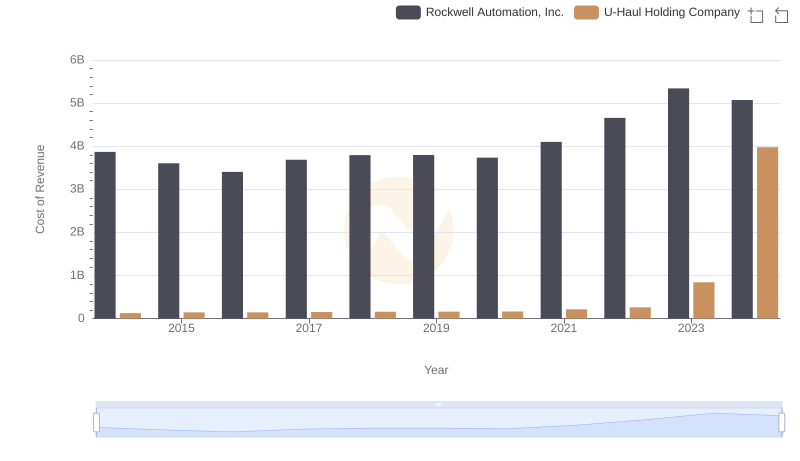

| __timestamp | Rockwell Automation, Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 2753900000 | 2707982000 |

| Thursday, January 1, 2015 | 2703100000 | 2928459000 |

| Friday, January 1, 2016 | 2475500000 | 3130666000 |

| Sunday, January 1, 2017 | 2624200000 | 3269282000 |

| Monday, January 1, 2018 | 2872200000 | 3440625000 |

| Tuesday, January 1, 2019 | 2900100000 | 3606565000 |

| Wednesday, January 1, 2020 | 2595200000 | 3814850000 |

| Friday, January 1, 2021 | 2897700000 | 4327926000 |

| Saturday, January 1, 2022 | 3102000000 | 5480162000 |

| Sunday, January 1, 2023 | 3717000000 | 5019797000 |

| Monday, January 1, 2024 | 3193400000 | 1649634000 |

In pursuit of knowledge

In the ever-evolving landscape of American industry, Rockwell Automation and U-Haul Holding Company stand as titans in their respective fields. From 2014 to 2024, these companies have showcased their prowess in generating gross profit, albeit with varying trajectories. Rockwell Automation, a leader in industrial automation, saw its gross profit grow by approximately 16% over the decade, peaking in 2023. Meanwhile, U-Haul, synonymous with moving and storage, experienced a staggering 102% increase in gross profit, reaching its zenith in 2022. This remarkable growth underscores U-Haul's adaptability and market expansion. However, 2024 presents a curious anomaly with U-Haul's gross profit plummeting to its lowest in the decade, hinting at potential market challenges or strategic shifts. As these giants continue to navigate their industries, their financial narratives offer valuable insights into the broader economic landscape.

Analyzing Cost of Revenue: Rockwell Automation, Inc. and U-Haul Holding Company

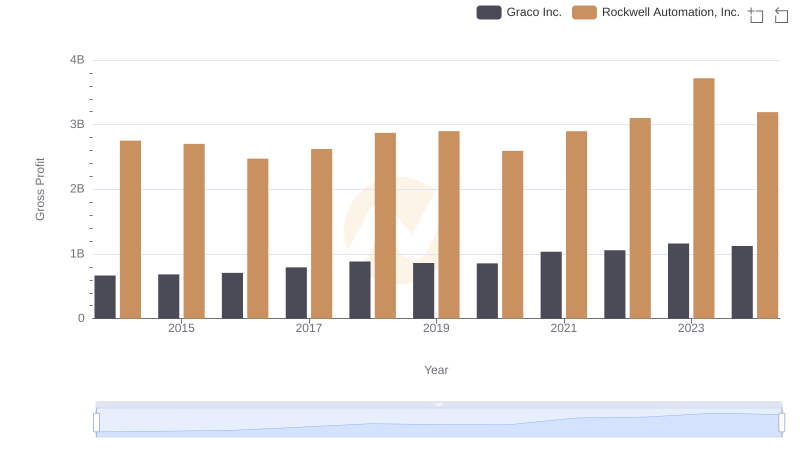

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Graco Inc.

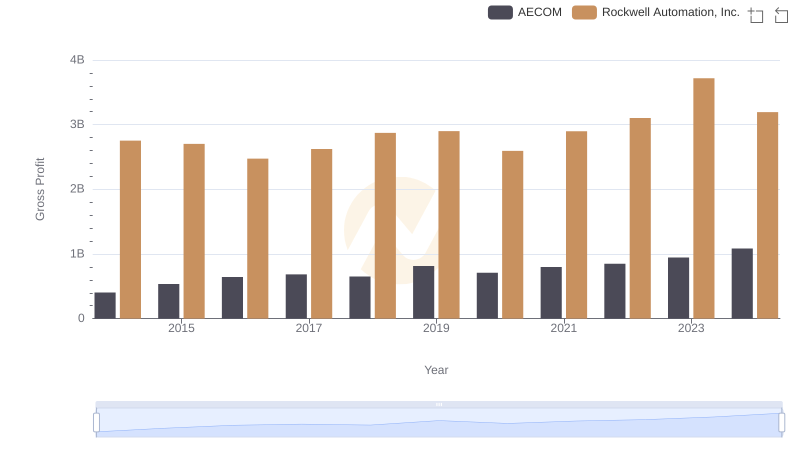

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and AECOM

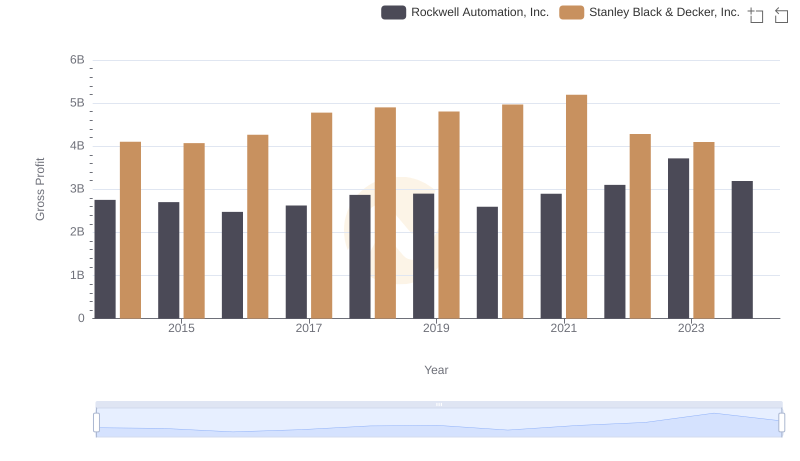

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

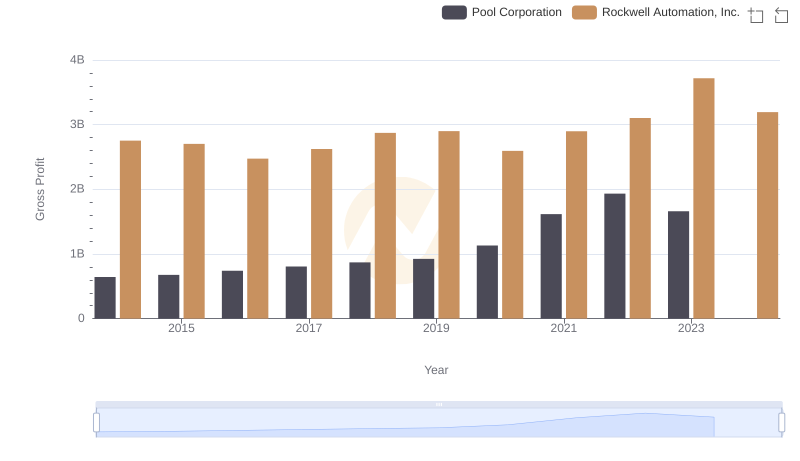

Rockwell Automation, Inc. and Pool Corporation: A Detailed Gross Profit Analysis

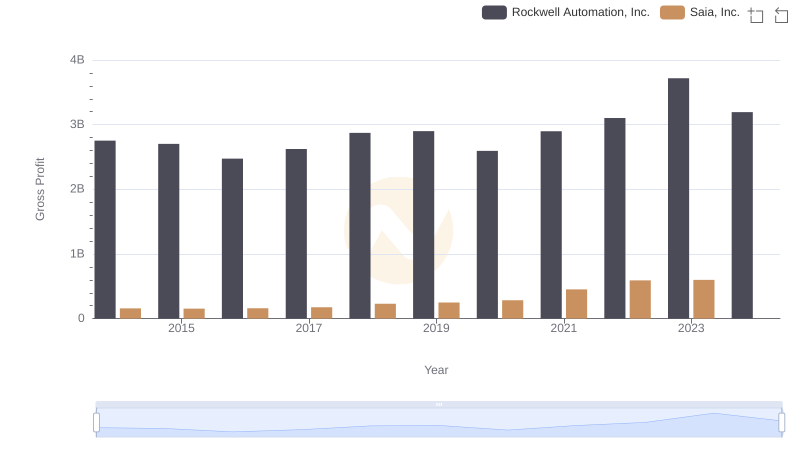

Key Insights on Gross Profit: Rockwell Automation, Inc. vs Saia, Inc.

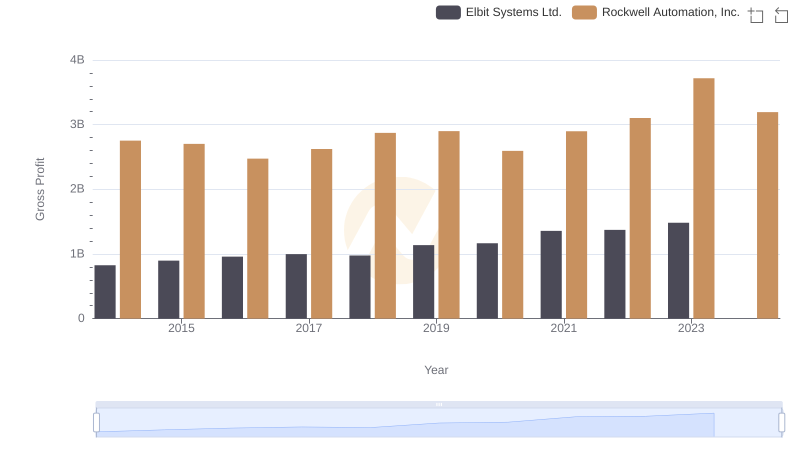

Rockwell Automation, Inc. vs Elbit Systems Ltd.: A Gross Profit Performance Breakdown

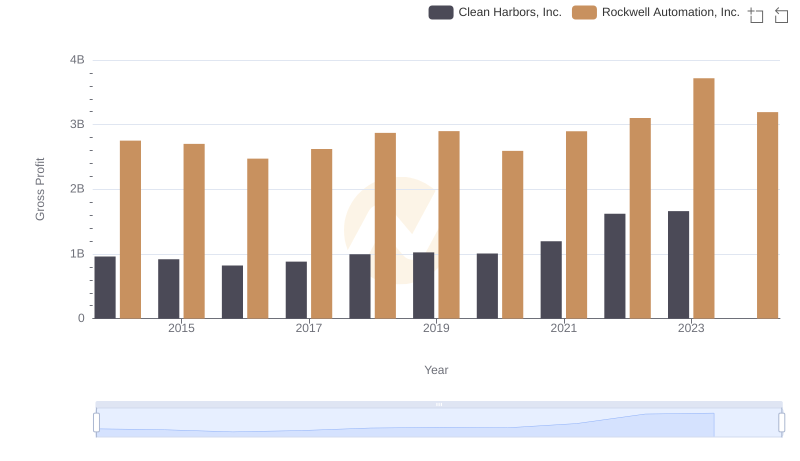

Rockwell Automation, Inc. vs Clean Harbors, Inc.: A Gross Profit Performance Breakdown

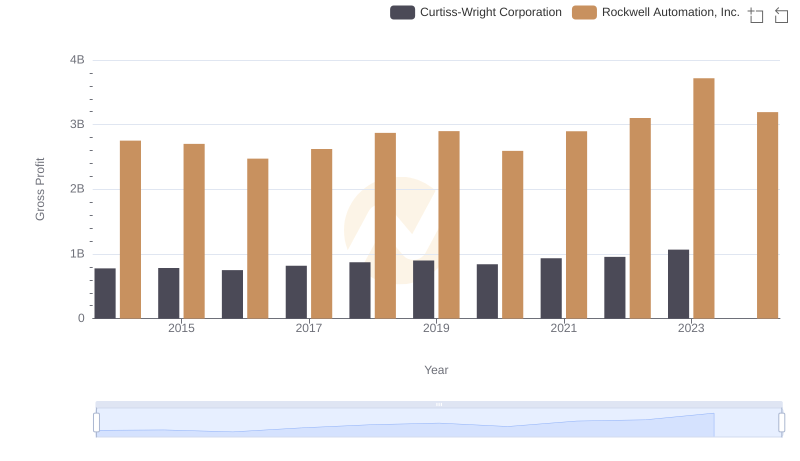

Rockwell Automation, Inc. and Curtiss-Wright Corporation: A Detailed Gross Profit Analysis

SG&A Efficiency Analysis: Comparing Rockwell Automation, Inc. and U-Haul Holding Company

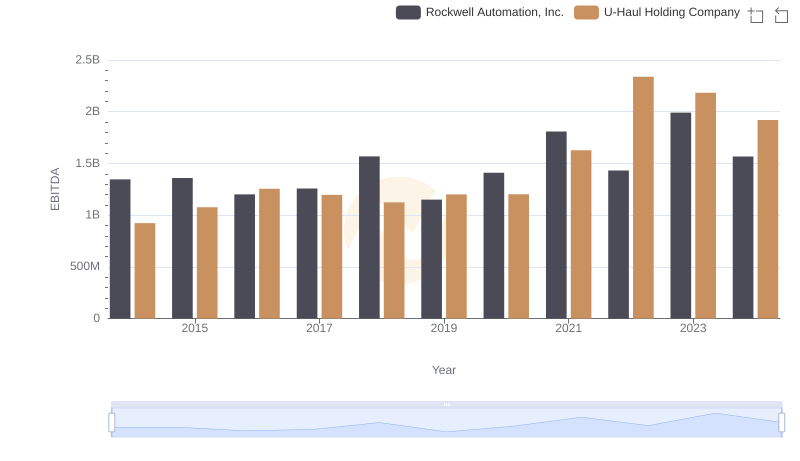

Rockwell Automation, Inc. and U-Haul Holding Company: A Detailed Examination of EBITDA Performance