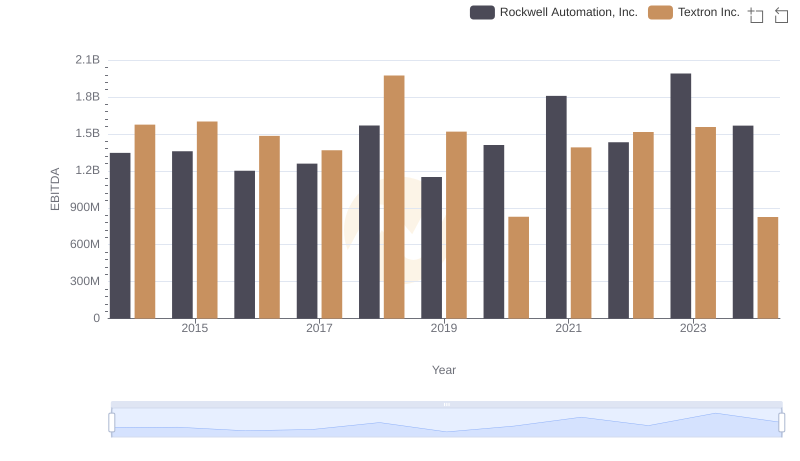

| __timestamp | Rockwell Automation, Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2753900000 | 2457000000 |

| Thursday, January 1, 2015 | 2703100000 | 2444000000 |

| Friday, January 1, 2016 | 2475500000 | 2477000000 |

| Sunday, January 1, 2017 | 2624200000 | 2403000000 |

| Monday, January 1, 2018 | 2872200000 | 2378000000 |

| Tuesday, January 1, 2019 | 2900100000 | 2224000000 |

| Wednesday, January 1, 2020 | 2595200000 | 1557000000 |

| Friday, January 1, 2021 | 2897700000 | 2085000000 |

| Saturday, January 1, 2022 | 3102000000 | 2069000000 |

| Sunday, January 1, 2023 | 3717000000 | 2278000000 |

| Monday, January 1, 2024 | 3193400000 | 2502000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial automation and aerospace, Rockwell Automation, Inc. and Textron Inc. have showcased intriguing gross profit trends over the past decade. From 2014 to 2023, Rockwell Automation's gross profit has seen a steady climb, peaking in 2023 with a remarkable 35% increase from its 2014 figures. Meanwhile, Textron Inc. experienced a more volatile journey, with a significant surge in 2024, marking a 457% increase from the previous year. This dramatic rise highlights Textron's strategic maneuvers in the aerospace sector. Despite the challenges of 2020, both companies have demonstrated resilience, with Rockwell Automation maintaining a consistent upward trajectory and Textron rebounding strongly. These trends underscore the dynamic nature of these industries and the strategic adaptations of these corporate titans.

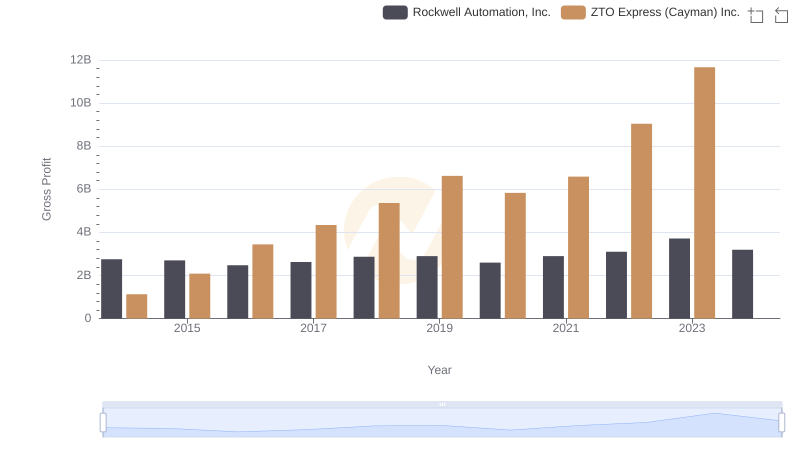

Key Insights on Gross Profit: Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.

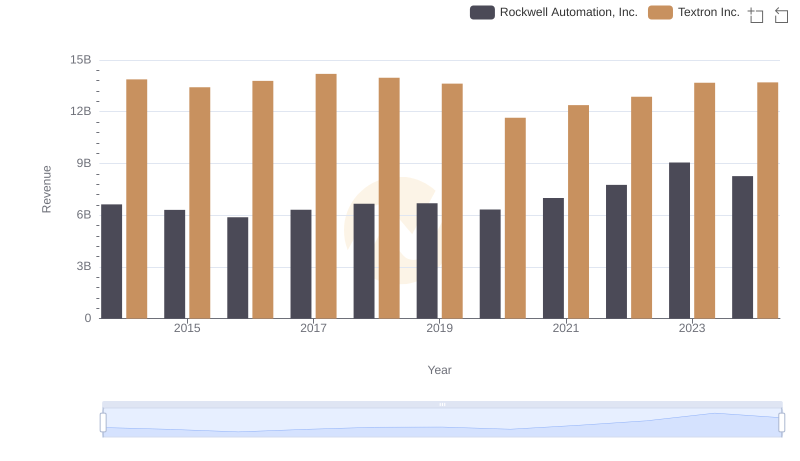

Who Generates More Revenue? Rockwell Automation, Inc. or Textron Inc.

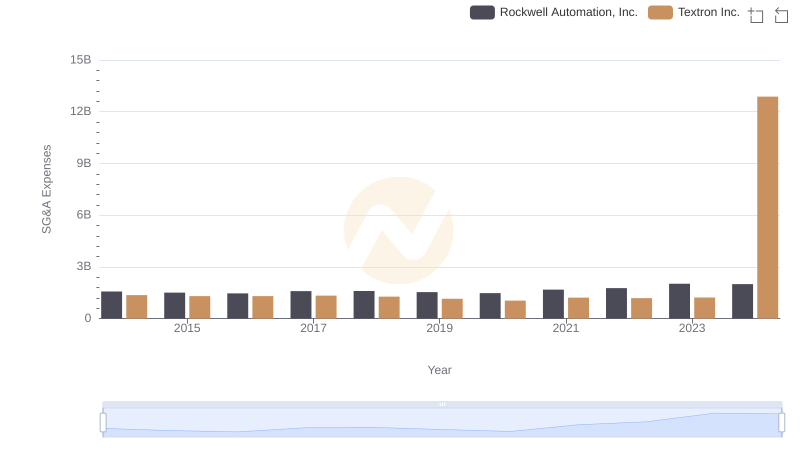

Rockwell Automation, Inc. vs Textron Inc.: SG&A Expense Trends

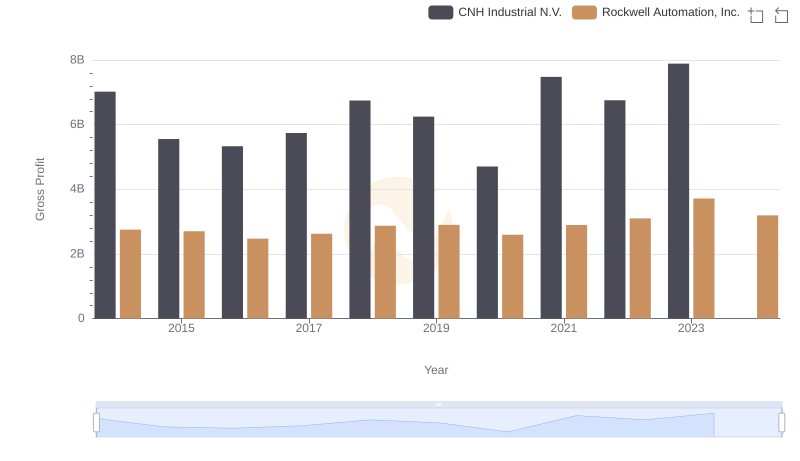

Rockwell Automation, Inc. and CNH Industrial N.V.: A Detailed Gross Profit Analysis

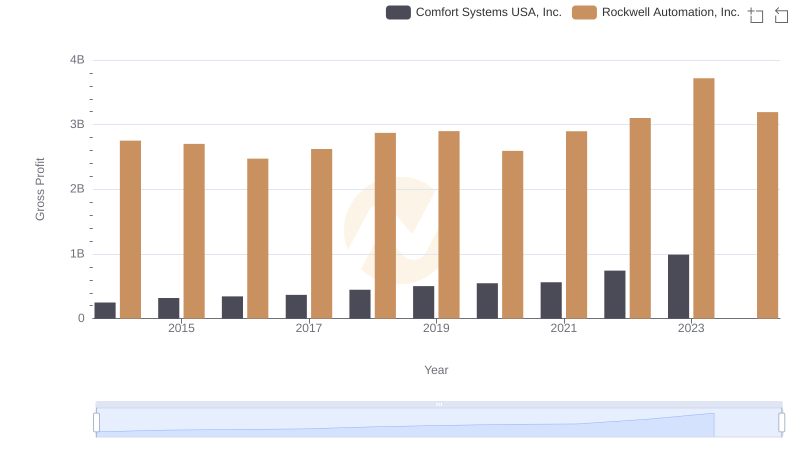

Rockwell Automation, Inc. vs Comfort Systems USA, Inc.: A Gross Profit Performance Breakdown

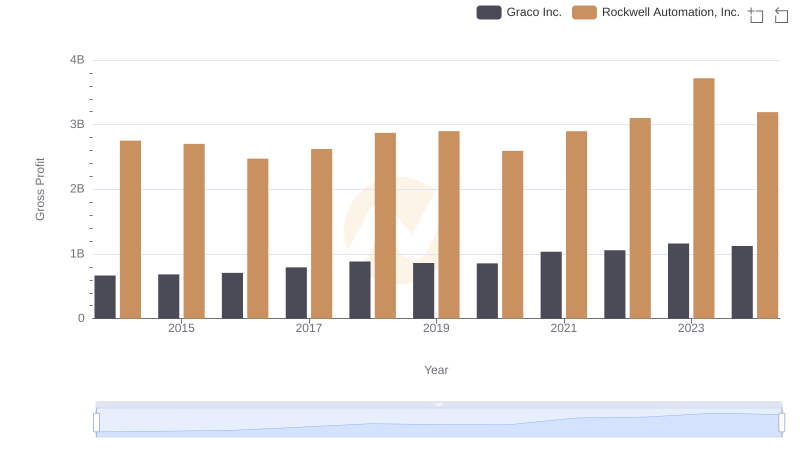

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Graco Inc.

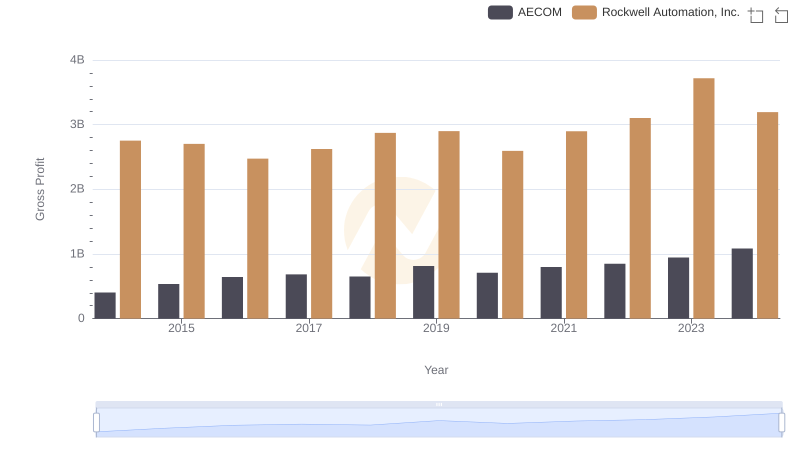

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and AECOM

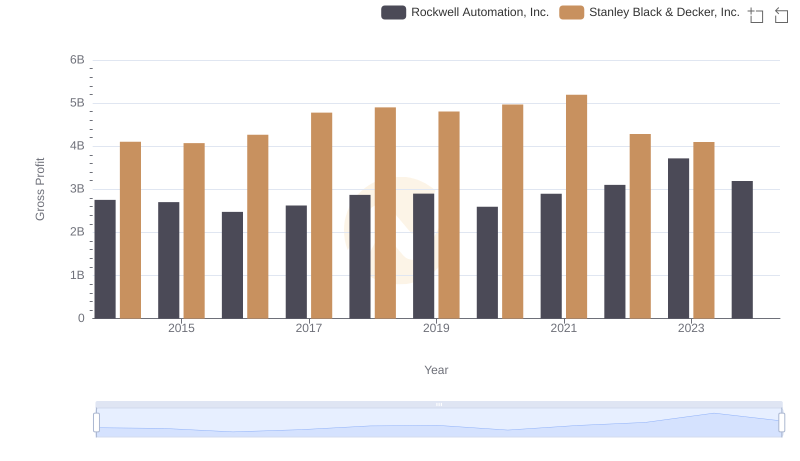

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

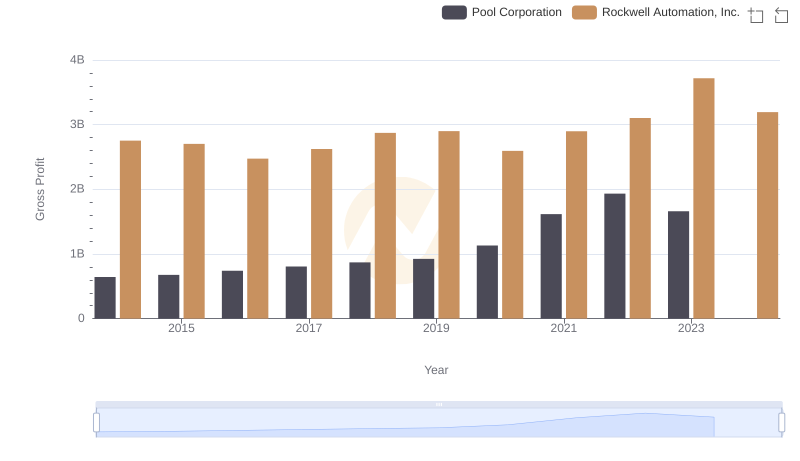

Rockwell Automation, Inc. and Pool Corporation: A Detailed Gross Profit Analysis

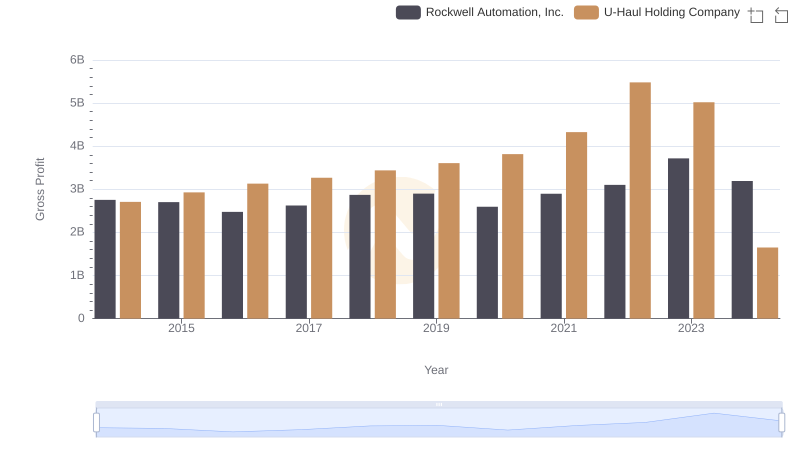

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or U-Haul Holding Company

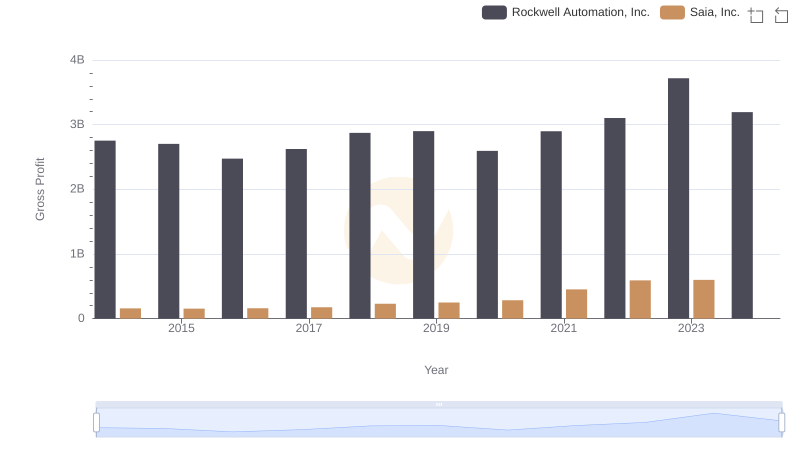

Key Insights on Gross Profit: Rockwell Automation, Inc. vs Saia, Inc.

A Side-by-Side Analysis of EBITDA: Rockwell Automation, Inc. and Textron Inc.