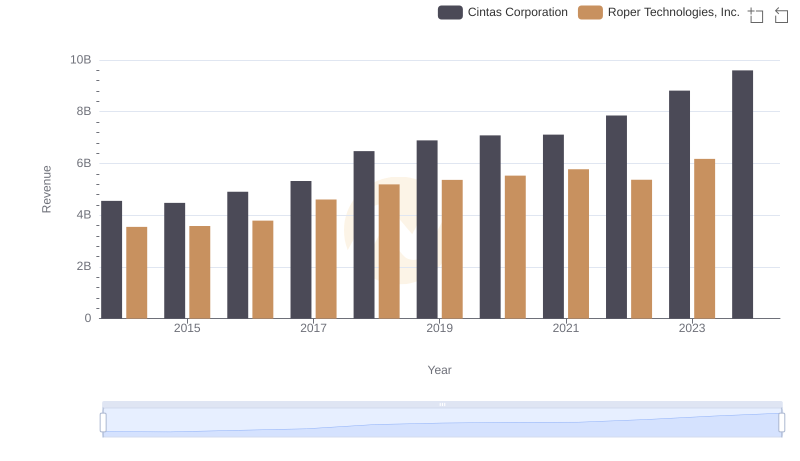

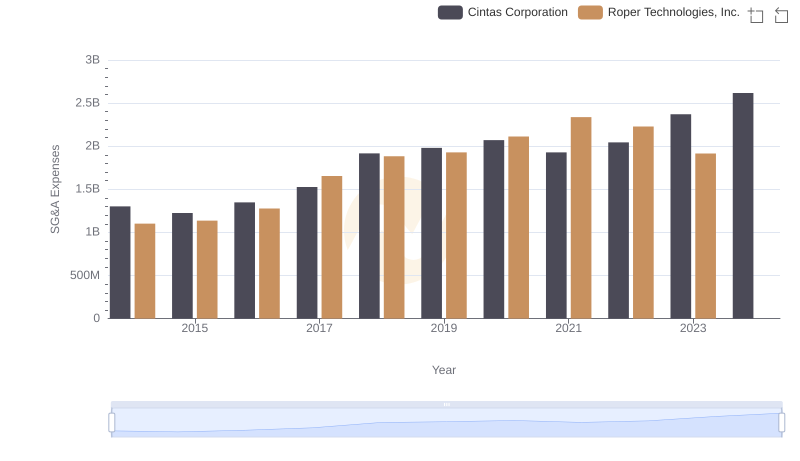

| __timestamp | Cintas Corporation | Roper Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 2101899000 |

| Thursday, January 1, 2015 | 1921337000 | 2164646000 |

| Friday, January 1, 2016 | 2129870000 | 2332410000 |

| Sunday, January 1, 2017 | 2380295000 | 2864796000 |

| Monday, January 1, 2018 | 2908523000 | 3279500000 |

| Tuesday, January 1, 2019 | 3128588000 | 3427100000 |

| Wednesday, January 1, 2020 | 3233748000 | 3543000000 |

| Friday, January 1, 2021 | 3314651000 | 3917400000 |

| Saturday, January 1, 2022 | 3632246000 | 3752800000 |

| Sunday, January 1, 2023 | 4173368000 | 4307200000 |

| Monday, January 1, 2024 | 4686416000 | 4878300000 |

Igniting the spark of knowledge

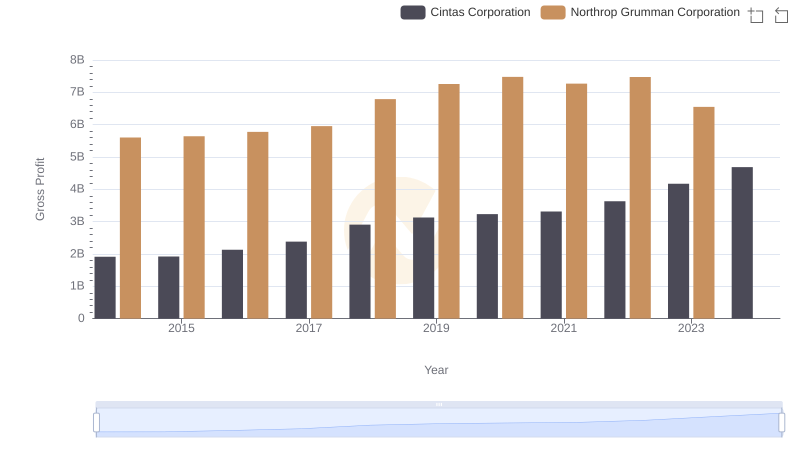

In the competitive landscape of corporate America, Cintas Corporation and Roper Technologies, Inc. have demonstrated remarkable growth in gross profit over the past decade. From 2014 to 2023, Cintas Corporation's gross profit surged by approximately 145%, reflecting its robust business model and strategic expansions. Meanwhile, Roper Technologies, Inc. experienced a commendable 105% increase in the same period, showcasing its resilience and adaptability in the tech-driven market.

This data highlights the dynamic growth trajectories of these industry leaders, offering valuable insights for investors and market analysts.

Comparing Revenue Performance: Cintas Corporation or Roper Technologies, Inc.?

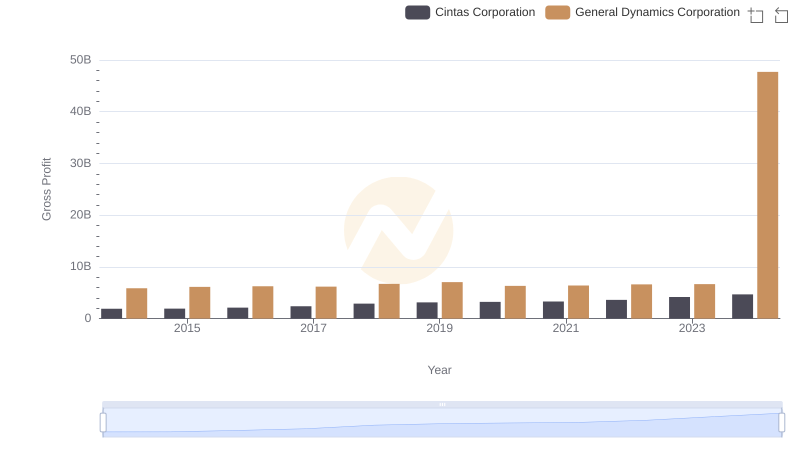

Gross Profit Trends Compared: Cintas Corporation vs General Dynamics Corporation

Cintas Corporation and Northrop Grumman Corporation: A Detailed Gross Profit Analysis

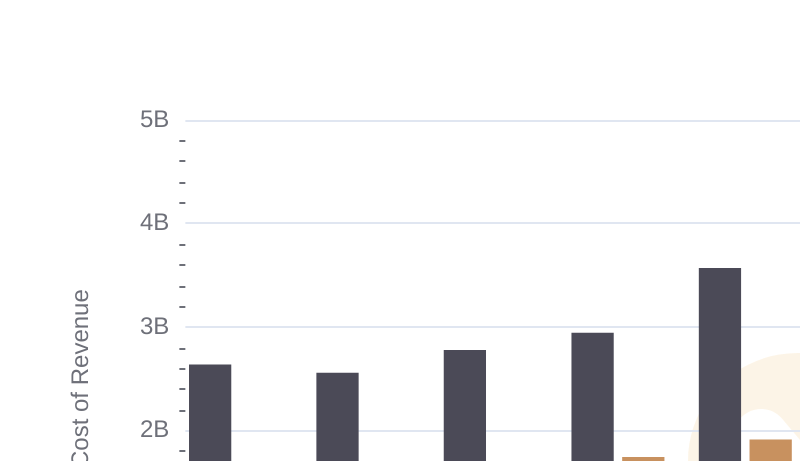

Cost of Revenue Comparison: Cintas Corporation vs Roper Technologies, Inc.

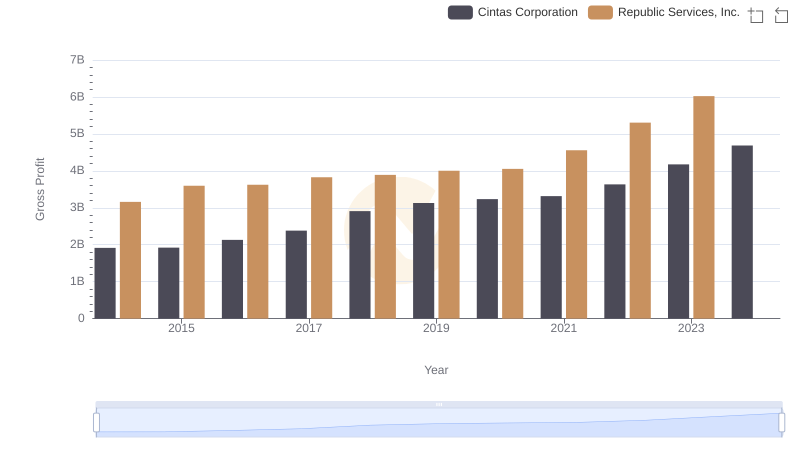

Cintas Corporation vs Republic Services, Inc.: A Gross Profit Performance Breakdown

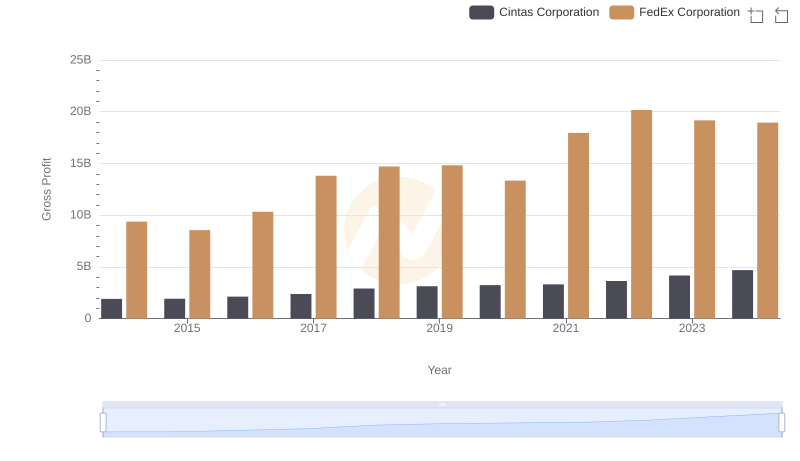

Gross Profit Comparison: Cintas Corporation and FedEx Corporation Trends

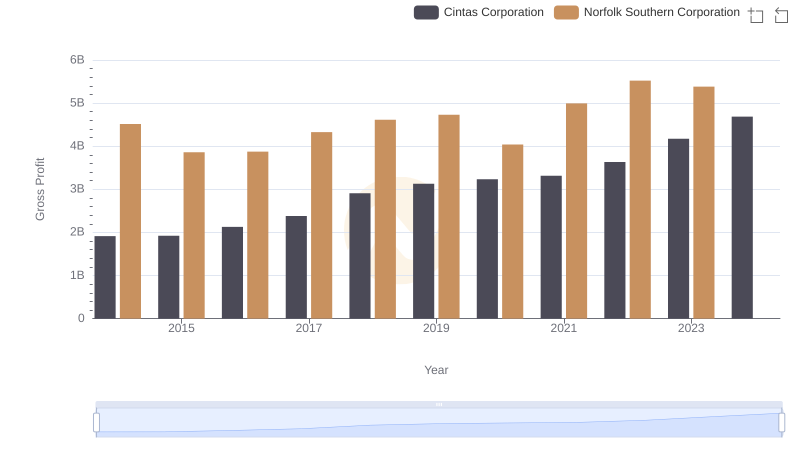

Gross Profit Analysis: Comparing Cintas Corporation and Norfolk Southern Corporation

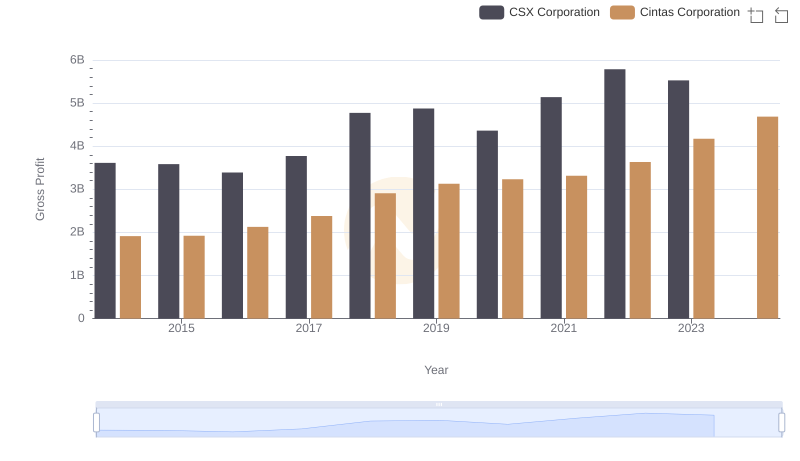

Cintas Corporation vs CSX Corporation: A Gross Profit Performance Breakdown

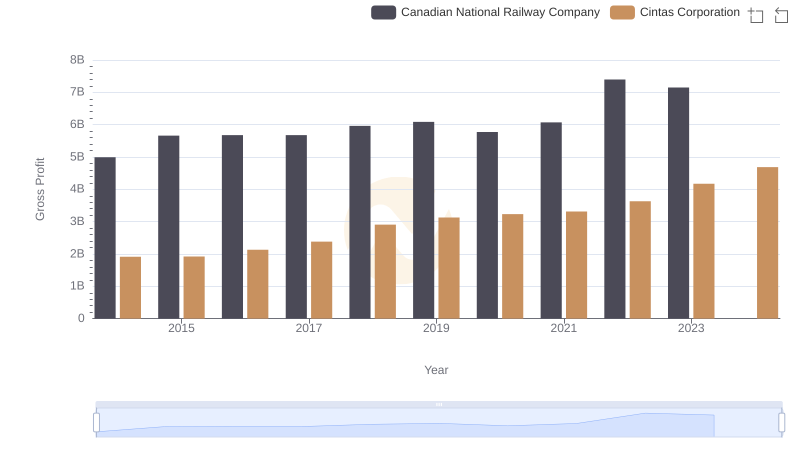

Gross Profit Trends Compared: Cintas Corporation vs Canadian National Railway Company

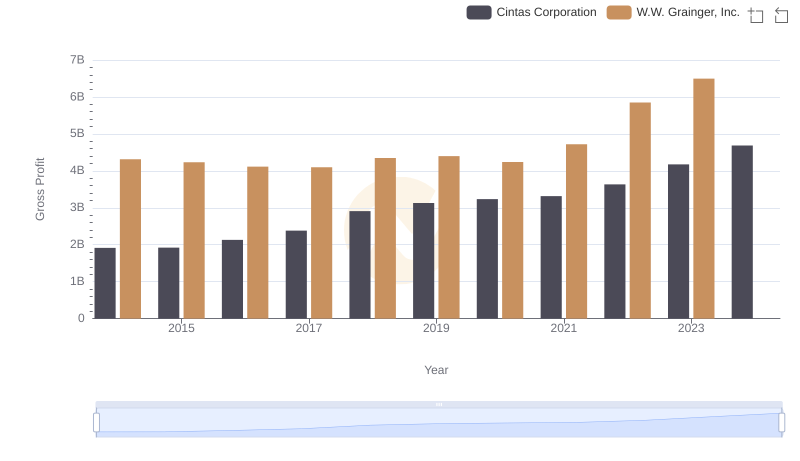

Who Generates Higher Gross Profit? Cintas Corporation or W.W. Grainger, Inc.

Comparing SG&A Expenses: Cintas Corporation vs Roper Technologies, Inc. Trends and Insights

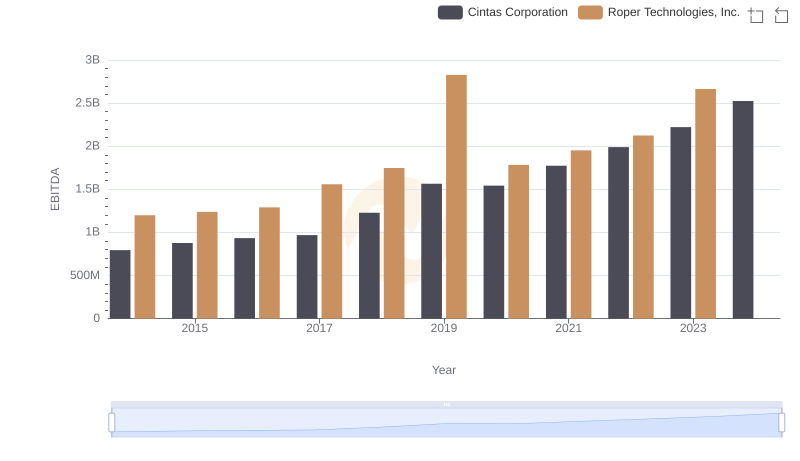

Comprehensive EBITDA Comparison: Cintas Corporation vs Roper Technologies, Inc.