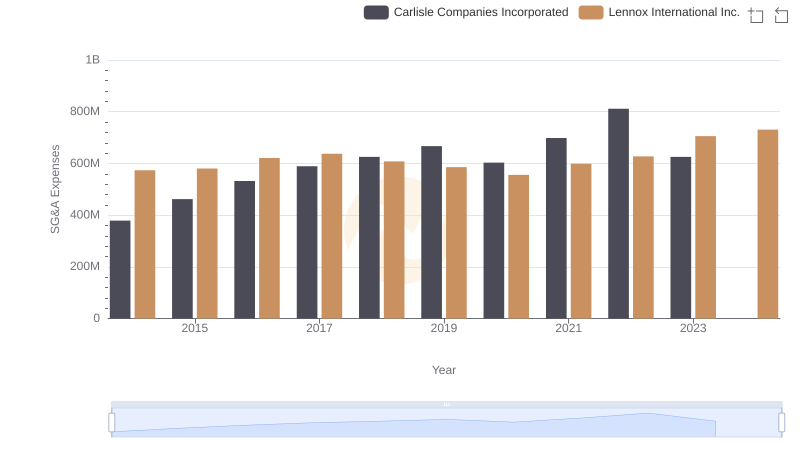

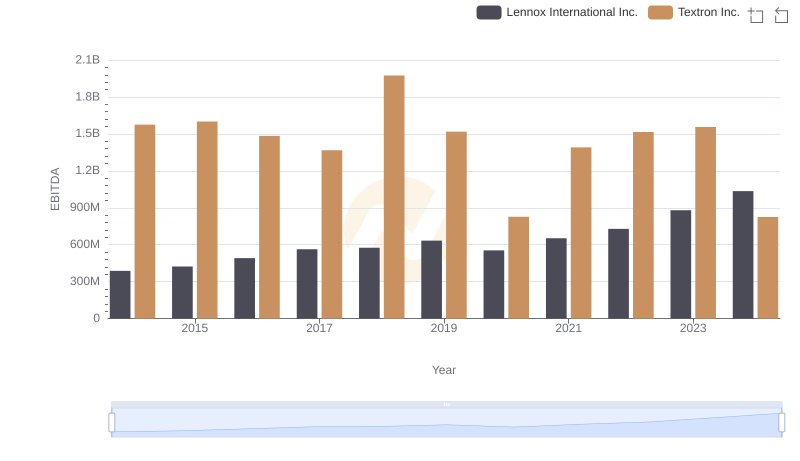

| __timestamp | Lennox International Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 573700000 | 1361000000 |

| Thursday, January 1, 2015 | 580500000 | 1304000000 |

| Friday, January 1, 2016 | 621000000 | 1304000000 |

| Sunday, January 1, 2017 | 637700000 | 1337000000 |

| Monday, January 1, 2018 | 608200000 | 1275000000 |

| Tuesday, January 1, 2019 | 585900000 | 1152000000 |

| Wednesday, January 1, 2020 | 555900000 | 1045000000 |

| Friday, January 1, 2021 | 598900000 | 1221000000 |

| Saturday, January 1, 2022 | 627200000 | 1186000000 |

| Sunday, January 1, 2023 | 705500000 | 1225000000 |

| Monday, January 1, 2024 | 730600000 | 1156000000 |

Unlocking the unknown

In the competitive landscape of industrial giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Lennox International Inc. and Textron Inc. have been at the forefront of this financial balancing act since 2014. Over the past decade, Lennox has demonstrated a steady control over its SG&A costs, with a modest increase of approximately 27% from 2014 to 2024. In contrast, Textron's SG&A expenses have shown more volatility, with a significant spike in 2024, reaching nearly ten times its 2014 levels. This dramatic rise suggests a strategic shift or an operational challenge. As businesses navigate economic uncertainties, understanding these trends offers valuable insights into corporate efficiency and strategic planning.

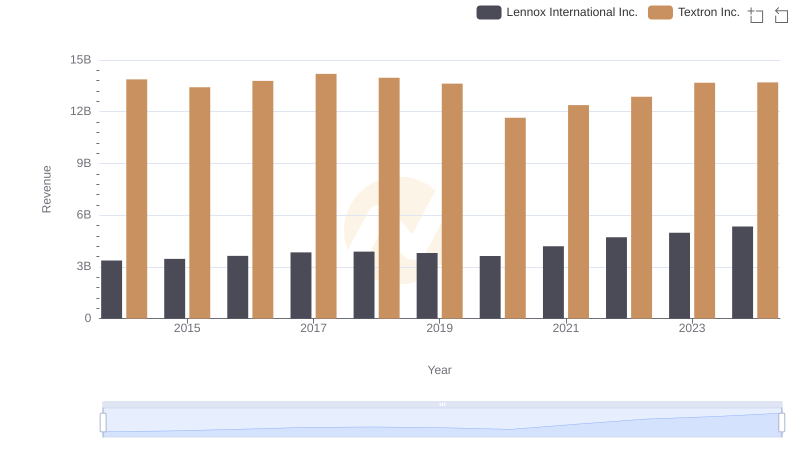

Lennox International Inc. vs Textron Inc.: Annual Revenue Growth Compared

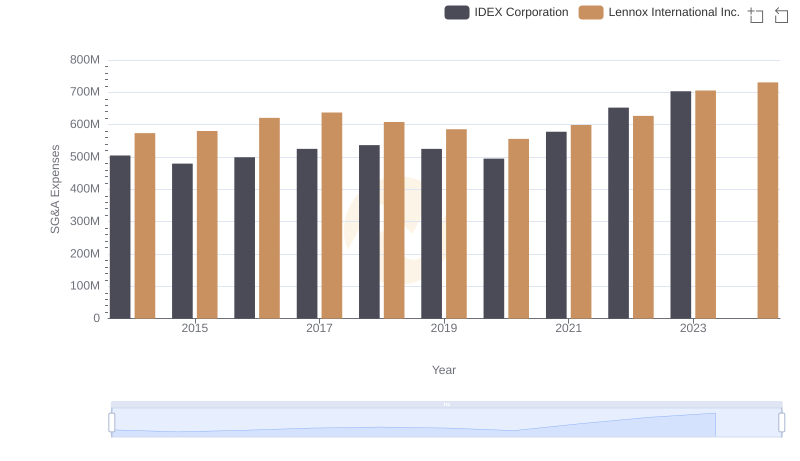

Lennox International Inc. vs IDEX Corporation: SG&A Expense Trends

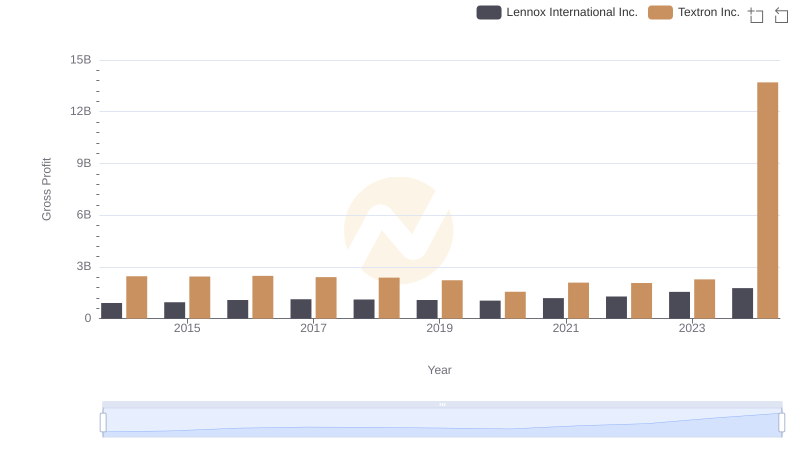

Gross Profit Comparison: Lennox International Inc. and Textron Inc. Trends

Selling, General, and Administrative Costs: Lennox International Inc. vs Carlisle Companies Incorporated

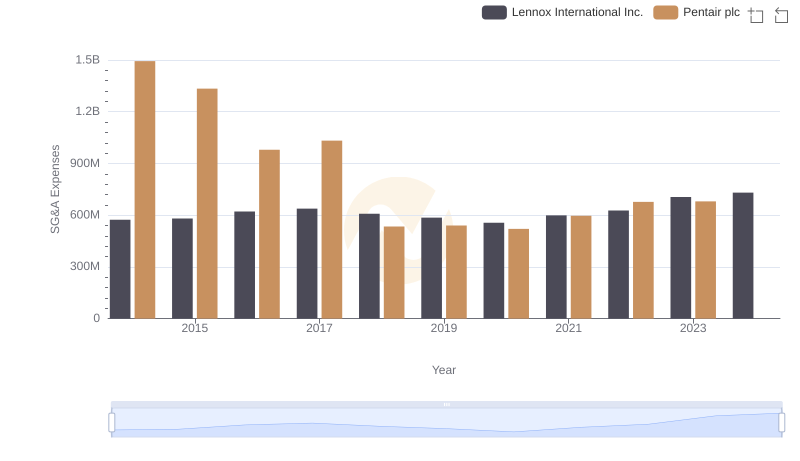

Lennox International Inc. and Pentair plc: SG&A Spending Patterns Compared

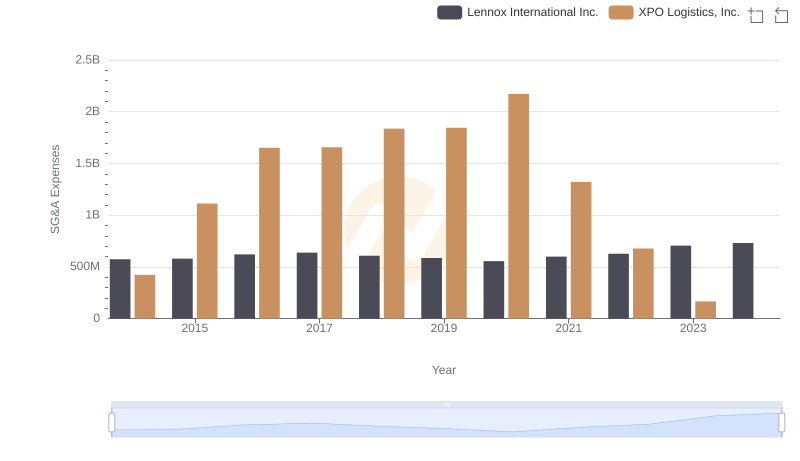

Lennox International Inc. vs XPO Logistics, Inc.: SG&A Expense Trends

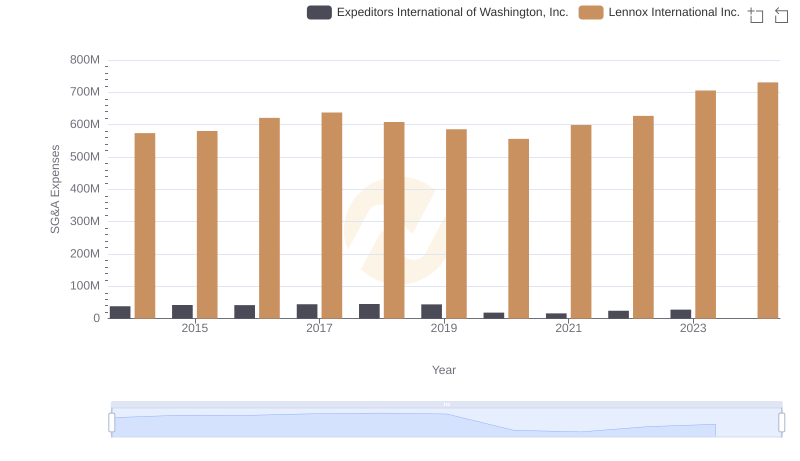

SG&A Efficiency Analysis: Comparing Lennox International Inc. and Expeditors International of Washington, Inc.

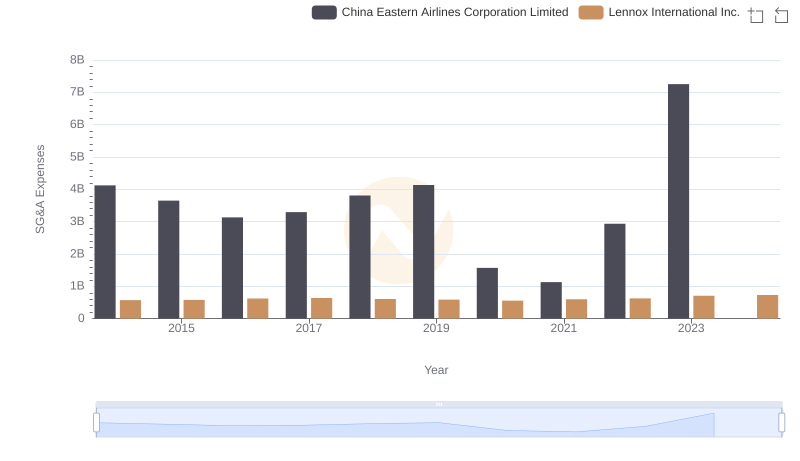

Lennox International Inc. and China Eastern Airlines Corporation Limited: SG&A Spending Patterns Compared

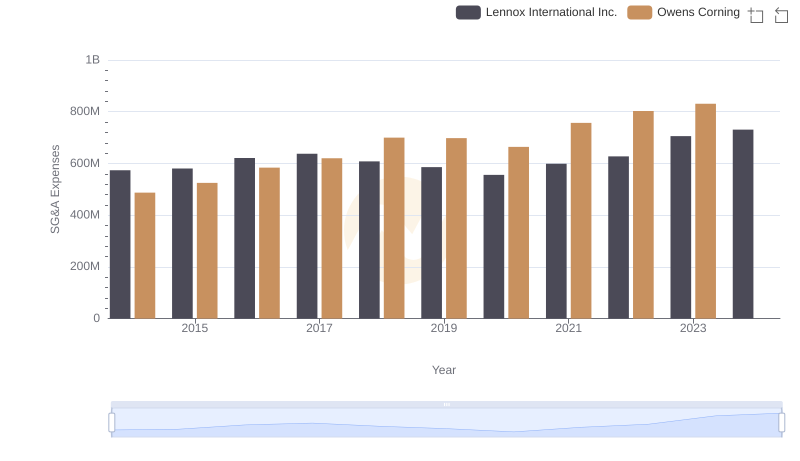

Lennox International Inc. or Owens Corning: Who Manages SG&A Costs Better?

EBITDA Performance Review: Lennox International Inc. vs Textron Inc.

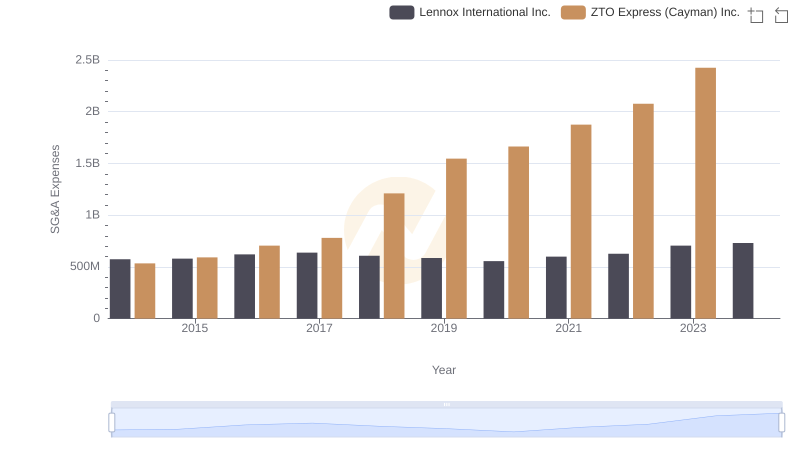

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and ZTO Express (Cayman) Inc.

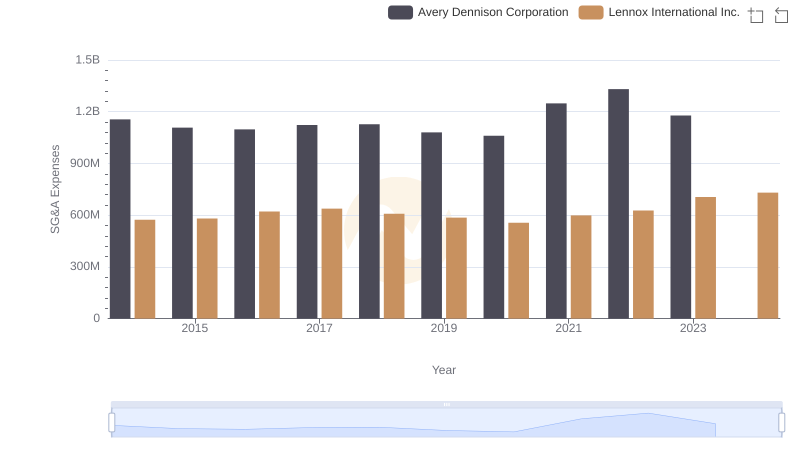

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and Avery Dennison Corporation