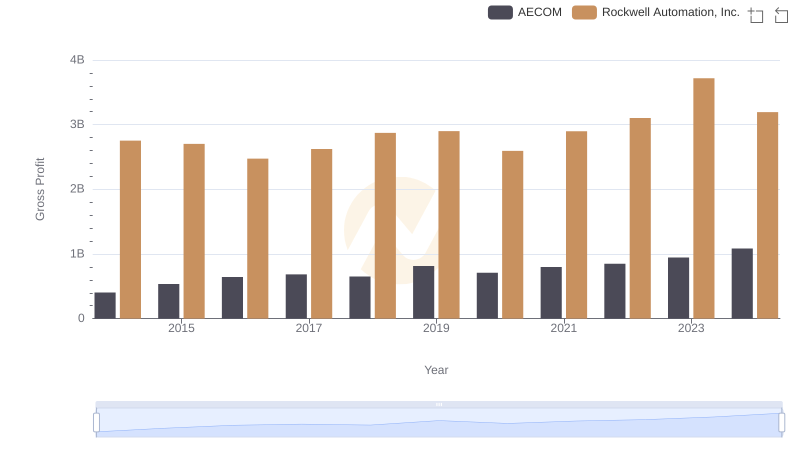

| __timestamp | Rockwell Automation, Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

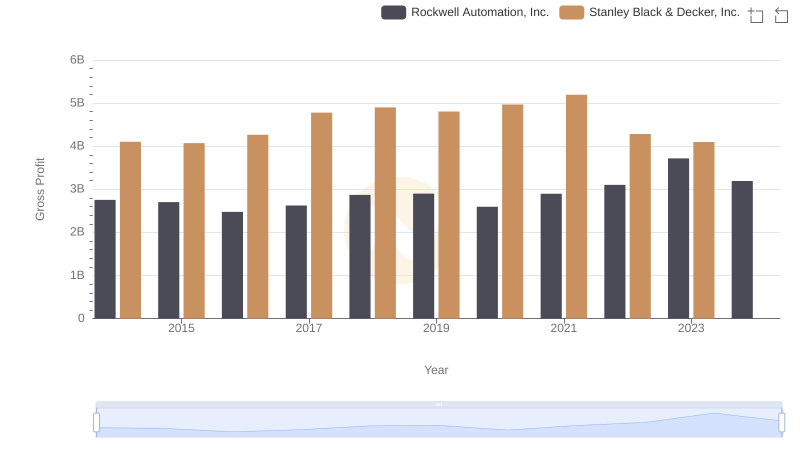

| Wednesday, January 1, 2014 | 2753900000 | 4102700000 |

| Thursday, January 1, 2015 | 2703100000 | 4072000000 |

| Friday, January 1, 2016 | 2475500000 | 4267200000 |

| Sunday, January 1, 2017 | 2624200000 | 4778000000 |

| Monday, January 1, 2018 | 2872200000 | 4901900000 |

| Tuesday, January 1, 2019 | 2900100000 | 4805500000 |

| Wednesday, January 1, 2020 | 2595200000 | 4967900000 |

| Friday, January 1, 2021 | 2897700000 | 5194200000 |

| Saturday, January 1, 2022 | 3102000000 | 4284100000 |

| Sunday, January 1, 2023 | 3717000000 | 4098000000 |

| Monday, January 1, 2024 | 3193400000 | 4514400000 |

Unleashing insights

In the competitive landscape of industrial automation and tools, Rockwell Automation and Stanley Black & Decker have been vying for supremacy in gross profit generation. Over the past decade, Stanley Black & Decker consistently outperformed Rockwell Automation, boasting a gross profit that was approximately 57% higher on average. However, 2023 marked a turning point, with Rockwell Automation achieving a remarkable 20% increase in gross profit, reaching its highest level in the past decade. This surge narrowed the gap significantly, as Stanley Black & Decker's profits saw a decline. The data from 2014 to 2023 highlights the dynamic shifts in market leadership and the resilience of these industrial titans. As we look to the future, the question remains: will Rockwell Automation maintain its upward trajectory, or will Stanley Black & Decker reclaim its dominant position?

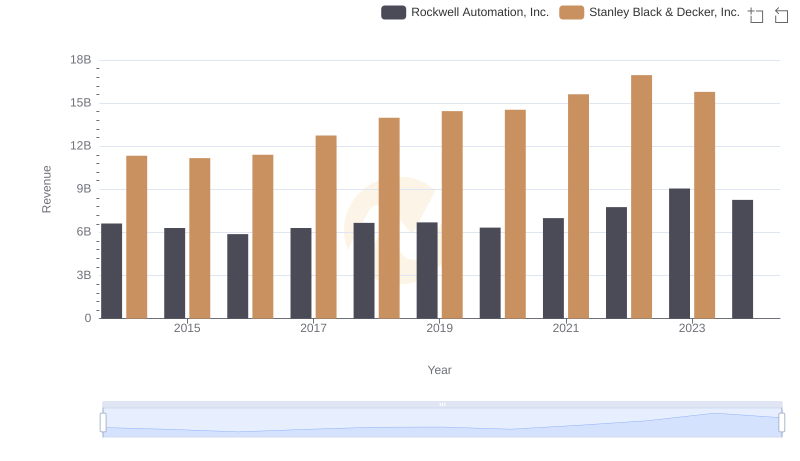

Who Generates More Revenue? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

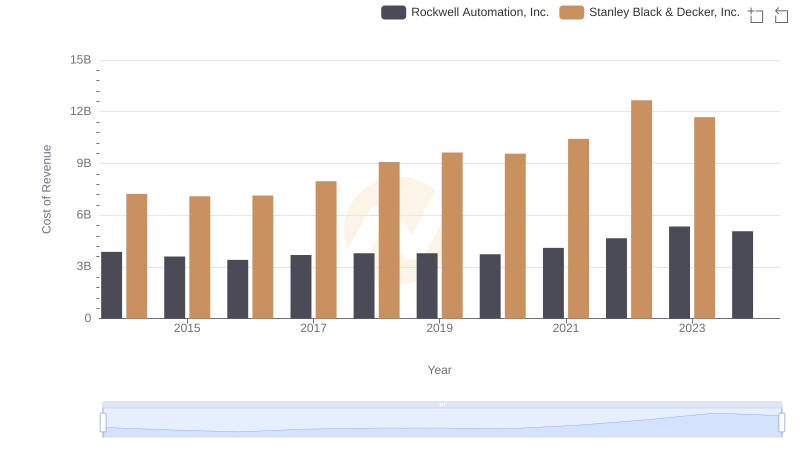

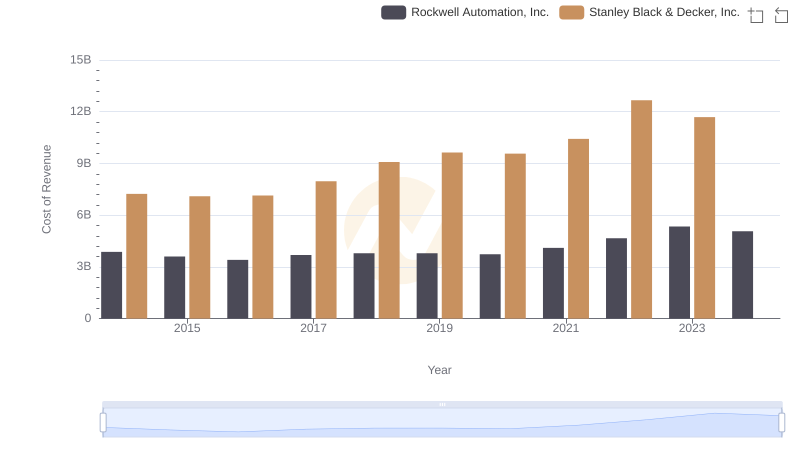

Comparing Cost of Revenue Efficiency: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

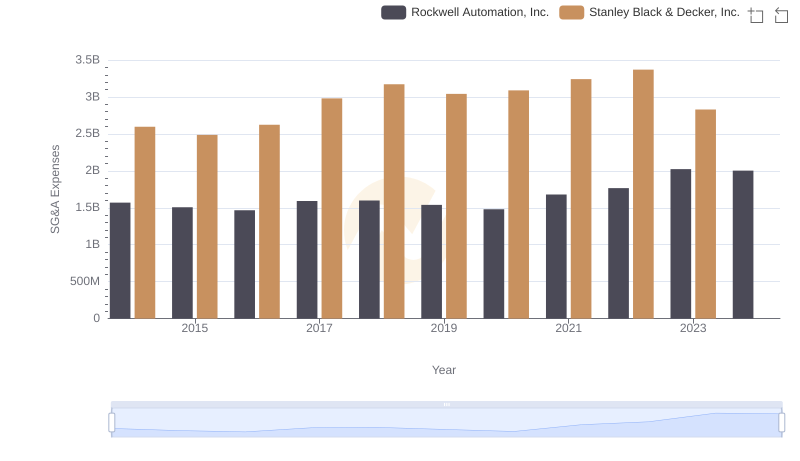

Selling, General, and Administrative Costs: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.

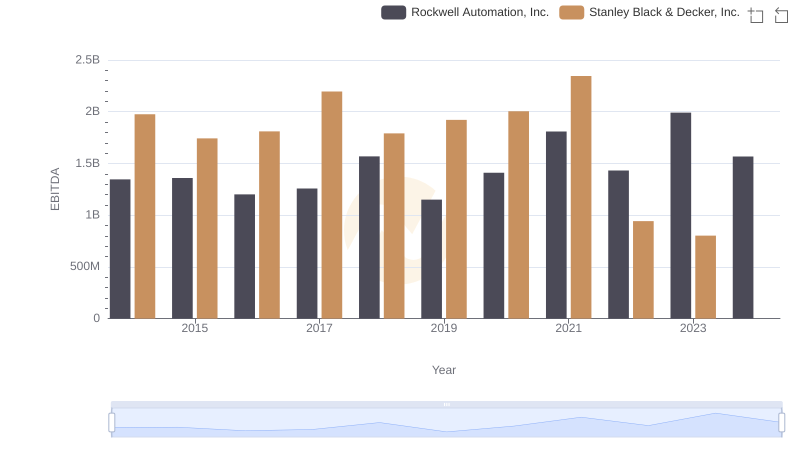

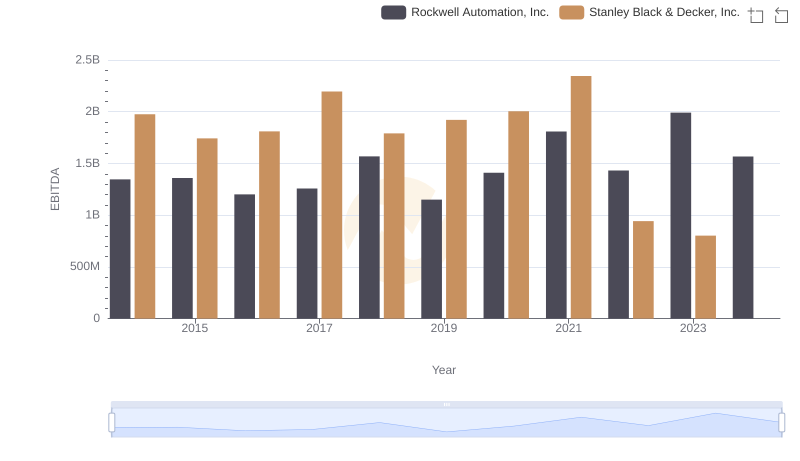

Rockwell Automation, Inc. and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance

Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and AECOM

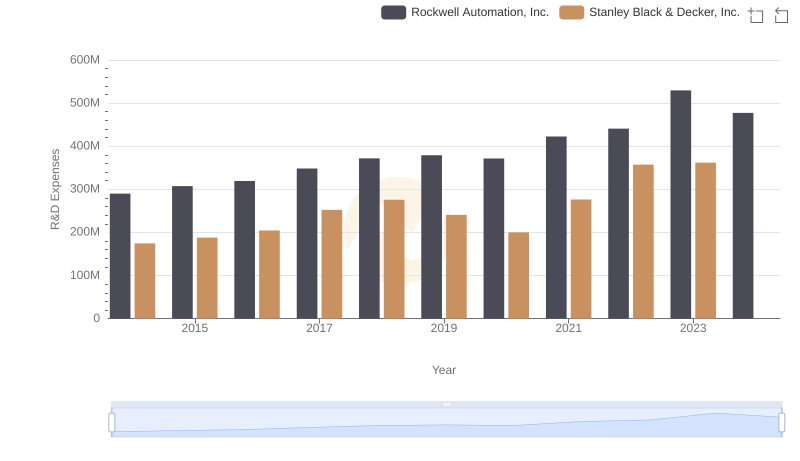

Rockwell Automation, Inc. or Stanley Black & Decker, Inc.: Who Invests More in Innovation?

Who Optimizes SG&A Costs Better? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

Comprehensive EBITDA Comparison: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.