| __timestamp | Rockwell Automation, Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6623500000 | 13878000000 |

| Thursday, January 1, 2015 | 6307900000 | 13423000000 |

| Friday, January 1, 2016 | 5879500000 | 13788000000 |

| Sunday, January 1, 2017 | 6311300000 | 14198000000 |

| Monday, January 1, 2018 | 6666000000 | 13972000000 |

| Tuesday, January 1, 2019 | 6694800000 | 13630000000 |

| Wednesday, January 1, 2020 | 6329800000 | 11651000000 |

| Friday, January 1, 2021 | 6997400000 | 12382000000 |

| Saturday, January 1, 2022 | 7760400000 | 12869000000 |

| Sunday, January 1, 2023 | 9058000000 | 13683000000 |

| Monday, January 1, 2024 | 8264200000 | 13702000000 |

Igniting the spark of knowledge

In the competitive landscape of industrial giants, Rockwell Automation and Textron have been vying for revenue supremacy over the past decade. From 2014 to 2024, Textron consistently outperformed Rockwell Automation, generating approximately 50% more revenue on average. However, Rockwell Automation has shown impressive growth, with a notable 20% increase in revenue from 2022 to 2023, reaching its peak at $9 billion. This surge highlights Rockwell's resilience and strategic advancements in automation technology. Meanwhile, Textron's revenue remained relatively stable, peaking at $14 billion in 2017 and maintaining a steady course thereafter. As we look to the future, the question remains: will Rockwell Automation continue its upward trajectory, or will Textron maintain its lead? This ongoing rivalry underscores the dynamic nature of the industrial sector, where innovation and adaptability are key to sustaining growth.

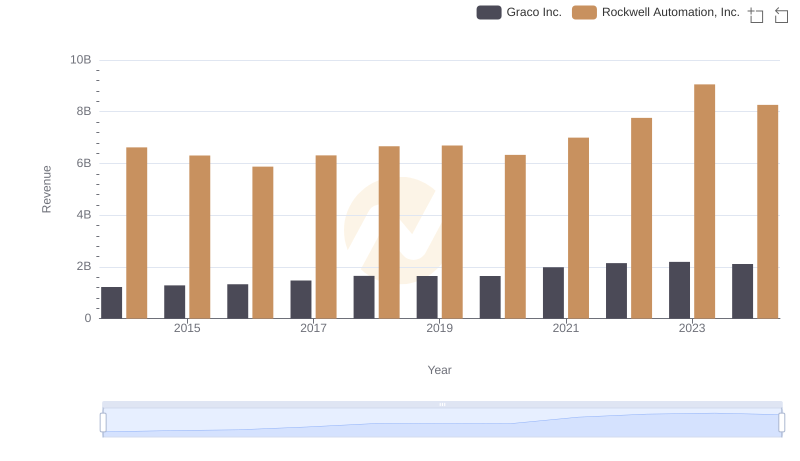

Rockwell Automation, Inc. vs Graco Inc.: Examining Key Revenue Metrics

Revenue Showdown: Rockwell Automation, Inc. vs CNH Industrial N.V.

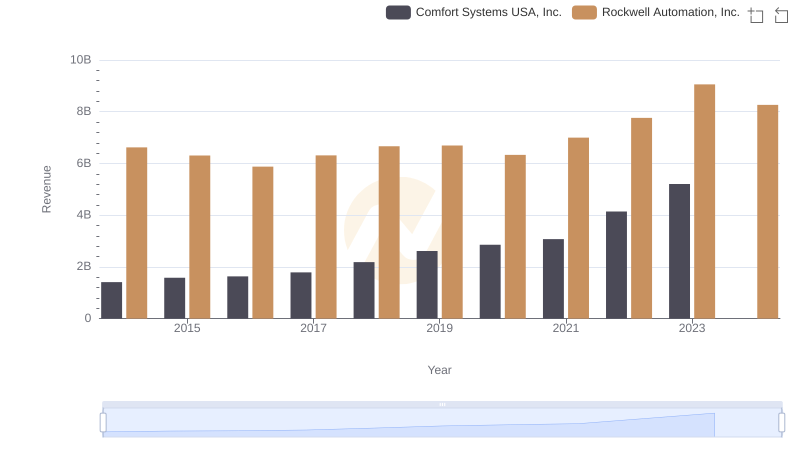

Comparing Revenue Performance: Rockwell Automation, Inc. or Comfort Systems USA, Inc.?

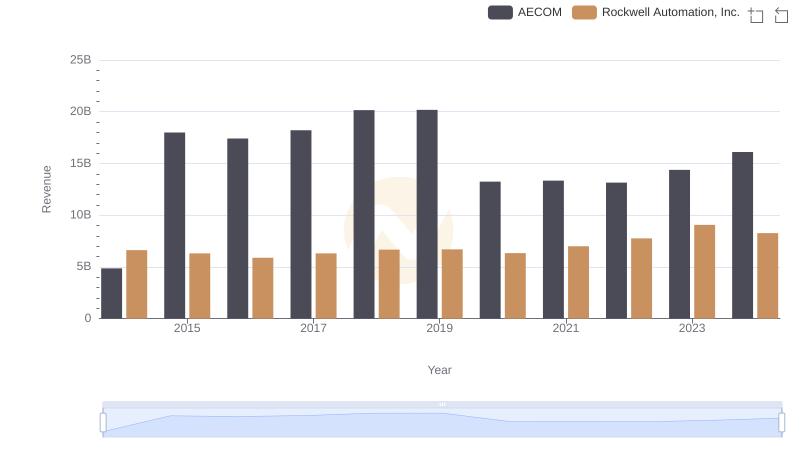

Breaking Down Revenue Trends: Rockwell Automation, Inc. vs AECOM

Revenue Showdown: Rockwell Automation, Inc. vs Saia, Inc.

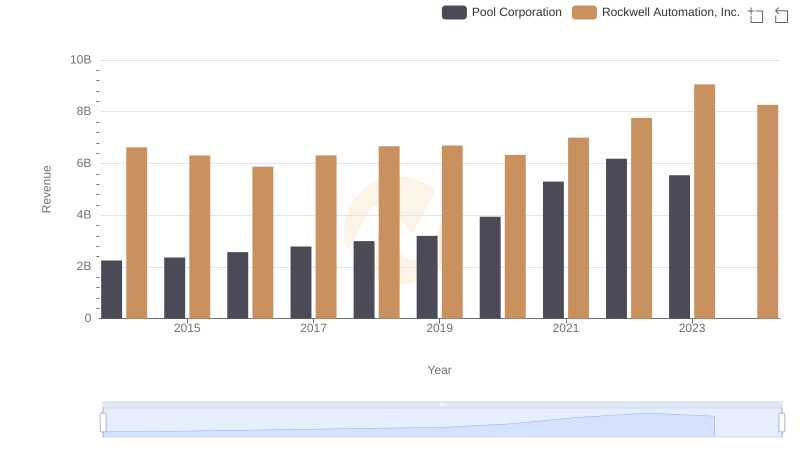

Annual Revenue Comparison: Rockwell Automation, Inc. vs Pool Corporation

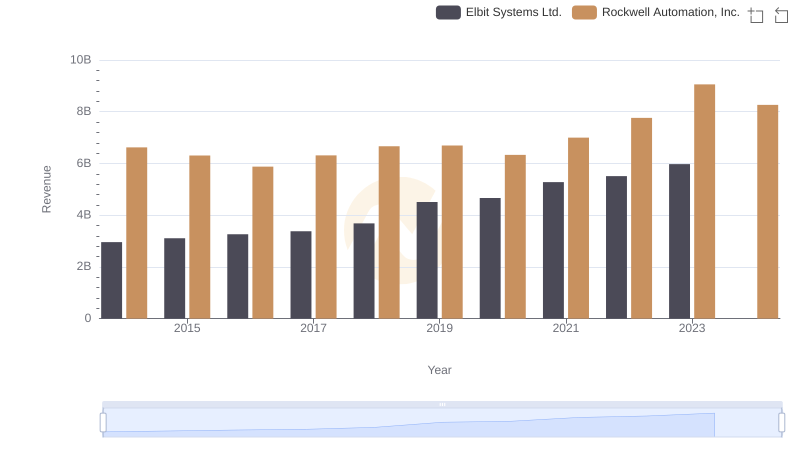

Revenue Showdown: Rockwell Automation, Inc. vs Elbit Systems Ltd.

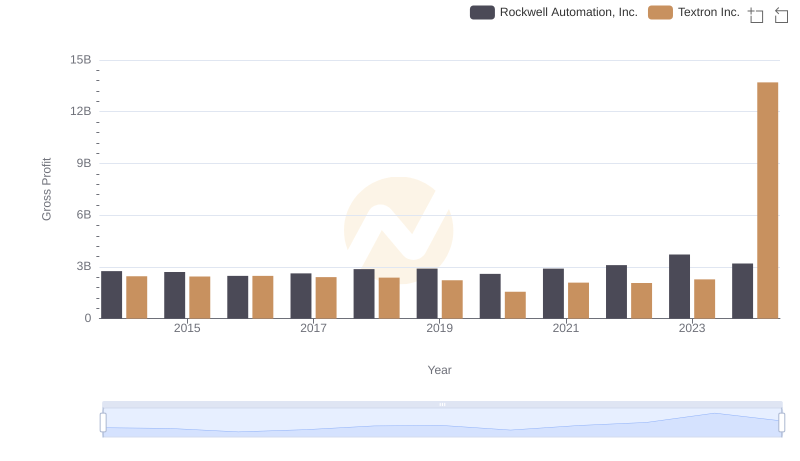

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Textron Inc.

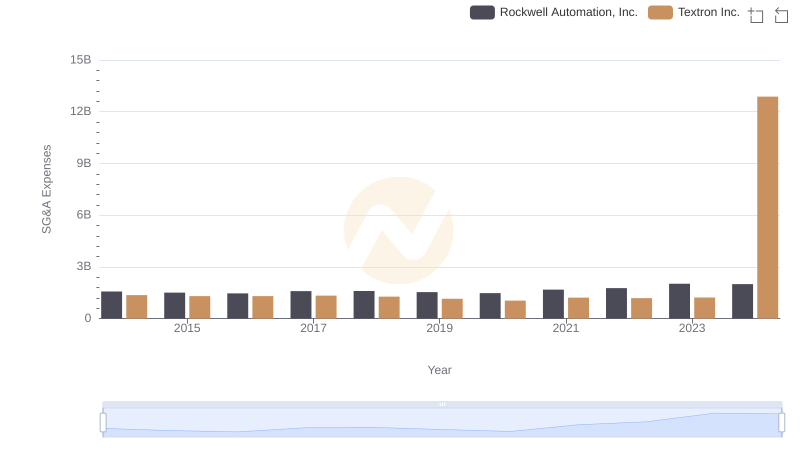

Rockwell Automation, Inc. vs Textron Inc.: SG&A Expense Trends

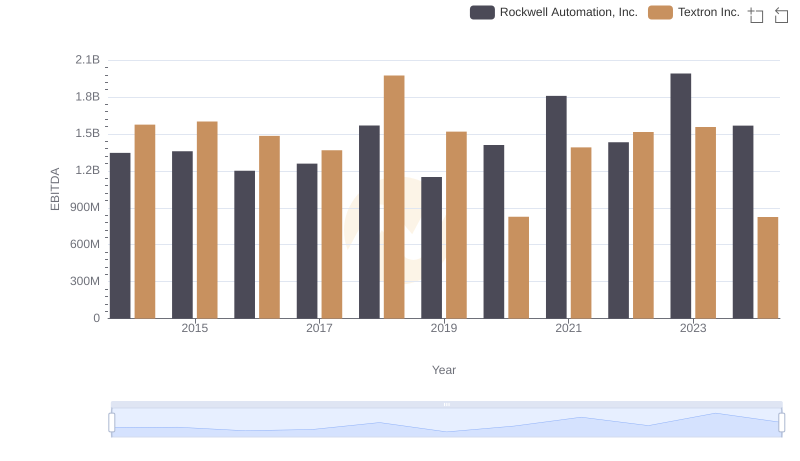

A Side-by-Side Analysis of EBITDA: Rockwell Automation, Inc. and Textron Inc.