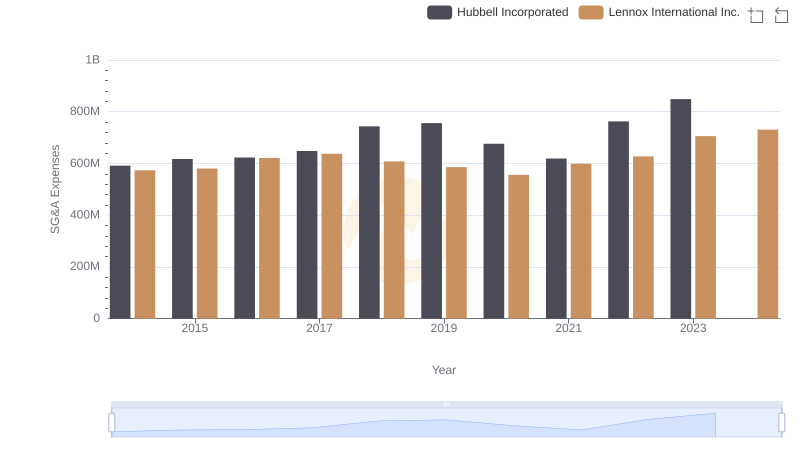

| __timestamp | AerCap Holdings N.V. | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 299900000 | 573700000 |

| Thursday, January 1, 2015 | 381308000 | 580500000 |

| Friday, January 1, 2016 | 351012000 | 621000000 |

| Sunday, January 1, 2017 | 348291000 | 637700000 |

| Monday, January 1, 2018 | 305226000 | 608200000 |

| Tuesday, January 1, 2019 | 267458000 | 585900000 |

| Wednesday, January 1, 2020 | 242161000 | 555900000 |

| Friday, January 1, 2021 | 317888000 | 598900000 |

| Saturday, January 1, 2022 | 399530000 | 627200000 |

| Sunday, January 1, 2023 | 464128000 | 705500000 |

| Monday, January 1, 2024 | 730600000 |

Unleashing the power of data

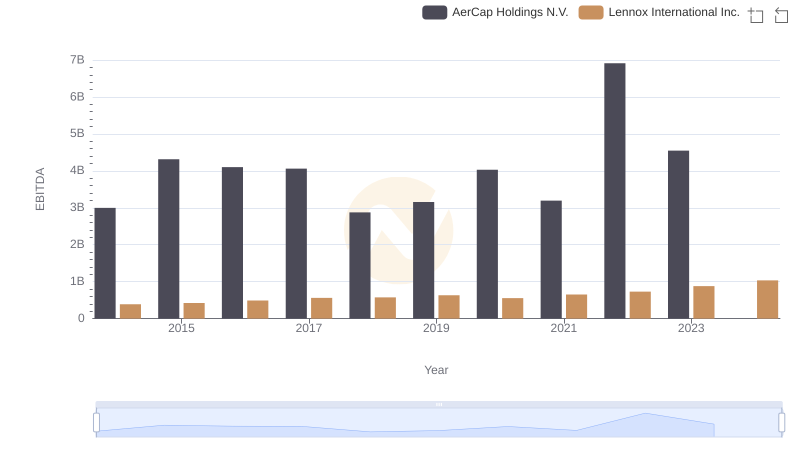

In the world of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Lennox International Inc. and AerCap Holdings N.V. from 2014 to 2023. Lennox International consistently outpaces AerCap, with SG&A expenses averaging 84% higher over the decade. Notably, Lennox's expenses peaked in 2023, reaching a staggering 7.1 billion, marking a 23% increase from 2014. Meanwhile, AerCap's expenses showed a more volatile trend, with a significant 54% rise from 2014 to 2023, peaking at 4.6 billion. The data for 2024 is incomplete, but Lennox's upward trajectory suggests continued growth. This comparison highlights the strategic financial management differences between the two companies, offering insights into their operational priorities and market strategies.

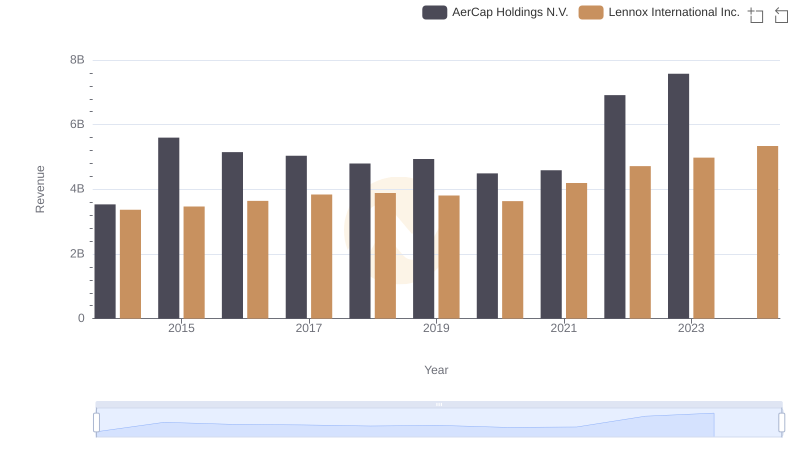

Annual Revenue Comparison: Lennox International Inc. vs AerCap Holdings N.V.

Analyzing Cost of Revenue: Lennox International Inc. and AerCap Holdings N.V.

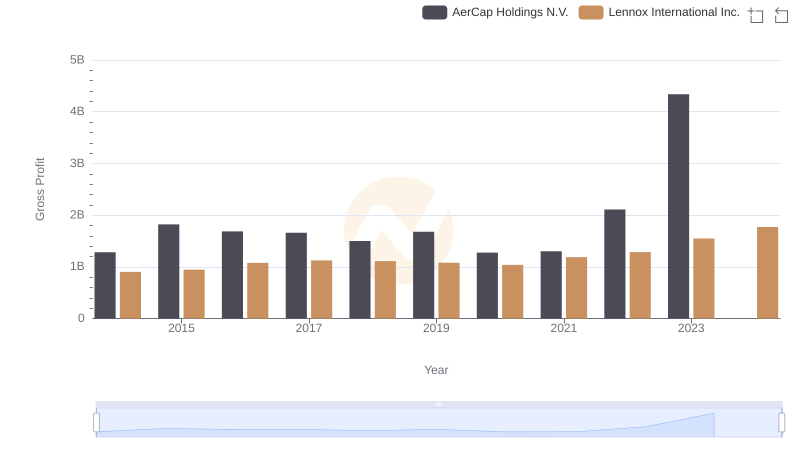

Gross Profit Trends Compared: Lennox International Inc. vs AerCap Holdings N.V.

Breaking Down SG&A Expenses: Lennox International Inc. vs Hubbell Incorporated

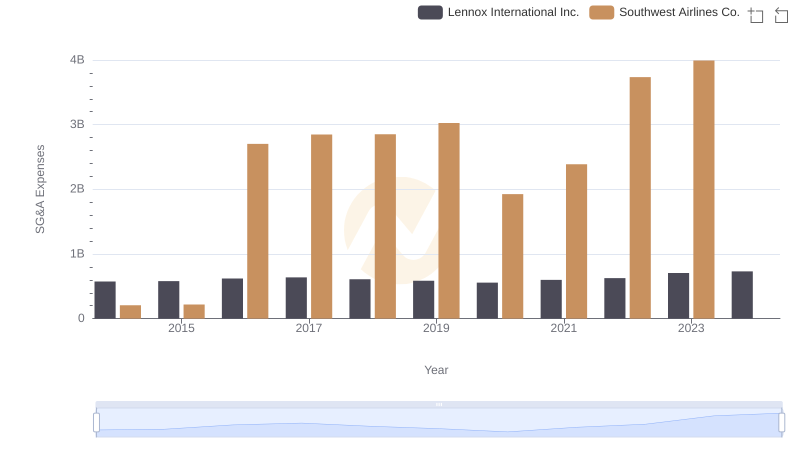

Cost Management Insights: SG&A Expenses for Lennox International Inc. and Southwest Airlines Co.

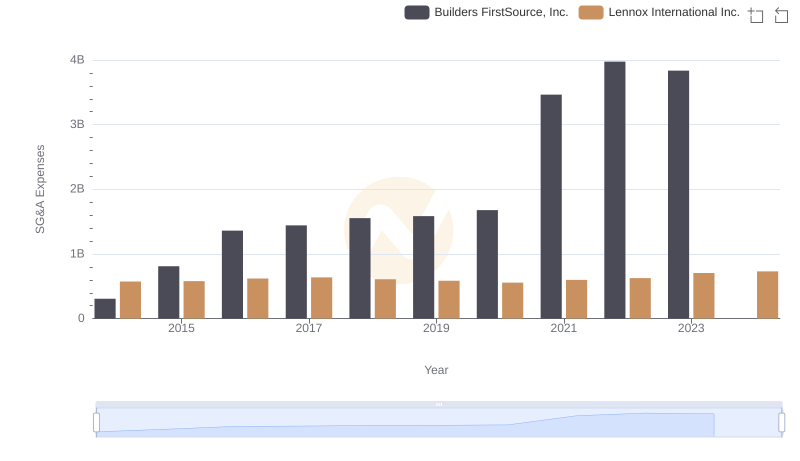

Lennox International Inc. or Builders FirstSource, Inc.: Who Manages SG&A Costs Better?

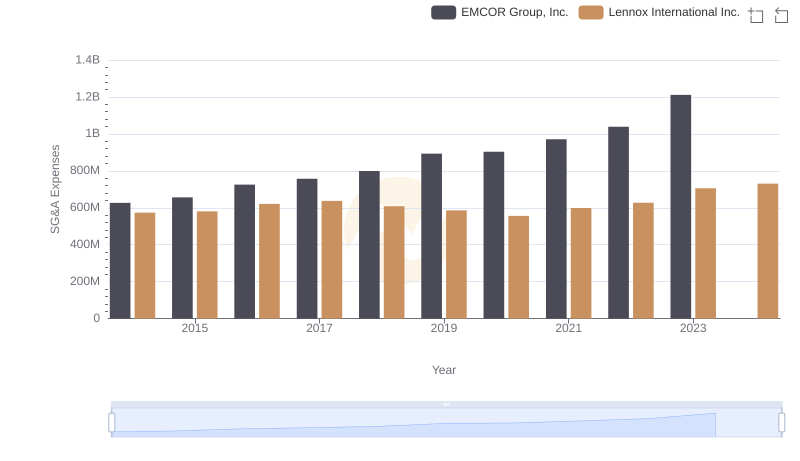

Who Optimizes SG&A Costs Better? Lennox International Inc. or EMCOR Group, Inc.

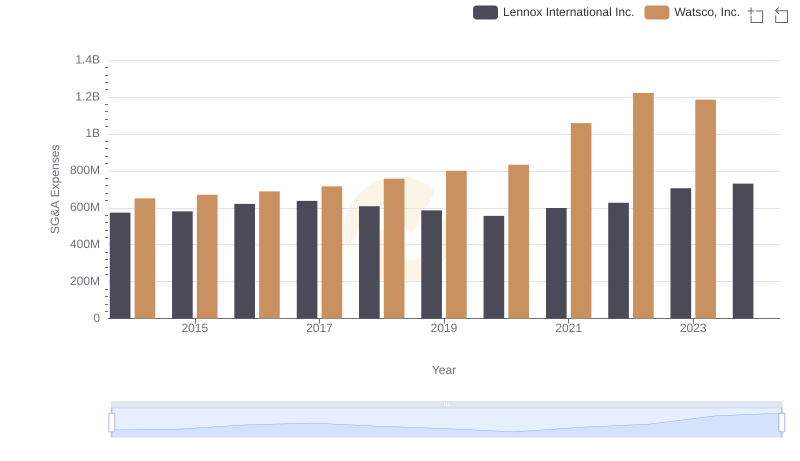

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and Watsco, Inc.

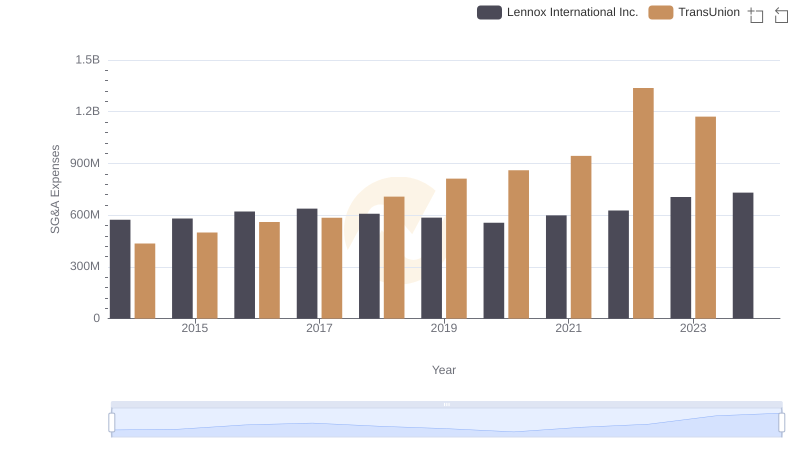

SG&A Efficiency Analysis: Comparing Lennox International Inc. and TransUnion

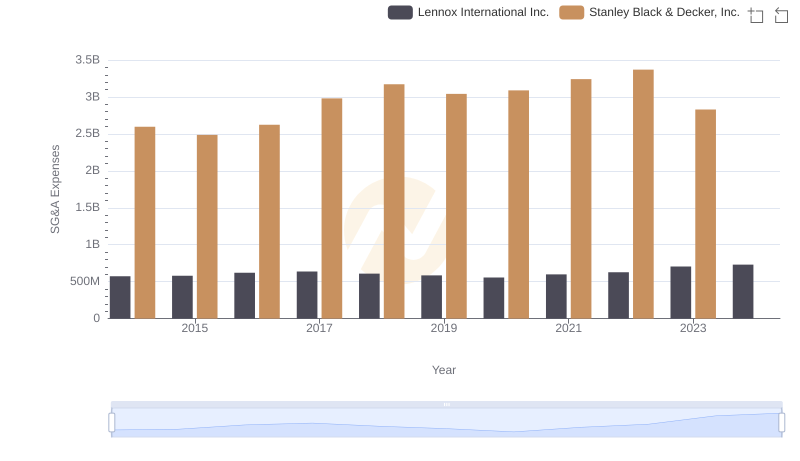

Who Optimizes SG&A Costs Better? Lennox International Inc. or Stanley Black & Decker, Inc.

EBITDA Analysis: Evaluating Lennox International Inc. Against AerCap Holdings N.V.

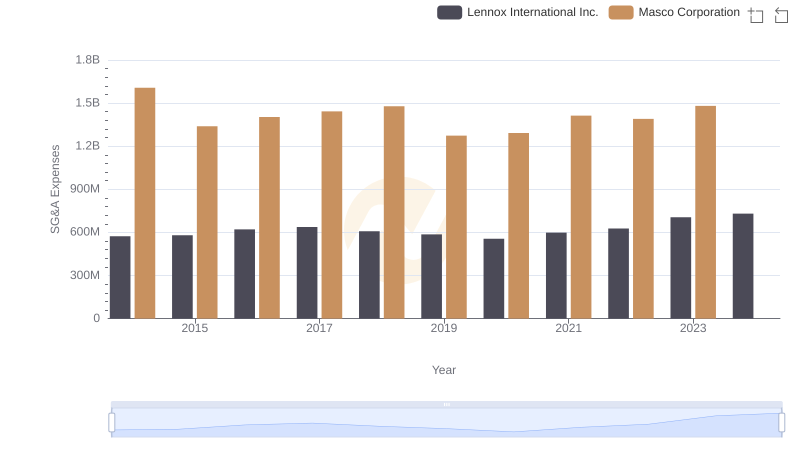

Lennox International Inc. or Masco Corporation: Who Manages SG&A Costs Better?