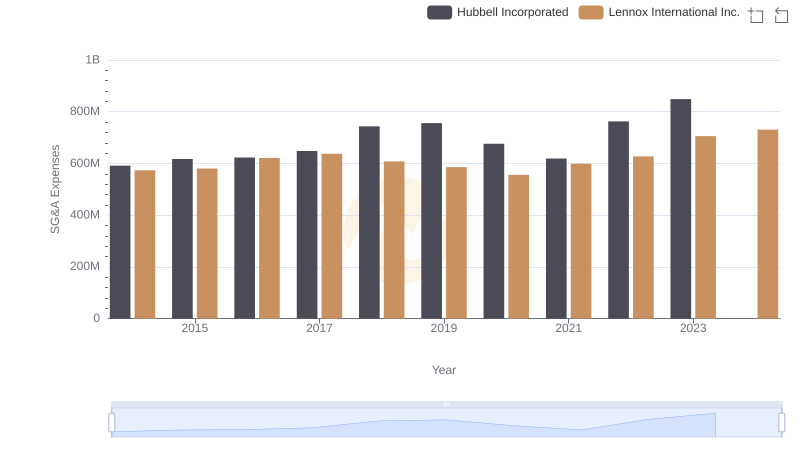

| __timestamp | Lennox International Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 573700000 | 650655000 |

| Thursday, January 1, 2015 | 580500000 | 670609000 |

| Friday, January 1, 2016 | 621000000 | 688952000 |

| Sunday, January 1, 2017 | 637700000 | 715671000 |

| Monday, January 1, 2018 | 608200000 | 757452000 |

| Tuesday, January 1, 2019 | 585900000 | 800328000 |

| Wednesday, January 1, 2020 | 555900000 | 833051000 |

| Friday, January 1, 2021 | 598900000 | 1058316000 |

| Saturday, January 1, 2022 | 627200000 | 1221382000 |

| Sunday, January 1, 2023 | 705500000 | 1185626000 |

| Monday, January 1, 2024 | 730600000 | 1262938000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of operational costs, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's efficiency and strategic focus. Over the past decade, Lennox International Inc. and Watsco, Inc. have showcased intriguing trends in their SG&A expenditures.

From 2014 to 2023, Lennox International Inc. demonstrated a steady increase in SG&A expenses, peaking in 2023 with a 27% rise from 2014. Meanwhile, Watsco, Inc. experienced a more dramatic surge, with a 82% increase by 2022, before data became unavailable in 2024. This disparity highlights Watsco's aggressive expansion and operational scaling compared to Lennox's more measured approach.

These trends not only reflect the companies' strategic priorities but also offer insights into their market positioning and competitive dynamics. As we move forward, monitoring these expenses will be crucial for investors and analysts alike.

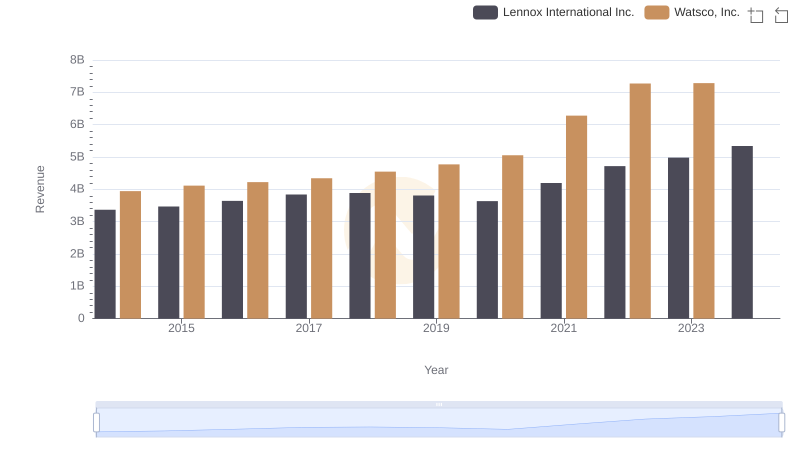

Comparing Revenue Performance: Lennox International Inc. or Watsco, Inc.?

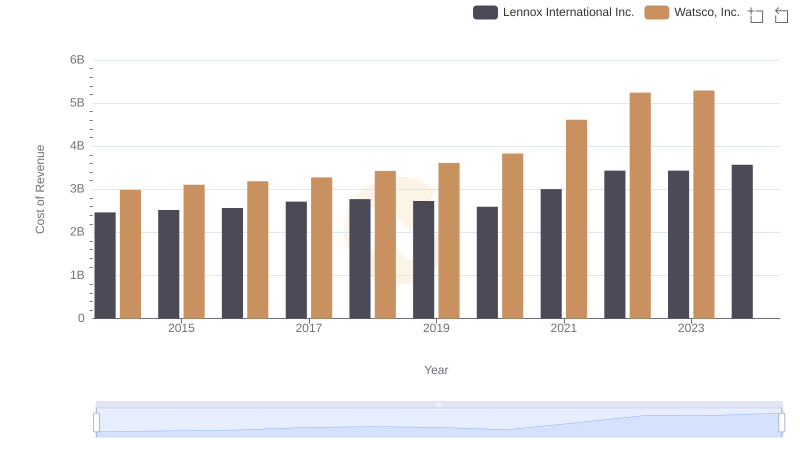

Cost of Revenue Trends: Lennox International Inc. vs Watsco, Inc.

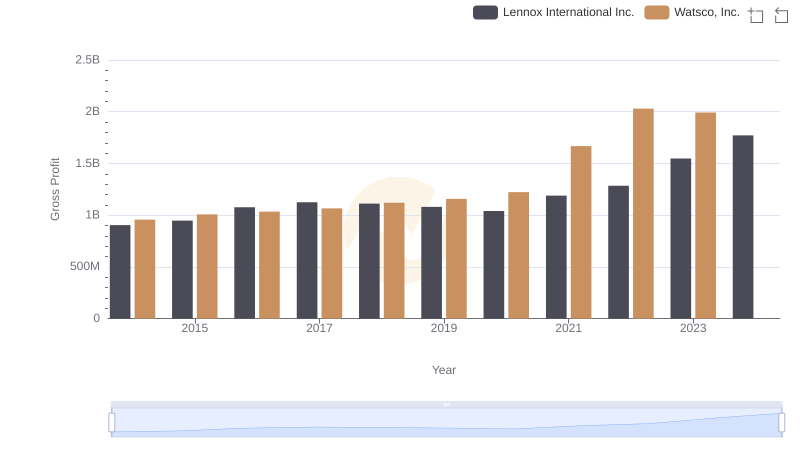

Lennox International Inc. and Watsco, Inc.: A Detailed Gross Profit Analysis

Breaking Down SG&A Expenses: Lennox International Inc. vs Hubbell Incorporated

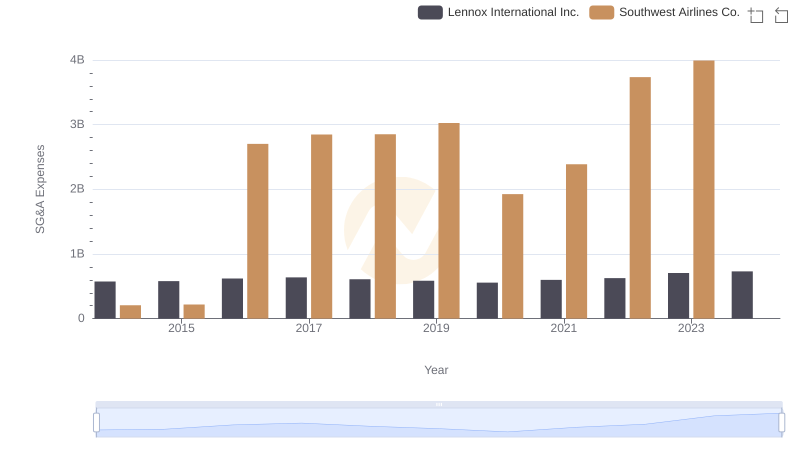

Cost Management Insights: SG&A Expenses for Lennox International Inc. and Southwest Airlines Co.

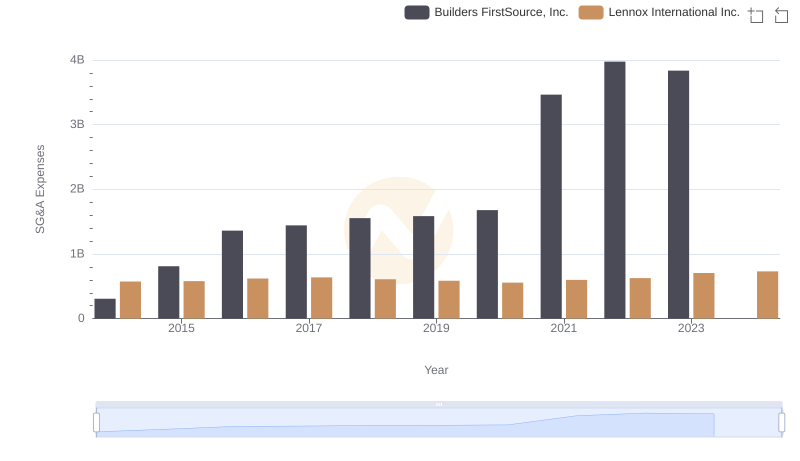

Lennox International Inc. or Builders FirstSource, Inc.: Who Manages SG&A Costs Better?

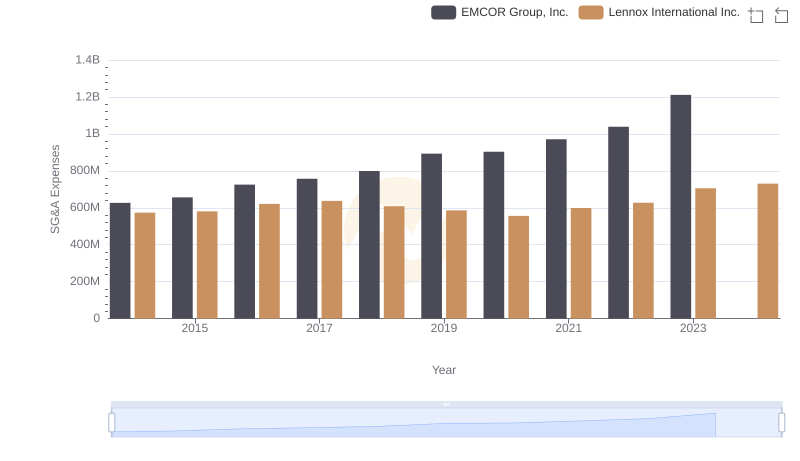

Who Optimizes SG&A Costs Better? Lennox International Inc. or EMCOR Group, Inc.

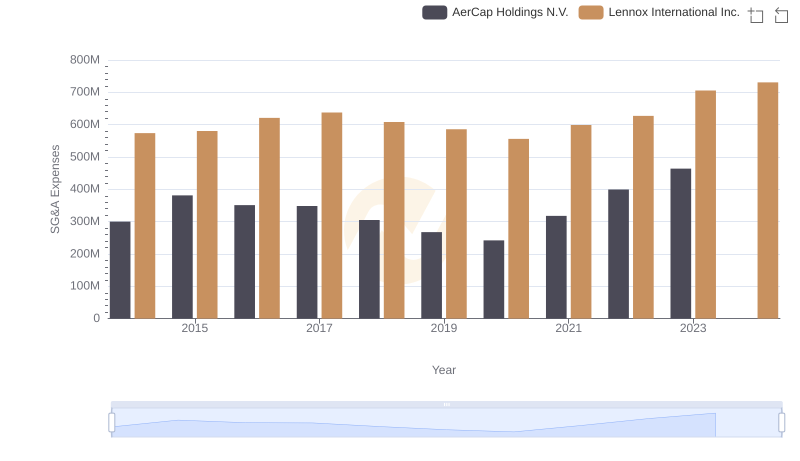

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and AerCap Holdings N.V.

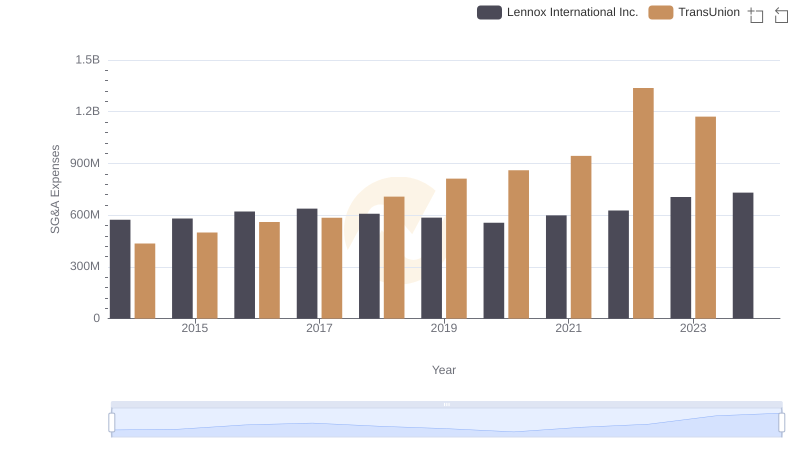

SG&A Efficiency Analysis: Comparing Lennox International Inc. and TransUnion

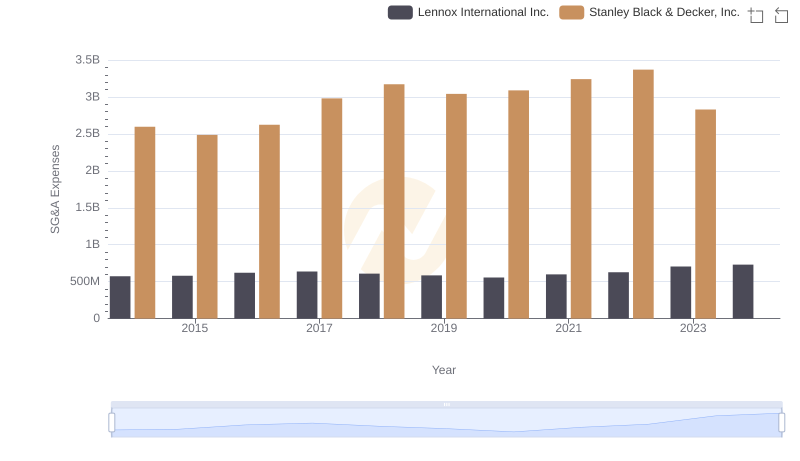

Who Optimizes SG&A Costs Better? Lennox International Inc. or Stanley Black & Decker, Inc.

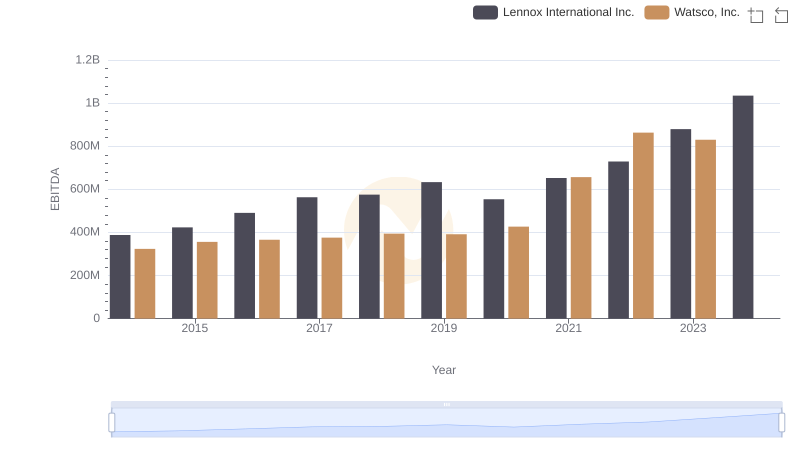

A Professional Review of EBITDA: Lennox International Inc. Compared to Watsco, Inc.

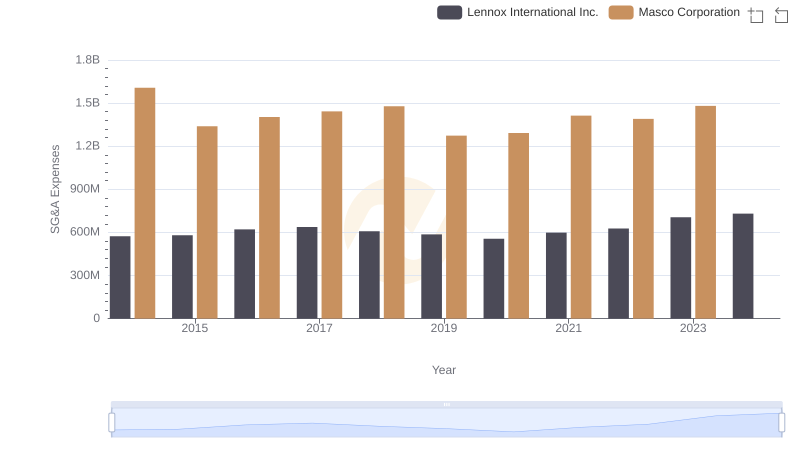

Lennox International Inc. or Masco Corporation: Who Manages SG&A Costs Better?