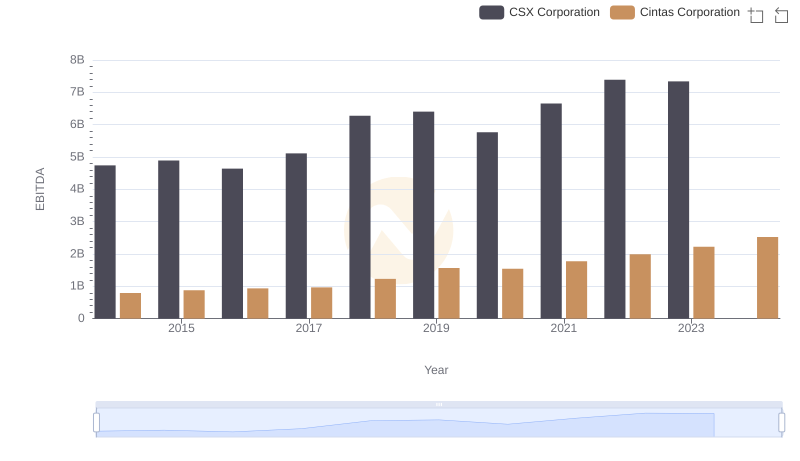

| __timestamp | CSX Corporation | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3613000000 | 1914386000 |

| Thursday, January 1, 2015 | 3584000000 | 1921337000 |

| Friday, January 1, 2016 | 3389000000 | 2129870000 |

| Sunday, January 1, 2017 | 3773000000 | 2380295000 |

| Monday, January 1, 2018 | 4773000000 | 2908523000 |

| Tuesday, January 1, 2019 | 4874000000 | 3128588000 |

| Wednesday, January 1, 2020 | 4362000000 | 3233748000 |

| Friday, January 1, 2021 | 5140000000 | 3314651000 |

| Saturday, January 1, 2022 | 5785000000 | 3632246000 |

| Sunday, January 1, 2023 | 5527000000 | 4173368000 |

| Monday, January 1, 2024 | 4686416000 |

Igniting the spark of knowledge

In the world of corporate finance, the battle for supremacy often boils down to profitability. Over the past decade, Cintas Corporation and CSX Corporation have been at the forefront of this competition. From 2014 to 2023, CSX Corporation's gross profit surged by approximately 53%, peaking in 2022. Meanwhile, Cintas Corporation demonstrated a remarkable growth trajectory, with its gross profit more than doubling, showcasing a 118% increase over the same period.

As we look to the future, the missing data for 2024 leaves us eagerly anticipating how these industry titans will continue to evolve.

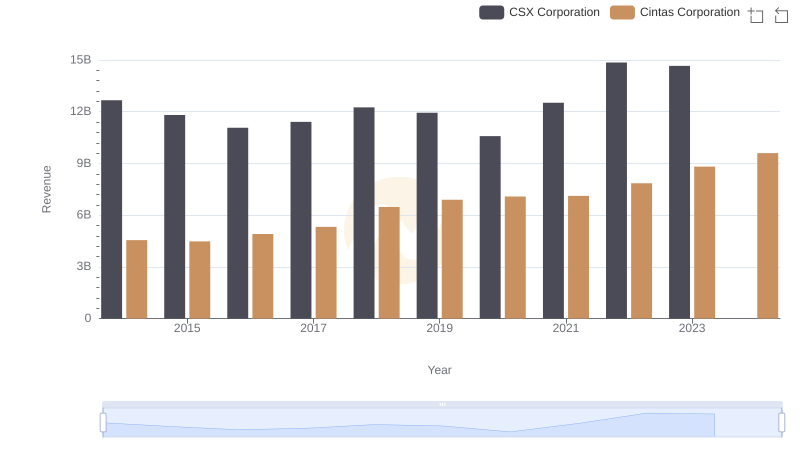

Revenue Insights: Cintas Corporation and CSX Corporation Performance Compared

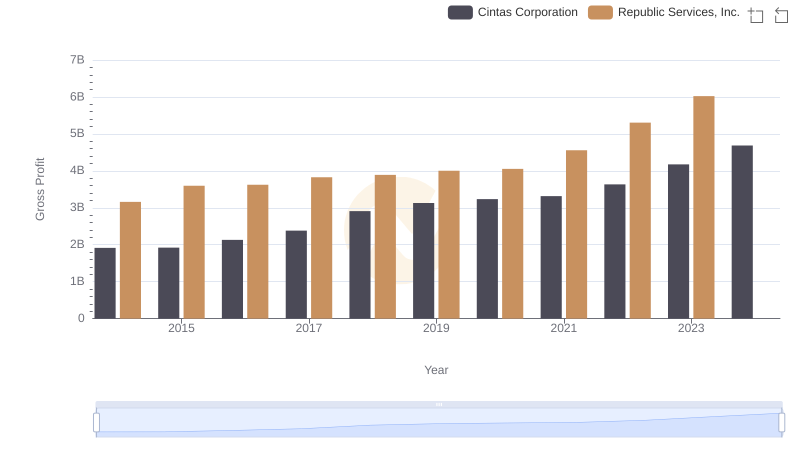

Cintas Corporation vs Republic Services, Inc.: A Gross Profit Performance Breakdown

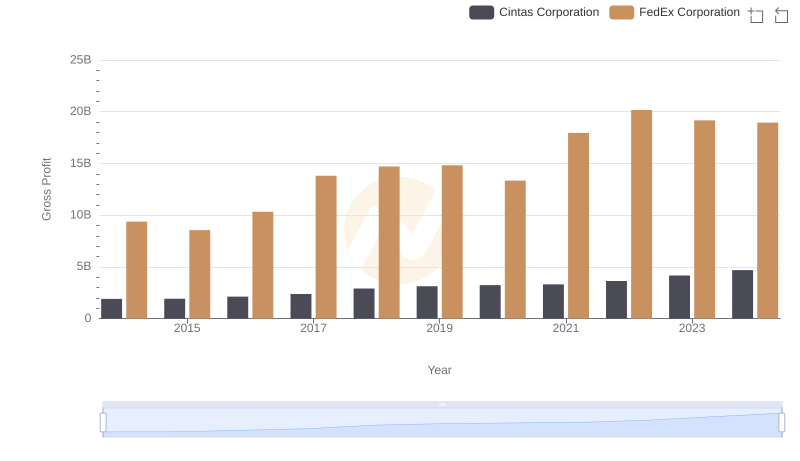

Gross Profit Comparison: Cintas Corporation and FedEx Corporation Trends

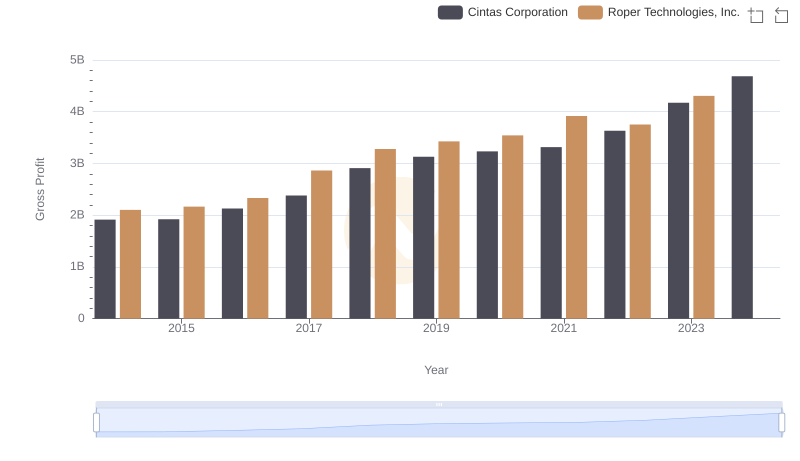

Key Insights on Gross Profit: Cintas Corporation vs Roper Technologies, Inc.

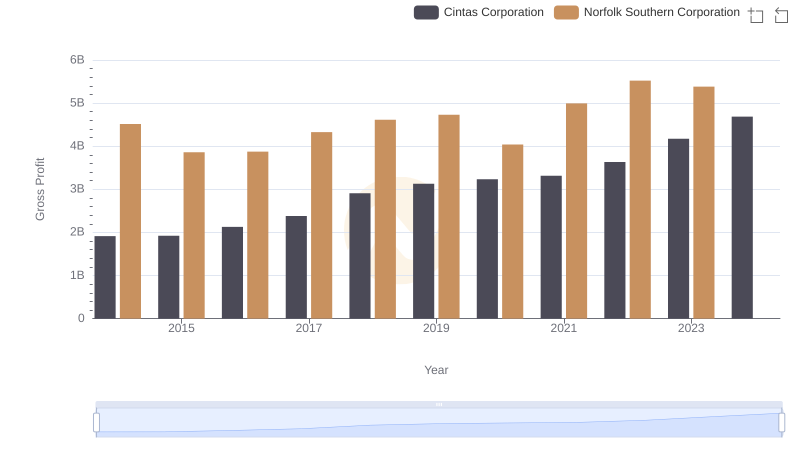

Gross Profit Analysis: Comparing Cintas Corporation and Norfolk Southern Corporation

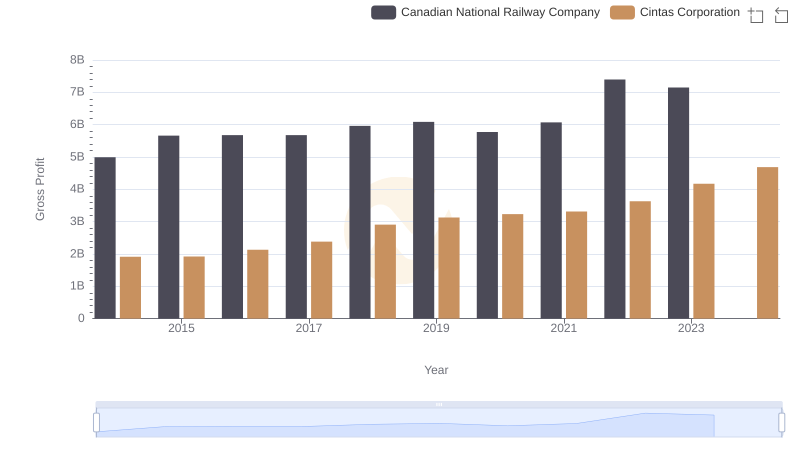

Gross Profit Trends Compared: Cintas Corporation vs Canadian National Railway Company

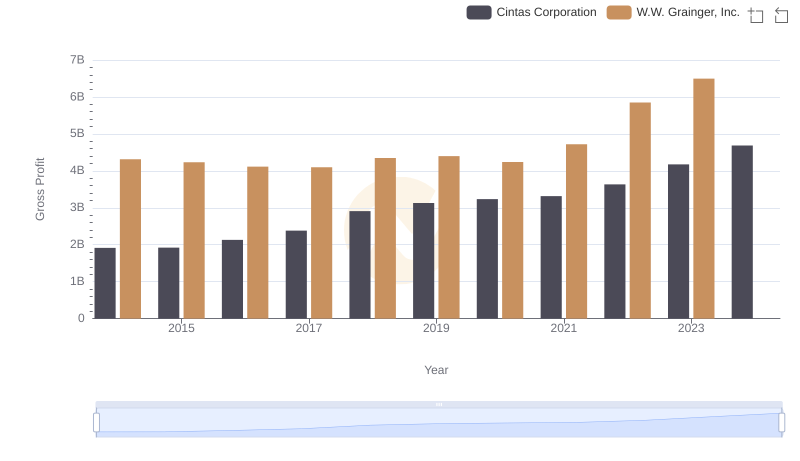

Who Generates Higher Gross Profit? Cintas Corporation or W.W. Grainger, Inc.

A Side-by-Side Analysis of EBITDA: Cintas Corporation and CSX Corporation

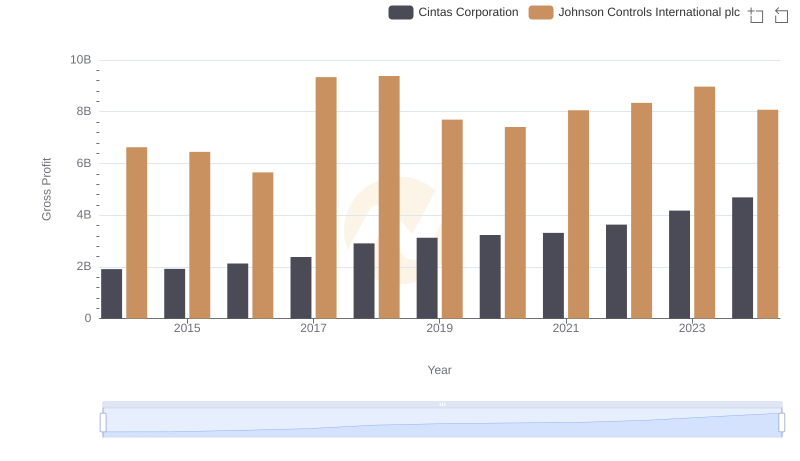

Gross Profit Trends Compared: Cintas Corporation vs Johnson Controls International plc

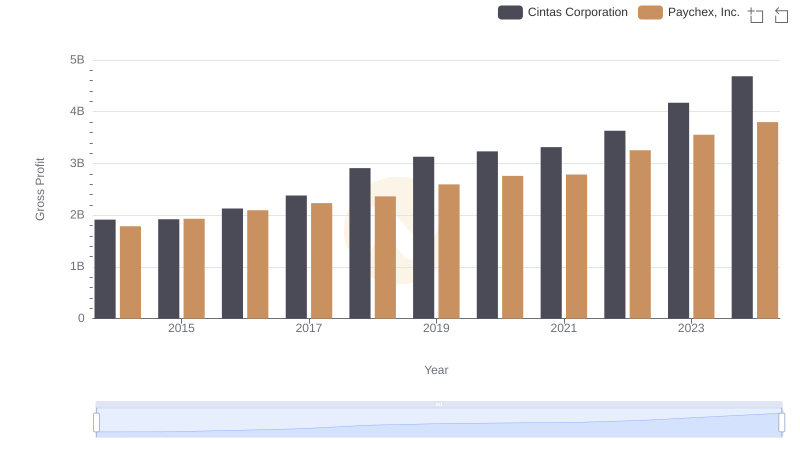

Key Insights on Gross Profit: Cintas Corporation vs Paychex, Inc.

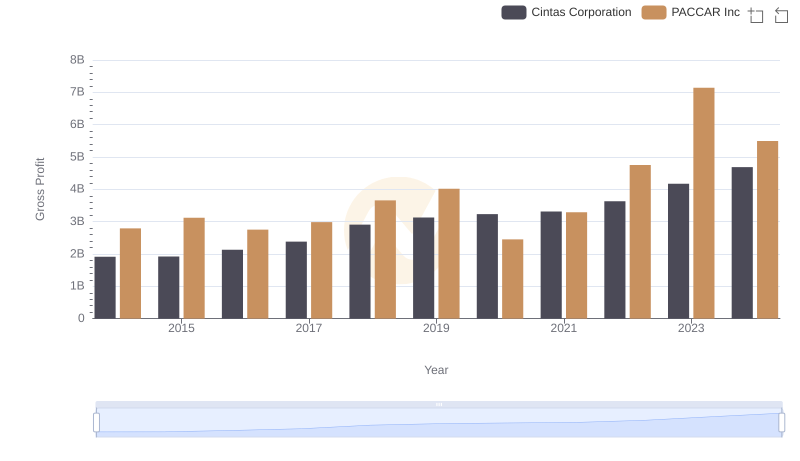

Gross Profit Comparison: Cintas Corporation and PACCAR Inc Trends