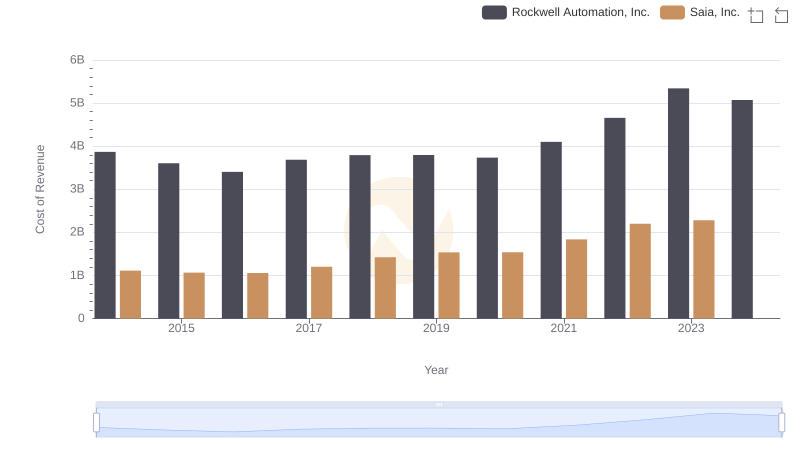

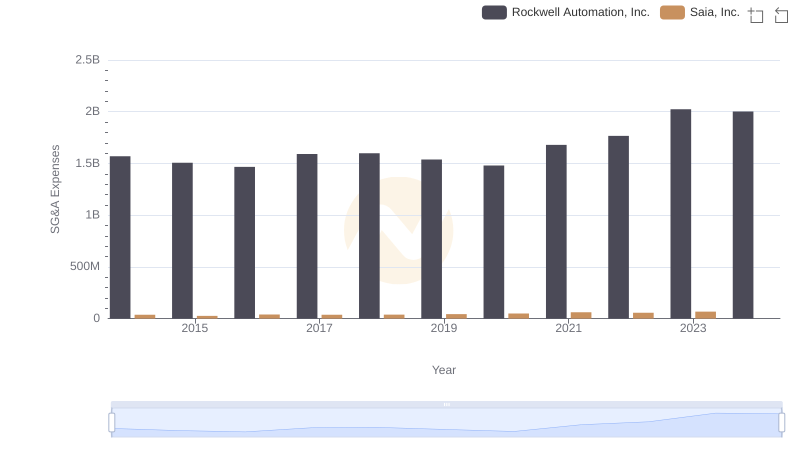

| __timestamp | Rockwell Automation, Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2753900000 | 159268000 |

| Thursday, January 1, 2015 | 2703100000 | 154120000 |

| Friday, January 1, 2016 | 2475500000 | 159502000 |

| Sunday, January 1, 2017 | 2624200000 | 175046000 |

| Monday, January 1, 2018 | 2872200000 | 230070000 |

| Tuesday, January 1, 2019 | 2900100000 | 249653000 |

| Wednesday, January 1, 2020 | 2595200000 | 283848000 |

| Friday, January 1, 2021 | 2897700000 | 451687000 |

| Saturday, January 1, 2022 | 3102000000 | 590963000 |

| Sunday, January 1, 2023 | 3717000000 | 598932000 |

| Monday, January 1, 2024 | 3193400000 |

Unlocking the unknown

In the ever-evolving landscape of industrial automation and logistics, Rockwell Automation, Inc. and Saia, Inc. have carved distinct paths. Over the past decade, Rockwell Automation has consistently demonstrated robust growth in gross profit, peaking in 2023 with a remarkable 35% increase from 2014. This growth underscores its strategic prowess in the automation sector. Meanwhile, Saia, Inc., a key player in the logistics industry, has shown impressive resilience, with its gross profit surging by nearly 276% from 2014 to 2023. This growth trajectory highlights Saia's adaptability and strategic expansion in a competitive market. However, data for 2024 remains incomplete, leaving room for speculation on future trends. As these companies continue to innovate, their financial trajectories offer valuable insights into the broader economic landscape.

Revenue Showdown: Rockwell Automation, Inc. vs Saia, Inc.

Cost of Revenue Comparison: Rockwell Automation, Inc. vs Saia, Inc.

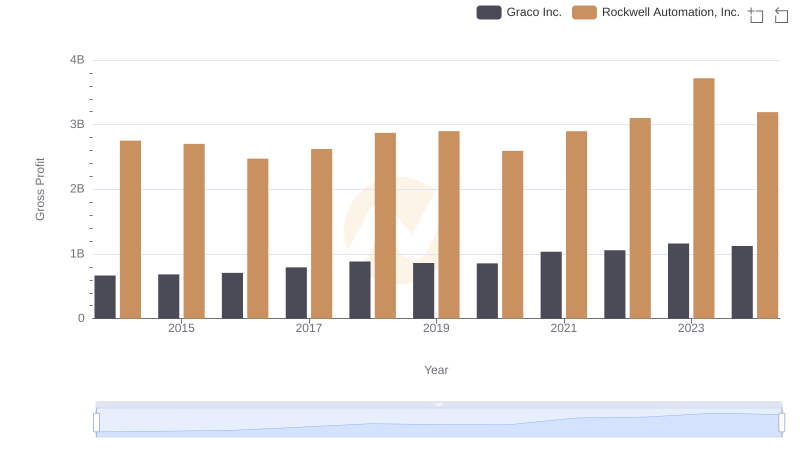

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Graco Inc.

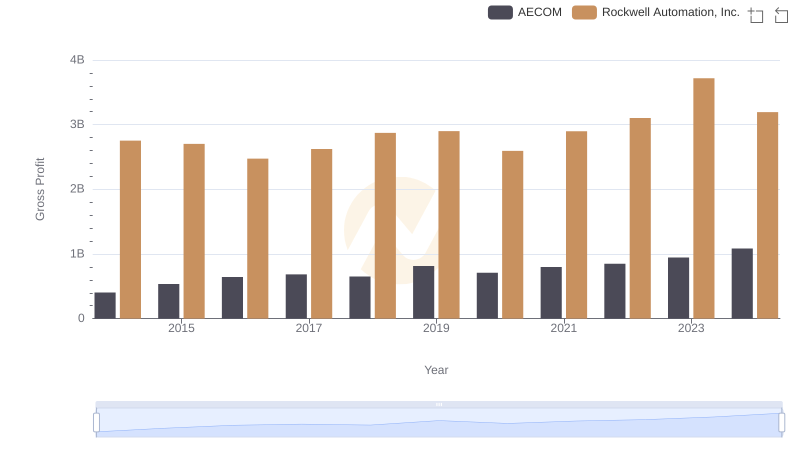

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and AECOM

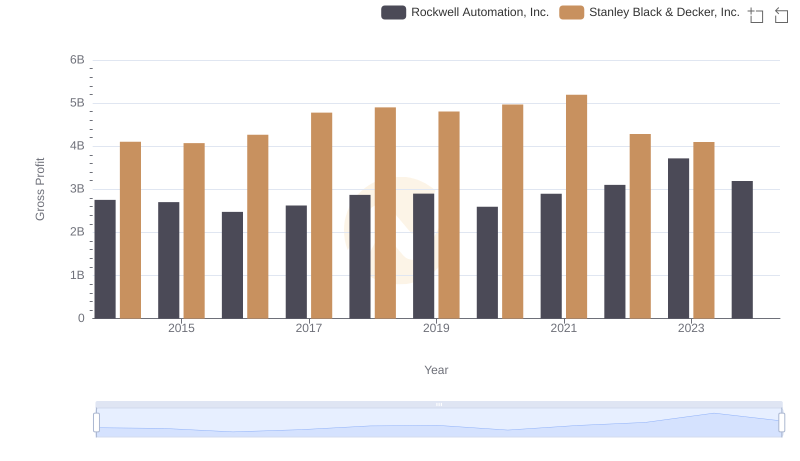

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

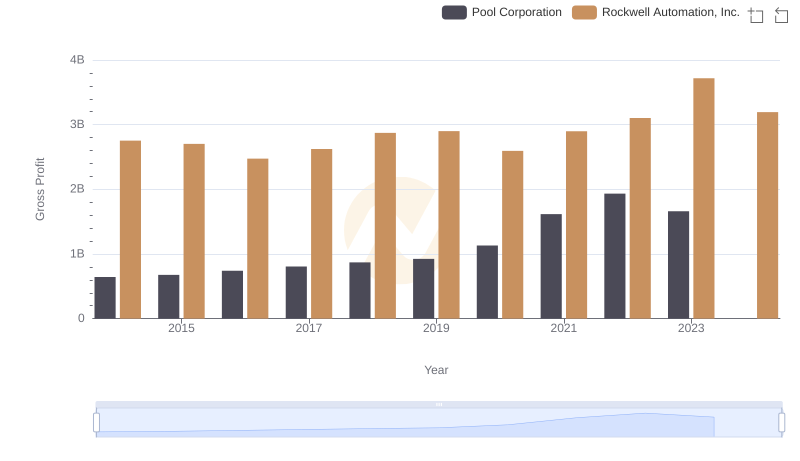

Rockwell Automation, Inc. and Pool Corporation: A Detailed Gross Profit Analysis

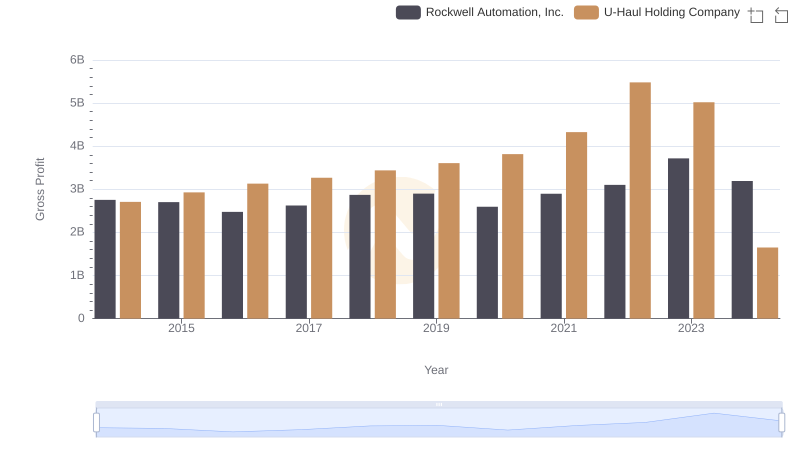

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or U-Haul Holding Company

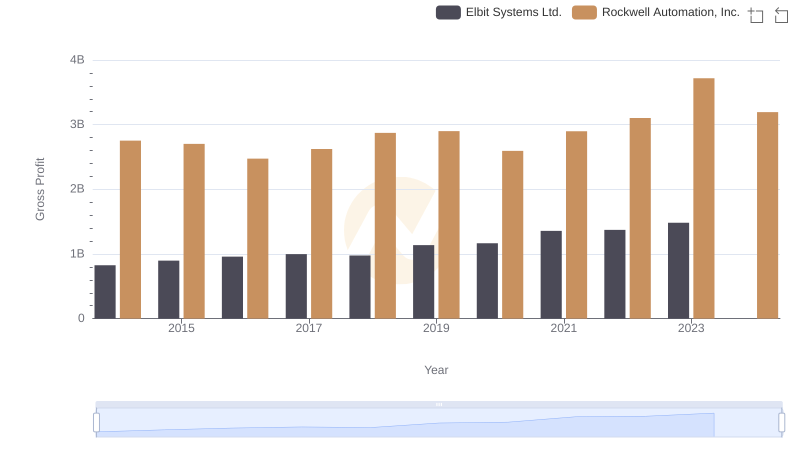

Rockwell Automation, Inc. vs Elbit Systems Ltd.: A Gross Profit Performance Breakdown

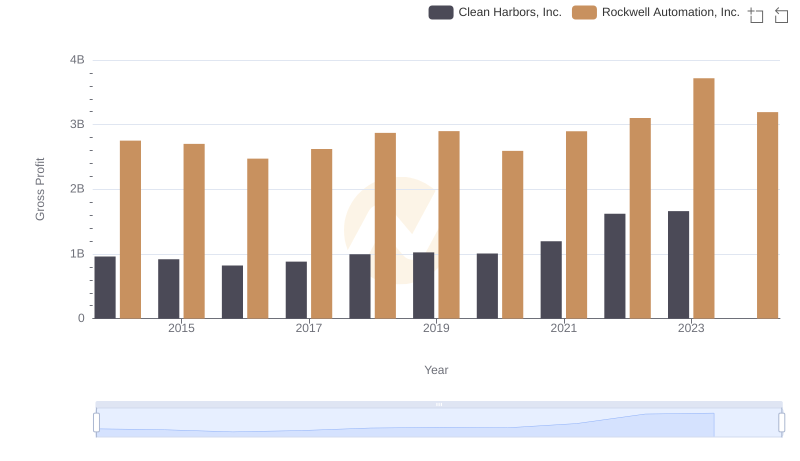

Rockwell Automation, Inc. vs Clean Harbors, Inc.: A Gross Profit Performance Breakdown

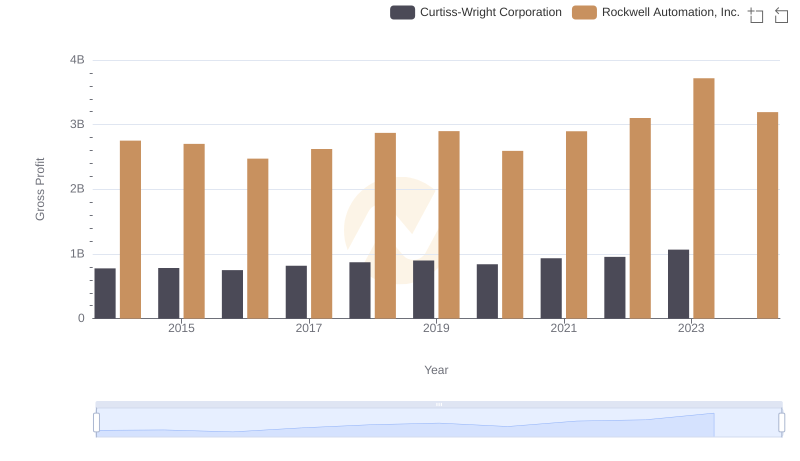

Rockwell Automation, Inc. and Curtiss-Wright Corporation: A Detailed Gross Profit Analysis

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Saia, Inc. Trends and Insights