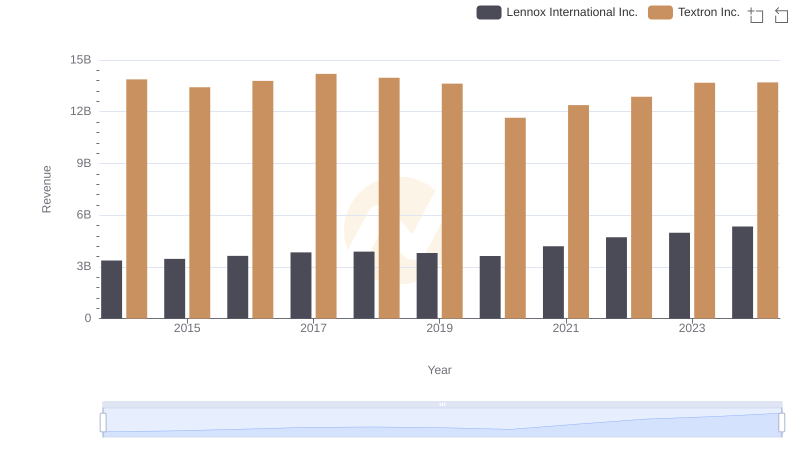

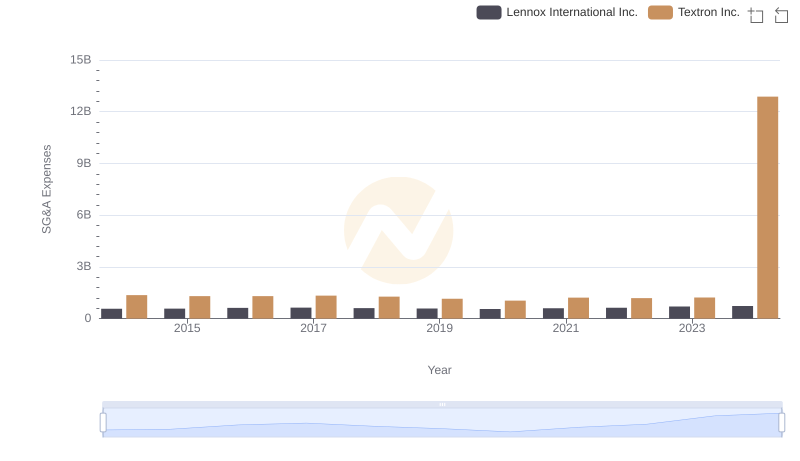

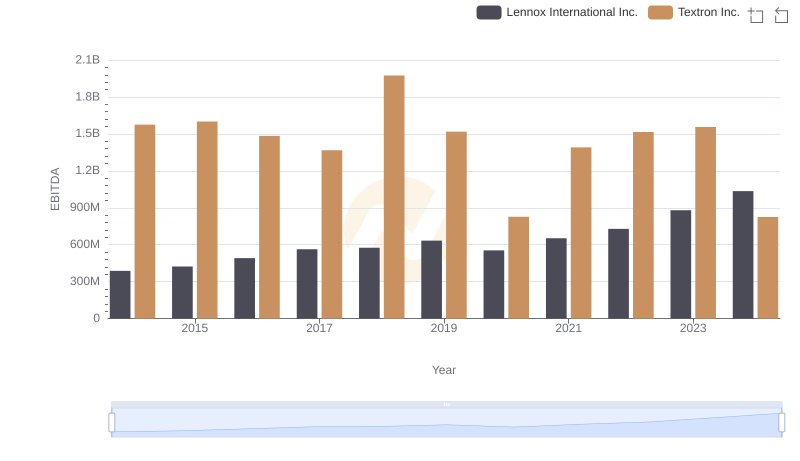

| __timestamp | Lennox International Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 903300000 | 2457000000 |

| Thursday, January 1, 2015 | 947400000 | 2444000000 |

| Friday, January 1, 2016 | 1076500000 | 2477000000 |

| Sunday, January 1, 2017 | 1125200000 | 2403000000 |

| Monday, January 1, 2018 | 1111200000 | 2378000000 |

| Tuesday, January 1, 2019 | 1079800000 | 2224000000 |

| Wednesday, January 1, 2020 | 1040100000 | 1557000000 |

| Friday, January 1, 2021 | 1188400000 | 2085000000 |

| Saturday, January 1, 2022 | 1284700000 | 2069000000 |

| Sunday, January 1, 2023 | 1547800000 | 2278000000 |

| Monday, January 1, 2024 | 1771900000 | 2502000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial manufacturing, Lennox International Inc. and Textron Inc. have showcased intriguing trends in their gross profit margins over the past decade. From 2014 to 2024, Lennox International Inc. has seen a steady increase in gross profit, culminating in a remarkable 96% growth by 2024. This upward trajectory highlights Lennox's strategic market positioning and operational efficiency.

Conversely, Textron Inc. experienced fluctuations, with a notable dip in 2020, reflecting the broader economic challenges of that year. However, by 2024, Textron's gross profit surged to nearly 6 times its 2014 value, indicating a robust recovery and expansion strategy.

These trends underscore the dynamic nature of the industrial sector, where adaptability and strategic foresight are key to sustaining growth and profitability.

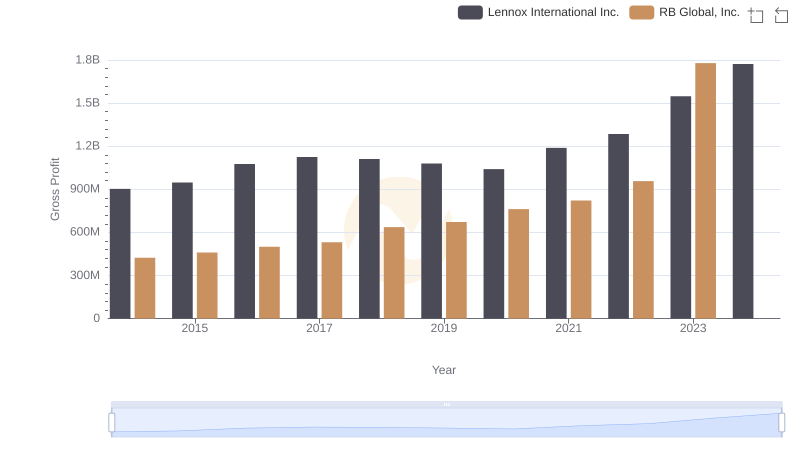

Lennox International Inc. vs RB Global, Inc.: A Gross Profit Performance Breakdown

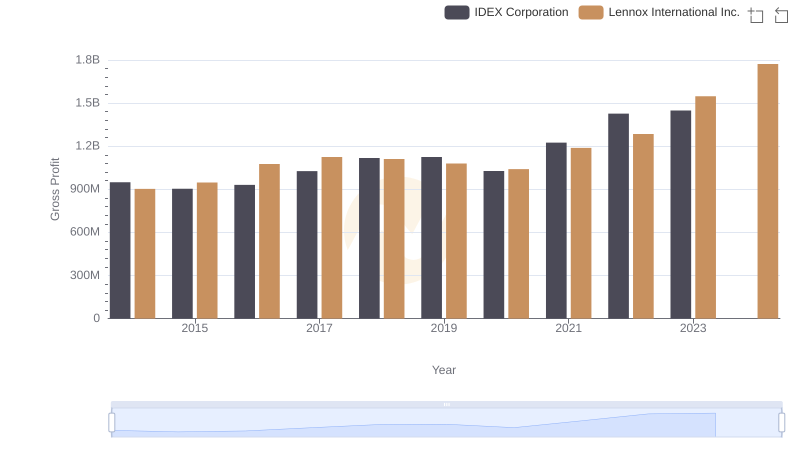

Gross Profit Comparison: Lennox International Inc. and IDEX Corporation Trends

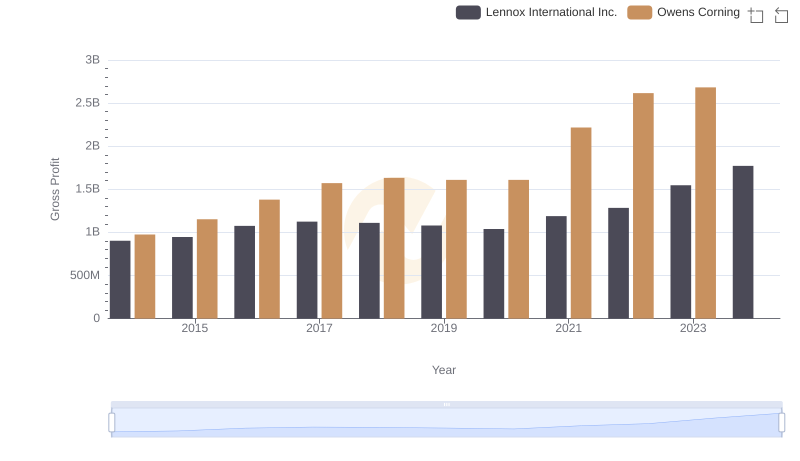

Gross Profit Analysis: Comparing Lennox International Inc. and Owens Corning

Lennox International Inc. vs Textron Inc.: Annual Revenue Growth Compared

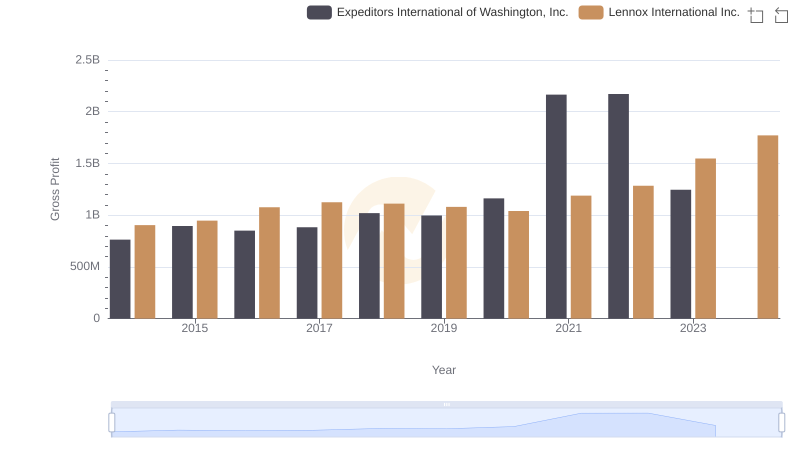

Gross Profit Trends Compared: Lennox International Inc. vs Expeditors International of Washington, Inc.

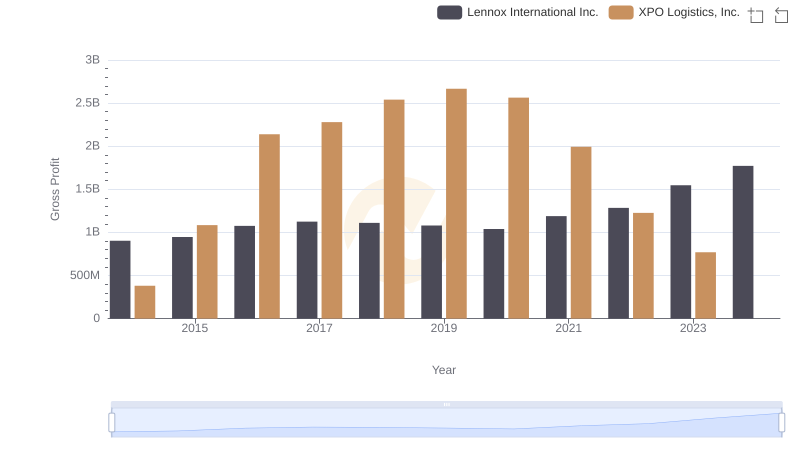

Gross Profit Comparison: Lennox International Inc. and XPO Logistics, Inc. Trends

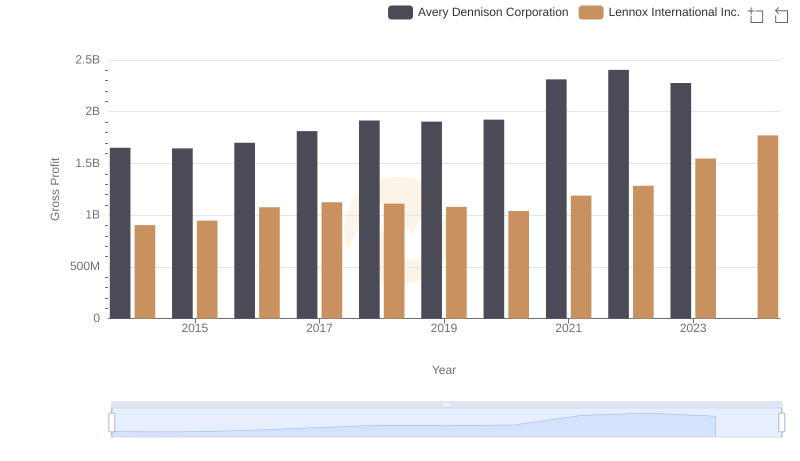

Gross Profit Analysis: Comparing Lennox International Inc. and Avery Dennison Corporation

Lennox International Inc. or Textron Inc.: Who Manages SG&A Costs Better?

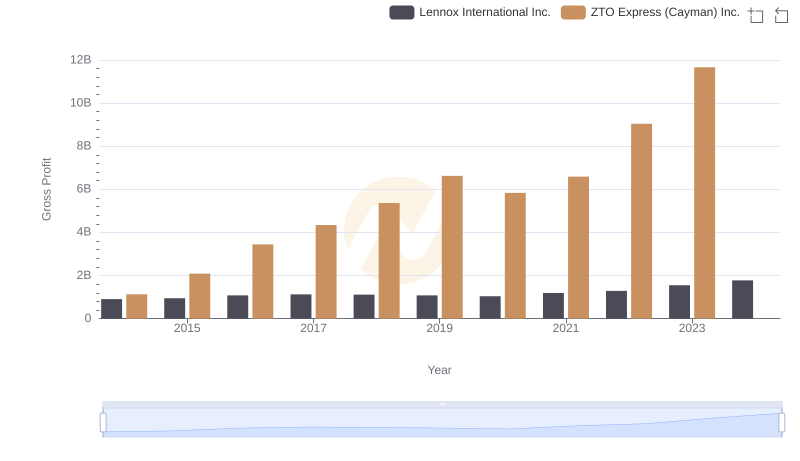

Gross Profit Comparison: Lennox International Inc. and ZTO Express (Cayman) Inc. Trends

EBITDA Performance Review: Lennox International Inc. vs Textron Inc.

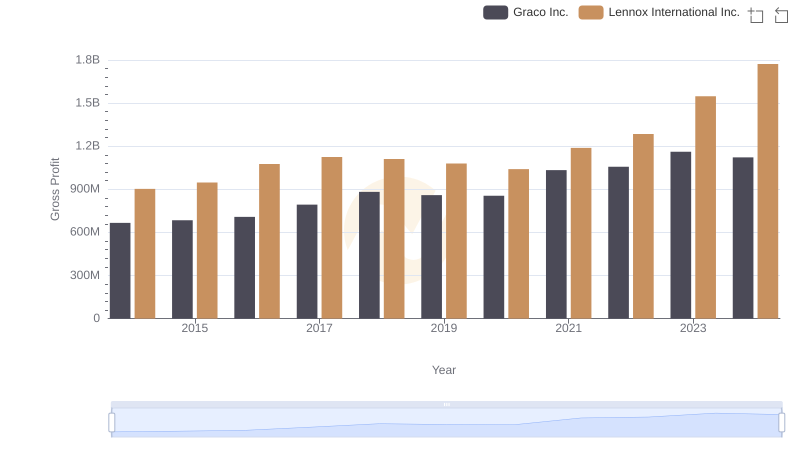

Lennox International Inc. and Graco Inc.: A Detailed Gross Profit Analysis

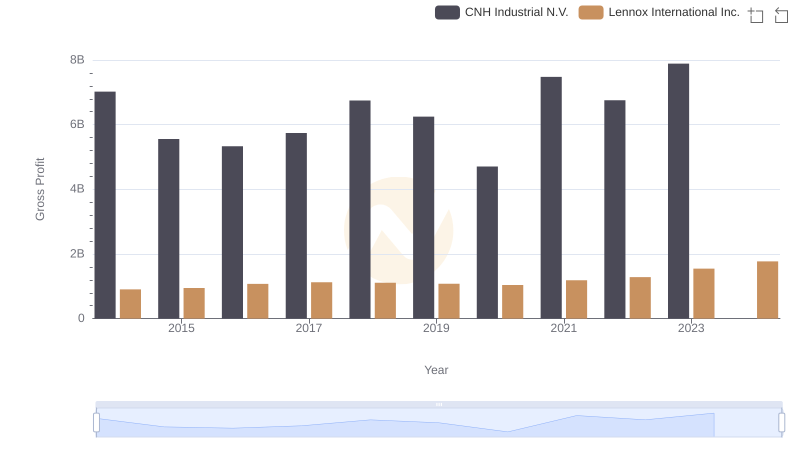

Lennox International Inc. and CNH Industrial N.V.: A Detailed Gross Profit Analysis