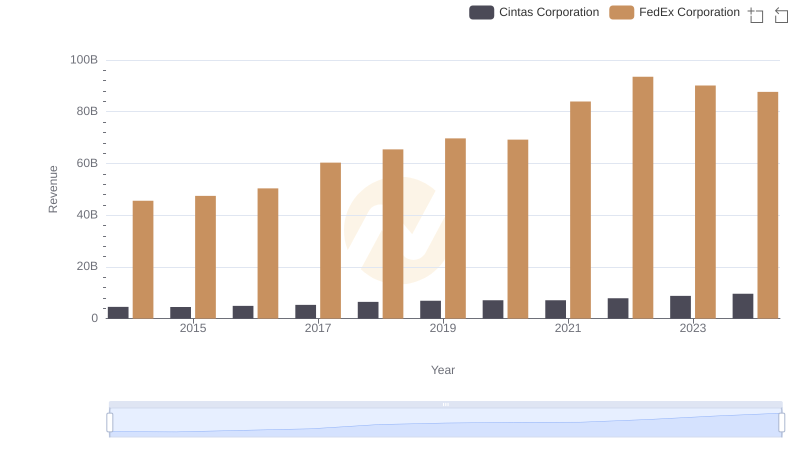

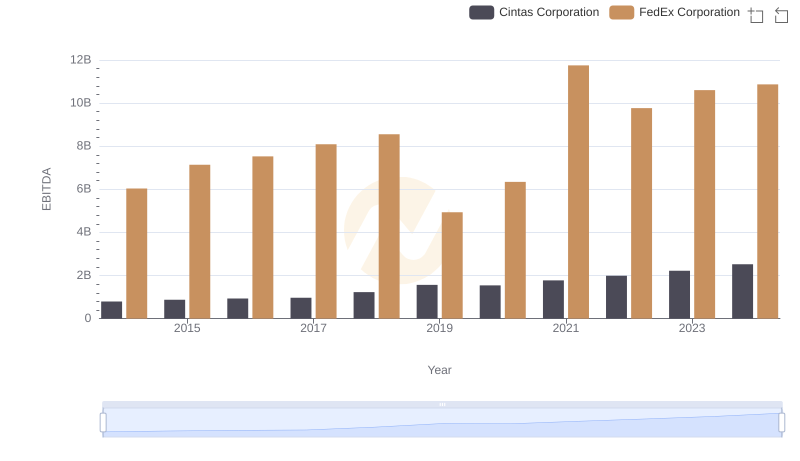

| __timestamp | Cintas Corporation | FedEx Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 9373000000 |

| Thursday, January 1, 2015 | 1921337000 | 8558000000 |

| Friday, January 1, 2016 | 2129870000 | 10328000000 |

| Sunday, January 1, 2017 | 2380295000 | 13808000000 |

| Monday, January 1, 2018 | 2908523000 | 14700000000 |

| Tuesday, January 1, 2019 | 3128588000 | 14827000000 |

| Wednesday, January 1, 2020 | 3233748000 | 13344000000 |

| Friday, January 1, 2021 | 3314651000 | 17954000000 |

| Saturday, January 1, 2022 | 3632246000 | 20167000000 |

| Sunday, January 1, 2023 | 4173368000 | 19166000000 |

| Monday, January 1, 2024 | 4686416000 | 18952000000 |

Igniting the spark of knowledge

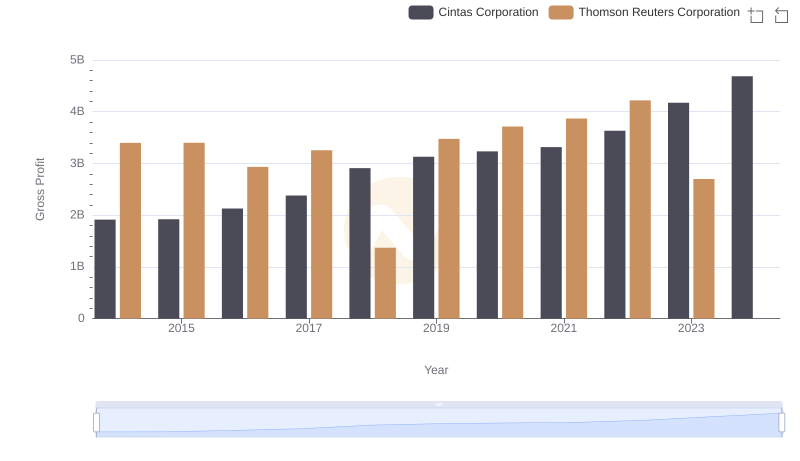

In the ever-evolving landscape of corporate America, Cintas Corporation and FedEx Corporation stand as titans in their respective industries. Over the past decade, from 2014 to 2024, these companies have showcased remarkable growth in gross profit, reflecting their strategic prowess and market adaptability.

Cintas, a leader in corporate uniforms and facility services, has seen its gross profit soar by approximately 145%, from $1.9 billion in 2014 to an impressive $4.7 billion in 2024. This growth underscores Cintas's ability to expand its market share and optimize operations.

Meanwhile, FedEx, a global logistics powerhouse, experienced a 102% increase in gross profit, peaking at $20.2 billion in 2022 before slightly declining to $19 billion in 2024. This trend highlights FedEx's resilience amidst global supply chain challenges.

These trends offer a fascinating glimpse into the financial trajectories of two industry leaders, each navigating their unique paths to success.

Cintas Corporation vs FedEx Corporation: Annual Revenue Growth Compared

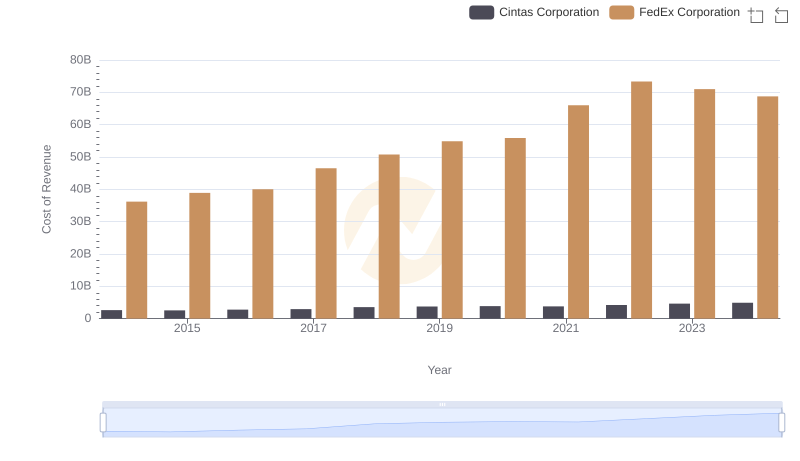

Cintas Corporation vs FedEx Corporation: Efficiency in Cost of Revenue Explored

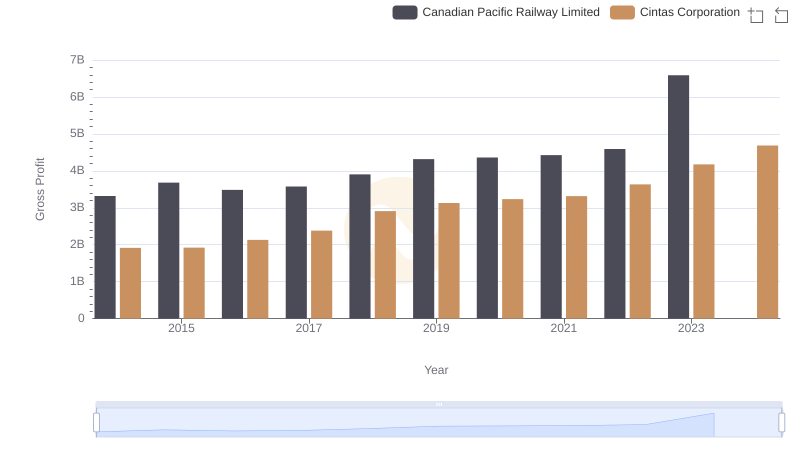

Gross Profit Comparison: Cintas Corporation and Canadian Pacific Railway Limited Trends

Cintas Corporation and Thomson Reuters Corporation: A Detailed Gross Profit Analysis

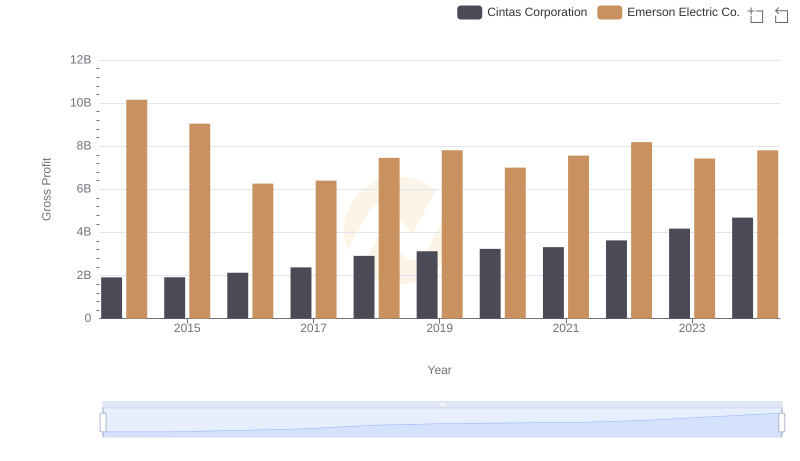

Who Generates Higher Gross Profit? Cintas Corporation or Emerson Electric Co.

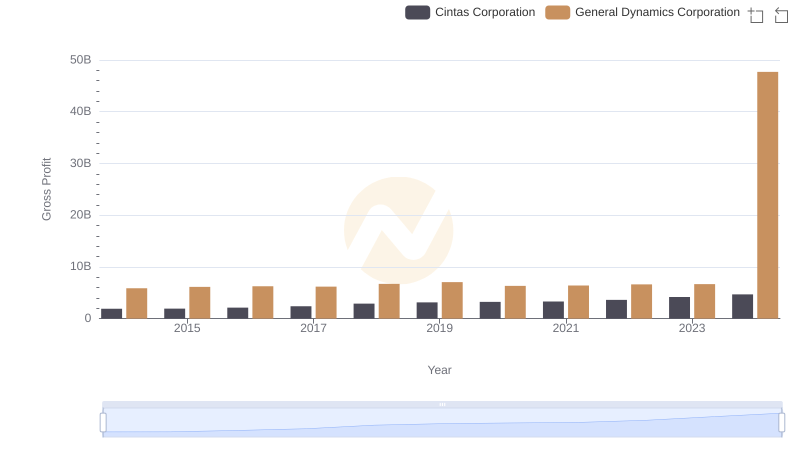

Gross Profit Trends Compared: Cintas Corporation vs General Dynamics Corporation

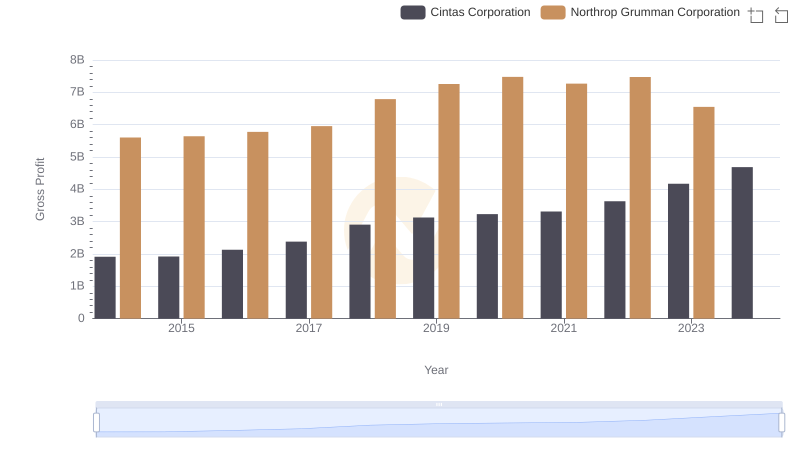

Cintas Corporation and Northrop Grumman Corporation: A Detailed Gross Profit Analysis

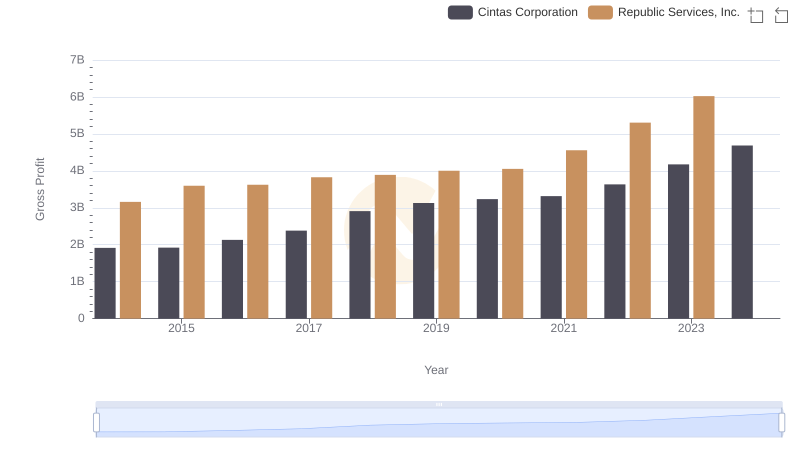

Cintas Corporation vs Republic Services, Inc.: A Gross Profit Performance Breakdown

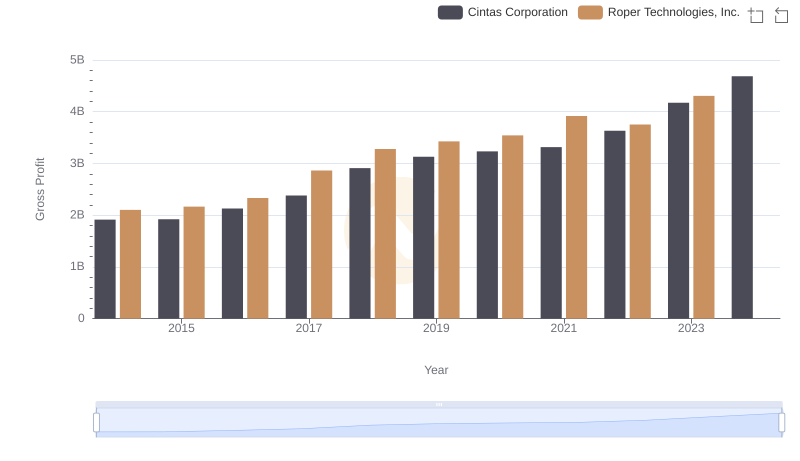

Key Insights on Gross Profit: Cintas Corporation vs Roper Technologies, Inc.

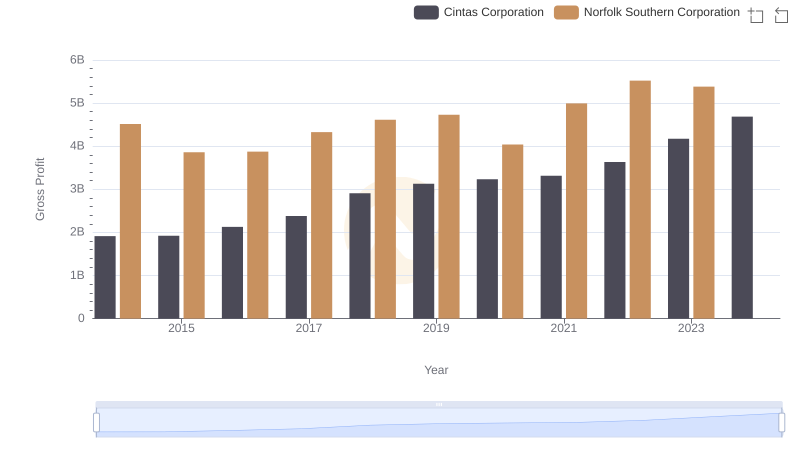

Gross Profit Analysis: Comparing Cintas Corporation and Norfolk Southern Corporation

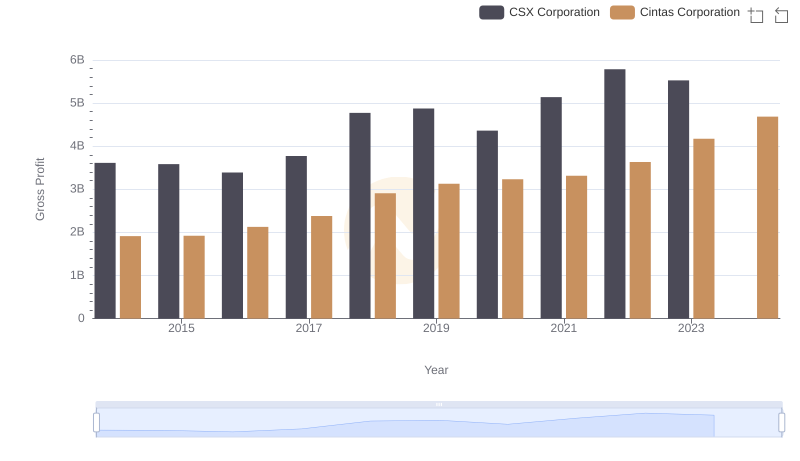

Cintas Corporation vs CSX Corporation: A Gross Profit Performance Breakdown

Professional EBITDA Benchmarking: Cintas Corporation vs FedEx Corporation