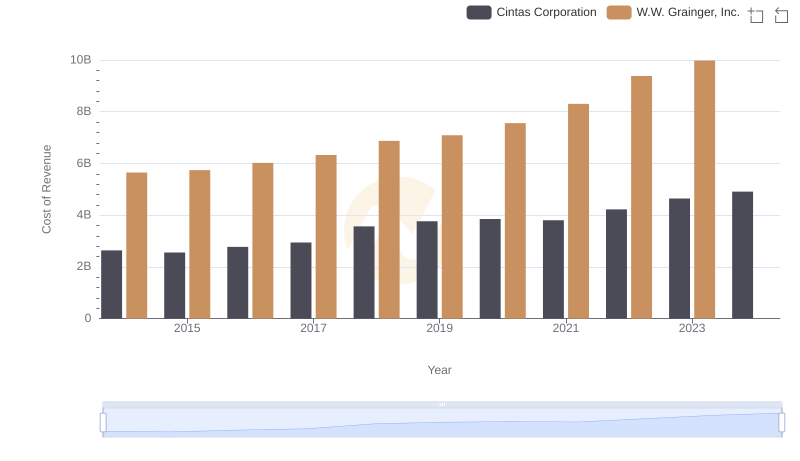

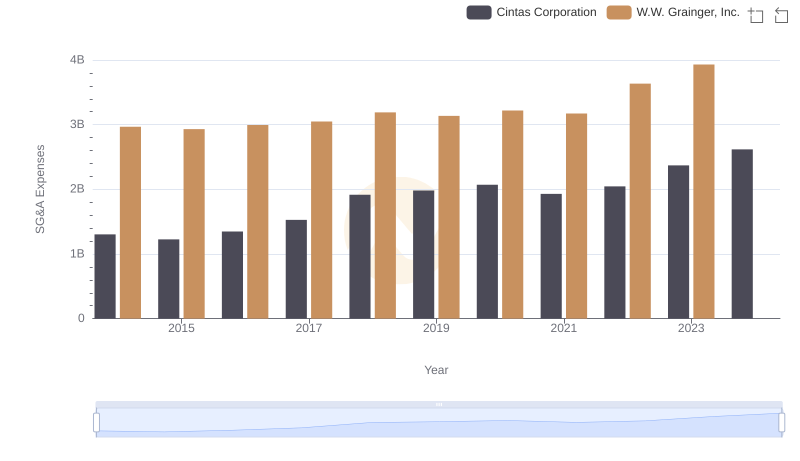

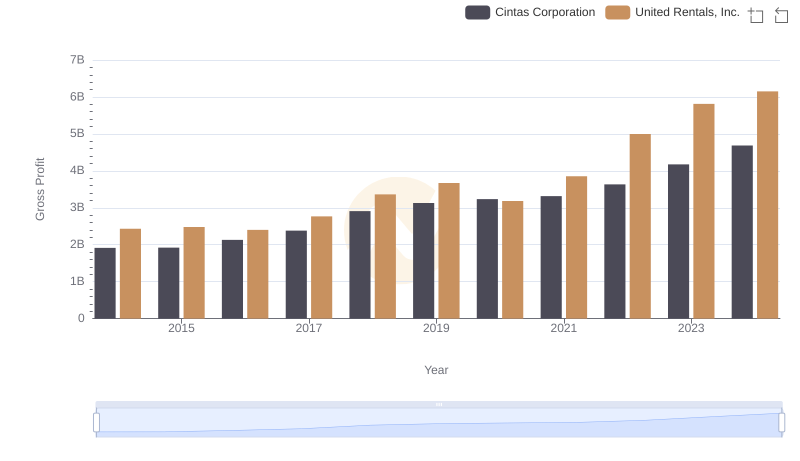

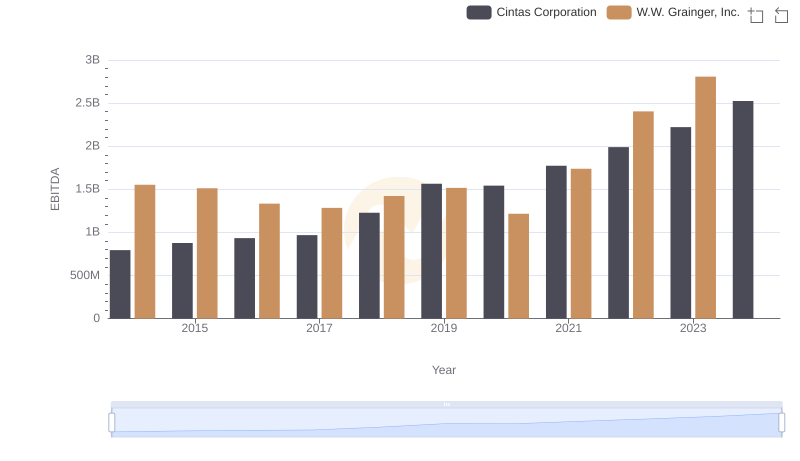

| __timestamp | Cintas Corporation | W.W. Grainger, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 4314242000 |

| Thursday, January 1, 2015 | 1921337000 | 4231428000 |

| Friday, January 1, 2016 | 2129870000 | 4114557000 |

| Sunday, January 1, 2017 | 2380295000 | 4097557000 |

| Monday, January 1, 2018 | 2908523000 | 4348000000 |

| Tuesday, January 1, 2019 | 3128588000 | 4397000000 |

| Wednesday, January 1, 2020 | 3233748000 | 4238000000 |

| Friday, January 1, 2021 | 3314651000 | 4720000000 |

| Saturday, January 1, 2022 | 3632246000 | 5849000000 |

| Sunday, January 1, 2023 | 4173368000 | 6496000000 |

| Monday, January 1, 2024 | 4686416000 | 6758000000 |

Infusing magic into the data realm

In the competitive landscape of industrial supply and services, Cintas Corporation and W.W. Grainger, Inc. have long been industry stalwarts. Over the past decade, W.W. Grainger has consistently outperformed Cintas in terms of gross profit, with Grainger's figures peaking at approximately 6.5 billion in 2023, a remarkable 56% increase from 2014. Meanwhile, Cintas has shown impressive growth, with its gross profit rising by 145% over the same period, reaching nearly 4.7 billion in 2024. This growth trajectory highlights Cintas's strategic advancements and market penetration. However, the data for 2024 is incomplete for Grainger, leaving room for speculation on whether Cintas might close the gap further. As these giants continue to innovate and expand, the coming years promise an intriguing battle for market dominance.

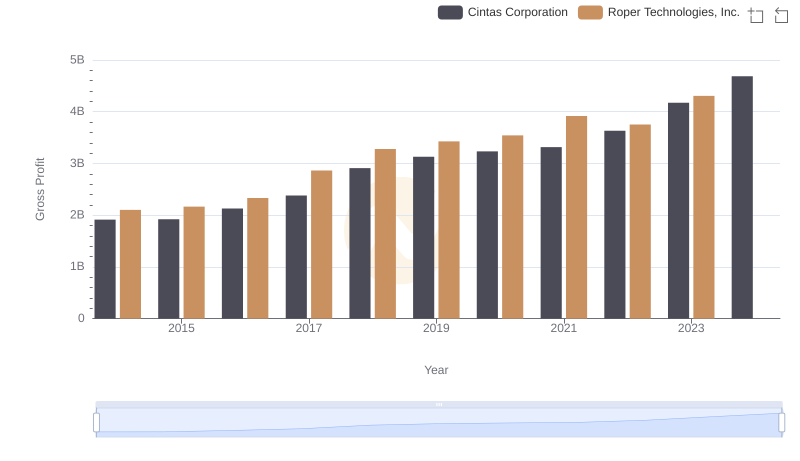

Key Insights on Gross Profit: Cintas Corporation vs Roper Technologies, Inc.

Cintas Corporation vs W.W. Grainger, Inc.: Efficiency in Cost of Revenue Explored

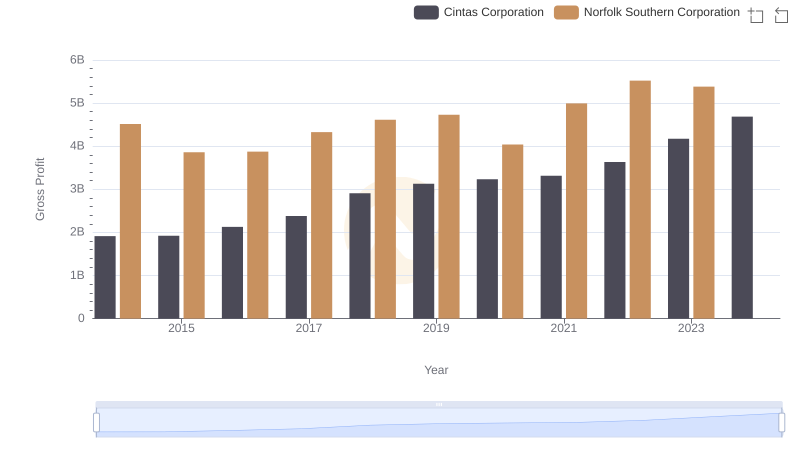

Gross Profit Analysis: Comparing Cintas Corporation and Norfolk Southern Corporation

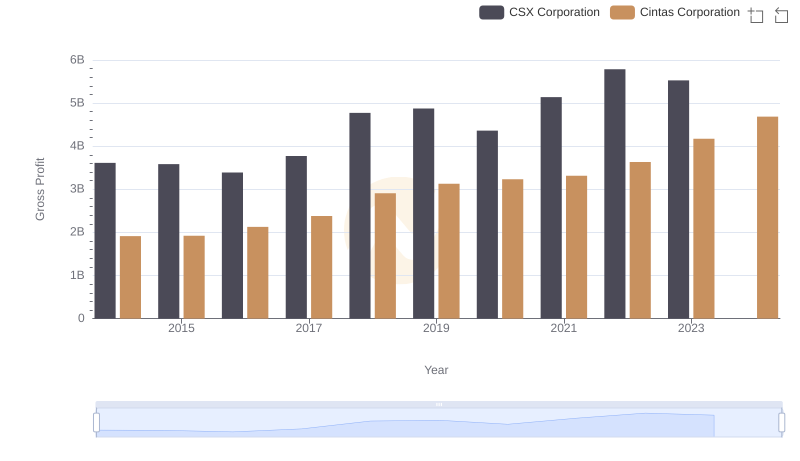

Cintas Corporation vs CSX Corporation: A Gross Profit Performance Breakdown

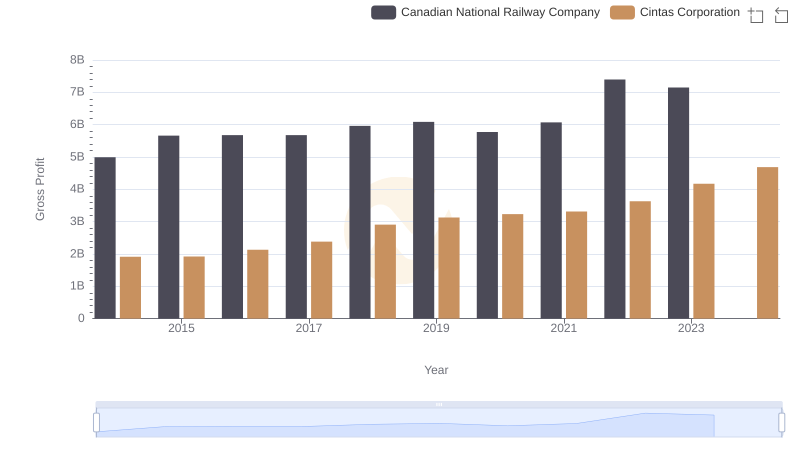

Gross Profit Trends Compared: Cintas Corporation vs Canadian National Railway Company

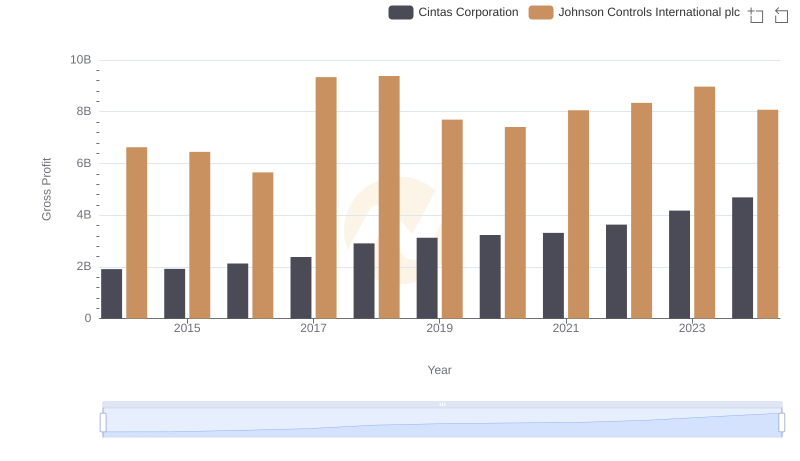

Gross Profit Trends Compared: Cintas Corporation vs Johnson Controls International plc

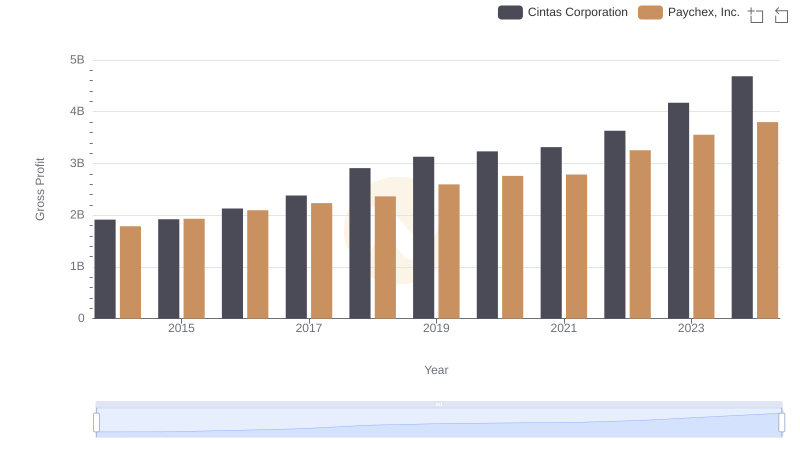

Key Insights on Gross Profit: Cintas Corporation vs Paychex, Inc.

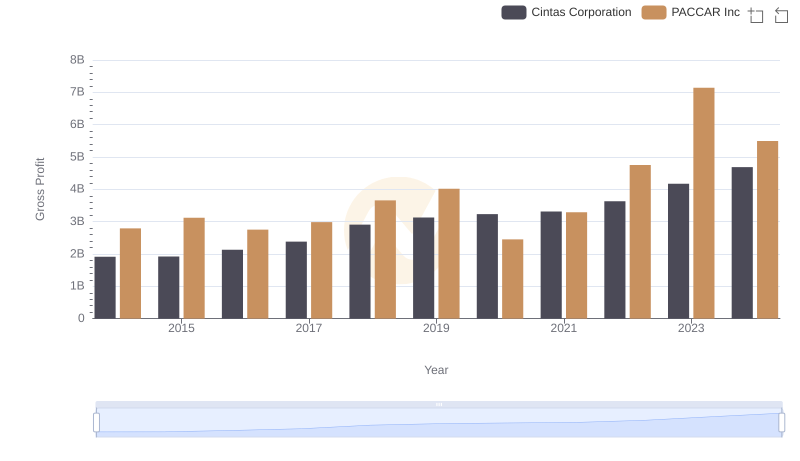

Gross Profit Comparison: Cintas Corporation and PACCAR Inc Trends

Cintas Corporation vs W.W. Grainger, Inc.: SG&A Expense Trends

Gross Profit Analysis: Comparing Cintas Corporation and United Rentals, Inc.

Cintas Corporation vs W.W. Grainger, Inc.: In-Depth EBITDA Performance Comparison