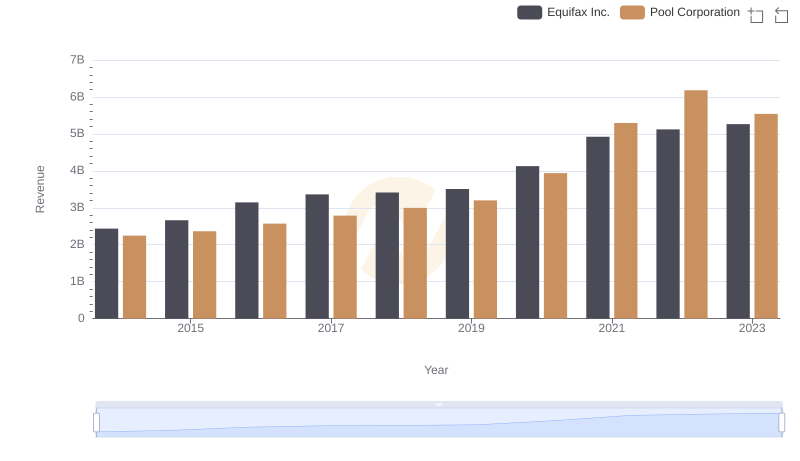

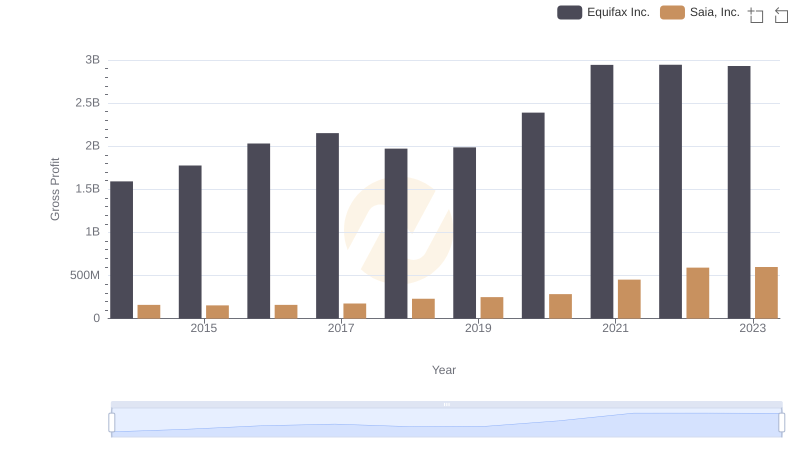

| __timestamp | Equifax Inc. | Pool Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 643340000 |

| Thursday, January 1, 2015 | 1776200000 | 675644000 |

| Friday, January 1, 2016 | 2031500000 | 741087000 |

| Sunday, January 1, 2017 | 2151500000 | 805289000 |

| Monday, January 1, 2018 | 1971700000 | 870173000 |

| Tuesday, January 1, 2019 | 1985900000 | 924925000 |

| Wednesday, January 1, 2020 | 2390100000 | 1130902000 |

| Friday, January 1, 2021 | 2943000000 | 1617092000 |

| Saturday, January 1, 2022 | 2945000000 | 1933412000 |

| Sunday, January 1, 2023 | 2930100000 | 1660044000 |

| Monday, January 1, 2024 | 5681100000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding the trends in gross profit can offer valuable insights into a company's operational efficiency and market position. Over the past decade, Equifax Inc. and Pool Corporation have demonstrated distinct trajectories in their financial performance.

Equifax Inc. has shown a robust growth pattern, with its gross profit increasing by approximately 84% from 2014 to 2023. Notably, the company experienced a significant surge in 2021, reaching its peak gross profit, which was nearly double its 2014 figures. This growth reflects Equifax's strategic initiatives and market adaptability.

Pool Corporation, on the other hand, has also seen impressive growth, with its gross profit more than doubling over the same period. The company reached its highest gross profit in 2022, marking a 200% increase since 2014. This trend underscores Pool Corporation's strong market presence and operational efficiency.

Both companies have navigated the financial landscape with resilience, showcasing their ability to adapt and thrive in changing market conditions.

Comparing Revenue Performance: Equifax Inc. or Pool Corporation?

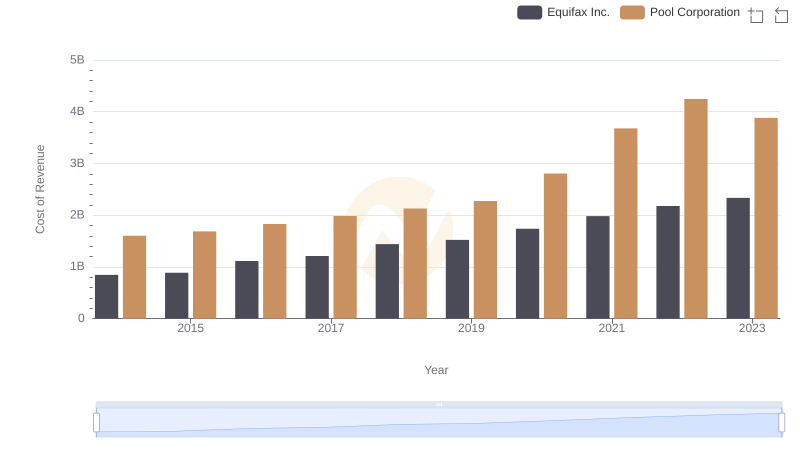

Cost of Revenue Comparison: Equifax Inc. vs Pool Corporation

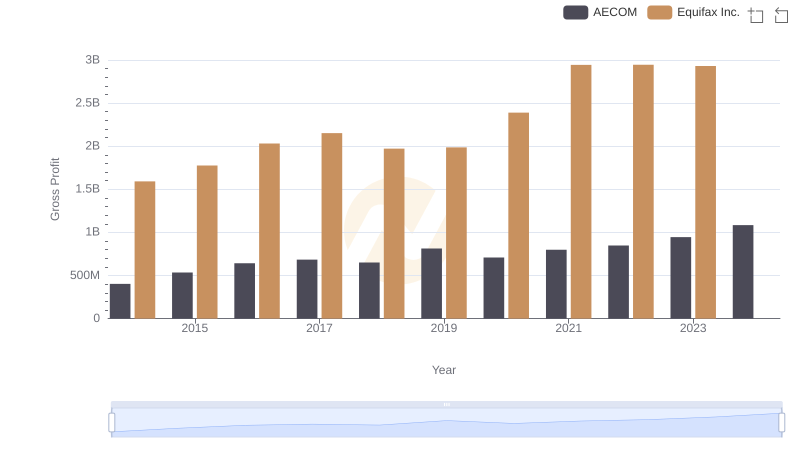

Who Generates Higher Gross Profit? Equifax Inc. or AECOM

Key Insights on Gross Profit: Equifax Inc. vs Comfort Systems USA, Inc.

Who Generates Higher Gross Profit? Equifax Inc. or Saia, Inc.

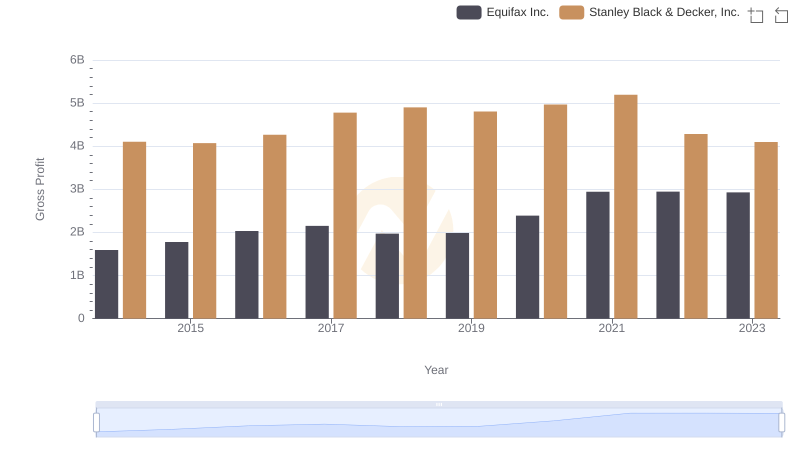

Key Insights on Gross Profit: Equifax Inc. vs Stanley Black & Decker, Inc.

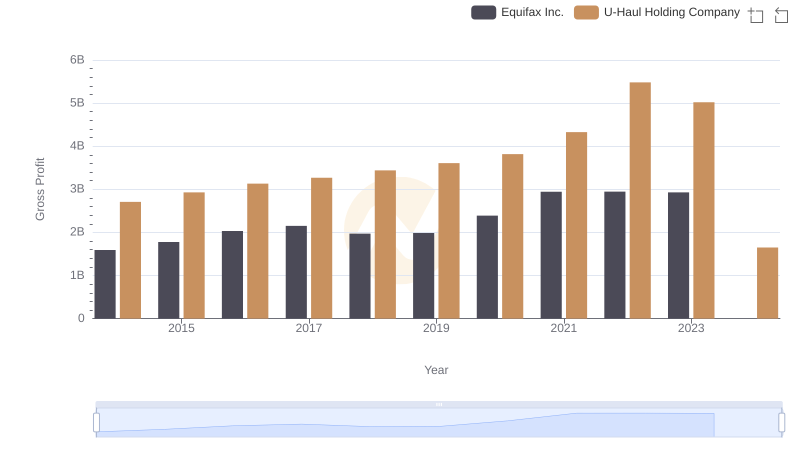

Equifax Inc. and U-Haul Holding Company: A Detailed Gross Profit Analysis

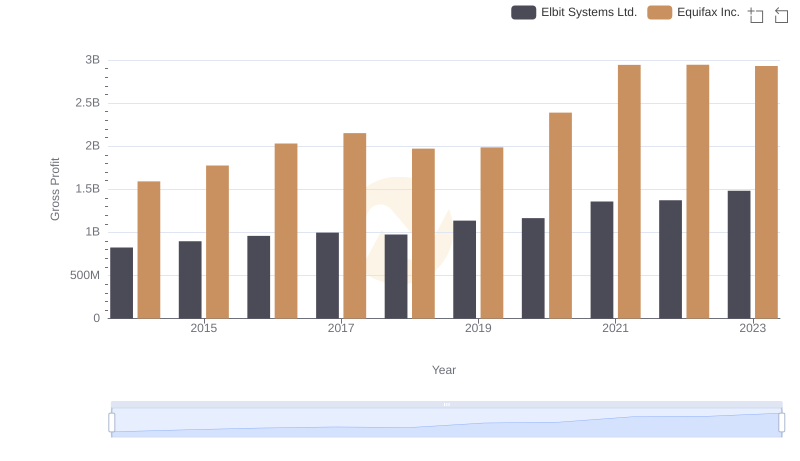

Gross Profit Analysis: Comparing Equifax Inc. and Elbit Systems Ltd.

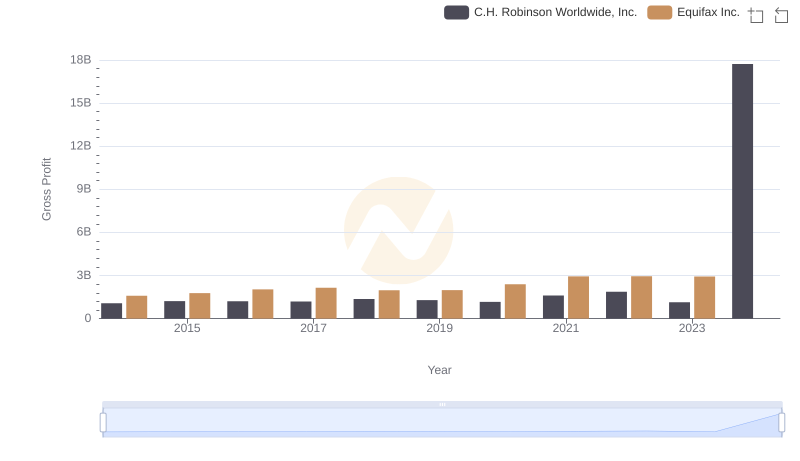

Equifax Inc. and C.H. Robinson Worldwide, Inc.: A Detailed Gross Profit Analysis

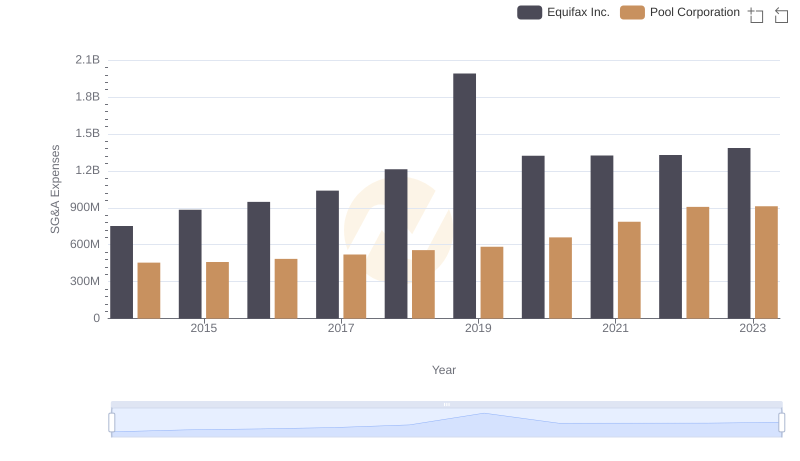

Comparing SG&A Expenses: Equifax Inc. vs Pool Corporation Trends and Insights

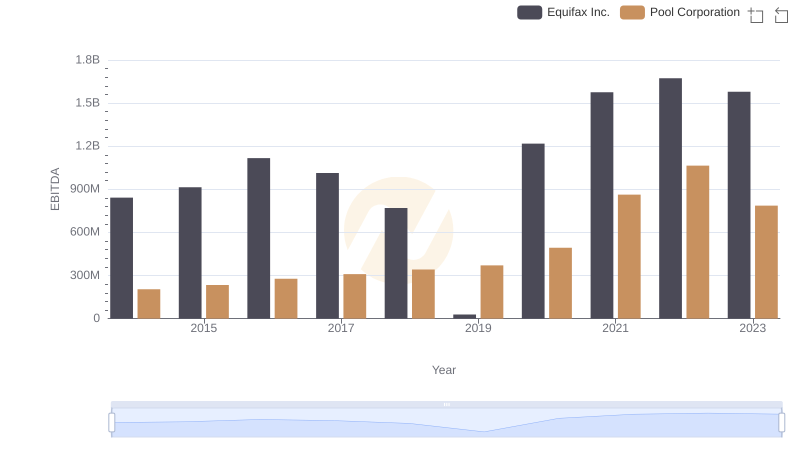

EBITDA Analysis: Evaluating Equifax Inc. Against Pool Corporation