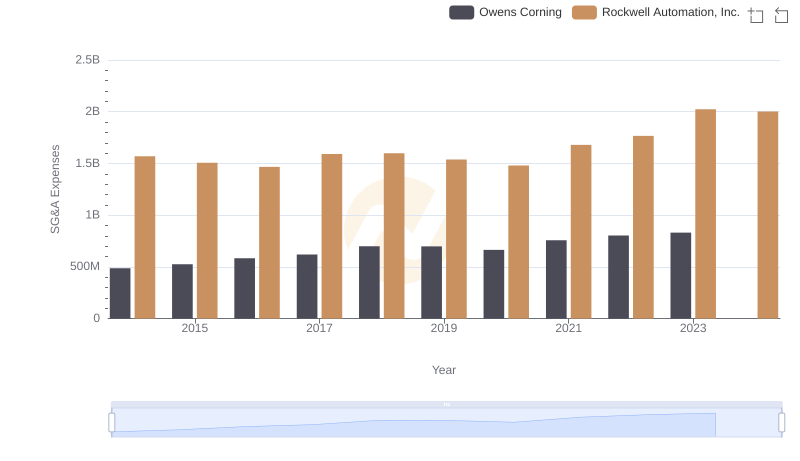

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Owens Corning

Comprehensive EBITDA Comparison: Rockwell Automation, Inc. vs XPO Logistics, Inc.