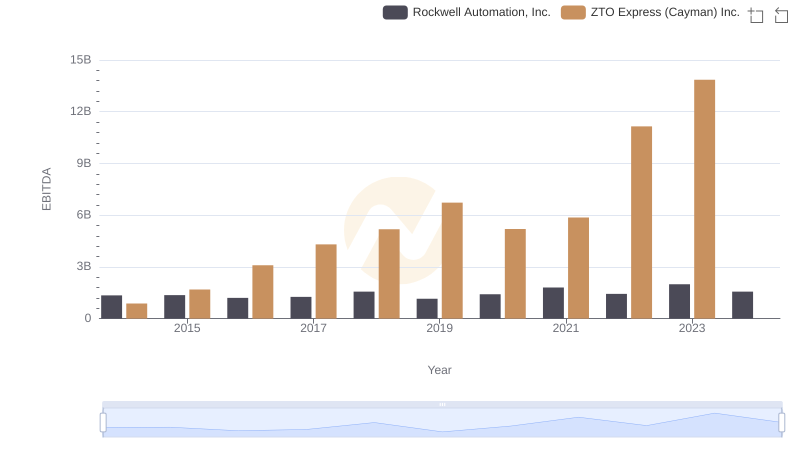

| __timestamp | Rockwell Automation, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1570100000 | 534537000 |

| Thursday, January 1, 2015 | 1506400000 | 591738000 |

| Friday, January 1, 2016 | 1467400000 | 705995000 |

| Sunday, January 1, 2017 | 1591500000 | 780517000 |

| Monday, January 1, 2018 | 1599000000 | 1210717000 |

| Tuesday, January 1, 2019 | 1538500000 | 1546227000 |

| Wednesday, January 1, 2020 | 1479800000 | 1663712000 |

| Friday, January 1, 2021 | 1680000000 | 1875869000 |

| Saturday, January 1, 2022 | 1766700000 | 2077372000 |

| Sunday, January 1, 2023 | 2023700000 | 2425253000 |

| Monday, January 1, 2024 | 2002600000 |

Unleashing the power of data

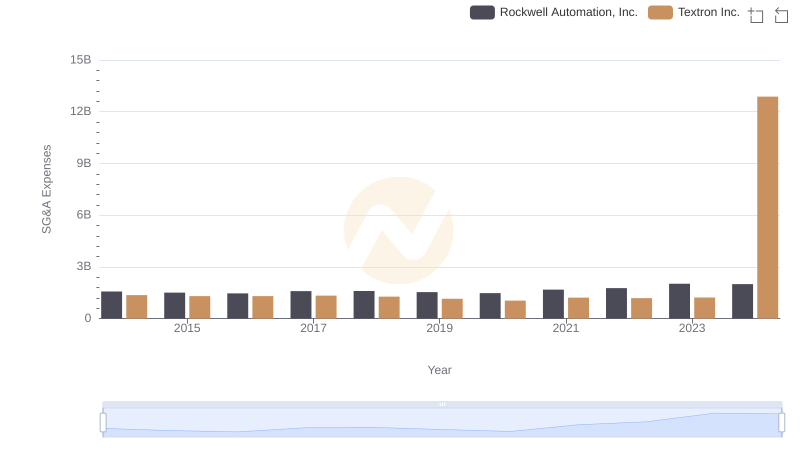

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Rockwell Automation, Inc. and ZTO Express (Cayman) Inc. offer a fascinating study in contrasts. From 2014 to 2023, Rockwell Automation's SG&A expenses grew by approximately 29%, while ZTO Express saw a staggering 354% increase. This dramatic rise for ZTO Express highlights its rapid expansion in the logistics sector, especially in the booming Chinese market. Meanwhile, Rockwell Automation's steadier growth reflects its established presence in industrial automation. Notably, in 2023, ZTO Express's SG&A expenses surpassed Rockwell's by about 20%, indicating a shift in scale and operational complexity. However, data for 2024 is missing for ZTO Express, leaving room for speculation on its future trajectory. This comparison underscores the diverse strategies companies employ to optimize costs in their respective industries.

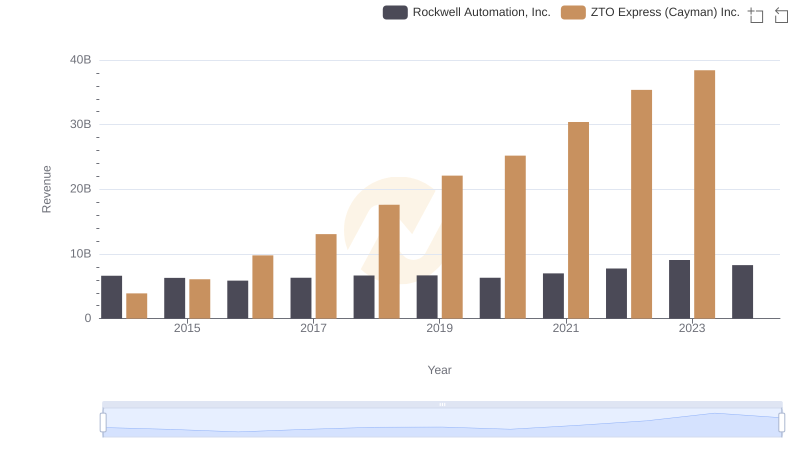

Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.: Annual Revenue Growth Compared

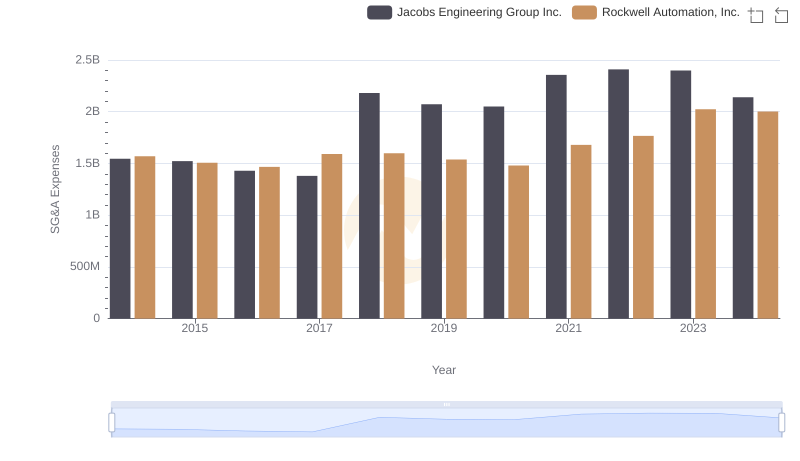

Rockwell Automation, Inc. vs Jacobs Engineering Group Inc.: SG&A Expense Trends

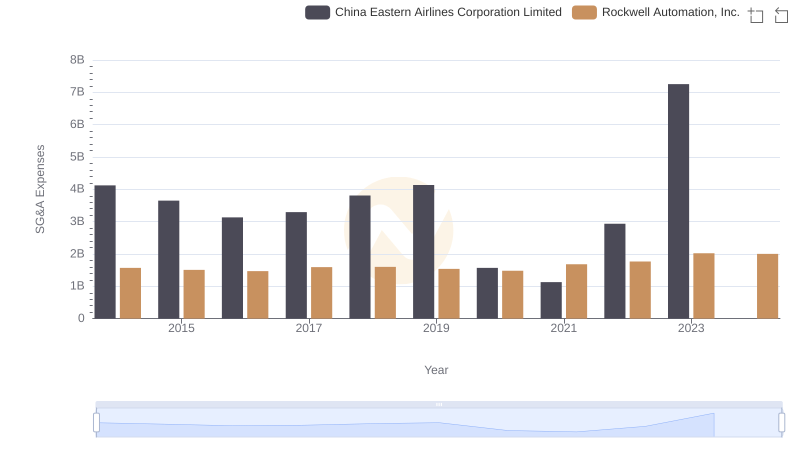

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs China Eastern Airlines Corporation Limited

Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.: Efficiency in Cost of Revenue Explored

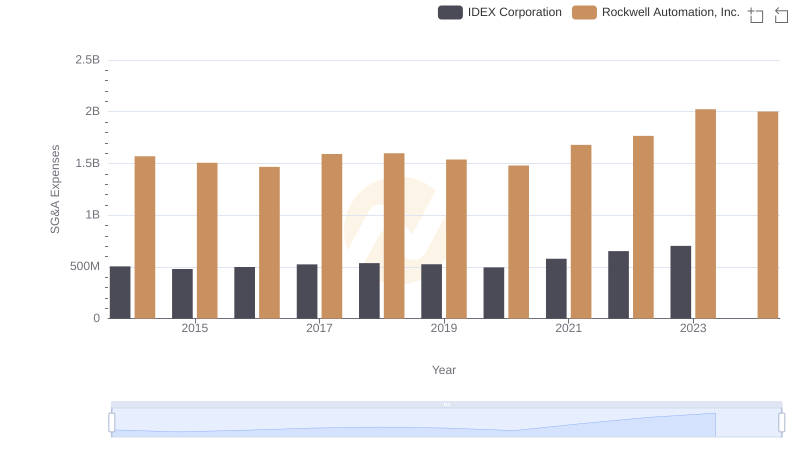

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs IDEX Corporation

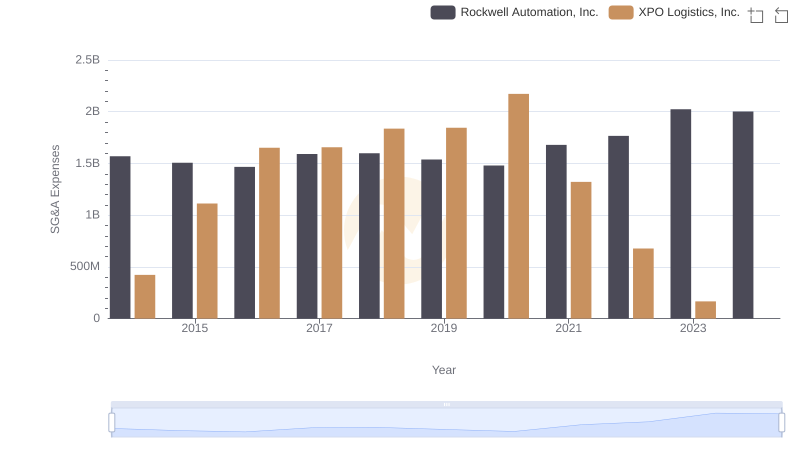

Rockwell Automation, Inc. or XPO Logistics, Inc.: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Expeditors International of Washington, Inc.

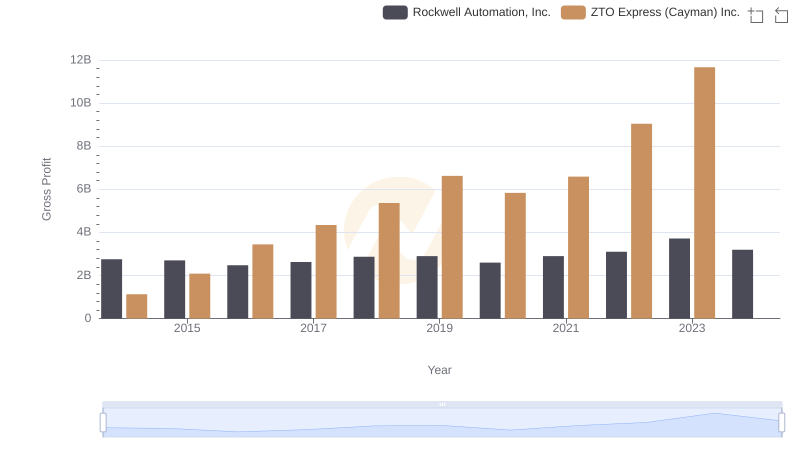

Key Insights on Gross Profit: Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.

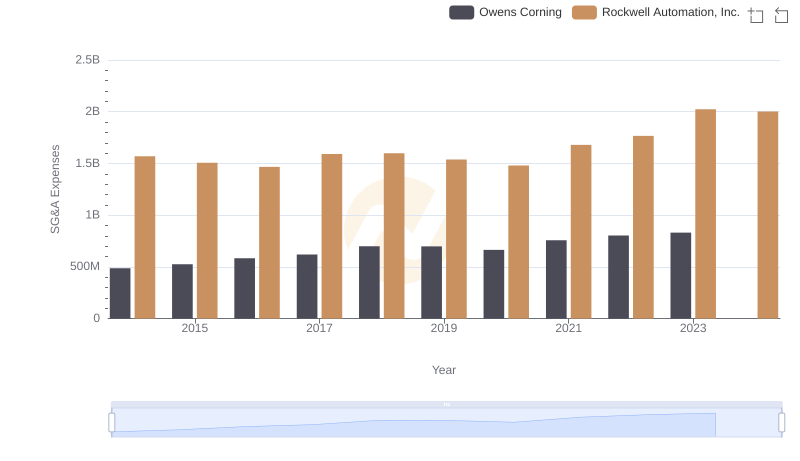

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Owens Corning

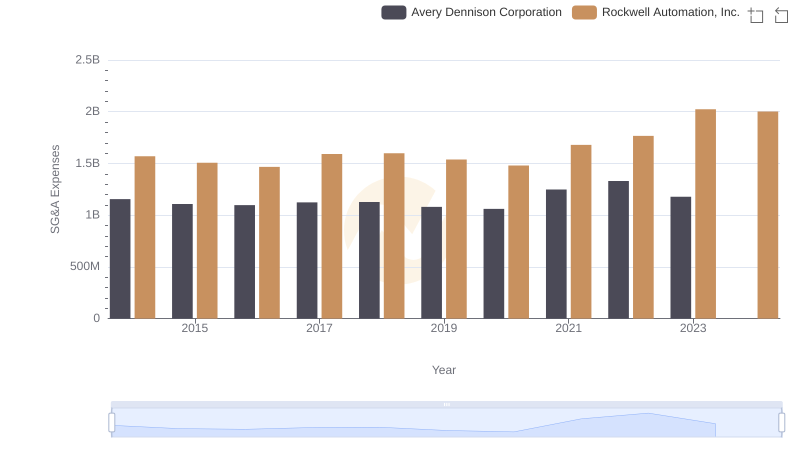

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Avery Dennison Corporation Trends and Insights

EBITDA Performance Review: Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.

Rockwell Automation, Inc. vs Textron Inc.: SG&A Expense Trends