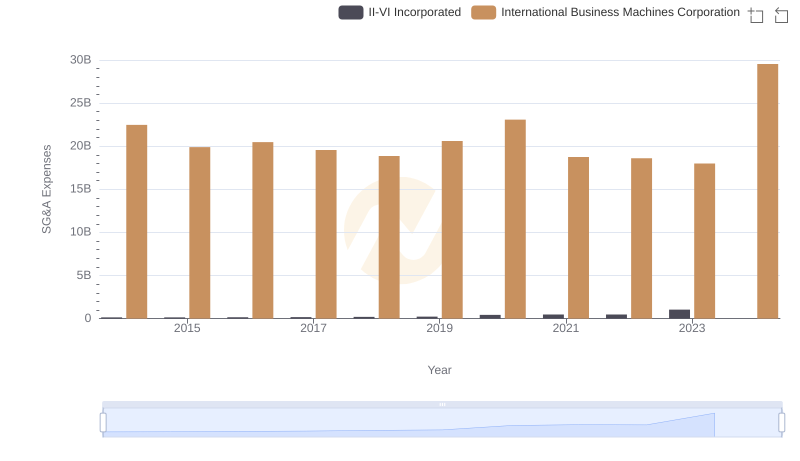

| __timestamp | GoDaddy Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 333054000 | 22472000000 |

| Thursday, January 1, 2015 | 421900000 | 19894000000 |

| Friday, January 1, 2016 | 450000000 | 20279000000 |

| Sunday, January 1, 2017 | 535600000 | 19680000000 |

| Monday, January 1, 2018 | 625400000 | 19366000000 |

| Tuesday, January 1, 2019 | 707700000 | 18724000000 |

| Wednesday, January 1, 2020 | 762300000 | 20561000000 |

| Friday, January 1, 2021 | 849700000 | 18745000000 |

| Saturday, January 1, 2022 | 797800000 | 17483000000 |

| Sunday, January 1, 2023 | 1019300000 | 17997000000 |

| Monday, January 1, 2024 | 751100000 | 29536000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, International Business Machines Corporation (IBM) and GoDaddy Inc. have demonstrated contrasting approaches to cost management.

From 2014 to 2023, IBM's SG&A expenses have shown a downward trend, decreasing by approximately 20% from their peak in 2014. This reflects IBM's strategic shift towards more efficient operations. In contrast, GoDaddy's SG&A expenses have surged by over 200% during the same period, indicating aggressive expansion and investment in growth.

While IBM's data extends into 2024, GoDaddy's figures for that year remain elusive, leaving room for speculation on future strategies. As businesses navigate the complexities of cost management, these insights offer valuable lessons in balancing growth with operational efficiency.

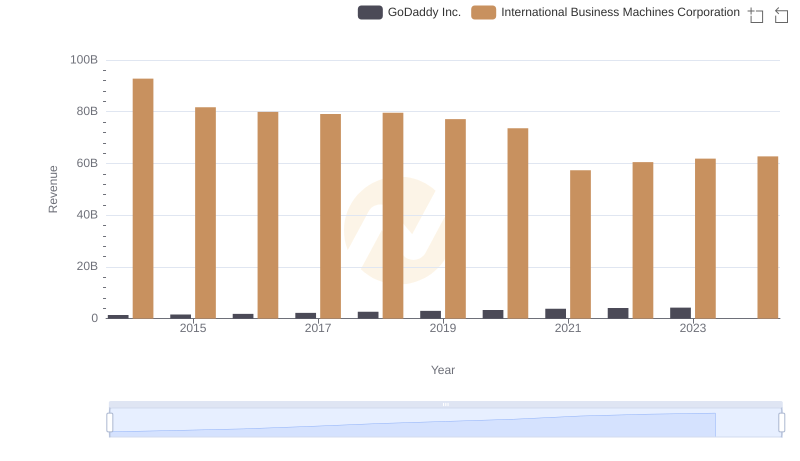

Who Generates More Revenue? International Business Machines Corporation or GoDaddy Inc.

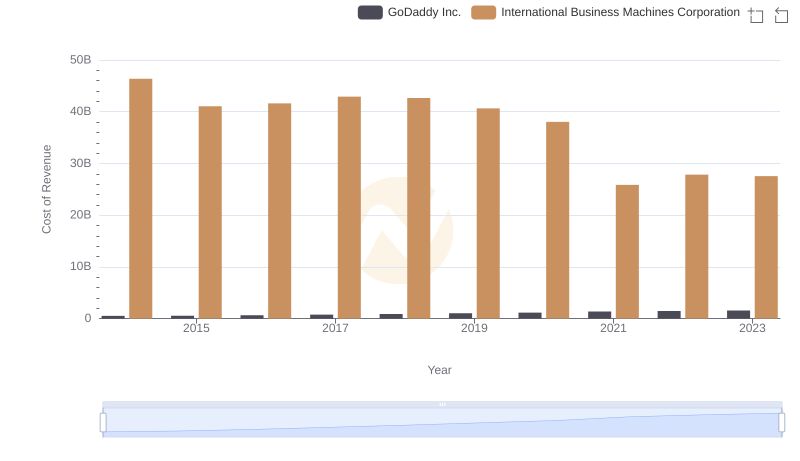

Cost Insights: Breaking Down International Business Machines Corporation and GoDaddy Inc.'s Expenses

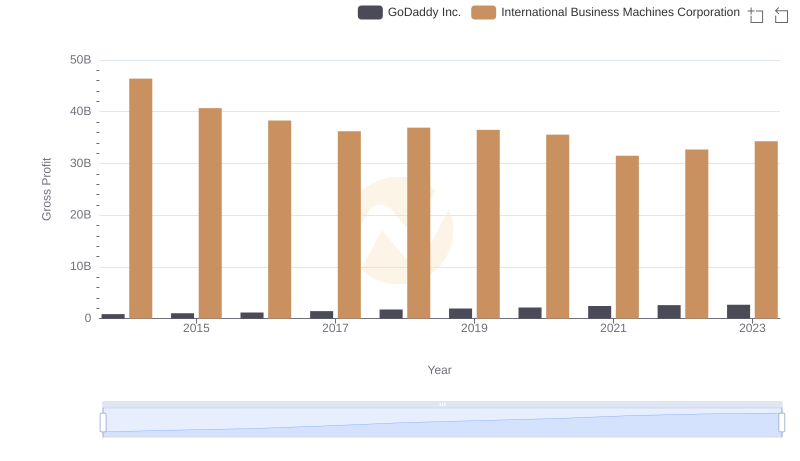

Gross Profit Comparison: International Business Machines Corporation and GoDaddy Inc. Trends

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and II-VI Incorporated

Who Prioritizes Innovation? R&D Spending Compared for International Business Machines Corporation and GoDaddy Inc.

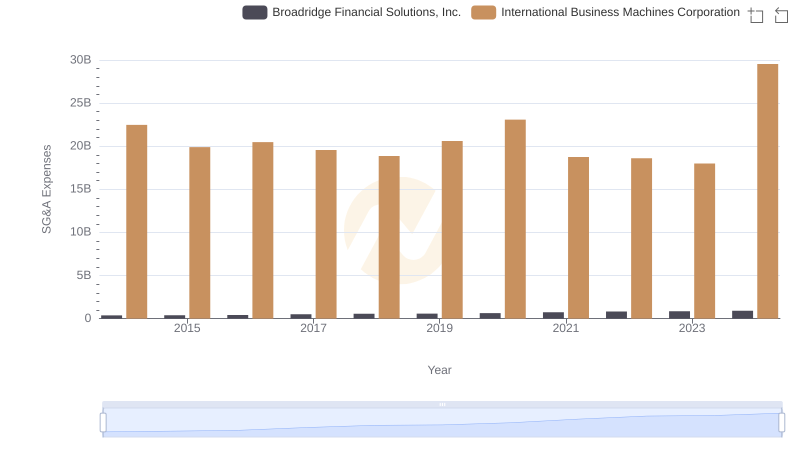

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Broadridge Financial Solutions, Inc.

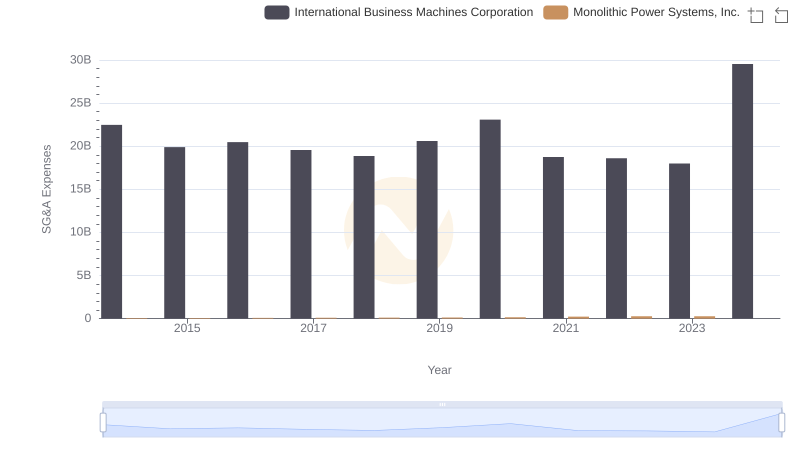

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Monolithic Power Systems, Inc.

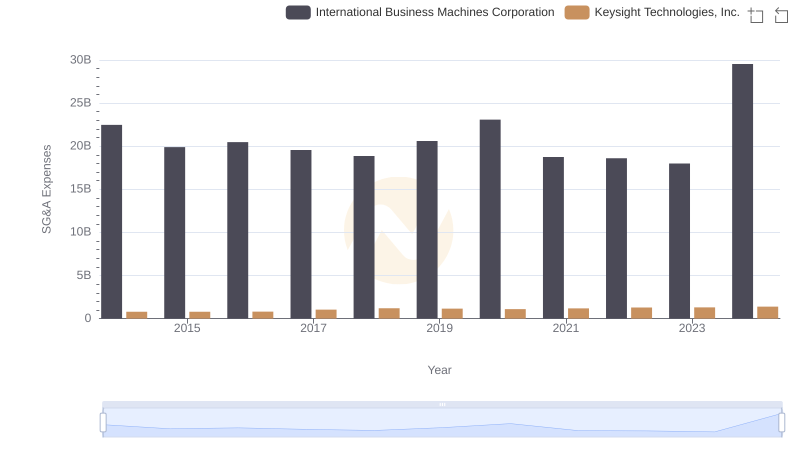

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Keysight Technologies, Inc.

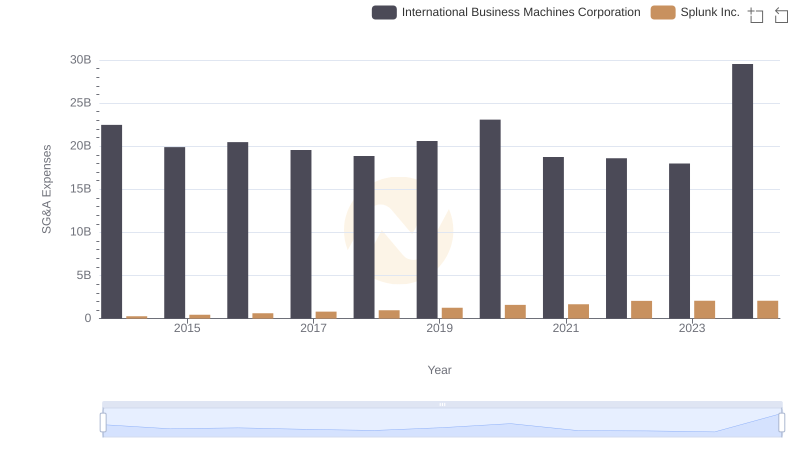

Selling, General, and Administrative Costs: International Business Machines Corporation vs Splunk Inc.

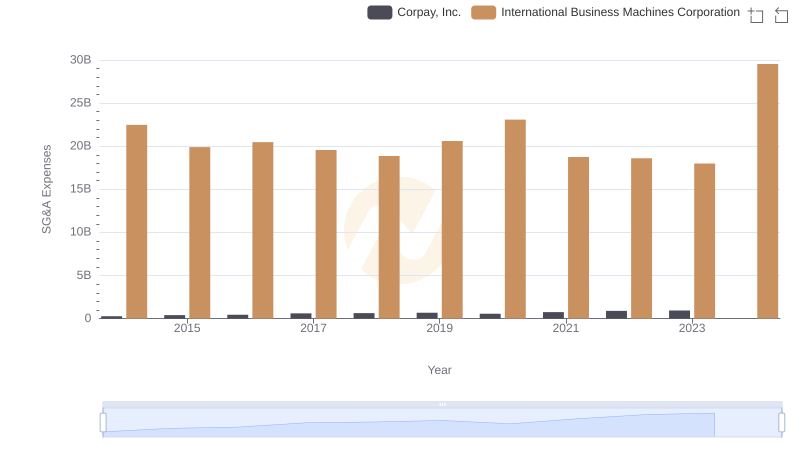

Breaking Down SG&A Expenses: International Business Machines Corporation vs Corpay, Inc.

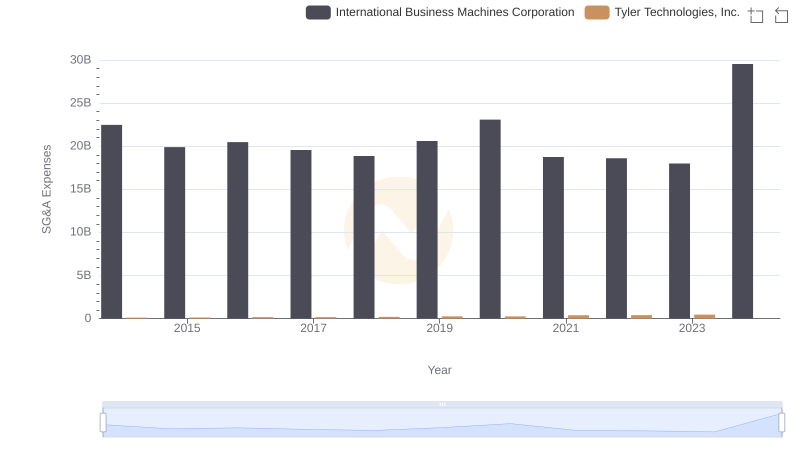

Comparing SG&A Expenses: International Business Machines Corporation vs Tyler Technologies, Inc. Trends and Insights

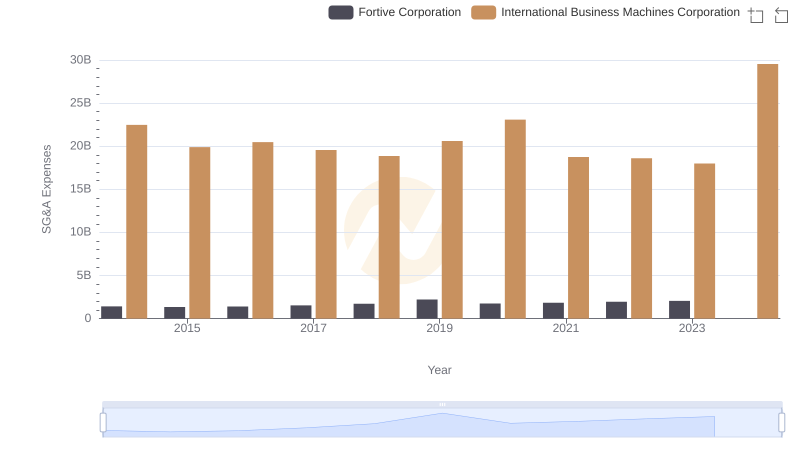

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Fortive Corporation