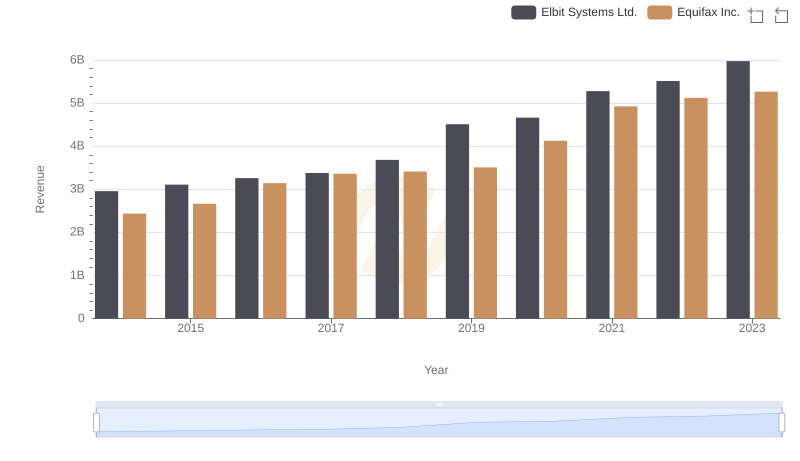

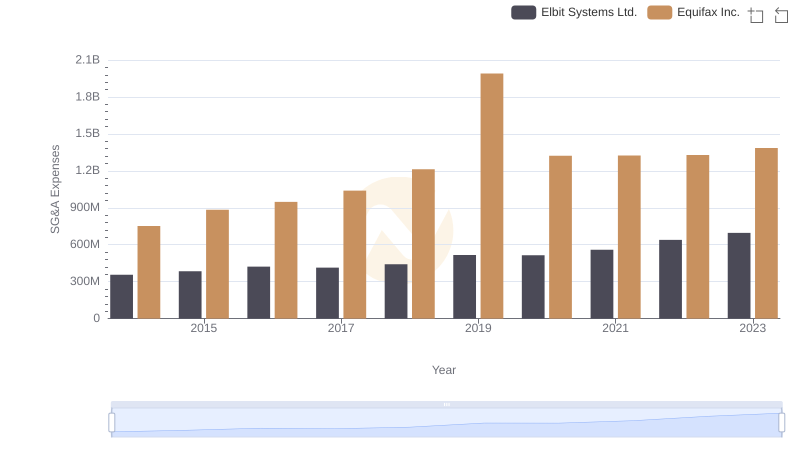

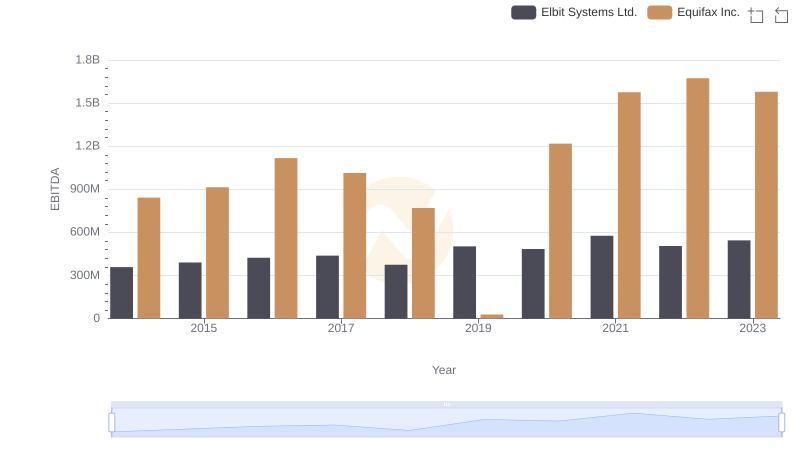

| __timestamp | Elbit Systems Ltd. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 825097000 | 1591700000 |

| Thursday, January 1, 2015 | 897053000 | 1776200000 |

| Friday, January 1, 2016 | 959583000 | 2031500000 |

| Sunday, January 1, 2017 | 997920000 | 2151500000 |

| Monday, January 1, 2018 | 976179000 | 1971700000 |

| Tuesday, January 1, 2019 | 1136467000 | 1985900000 |

| Wednesday, January 1, 2020 | 1165107000 | 2390100000 |

| Friday, January 1, 2021 | 1358048000 | 2943000000 |

| Saturday, January 1, 2022 | 1373283000 | 2945000000 |

| Sunday, January 1, 2023 | 1482954000 | 2930100000 |

| Monday, January 1, 2024 | 5681100000 |

Cracking the code

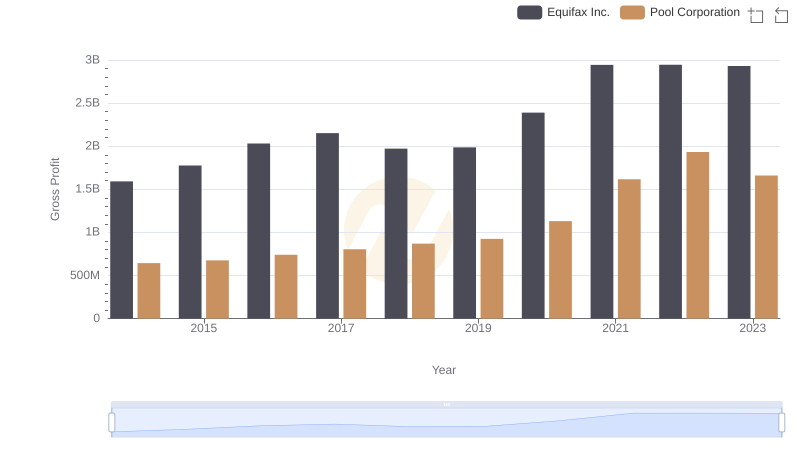

In the ever-evolving landscape of global business, understanding the financial health of companies is crucial. This analysis delves into the gross profit trends of two industry giants: Equifax Inc., a leader in consumer credit reporting, and Elbit Systems Ltd., a prominent player in defense electronics. From 2014 to 2023, Equifax consistently outperformed Elbit Systems in gross profit, with an average of 2.27 billion USD annually, nearly double that of Elbit's 1.12 billion USD. Notably, Equifax's gross profit peaked in 2022 at approximately 2.95 billion USD, marking a 85% increase from 2014. Meanwhile, Elbit Systems showed a steady growth, reaching its highest gross profit in 2023, a 80% rise from its 2014 figures. These trends highlight the robust financial strategies of both companies, with Equifax maintaining a dominant position in its sector.

Equifax Inc. or Elbit Systems Ltd.: Who Leads in Yearly Revenue?

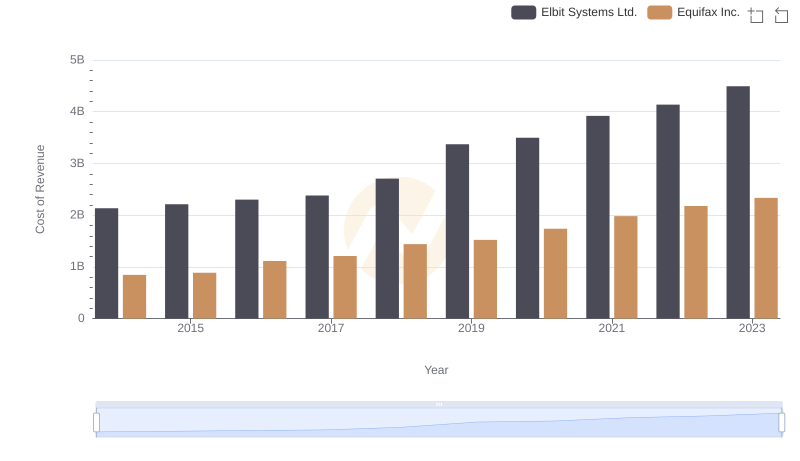

Cost of Revenue Comparison: Equifax Inc. vs Elbit Systems Ltd.

Key Insights on Gross Profit: Equifax Inc. vs Comfort Systems USA, Inc.

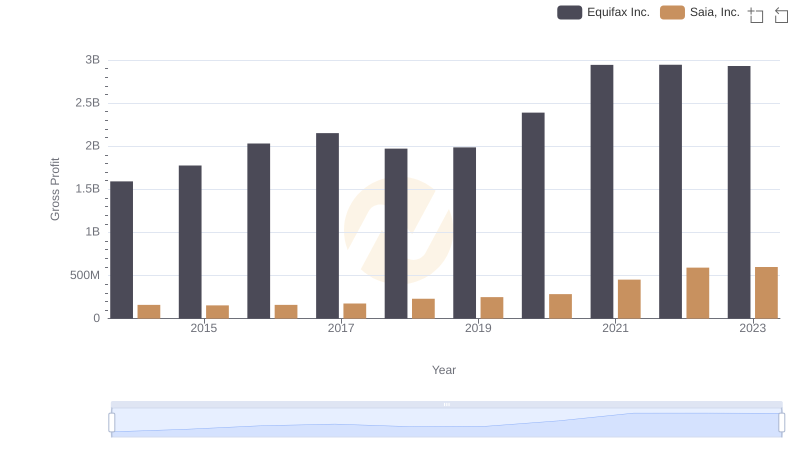

Who Generates Higher Gross Profit? Equifax Inc. or Saia, Inc.

Gross Profit Comparison: Equifax Inc. and Pool Corporation Trends

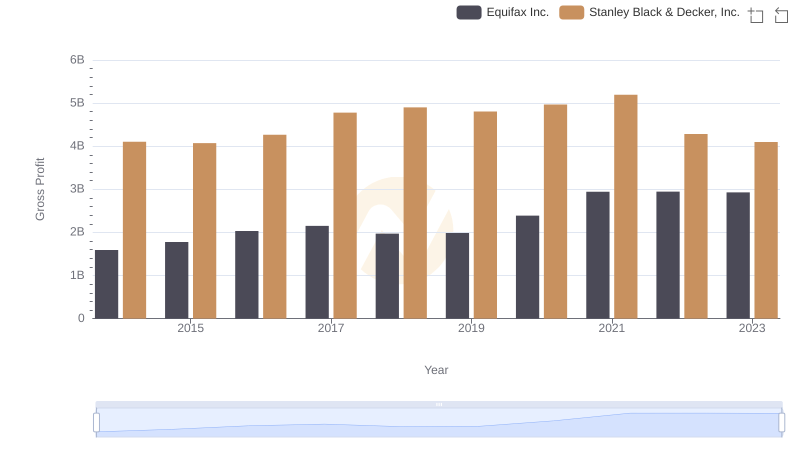

Key Insights on Gross Profit: Equifax Inc. vs Stanley Black & Decker, Inc.

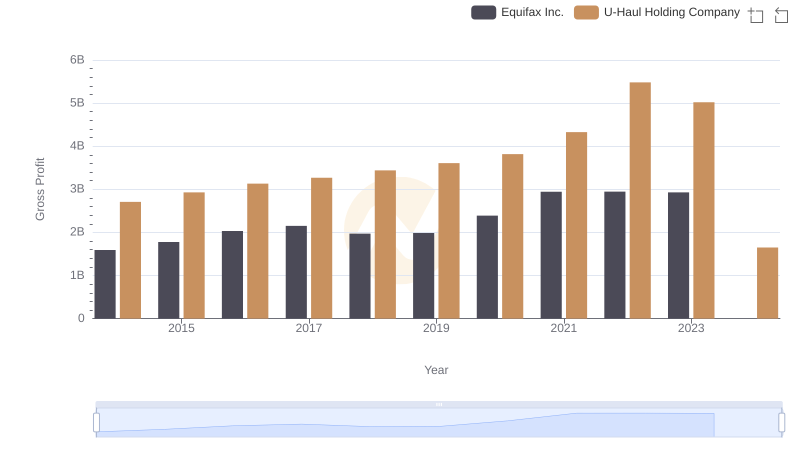

Equifax Inc. and U-Haul Holding Company: A Detailed Gross Profit Analysis

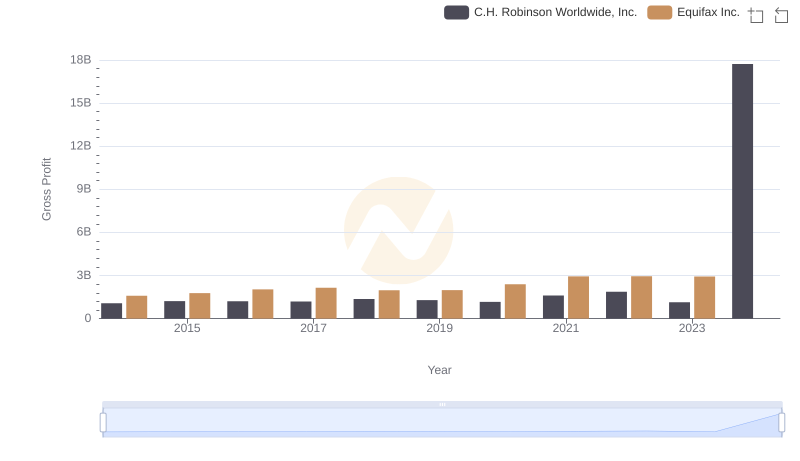

Equifax Inc. and C.H. Robinson Worldwide, Inc.: A Detailed Gross Profit Analysis

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Elbit Systems Ltd.

Comparative EBITDA Analysis: Equifax Inc. vs Elbit Systems Ltd.