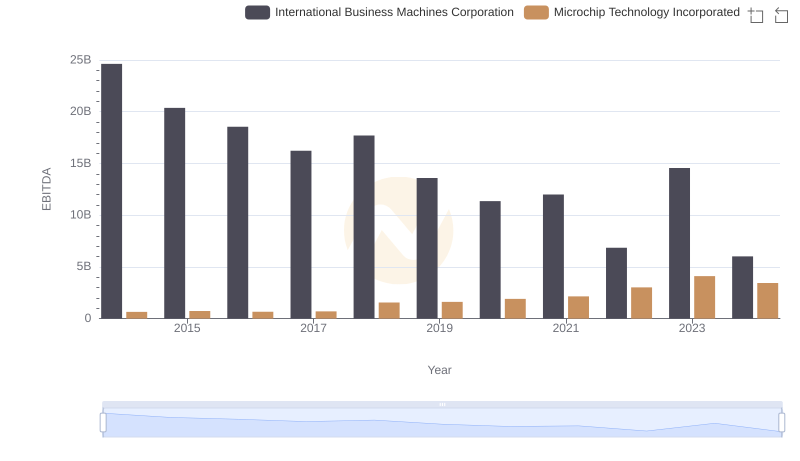

| __timestamp | International Business Machines Corporation | Microchip Technology Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 267278000 |

| Thursday, January 1, 2015 | 19894000000 | 274815000 |

| Friday, January 1, 2016 | 20279000000 | 301670000 |

| Sunday, January 1, 2017 | 19680000000 | 499811000 |

| Monday, January 1, 2018 | 19366000000 | 452100000 |

| Tuesday, January 1, 2019 | 18724000000 | 682900000 |

| Wednesday, January 1, 2020 | 20561000000 | 676600000 |

| Friday, January 1, 2021 | 18745000000 | 610300000 |

| Saturday, January 1, 2022 | 17483000000 | 718900000 |

| Sunday, January 1, 2023 | 17997000000 | 797700000 |

| Monday, January 1, 2024 | 29536000000 | 734200000 |

In pursuit of knowledge

In the ever-evolving landscape of technology, operational efficiency is paramount. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: International Business Machines Corporation (IBM) and Microchip Technology Incorporated, from 2014 to 2023. Over this decade, IBM's SG&A expenses have shown a downward trend, decreasing by approximately 20% from 2014 to 2023. In contrast, Microchip Technology's expenses have surged by nearly 200%, reflecting its aggressive growth strategy.

IBM's peak in 2020, with expenses reaching 23 billion, contrasts sharply with Microchip's steady climb, peaking at nearly 800 million in 2023. This divergence highlights differing strategic priorities: IBM's focus on streamlining operations versus Microchip's expansion. Notably, 2024 data for IBM is missing, indicating potential reporting delays or strategic shifts. This analysis underscores the dynamic nature of operational strategies in the tech sector.

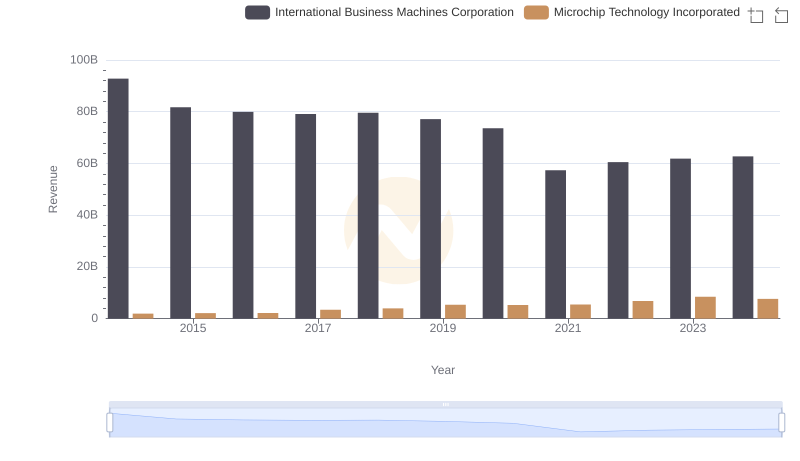

Annual Revenue Comparison: International Business Machines Corporation vs Microchip Technology Incorporated

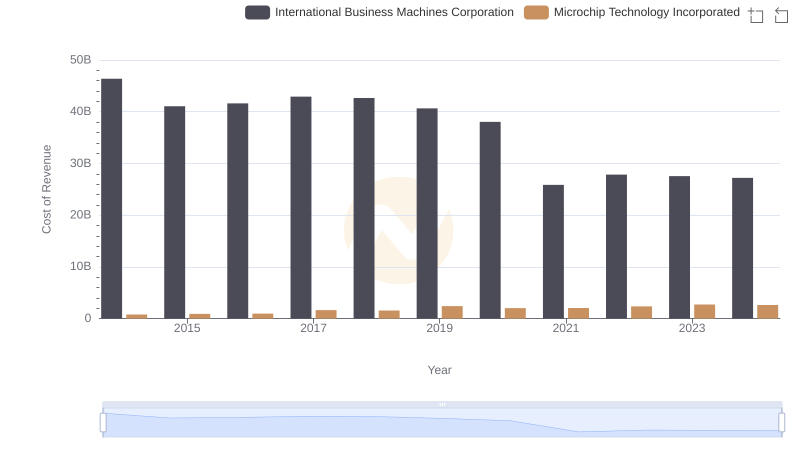

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Microchip Technology Incorporated

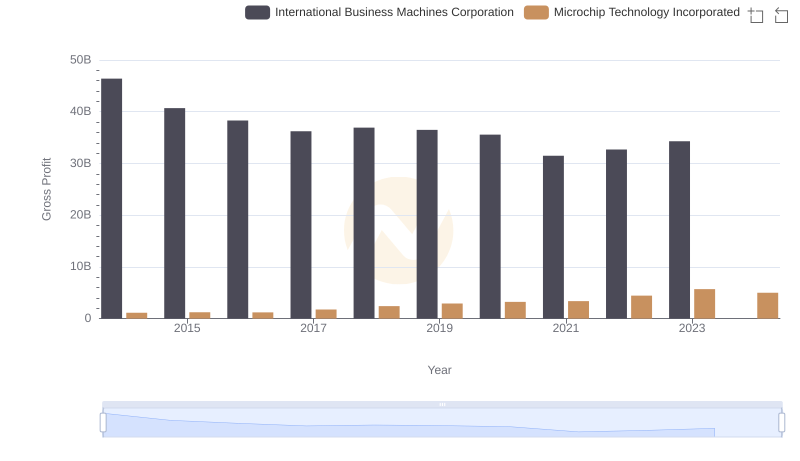

Gross Profit Analysis: Comparing International Business Machines Corporation and Microchip Technology Incorporated

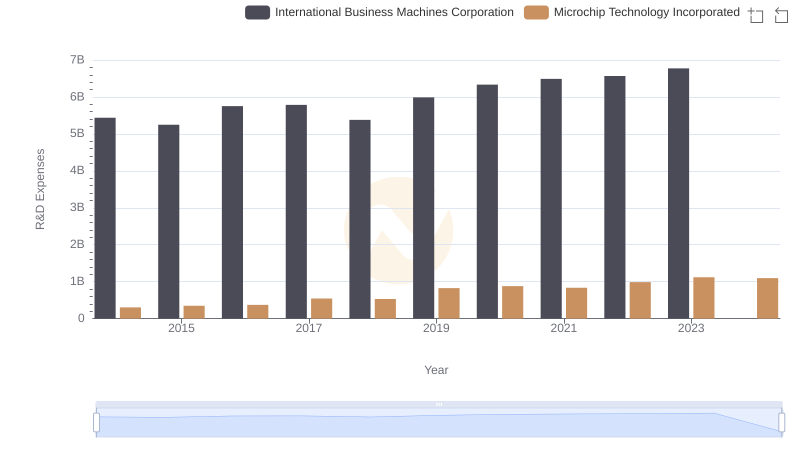

Analyzing R&D Budgets: International Business Machines Corporation vs Microchip Technology Incorporated

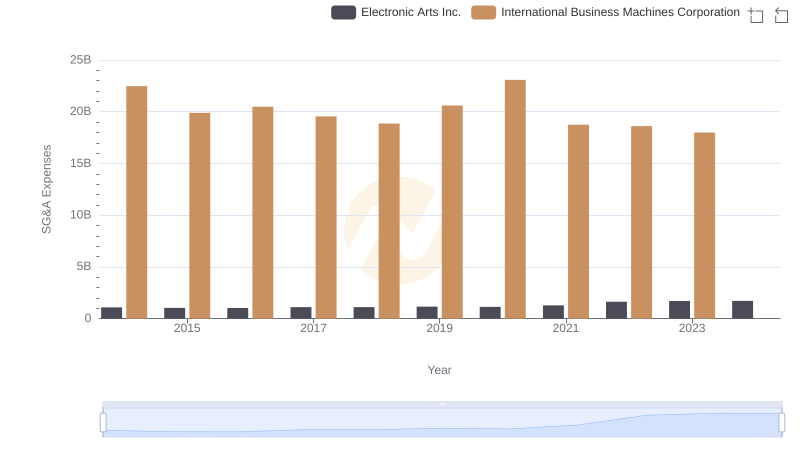

International Business Machines Corporation or Electronic Arts Inc.: Who Manages SG&A Costs Better?

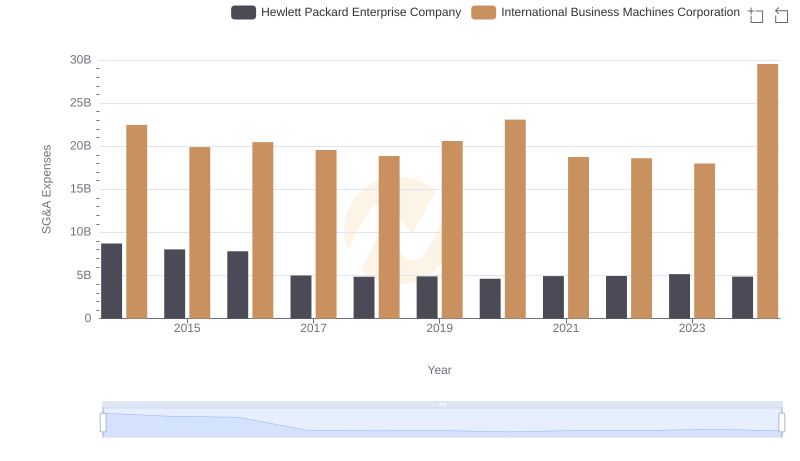

Comparing SG&A Expenses: International Business Machines Corporation vs Hewlett Packard Enterprise Company Trends and Insights

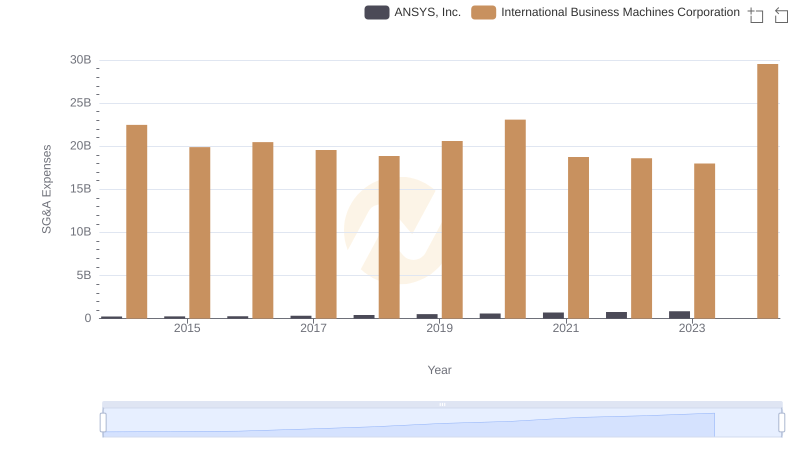

Comparing SG&A Expenses: International Business Machines Corporation vs ANSYS, Inc. Trends and Insights

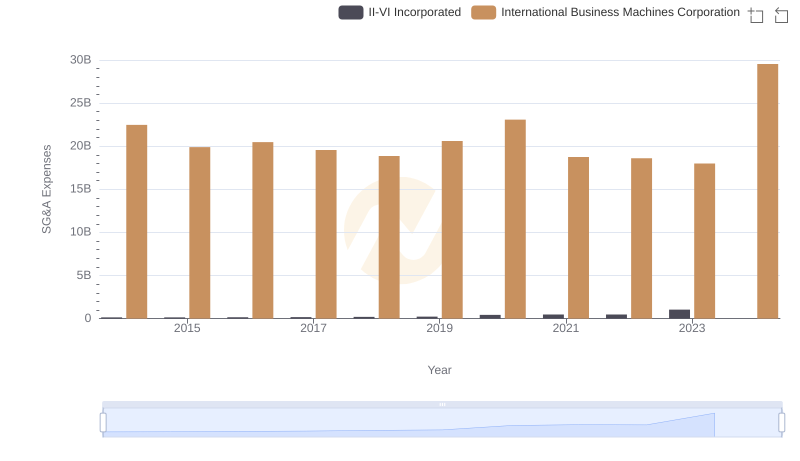

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and II-VI Incorporated

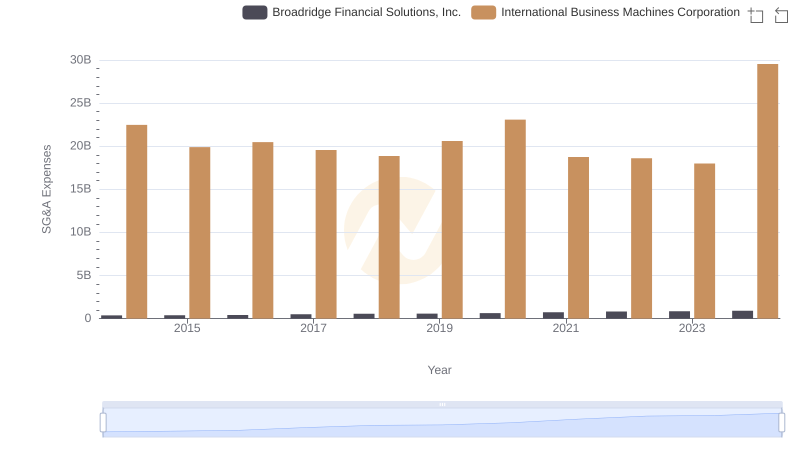

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Broadridge Financial Solutions, Inc.

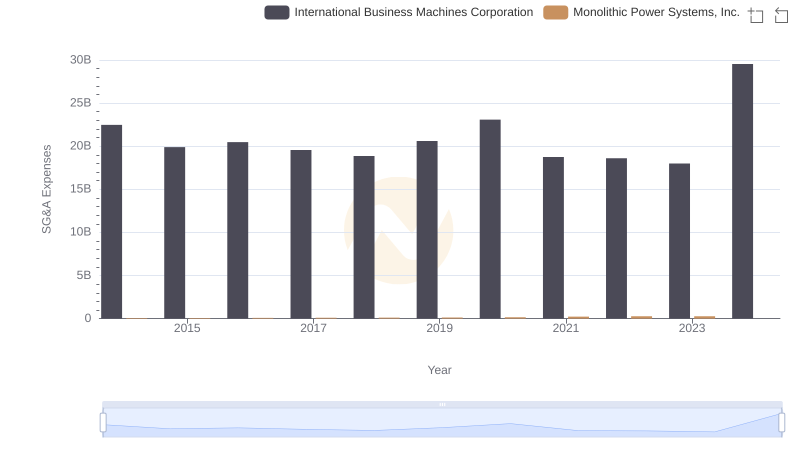

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Monolithic Power Systems, Inc.

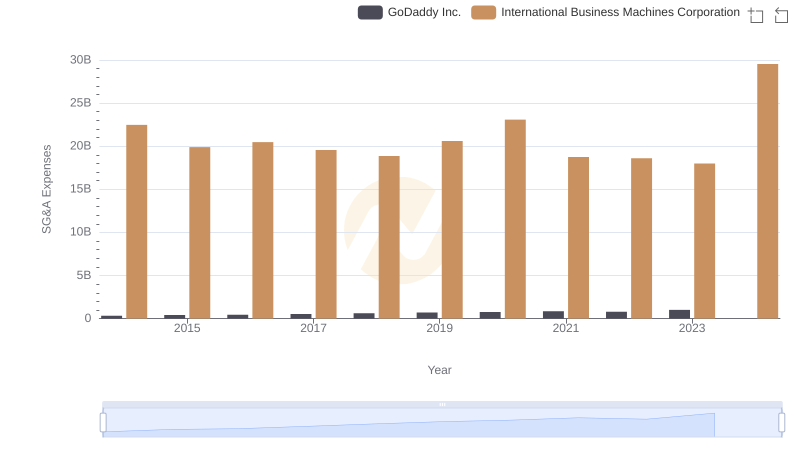

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and GoDaddy Inc.

EBITDA Metrics Evaluated: International Business Machines Corporation vs Microchip Technology Incorporated