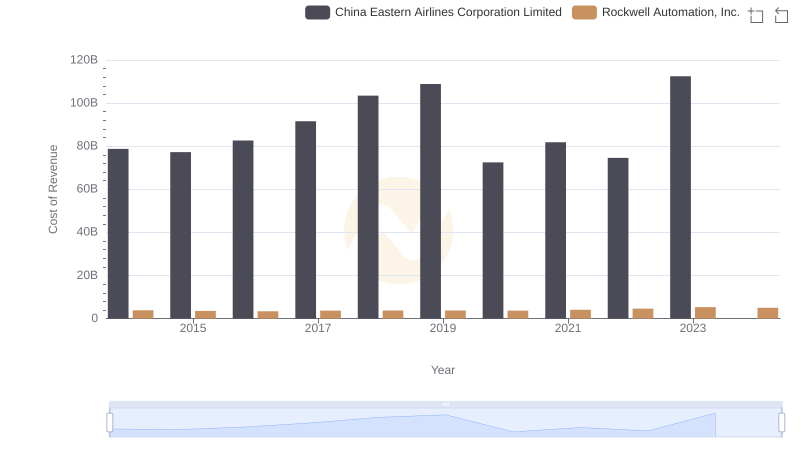

| __timestamp | China Eastern Airlines Corporation Limited | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4120000000 | 1570100000 |

| Thursday, January 1, 2015 | 3651000000 | 1506400000 |

| Friday, January 1, 2016 | 3133000000 | 1467400000 |

| Sunday, January 1, 2017 | 3294000000 | 1591500000 |

| Monday, January 1, 2018 | 3807000000 | 1599000000 |

| Tuesday, January 1, 2019 | 4134000000 | 1538500000 |

| Wednesday, January 1, 2020 | 1570000000 | 1479800000 |

| Friday, January 1, 2021 | 1128000000 | 1680000000 |

| Saturday, January 1, 2022 | 2933000000 | 1766700000 |

| Sunday, January 1, 2023 | 7254000000 | 2023700000 |

| Monday, January 1, 2024 | 2002600000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, understanding the financial dynamics of industry leaders is crucial. Rockwell Automation, Inc., a stalwart in industrial automation, and China Eastern Airlines Corporation Limited, a major player in the aviation sector, offer a fascinating comparison of Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, China Eastern Airlines experienced a rollercoaster in SG&A expenses, peaking in 2023 with a staggering 107% increase from its 2021 low. In contrast, Rockwell Automation maintained a more stable trajectory, with a modest 29% rise over the same period. This disparity highlights the volatile nature of the aviation industry compared to the steady growth in industrial automation.

As we look to the future, these trends offer valuable insights into the financial strategies and market conditions shaping these two diverse sectors.

Cost of Revenue: Key Insights for Rockwell Automation, Inc. and China Eastern Airlines Corporation Limited

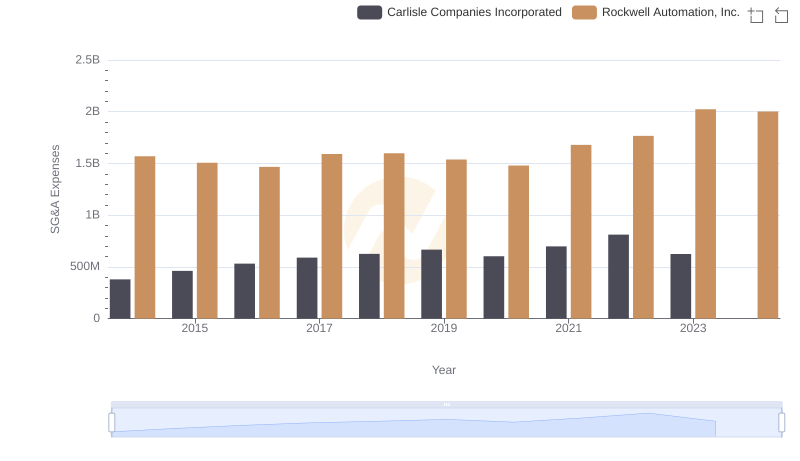

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and Carlisle Companies Incorporated

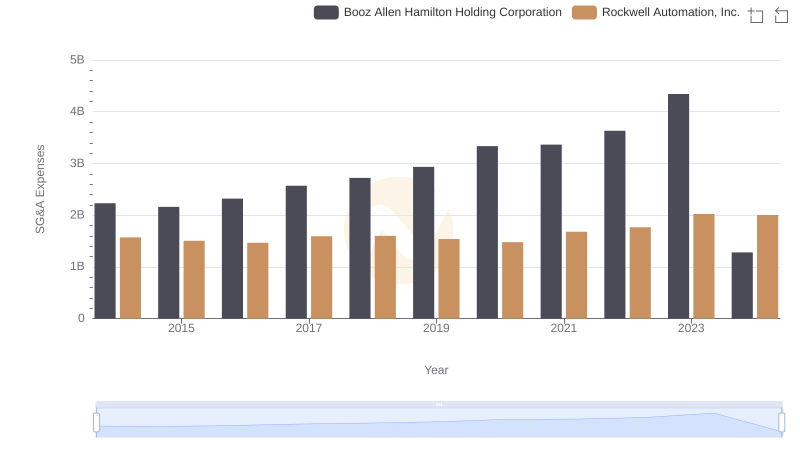

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and Booz Allen Hamilton Holding Corporation

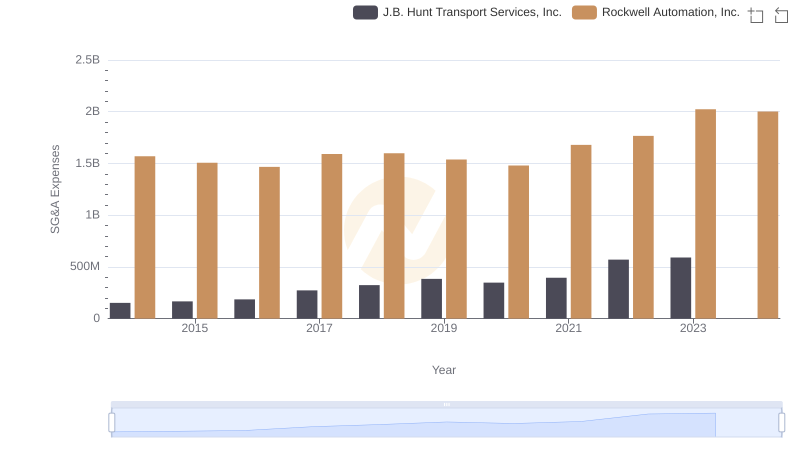

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs J.B. Hunt Transport Services, Inc.

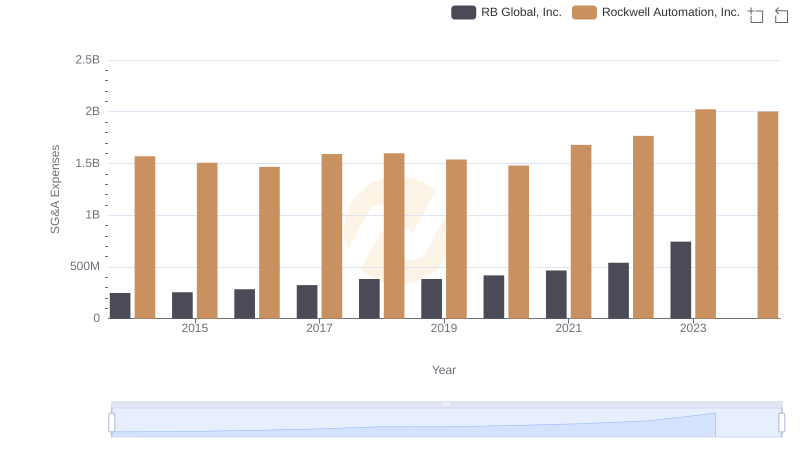

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and RB Global, Inc.

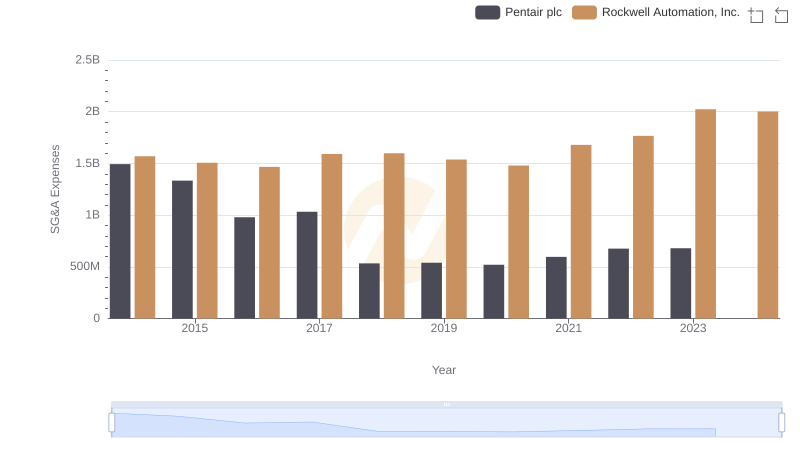

Rockwell Automation, Inc. vs Pentair plc: SG&A Expense Trends

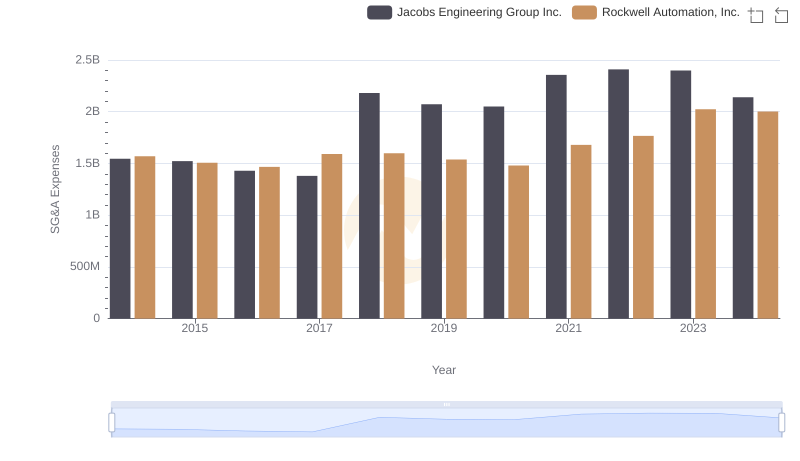

Rockwell Automation, Inc. vs Jacobs Engineering Group Inc.: SG&A Expense Trends

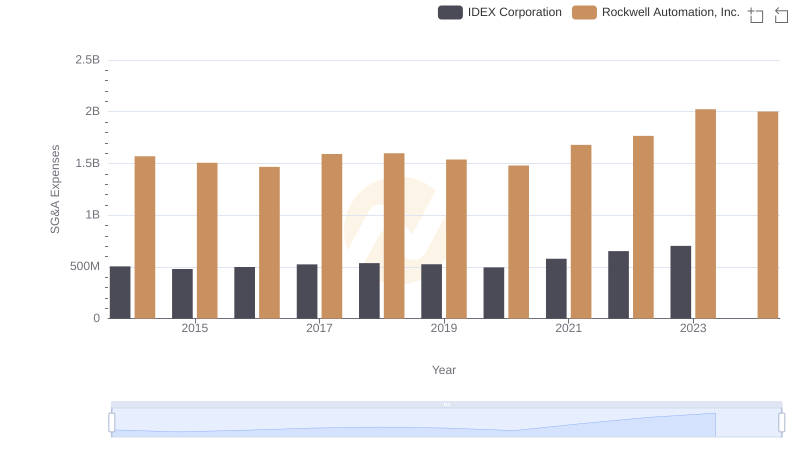

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs IDEX Corporation

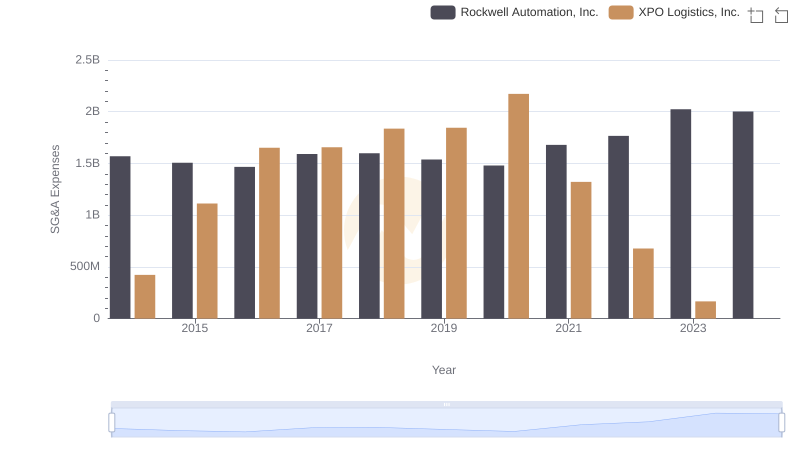

Rockwell Automation, Inc. or XPO Logistics, Inc.: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Rockwell Automation, Inc. and Expeditors International of Washington, Inc.

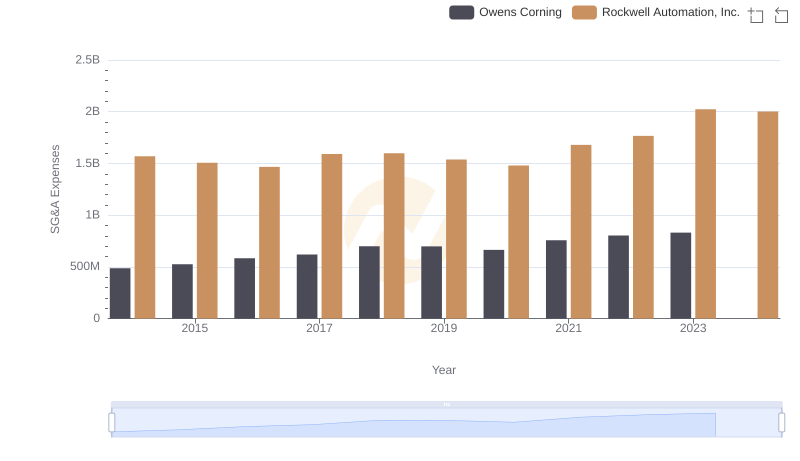

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Owens Corning