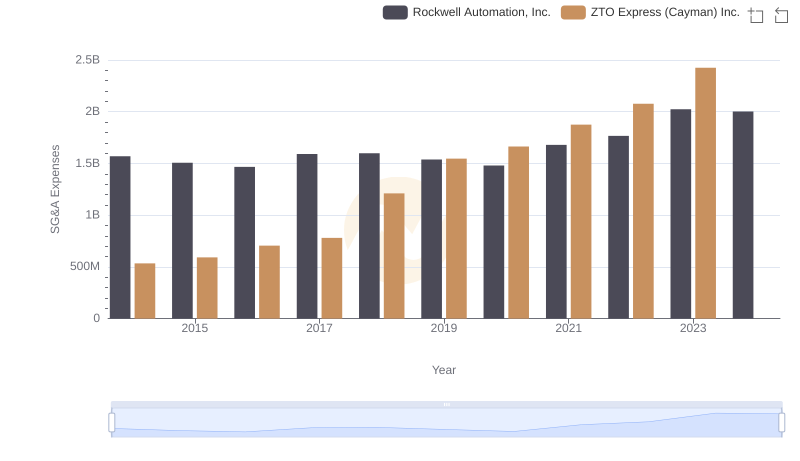

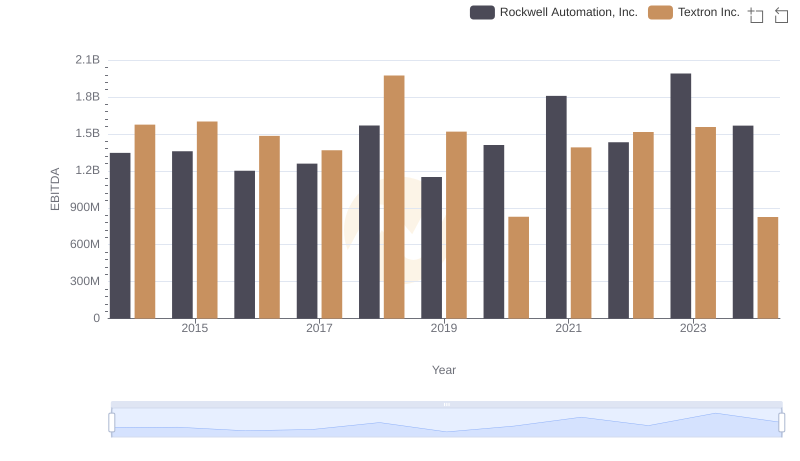

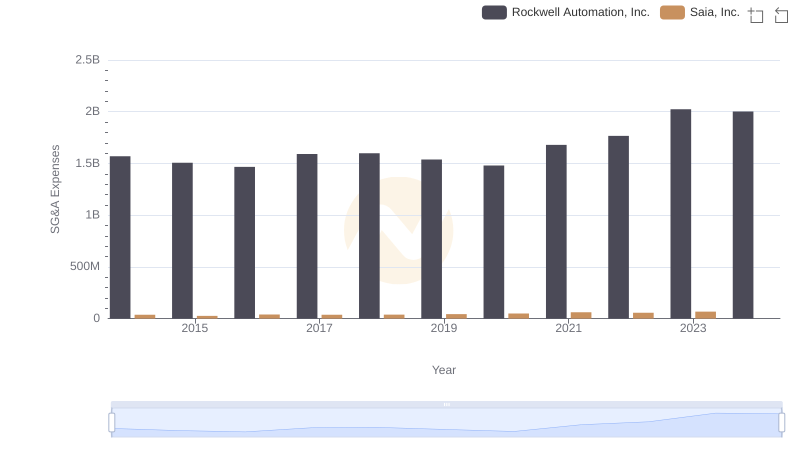

| __timestamp | Rockwell Automation, Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1570100000 | 1361000000 |

| Thursday, January 1, 2015 | 1506400000 | 1304000000 |

| Friday, January 1, 2016 | 1467400000 | 1304000000 |

| Sunday, January 1, 2017 | 1591500000 | 1337000000 |

| Monday, January 1, 2018 | 1599000000 | 1275000000 |

| Tuesday, January 1, 2019 | 1538500000 | 1152000000 |

| Wednesday, January 1, 2020 | 1479800000 | 1045000000 |

| Friday, January 1, 2021 | 1680000000 | 1221000000 |

| Saturday, January 1, 2022 | 1766700000 | 1186000000 |

| Sunday, January 1, 2023 | 2023700000 | 1225000000 |

| Monday, January 1, 2024 | 2002600000 | 1156000000 |

Cracking the code

In the ever-evolving landscape of industrial automation and aerospace, understanding the financial health of key players is crucial. Rockwell Automation and Textron, two giants in their respective fields, have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2023, Rockwell Automation's SG&A expenses have seen a steady increase, peaking in 2023 with a 29% rise from 2014. In contrast, Textron's expenses remained relatively stable until a dramatic surge in 2024, marking a nearly tenfold increase. This spike could indicate strategic investments or restructuring efforts. Such financial insights are vital for investors and industry analysts to gauge company strategies and market positioning. As we move forward, these trends will likely influence competitive dynamics and shareholder value in the industrial and aerospace sectors.

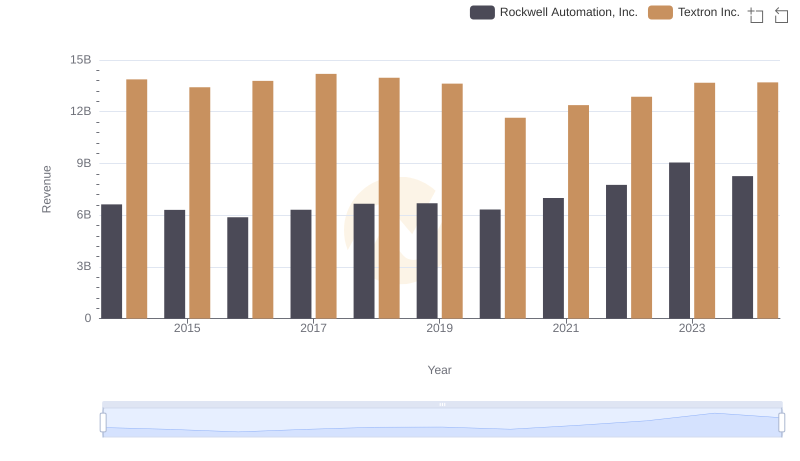

Who Generates More Revenue? Rockwell Automation, Inc. or Textron Inc.

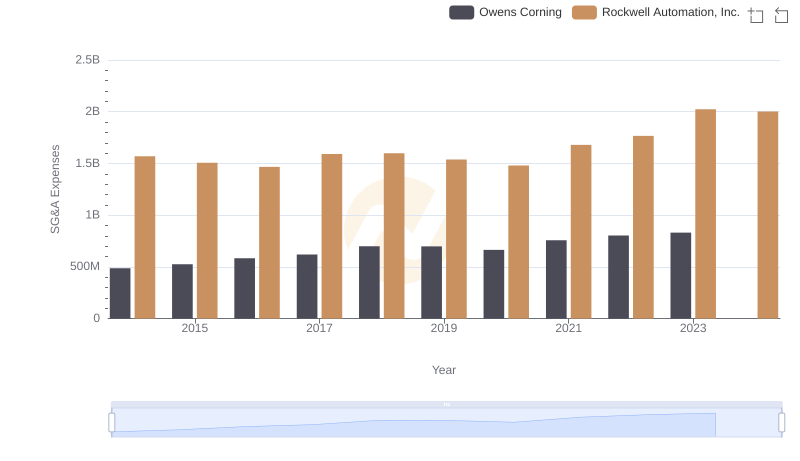

Operational Costs Compared: SG&A Analysis of Rockwell Automation, Inc. and Owens Corning

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or ZTO Express (Cayman) Inc.

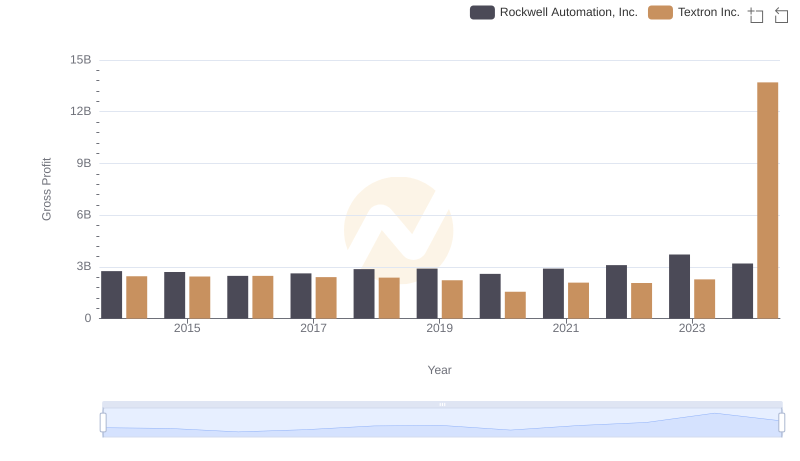

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Textron Inc.

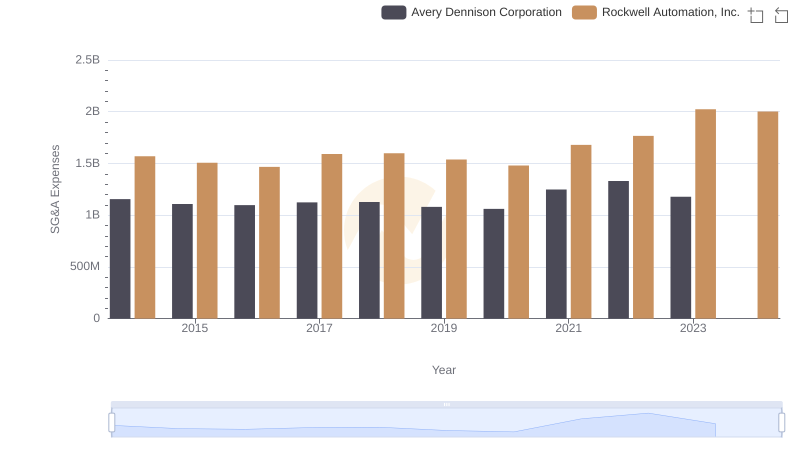

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Avery Dennison Corporation Trends and Insights

A Side-by-Side Analysis of EBITDA: Rockwell Automation, Inc. and Textron Inc.

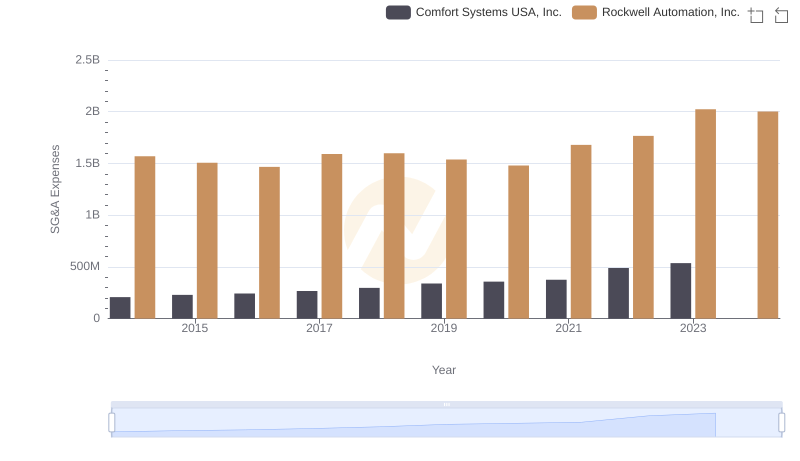

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and Comfort Systems USA, Inc.

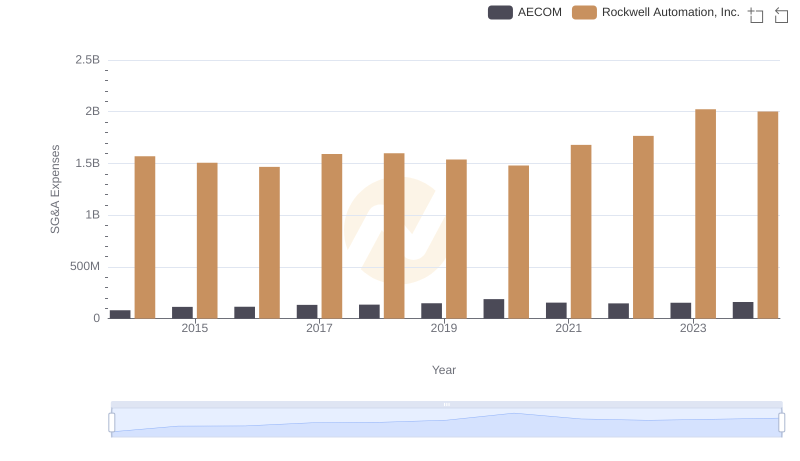

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and AECOM

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and U-Haul Holding Company

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Pool Corporation Trends and Insights

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Saia, Inc. Trends and Insights