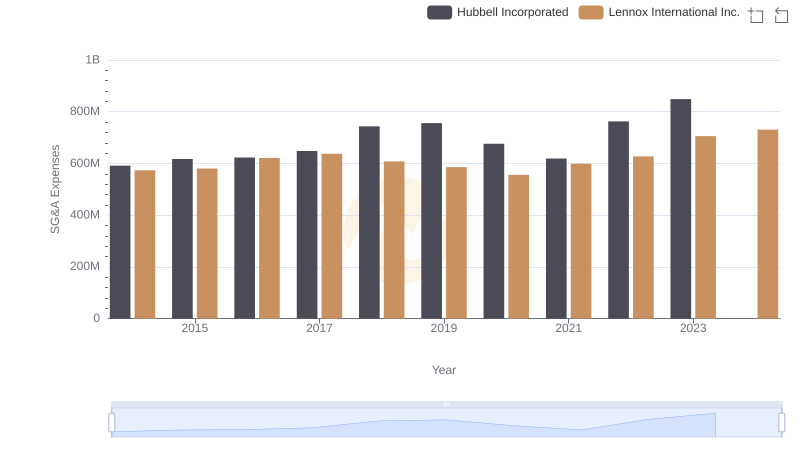

| __timestamp | EMCOR Group, Inc. | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 573700000 |

| Thursday, January 1, 2015 | 656573000 | 580500000 |

| Friday, January 1, 2016 | 725538000 | 621000000 |

| Sunday, January 1, 2017 | 757062000 | 637700000 |

| Monday, January 1, 2018 | 799157000 | 608200000 |

| Tuesday, January 1, 2019 | 893453000 | 585900000 |

| Wednesday, January 1, 2020 | 903584000 | 555900000 |

| Friday, January 1, 2021 | 970937000 | 598900000 |

| Saturday, January 1, 2022 | 1038717000 | 627200000 |

| Sunday, January 1, 2023 | 1211233000 | 705500000 |

| Monday, January 1, 2024 | 730600000 |

Unleashing the power of data

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Lennox International Inc. and EMCOR Group, Inc. have been at the forefront of this financial balancing act since 2014. Over the past decade, EMCOR Group has seen a steady increase in SG&A expenses, peaking at approximately 1.2 billion in 2023, a 93% rise from 2014. In contrast, Lennox International has maintained a more stable trajectory, with a modest 23% increase over the same period, reaching around 730 million in 2024. This suggests Lennox's strategic focus on cost efficiency, despite the absence of EMCOR's 2024 data. As businesses navigate economic uncertainties, these insights into SG&A optimization offer valuable lessons in financial stewardship and operational efficiency.

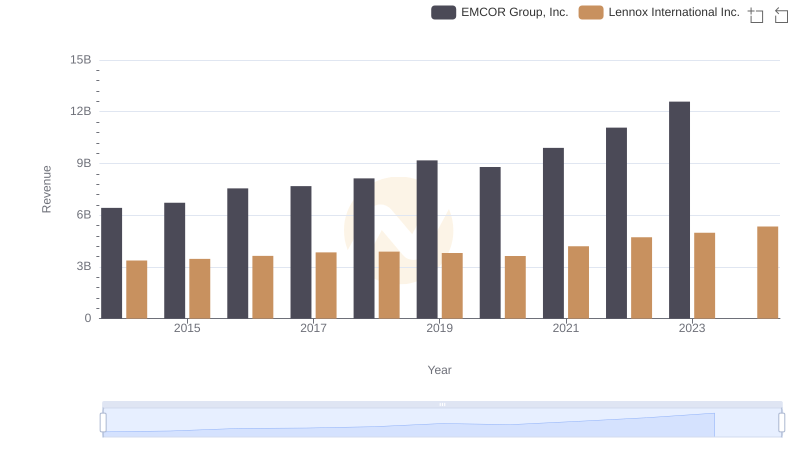

Who Generates More Revenue? Lennox International Inc. or EMCOR Group, Inc.

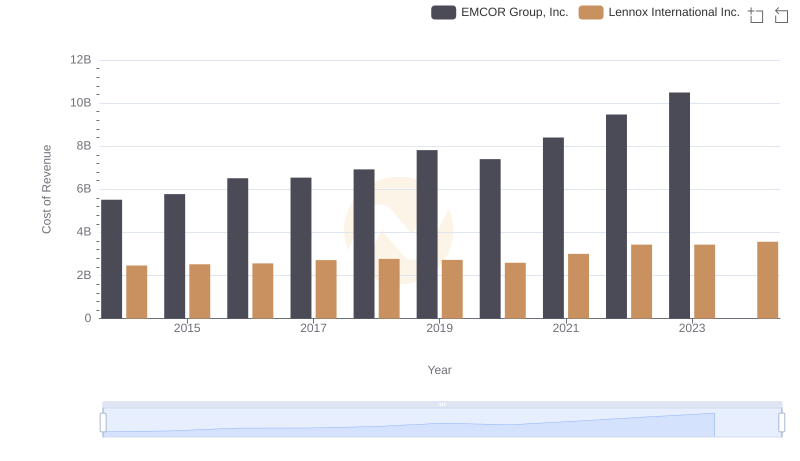

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs EMCOR Group, Inc.

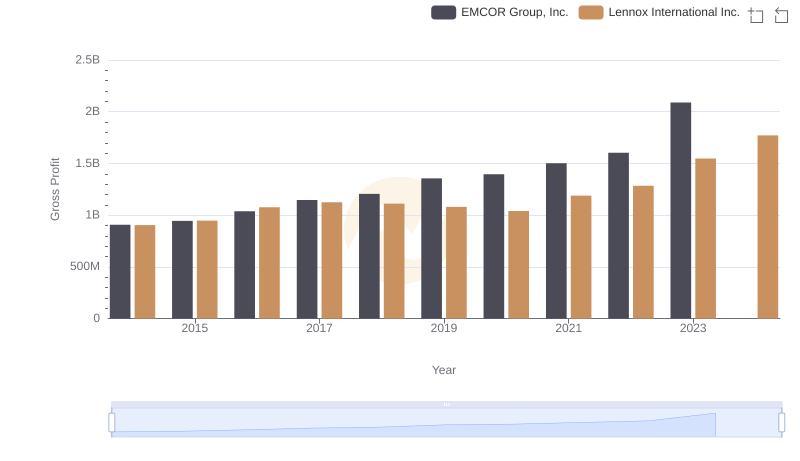

Gross Profit Trends Compared: Lennox International Inc. vs EMCOR Group, Inc.

Breaking Down SG&A Expenses: Lennox International Inc. vs Hubbell Incorporated

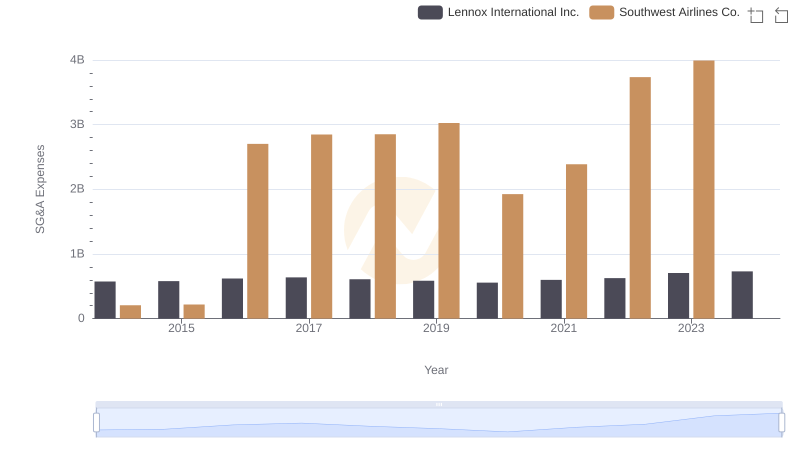

Cost Management Insights: SG&A Expenses for Lennox International Inc. and Southwest Airlines Co.

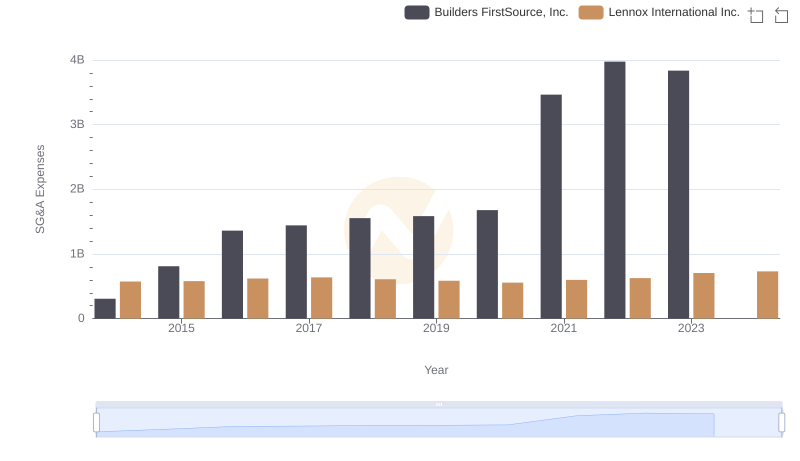

Lennox International Inc. or Builders FirstSource, Inc.: Who Manages SG&A Costs Better?

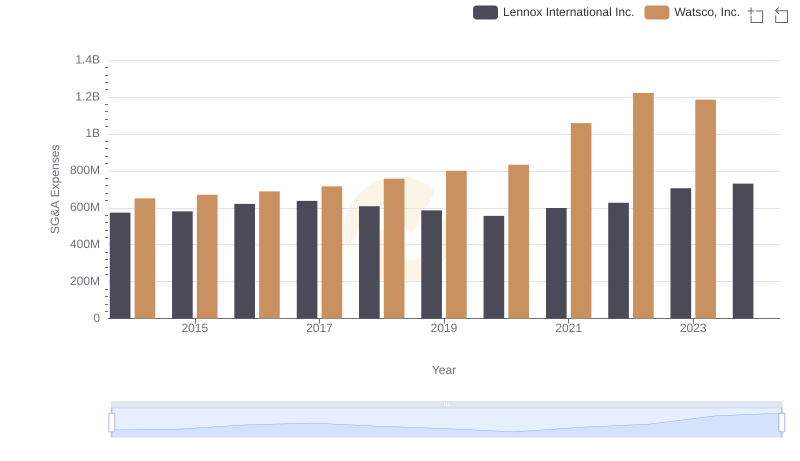

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and Watsco, Inc.

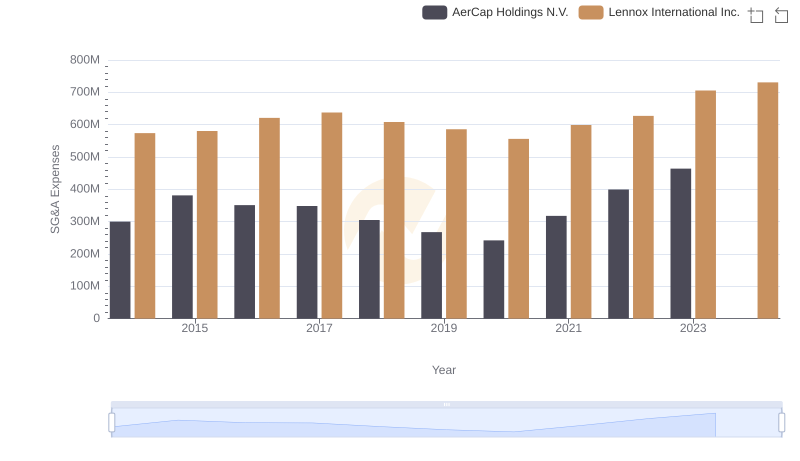

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and AerCap Holdings N.V.

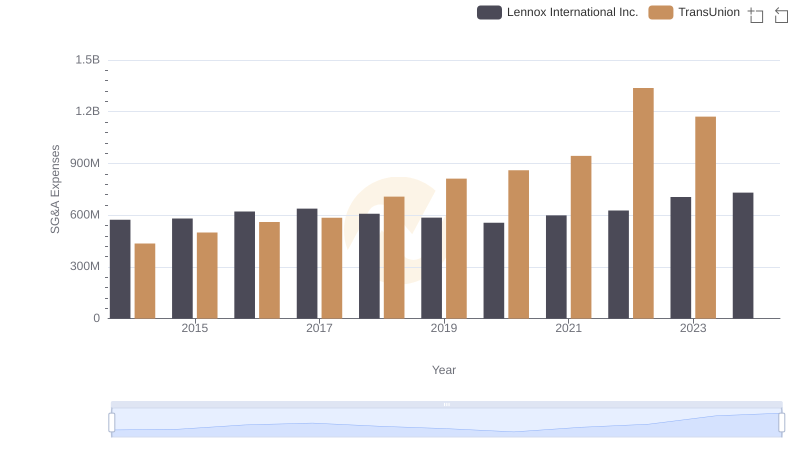

SG&A Efficiency Analysis: Comparing Lennox International Inc. and TransUnion

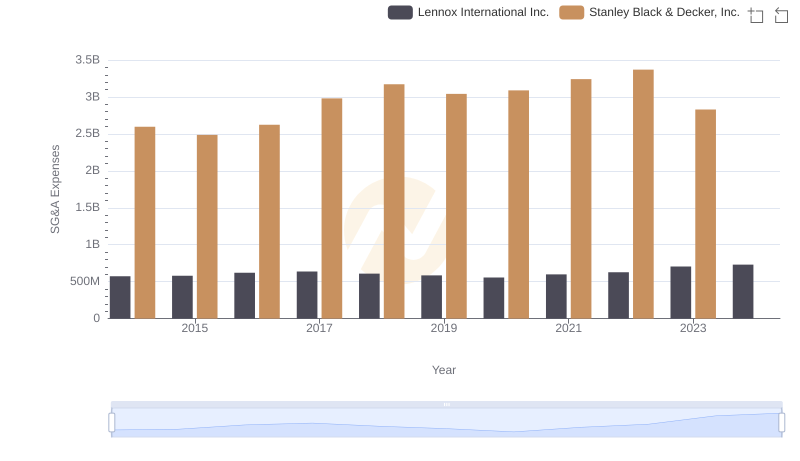

Who Optimizes SG&A Costs Better? Lennox International Inc. or Stanley Black & Decker, Inc.

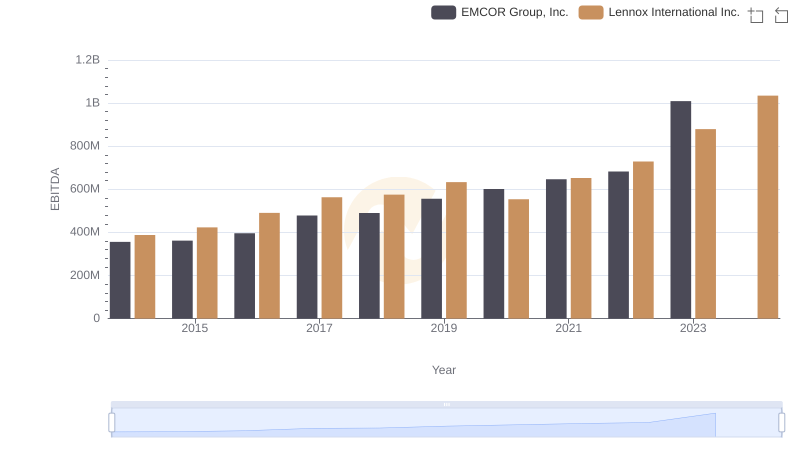

Lennox International Inc. vs EMCOR Group, Inc.: In-Depth EBITDA Performance Comparison

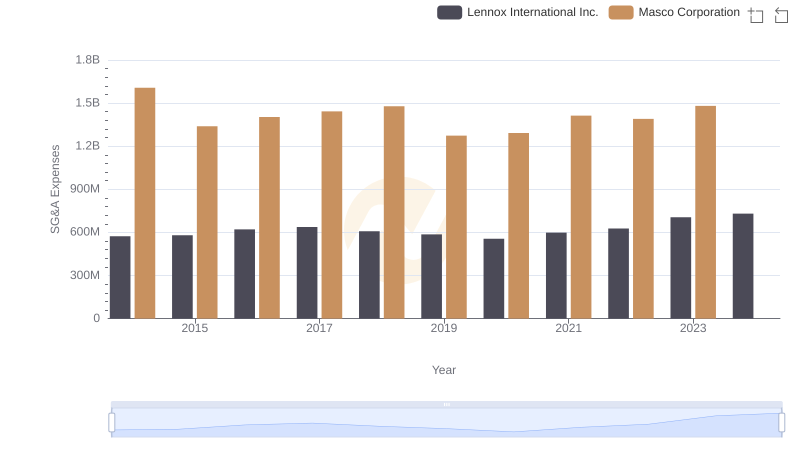

Lennox International Inc. or Masco Corporation: Who Manages SG&A Costs Better?