| __timestamp | Equifax Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 192800000 |

| Thursday, January 1, 2015 | 884300000 | 233900000 |

| Friday, January 1, 2016 | 948200000 | 292700000 |

| Sunday, January 1, 2017 | 1039100000 | 322300000 |

| Monday, January 1, 2018 | 1213300000 | 410400000 |

| Tuesday, January 1, 2019 | 1990200000 | 547300000 |

| Wednesday, January 1, 2020 | 1322500000 | 578800000 |

| Friday, January 1, 2021 | 1324600000 | 201500000 |

| Saturday, January 1, 2022 | 1328900000 | 411300000 |

| Sunday, January 1, 2023 | 1385700000 | 674400000 |

| Monday, January 1, 2024 | 1450500000 | 757200000 |

Unveiling the hidden dimensions of data

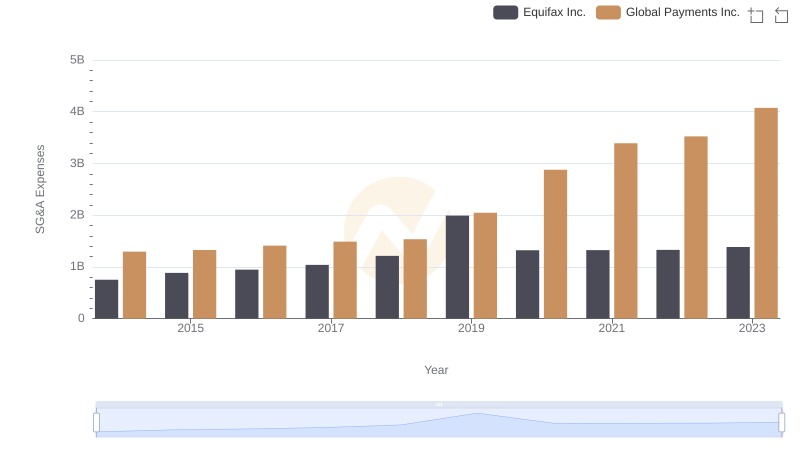

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial for stakeholders. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Equifax Inc. and Ryanair Holdings plc from 2014 to 2023. Over this period, Equifax's SG&A expenses have shown a significant upward trend, peaking in 2019 with a 165% increase from 2014. In contrast, Ryanair's expenses have grown more steadily, with a notable 250% rise by 2023. The data reveals a stark contrast in operational strategies, with Equifax experiencing a sharp spike in 2019, while Ryanair's expenses remained relatively stable, reflecting its cost-efficient business model. Notably, 2024 data for Equifax is missing, highlighting the need for continuous data monitoring. This comparative insight underscores the diverse financial strategies employed by these industry giants.

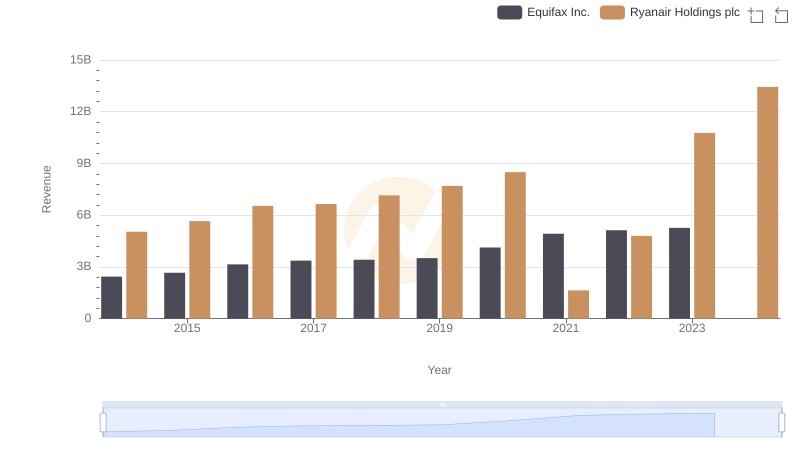

Revenue Showdown: Equifax Inc. vs Ryanair Holdings plc

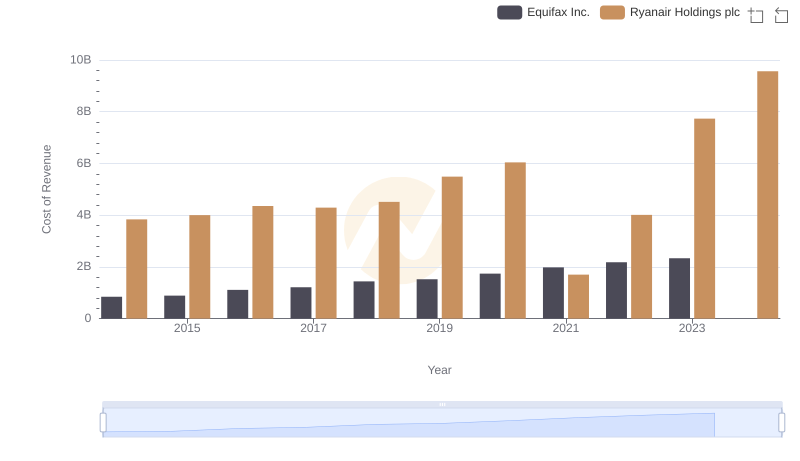

Equifax Inc. vs Ryanair Holdings plc: Efficiency in Cost of Revenue Explored

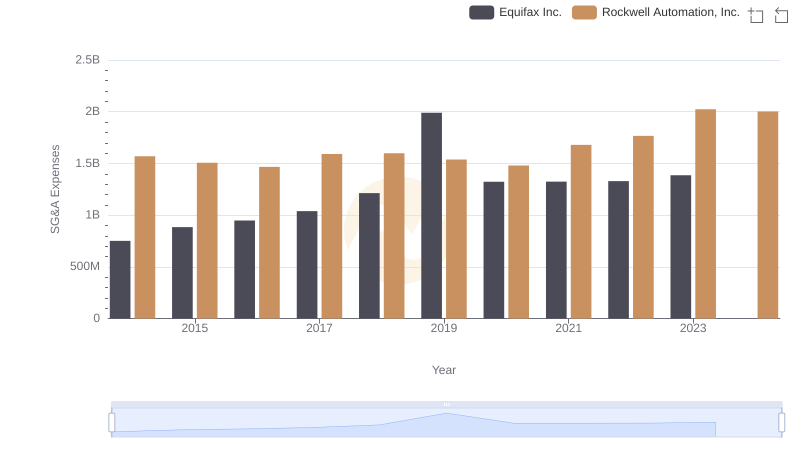

SG&A Efficiency Analysis: Comparing Equifax Inc. and Rockwell Automation, Inc.

Breaking Down SG&A Expenses: Equifax Inc. vs Global Payments Inc.

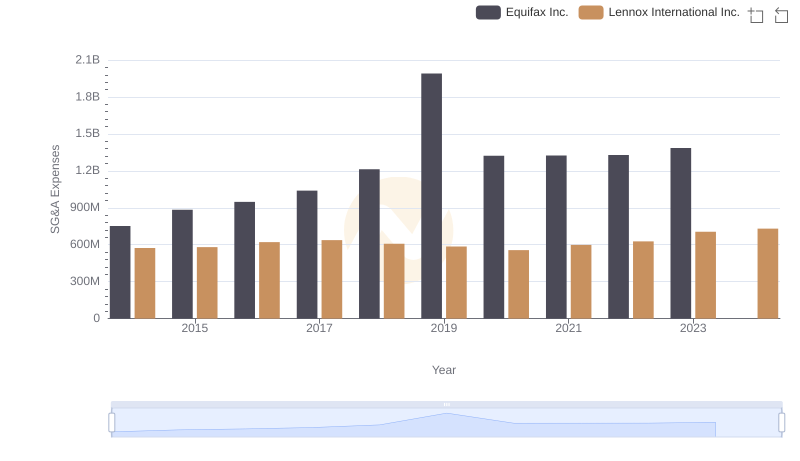

Selling, General, and Administrative Costs: Equifax Inc. vs Lennox International Inc.

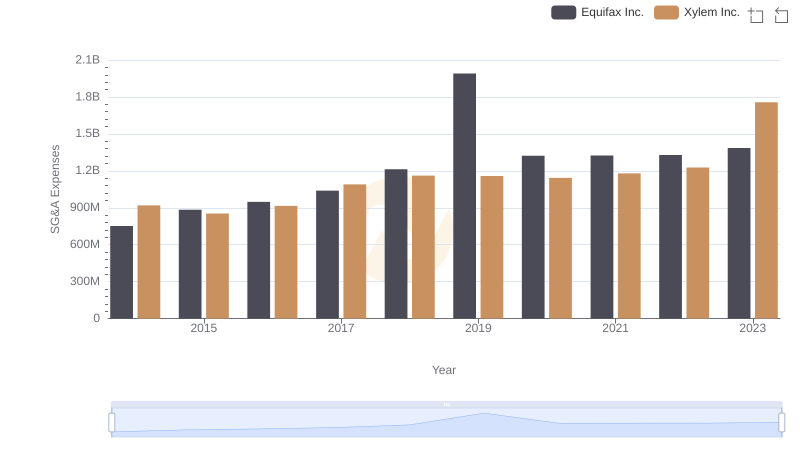

Equifax Inc. or Xylem Inc.: Who Manages SG&A Costs Better?

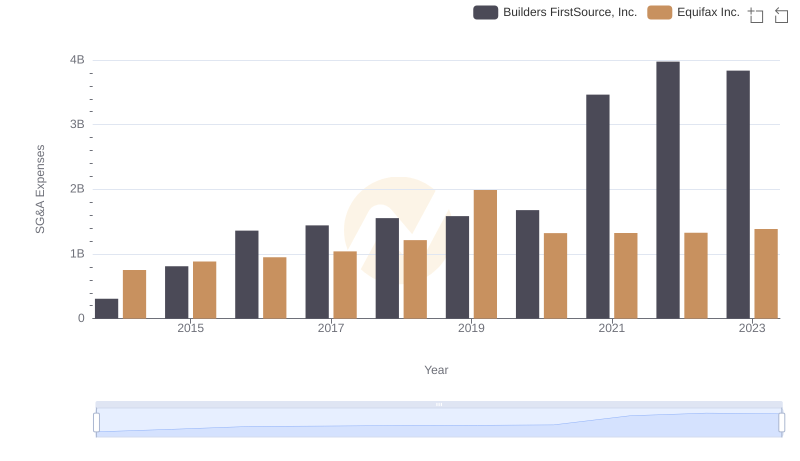

Selling, General, and Administrative Costs: Equifax Inc. vs Builders FirstSource, Inc.

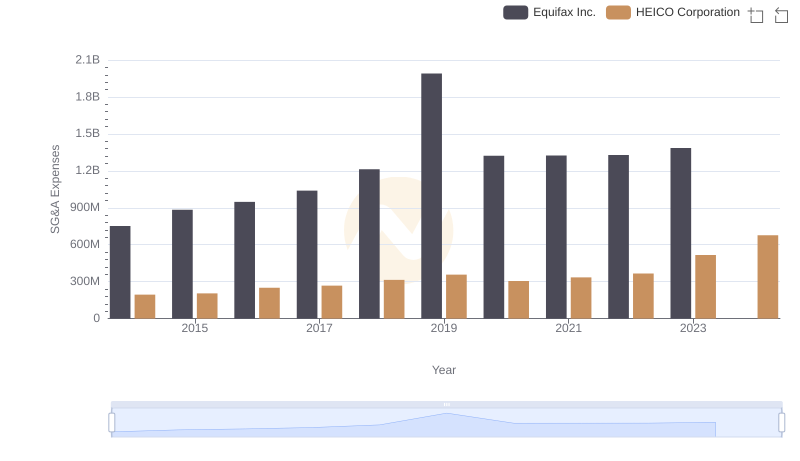

Comparing SG&A Expenses: Equifax Inc. vs HEICO Corporation Trends and Insights

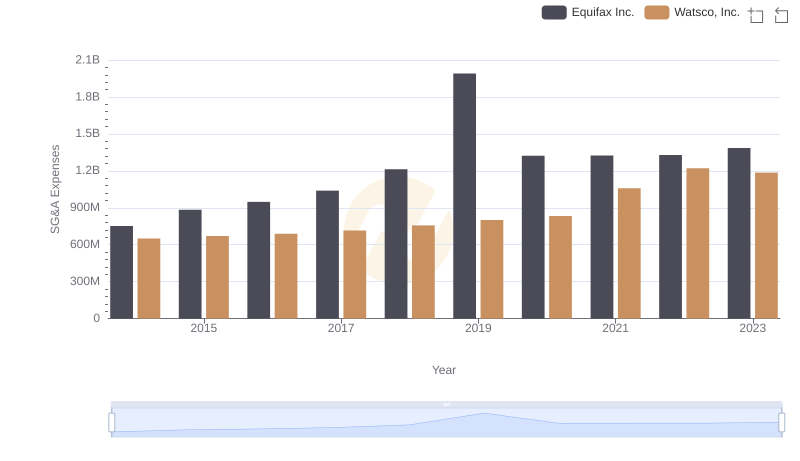

Cost Management Insights: SG&A Expenses for Equifax Inc. and Watsco, Inc.

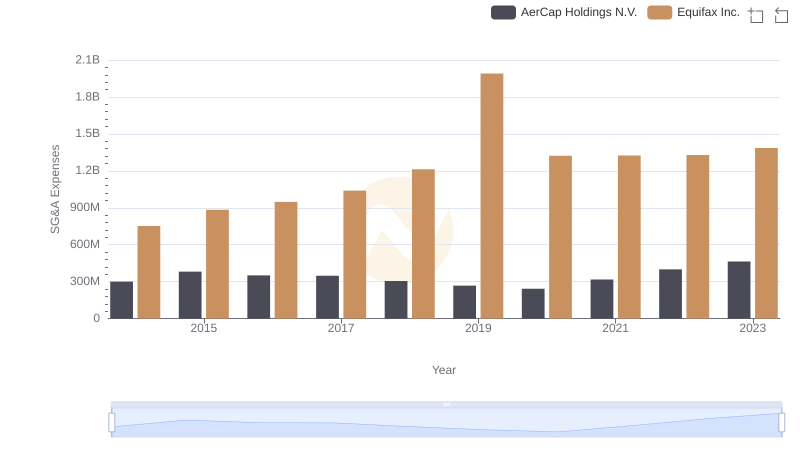

Comparing SG&A Expenses: Equifax Inc. vs AerCap Holdings N.V. Trends and Insights

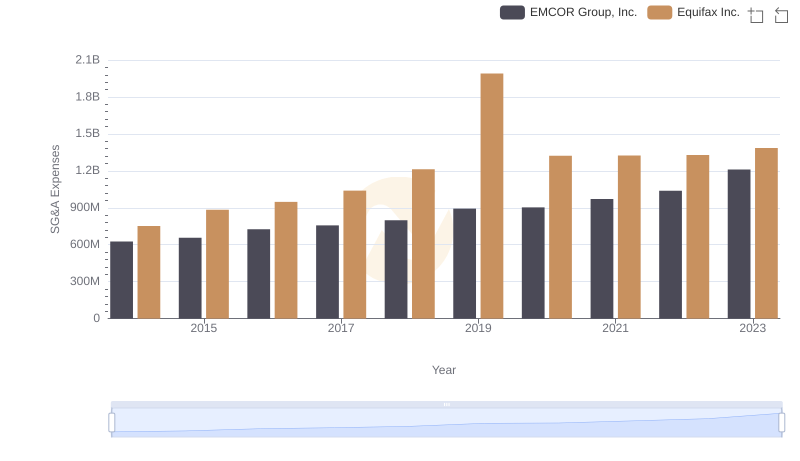

Breaking Down SG&A Expenses: Equifax Inc. vs EMCOR Group, Inc.