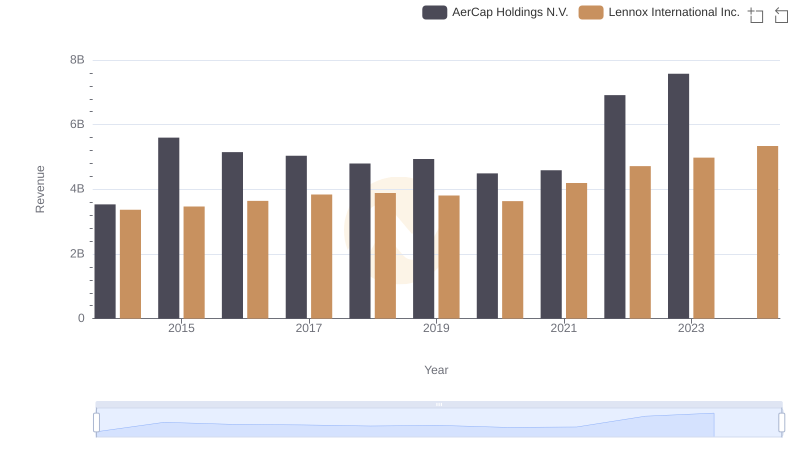

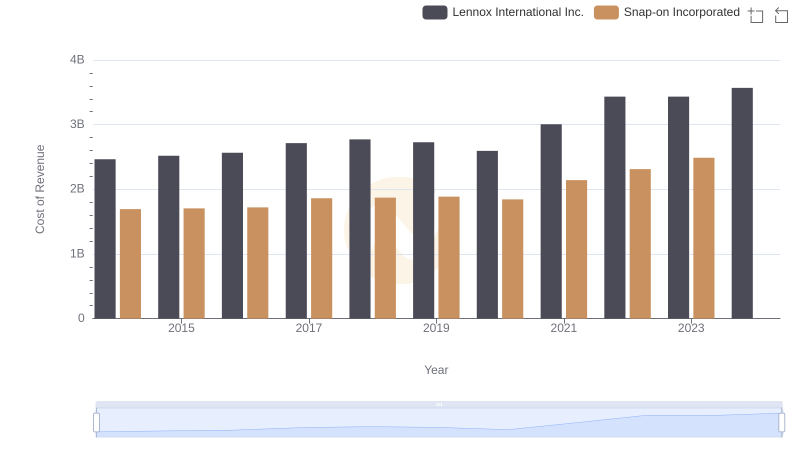

| __timestamp | AerCap Holdings N.V. | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2252878000 | 2464100000 |

| Thursday, January 1, 2015 | 3776407000 | 2520000000 |

| Friday, January 1, 2016 | 3465727000 | 2565100000 |

| Sunday, January 1, 2017 | 3377439000 | 2714400000 |

| Monday, January 1, 2018 | 3299635000 | 2772700000 |

| Tuesday, January 1, 2019 | 3259091000 | 2727400000 |

| Wednesday, January 1, 2020 | 3217133000 | 2594000000 |

| Friday, January 1, 2021 | 3287413000 | 3005700000 |

| Saturday, January 1, 2022 | 4805277000 | 3433700000 |

| Sunday, January 1, 2023 | 3237016000 | 3434100000 |

| Monday, January 1, 2024 | 3569400000 |

Unleashing the power of data

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's financial health. Lennox International Inc. and AerCap Holdings N.V., two industry leaders, offer a fascinating study in contrasts. From 2014 to 2023, Lennox International's cost of revenue grew by approximately 40%, peaking in 2023. In contrast, AerCap Holdings experienced a more volatile journey, with a notable spike in 2022, reaching a 45% increase from its 2014 figures. This fluctuation highlights the dynamic nature of the aviation leasing industry compared to the more stable growth in the HVAC sector. Notably, 2024 data for AerCap is missing, leaving room for speculation on future trends. As businesses navigate economic uncertainties, these insights provide a window into strategic financial management.

Annual Revenue Comparison: Lennox International Inc. vs AerCap Holdings N.V.

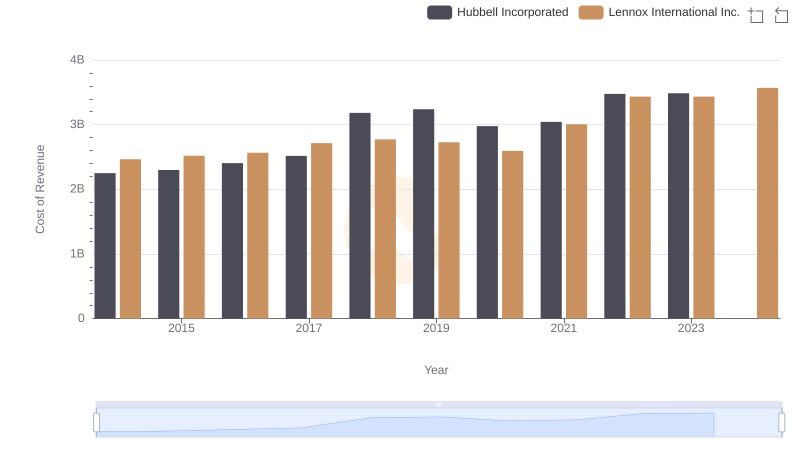

Cost of Revenue Comparison: Lennox International Inc. vs Hubbell Incorporated

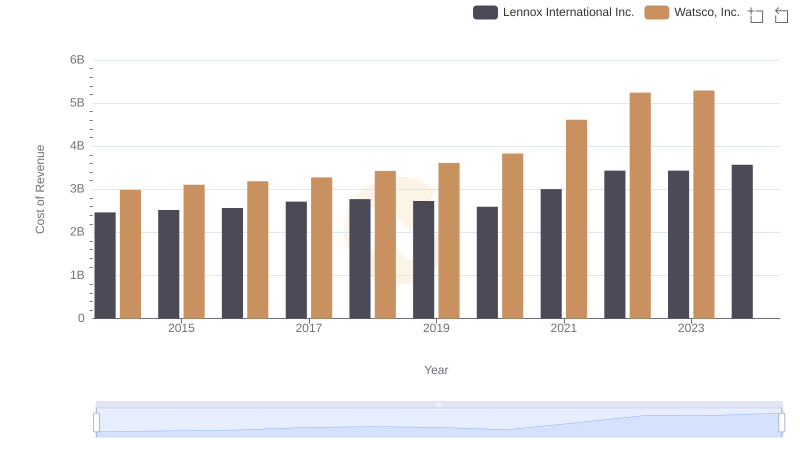

Cost of Revenue Trends: Lennox International Inc. vs Watsco, Inc.

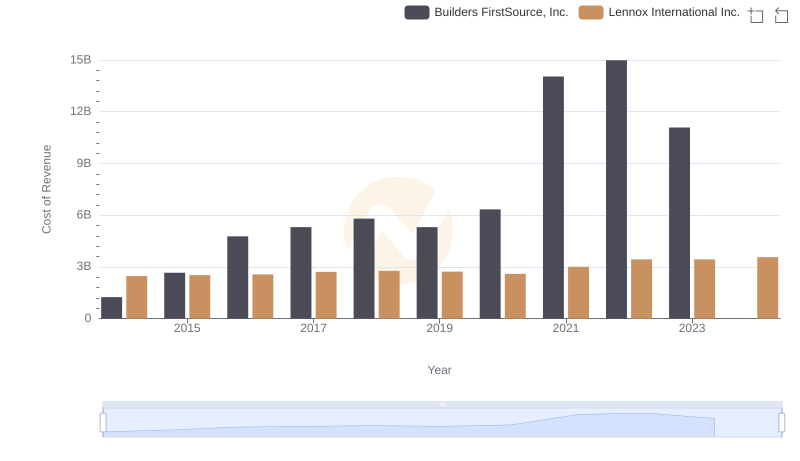

Cost Insights: Breaking Down Lennox International Inc. and Builders FirstSource, Inc.'s Expenses

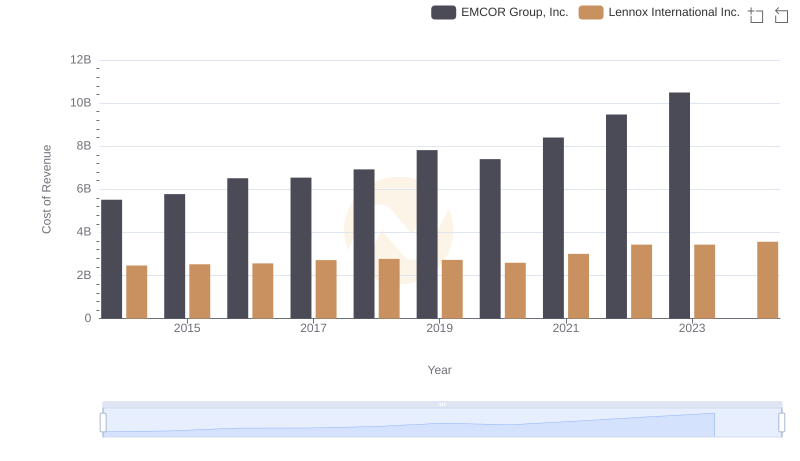

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs EMCOR Group, Inc.

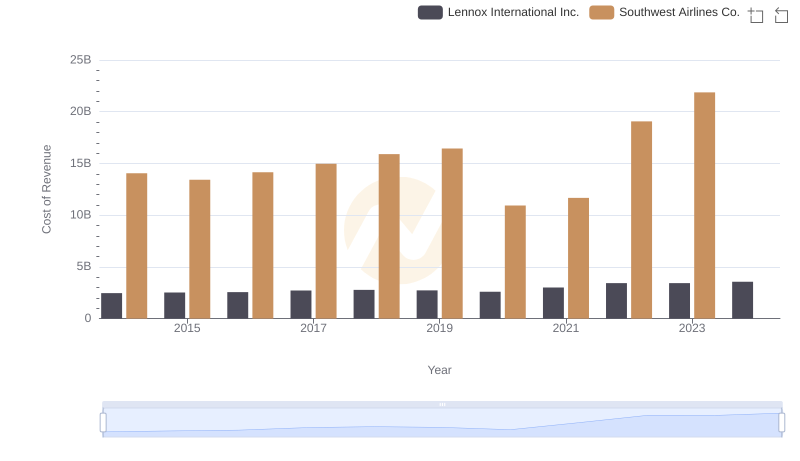

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs Southwest Airlines Co.

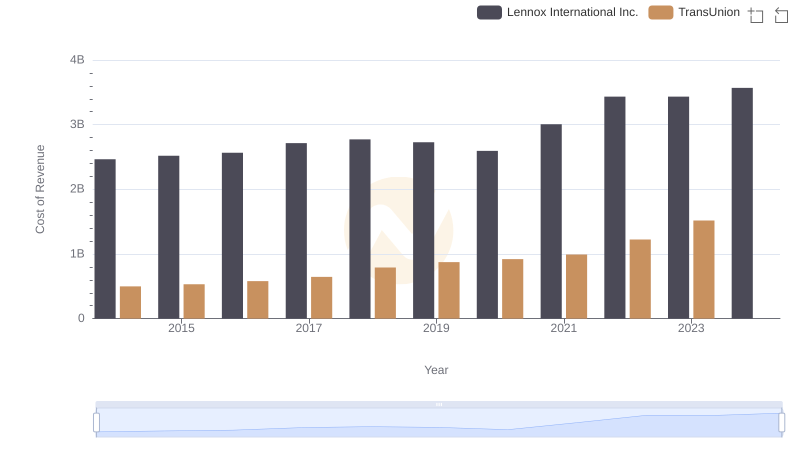

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs TransUnion

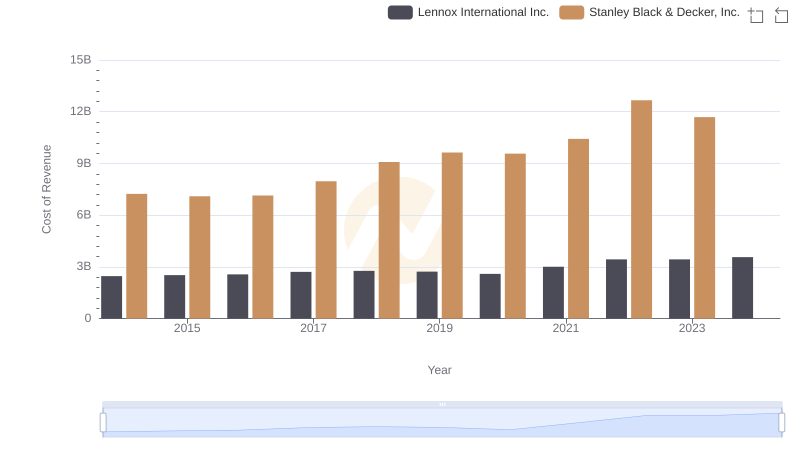

Lennox International Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

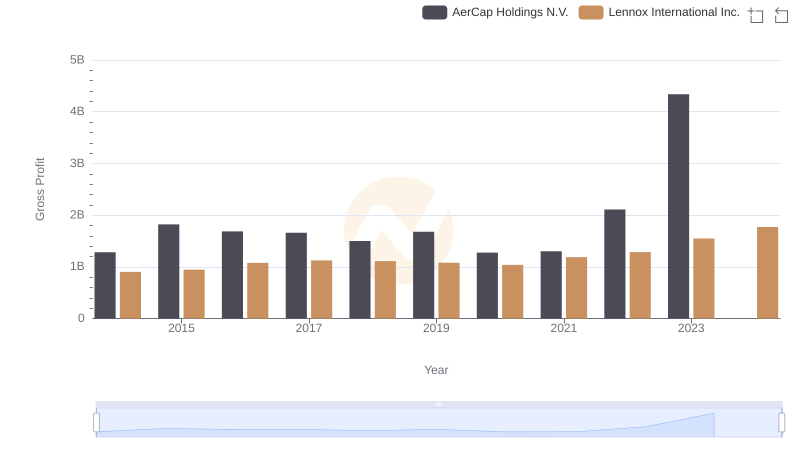

Gross Profit Trends Compared: Lennox International Inc. vs AerCap Holdings N.V.

Cost Insights: Breaking Down Lennox International Inc. and Snap-on Incorporated's Expenses

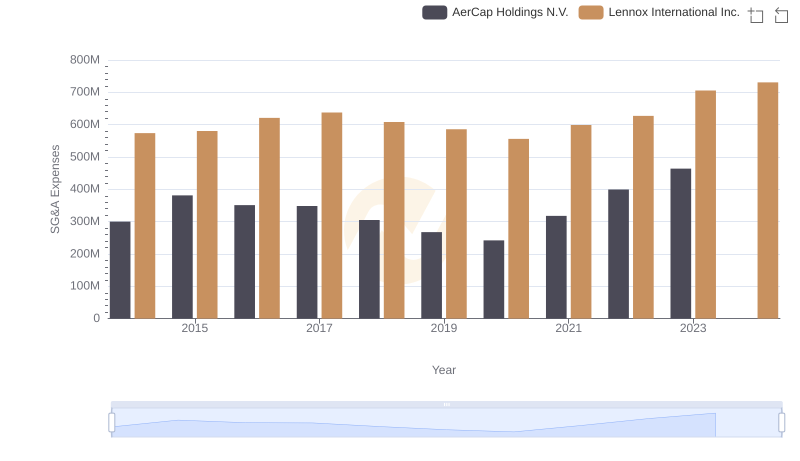

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and AerCap Holdings N.V.

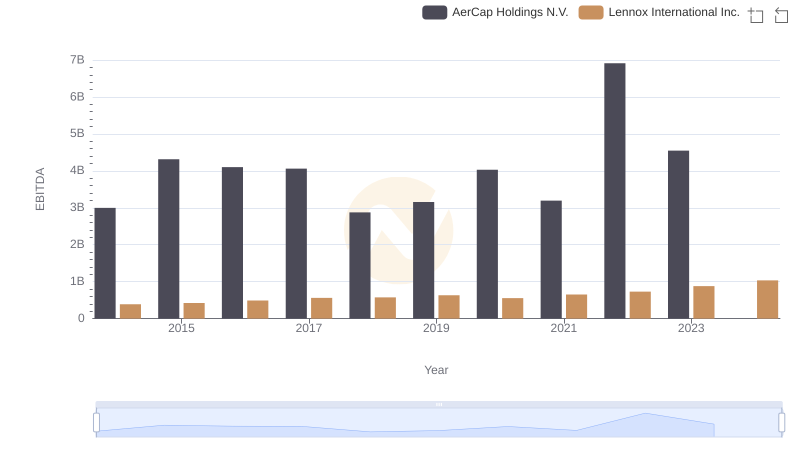

EBITDA Analysis: Evaluating Lennox International Inc. Against AerCap Holdings N.V.