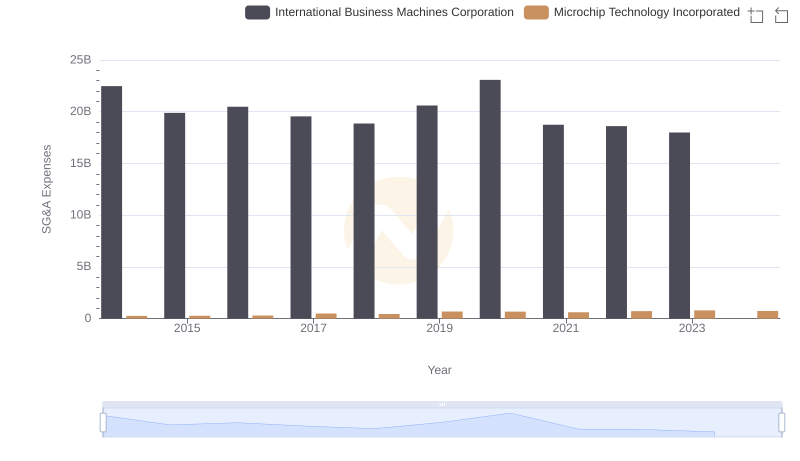

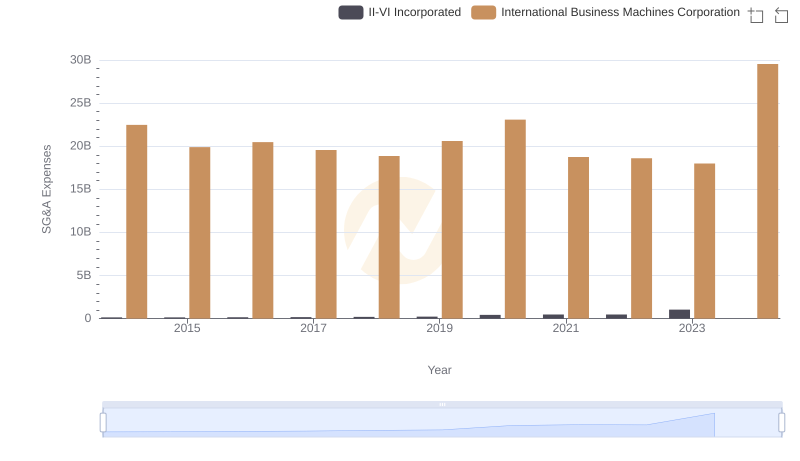

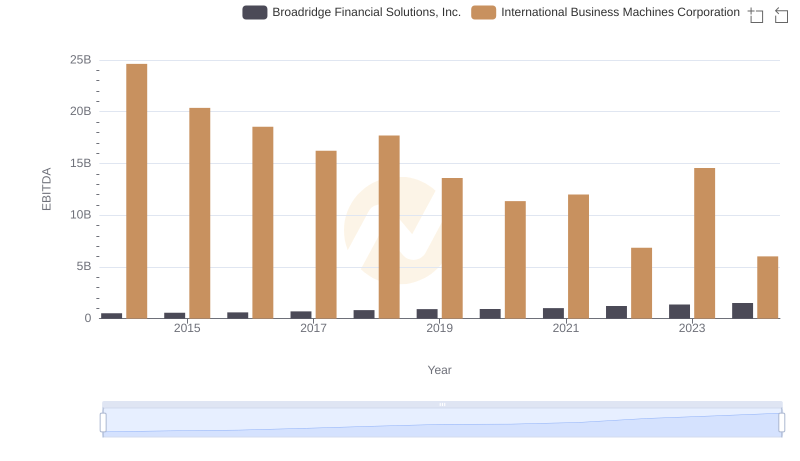

| __timestamp | Broadridge Financial Solutions, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 376000000 | 22472000000 |

| Thursday, January 1, 2015 | 396800000 | 19894000000 |

| Friday, January 1, 2016 | 420900000 | 20279000000 |

| Sunday, January 1, 2017 | 501400000 | 19680000000 |

| Monday, January 1, 2018 | 565400000 | 19366000000 |

| Tuesday, January 1, 2019 | 577500000 | 18724000000 |

| Wednesday, January 1, 2020 | 639000000 | 20561000000 |

| Friday, January 1, 2021 | 744300000 | 18745000000 |

| Saturday, January 1, 2022 | 832300000 | 17483000000 |

| Sunday, January 1, 2023 | 849000000 | 17997000000 |

| Monday, January 1, 2024 | 916800000 | 29536000000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: International Business Machines Corporation (IBM) and Broadridge Financial Solutions, Inc., from 2014 to 2024.

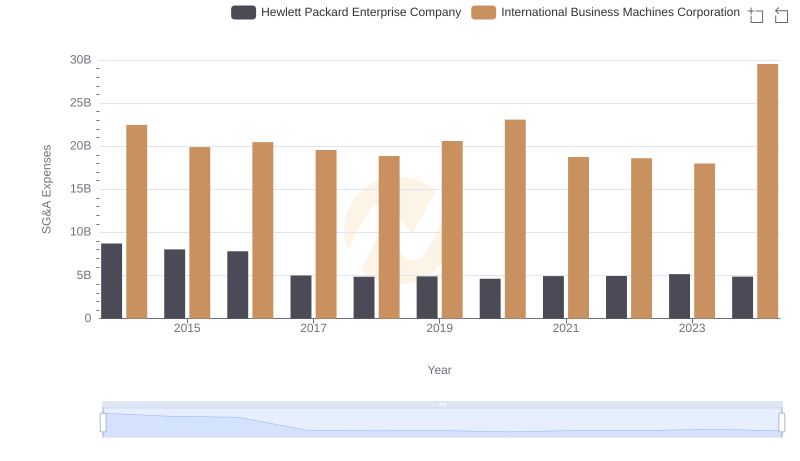

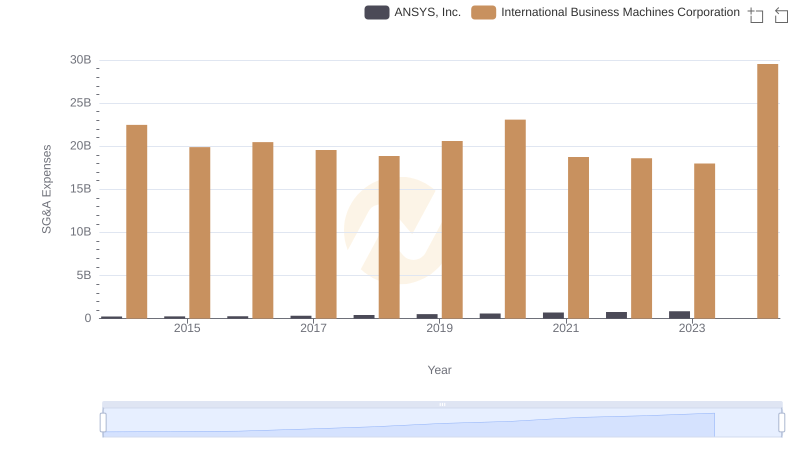

IBM, a stalwart in the tech industry, consistently reported SG&A expenses averaging around $20.9 billion annually. Notably, in 2024, IBM's expenses surged by 64% compared to 2023, reaching a peak of nearly $29.5 billion. This spike underscores IBM's strategic investments and operational scaling.

Conversely, Broadridge, a leader in financial technology, exhibited a steady upward trend in SG&A expenses, growing by approximately 144% over the decade. By 2024, Broadridge's expenses reached $916 million, reflecting its expansion and increased market presence.

This comparative analysis highlights the distinct financial strategies of these corporations, offering insights into their operational priorities and market dynamics.

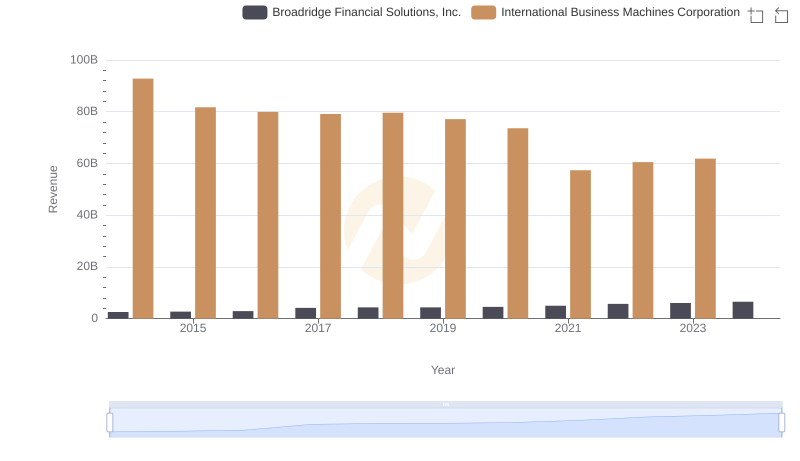

Revenue Insights: International Business Machines Corporation and Broadridge Financial Solutions, Inc. Performance Compared

Analyzing Cost of Revenue: International Business Machines Corporation and Broadridge Financial Solutions, Inc.

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Microchip Technology Incorporated

Comparing SG&A Expenses: International Business Machines Corporation vs Hewlett Packard Enterprise Company Trends and Insights

Comparing SG&A Expenses: International Business Machines Corporation vs ANSYS, Inc. Trends and Insights

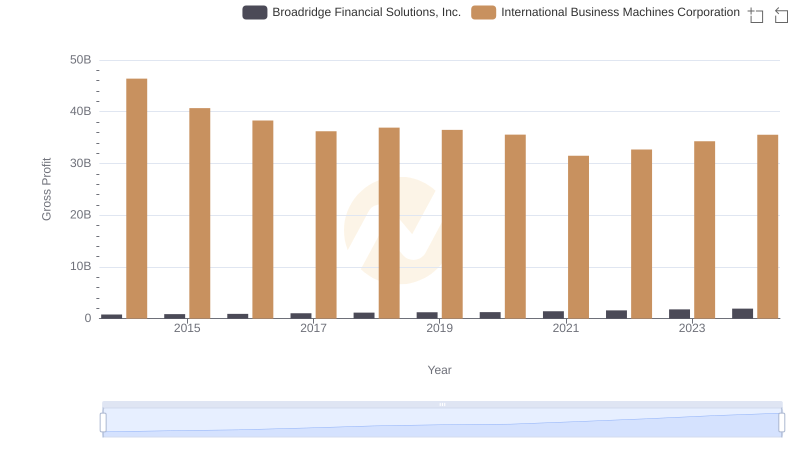

Gross Profit Trends Compared: International Business Machines Corporation vs Broadridge Financial Solutions, Inc.

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and II-VI Incorporated

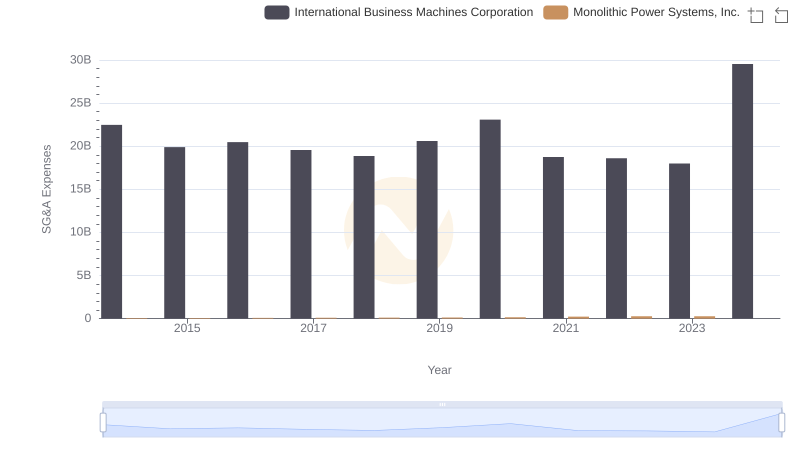

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Monolithic Power Systems, Inc.

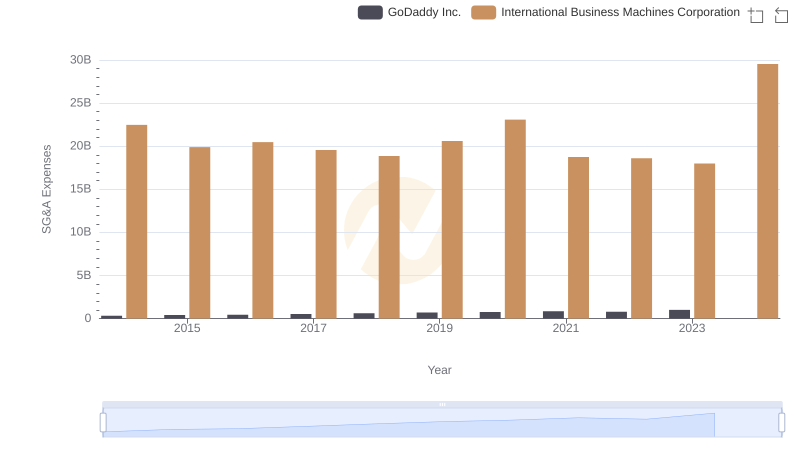

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and GoDaddy Inc.

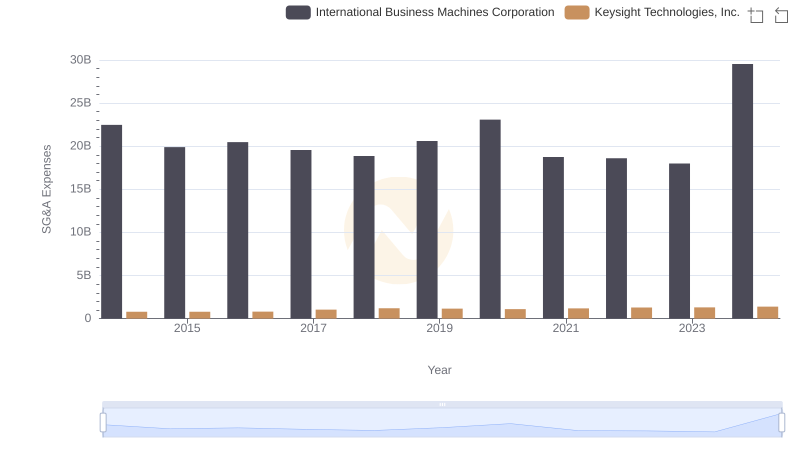

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Keysight Technologies, Inc.

International Business Machines Corporation and Broadridge Financial Solutions, Inc.: A Detailed Examination of EBITDA Performance

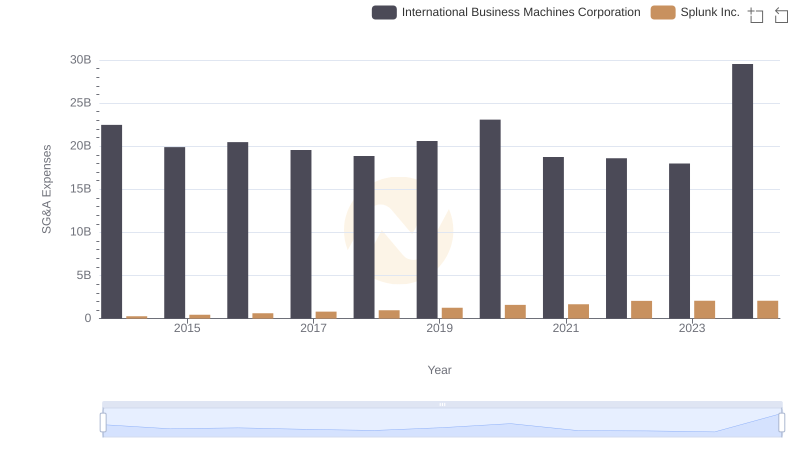

Selling, General, and Administrative Costs: International Business Machines Corporation vs Splunk Inc.