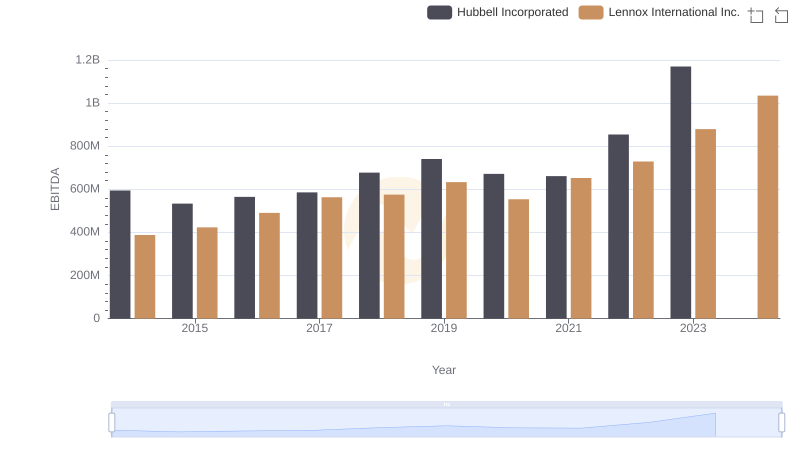

| __timestamp | AerCap Holdings N.V. | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2997442000 | 387700000 |

| Thursday, January 1, 2015 | 4313510000 | 423600000 |

| Friday, January 1, 2016 | 4101801000 | 490800000 |

| Sunday, January 1, 2017 | 4061381000 | 562900000 |

| Monday, January 1, 2018 | 2874193000 | 575200000 |

| Tuesday, January 1, 2019 | 3157061000 | 633300000 |

| Wednesday, January 1, 2020 | 4028661000 | 553900000 |

| Friday, January 1, 2021 | 3192341000 | 652500000 |

| Saturday, January 1, 2022 | 6911148000 | 729000000 |

| Sunday, January 1, 2023 | 4547656000 | 879500000 |

| Monday, January 1, 2024 | 1034800000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, understanding financial health is crucial. This analysis delves into the EBITDA performance of Lennox International Inc. and AerCap Holdings N.V. from 2014 to 2023. Over this decade, AerCap Holdings N.V. consistently outperformed Lennox International Inc., with an average EBITDA nearly six times higher. Notably, AerCap's EBITDA peaked in 2022, reaching a staggering 6.9 billion, a 117% increase from its 2014 figures. In contrast, Lennox International Inc. showed steady growth, culminating in a 168% rise in EBITDA by 2023. However, the data for 2024 is incomplete, leaving room for speculation on future trends. This comparative analysis highlights the resilience and growth strategies of these industry giants, offering valuable insights for investors and stakeholders alike.

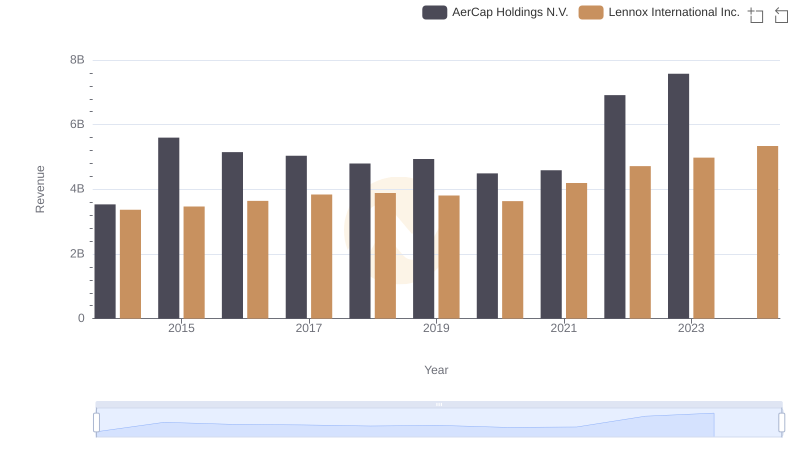

Annual Revenue Comparison: Lennox International Inc. vs AerCap Holdings N.V.

Analyzing Cost of Revenue: Lennox International Inc. and AerCap Holdings N.V.

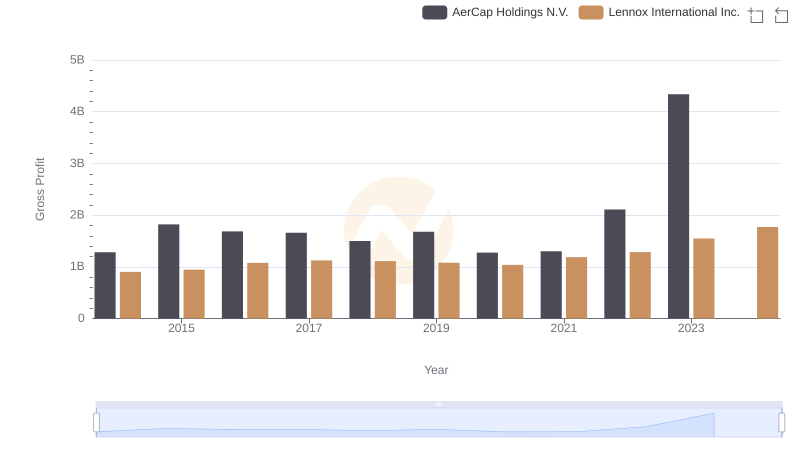

Gross Profit Trends Compared: Lennox International Inc. vs AerCap Holdings N.V.

A Side-by-Side Analysis of EBITDA: Lennox International Inc. and Hubbell Incorporated

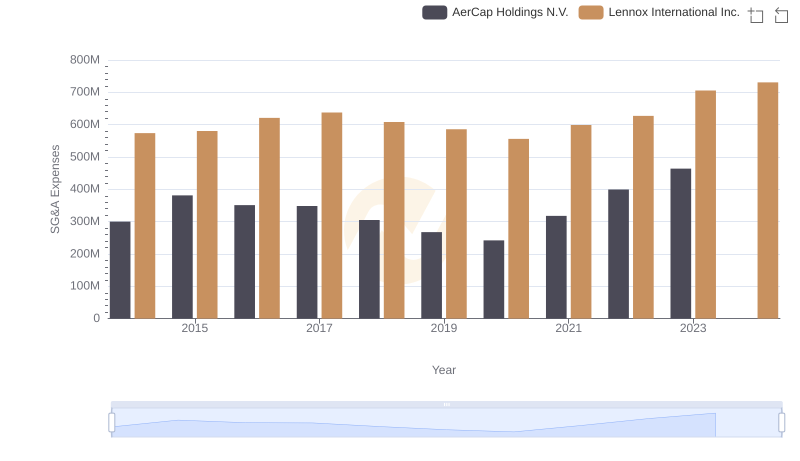

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and AerCap Holdings N.V.

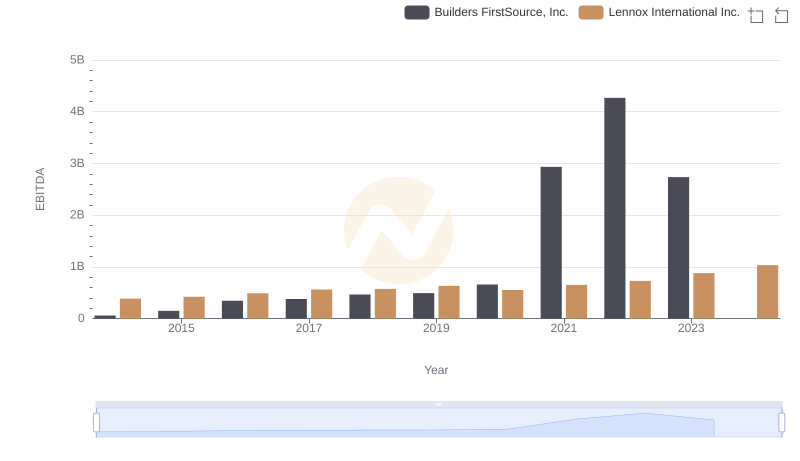

A Professional Review of EBITDA: Lennox International Inc. Compared to Builders FirstSource, Inc.

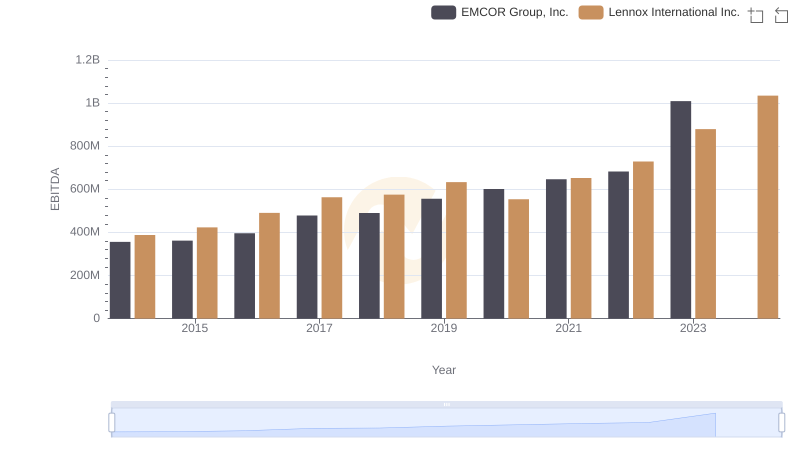

Lennox International Inc. vs EMCOR Group, Inc.: In-Depth EBITDA Performance Comparison

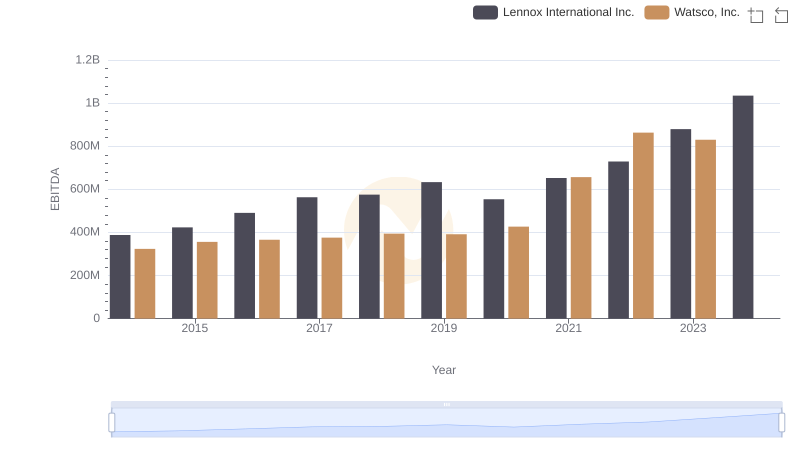

A Professional Review of EBITDA: Lennox International Inc. Compared to Watsco, Inc.

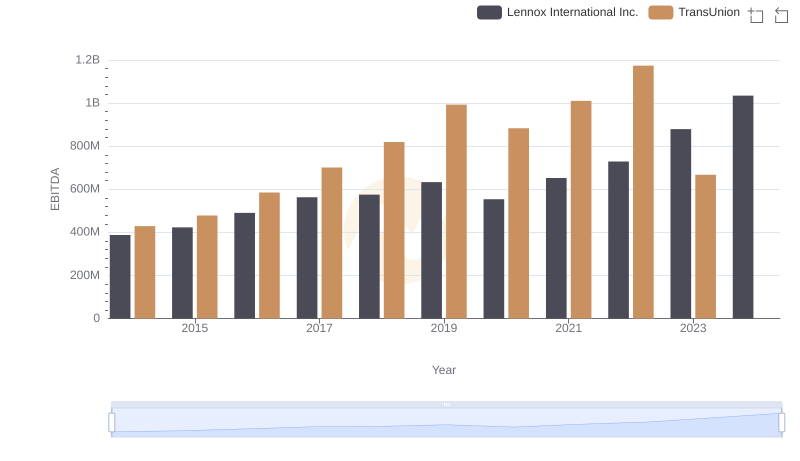

EBITDA Performance Review: Lennox International Inc. vs TransUnion

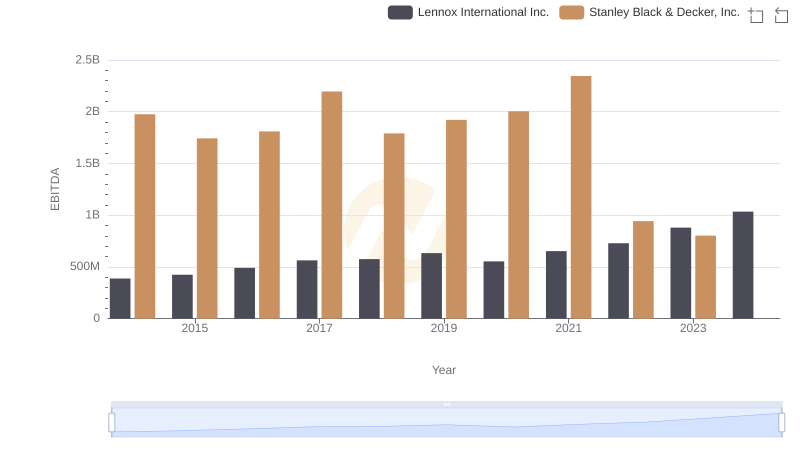

A Professional Review of EBITDA: Lennox International Inc. Compared to Stanley Black & Decker, Inc.

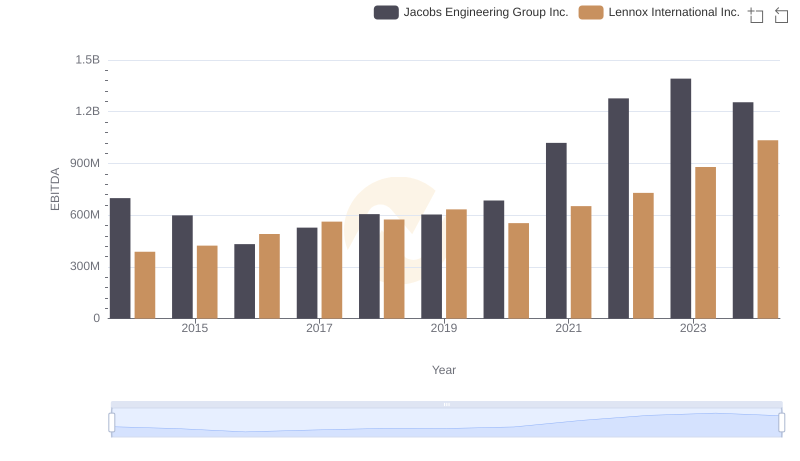

Lennox International Inc. and Jacobs Engineering Group Inc.: A Detailed Examination of EBITDA Performance

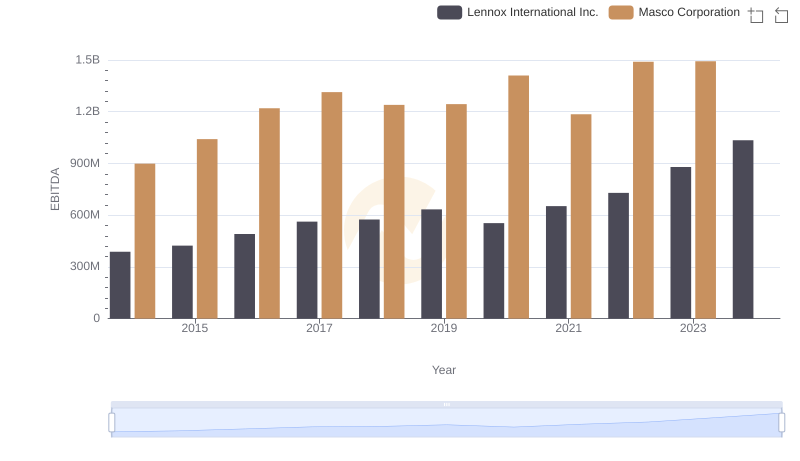

Comprehensive EBITDA Comparison: Lennox International Inc. vs Masco Corporation