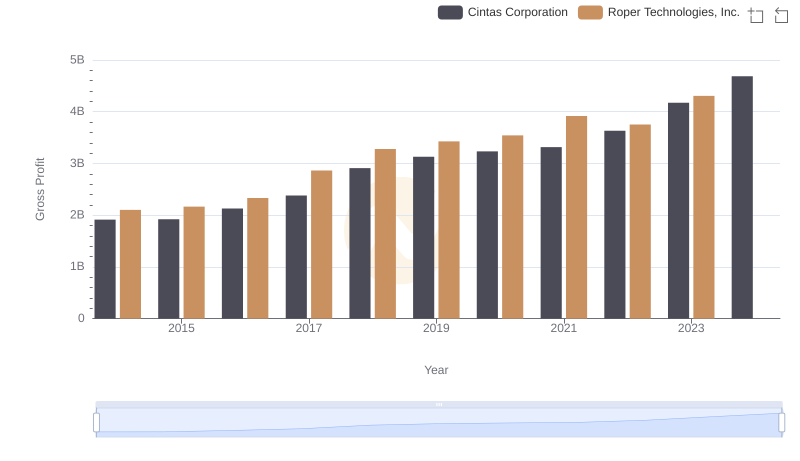

| __timestamp | Cintas Corporation | Roper Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4551812000 | 3549494000 |

| Thursday, January 1, 2015 | 4476886000 | 3582395000 |

| Friday, January 1, 2016 | 4905458000 | 3789925000 |

| Sunday, January 1, 2017 | 5323381000 | 4607471000 |

| Monday, January 1, 2018 | 6476632000 | 5191200000 |

| Tuesday, January 1, 2019 | 6892303000 | 5366800000 |

| Wednesday, January 1, 2020 | 7085120000 | 5527100000 |

| Friday, January 1, 2021 | 7116340000 | 5777800000 |

| Saturday, January 1, 2022 | 7854459000 | 5371800000 |

| Sunday, January 1, 2023 | 8815769000 | 6177800000 |

| Monday, January 1, 2024 | 9596615000 | 7039200000 |

Infusing magic into the data realm

In the competitive landscape of corporate America, Cintas Corporation and Roper Technologies, Inc. have showcased remarkable revenue trajectories over the past decade. From 2014 to 2023, Cintas Corporation has seen its revenue soar by over 110%, starting from approximately $4.6 billion and reaching nearly $8.8 billion. This consistent growth highlights Cintas's strategic prowess in the uniform and facility services industry.

Conversely, Roper Technologies, a diversified technology company, experienced a steady revenue increase of about 74% during the same period, climbing from $3.5 billion to $6.2 billion. Despite a slight dip in 2022, Roper's resilience is evident in its recovery by 2023.

While Cintas's revenue growth outpaced Roper's, both companies exemplify robust financial health and adaptability. Notably, data for 2024 is incomplete, leaving room for speculation on future performance.

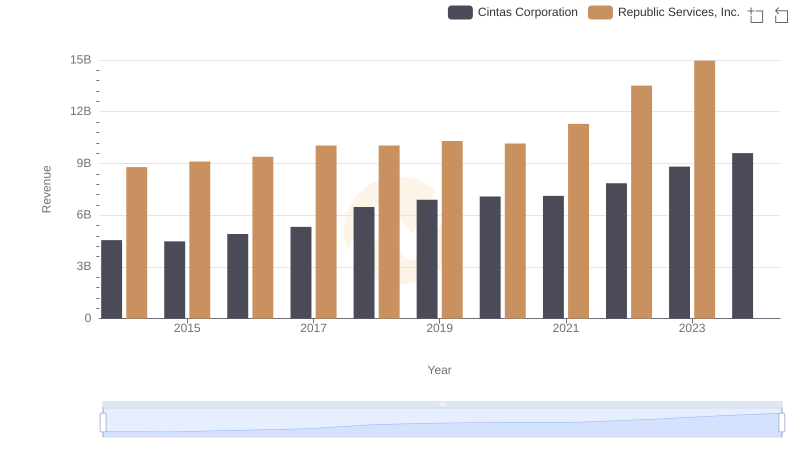

Cintas Corporation or Republic Services, Inc.: Who Leads in Yearly Revenue?

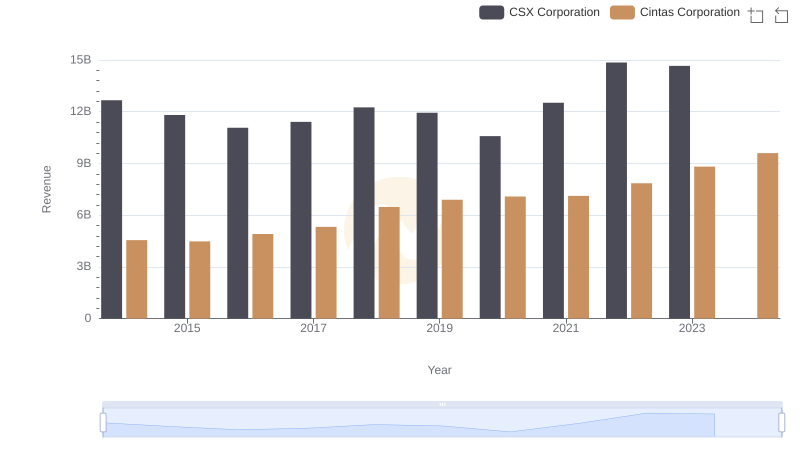

Revenue Insights: Cintas Corporation and CSX Corporation Performance Compared

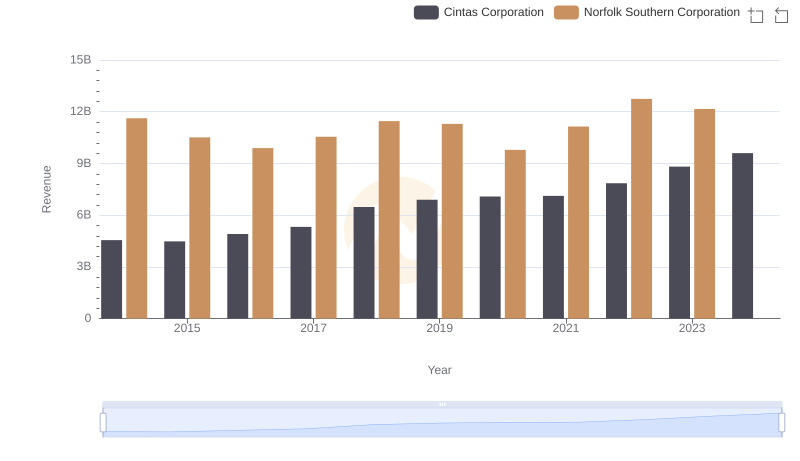

Cintas Corporation or Norfolk Southern Corporation: Who Leads in Yearly Revenue?

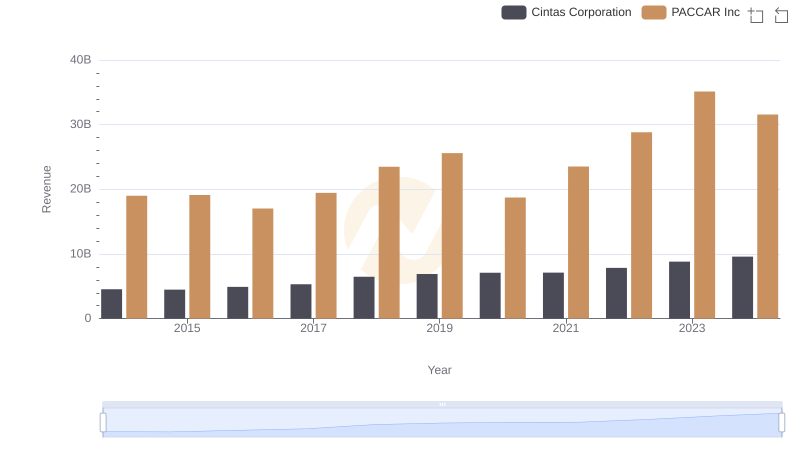

Who Generates More Revenue? Cintas Corporation or PACCAR Inc

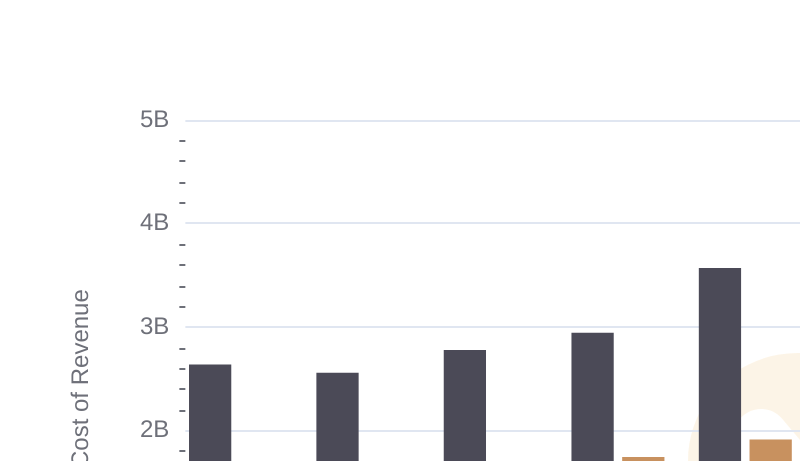

Cost of Revenue Comparison: Cintas Corporation vs Roper Technologies, Inc.

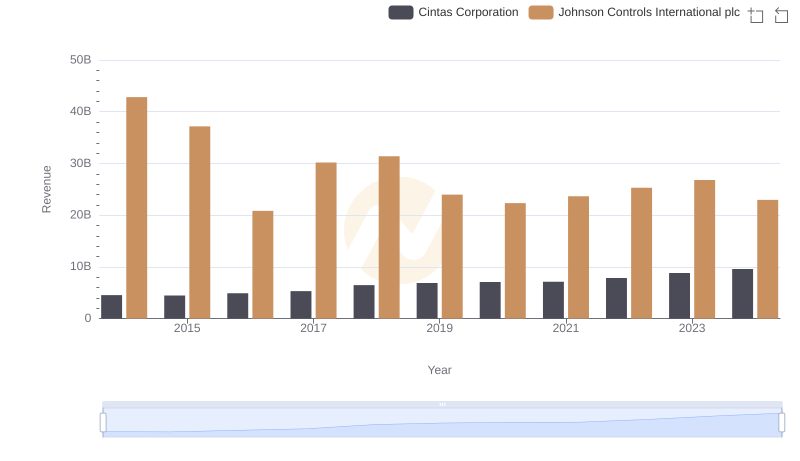

Comparing Revenue Performance: Cintas Corporation or Johnson Controls International plc?

Key Insights on Gross Profit: Cintas Corporation vs Roper Technologies, Inc.

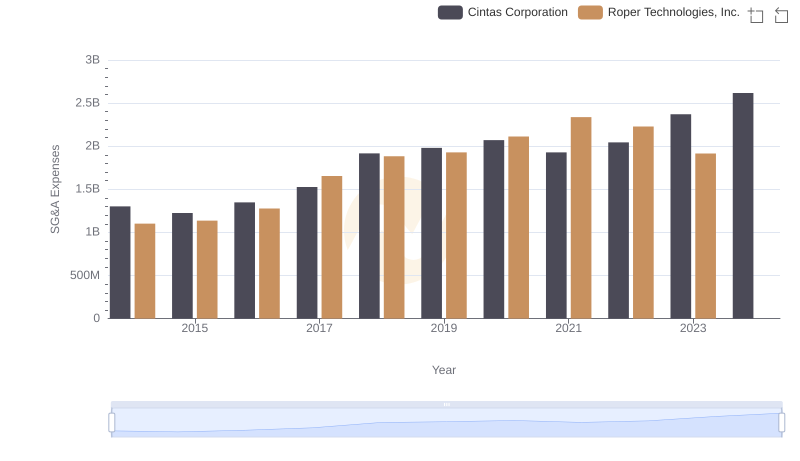

Comparing SG&A Expenses: Cintas Corporation vs Roper Technologies, Inc. Trends and Insights

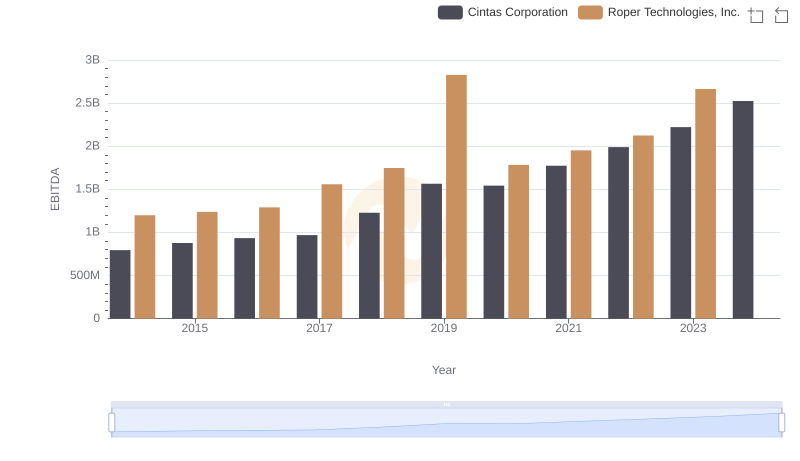

Comprehensive EBITDA Comparison: Cintas Corporation vs Roper Technologies, Inc.