| __timestamp | AECOM | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 403176000 | 1591700000 |

| Thursday, January 1, 2015 | 535188000 | 1776200000 |

| Friday, January 1, 2016 | 642824000 | 2031500000 |

| Sunday, January 1, 2017 | 683720000 | 2151500000 |

| Monday, January 1, 2018 | 650649000 | 1971700000 |

| Tuesday, January 1, 2019 | 813445000 | 1985900000 |

| Wednesday, January 1, 2020 | 709560000 | 2390100000 |

| Friday, January 1, 2021 | 798421000 | 2943000000 |

| Saturday, January 1, 2022 | 847974000 | 2945000000 |

| Sunday, January 1, 2023 | 945465000 | 2930100000 |

| Monday, January 1, 2024 | 1084341000 | 5681100000 |

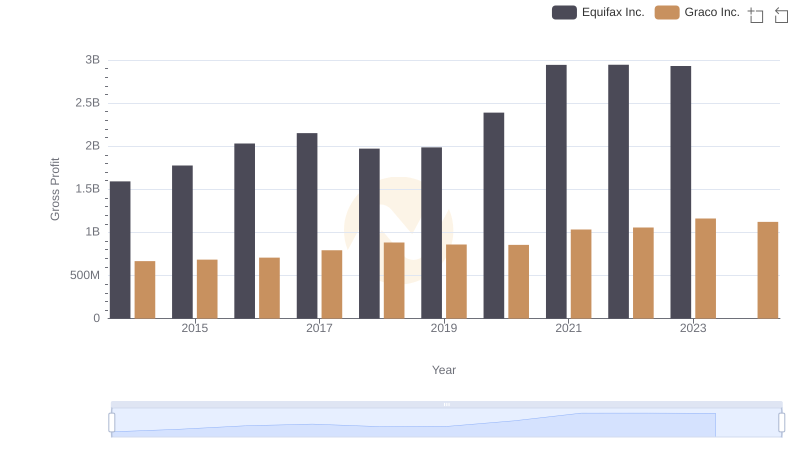

Unleashing insights

In the competitive landscape of American corporations, Equifax Inc. and AECOM have been pivotal players. Over the past decade, Equifax Inc. has consistently outperformed AECOM in terms of gross profit. From 2014 to 2023, Equifax's gross profit surged by approximately 84%, peaking in 2022 with a remarkable $2.945 billion. In contrast, AECOM's growth trajectory, while steady, was more modest, with a 169% increase over the same period, reaching its highest in 2024.

Equifax's dominance is evident, with its gross profit consistently more than double that of AECOM's. However, AECOM's recent growth spurt, especially in 2023, suggests a promising upward trend. The data for 2024 is incomplete for Equifax, leaving room for speculation on whether AECOM might close the gap in the coming years. This financial narrative underscores the dynamic nature of corporate profitability in the U.S. market.

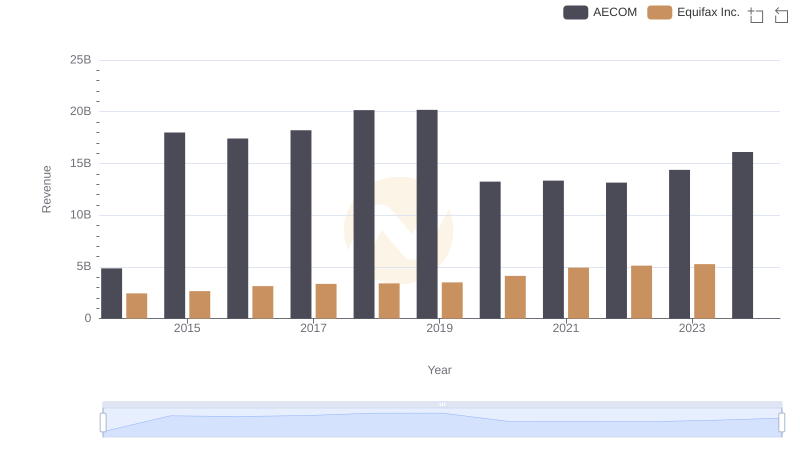

Breaking Down Revenue Trends: Equifax Inc. vs AECOM

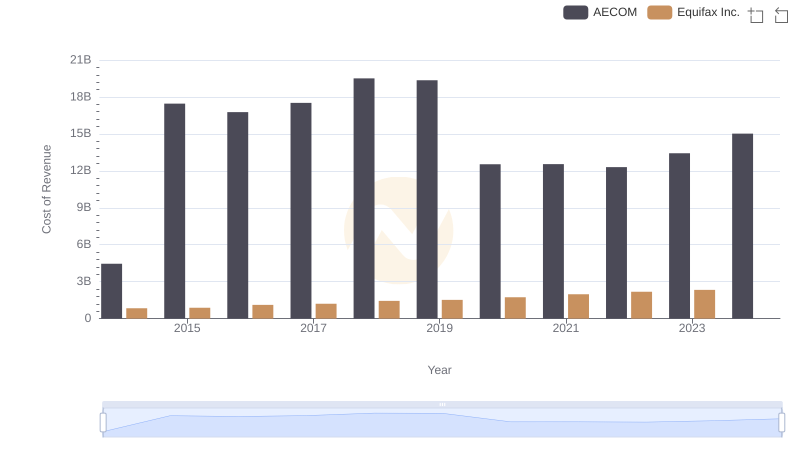

Equifax Inc. vs AECOM: Efficiency in Cost of Revenue Explored

Who Generates Higher Gross Profit? Equifax Inc. or Graco Inc.

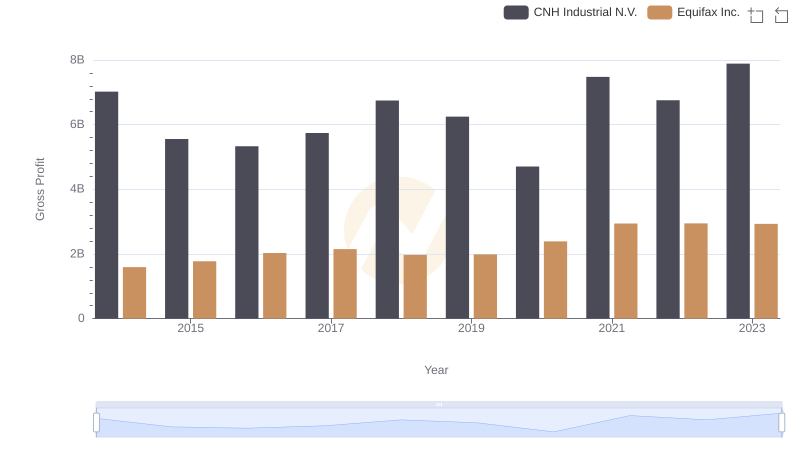

Gross Profit Analysis: Comparing Equifax Inc. and CNH Industrial N.V.

Key Insights on Gross Profit: Equifax Inc. vs Comfort Systems USA, Inc.

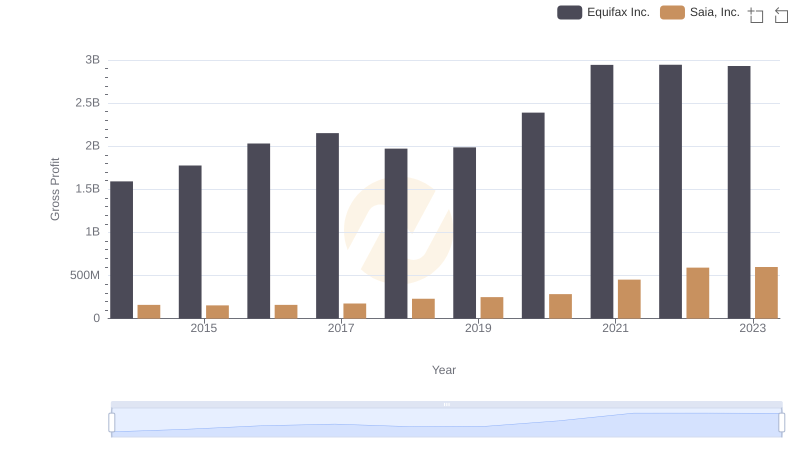

Who Generates Higher Gross Profit? Equifax Inc. or Saia, Inc.

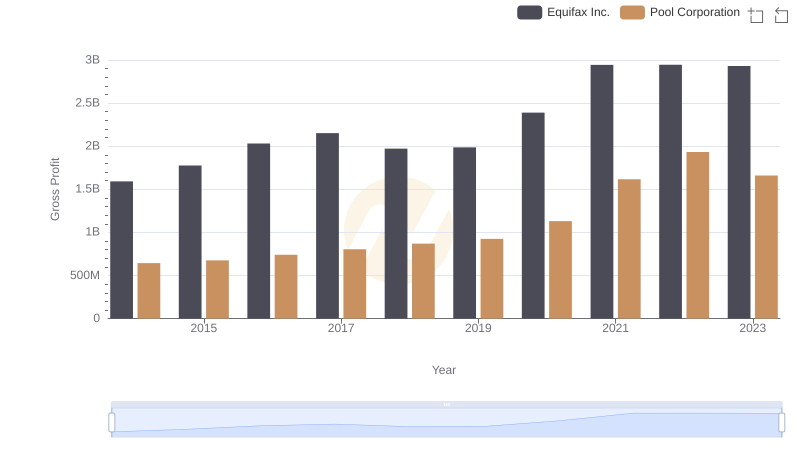

Gross Profit Comparison: Equifax Inc. and Pool Corporation Trends

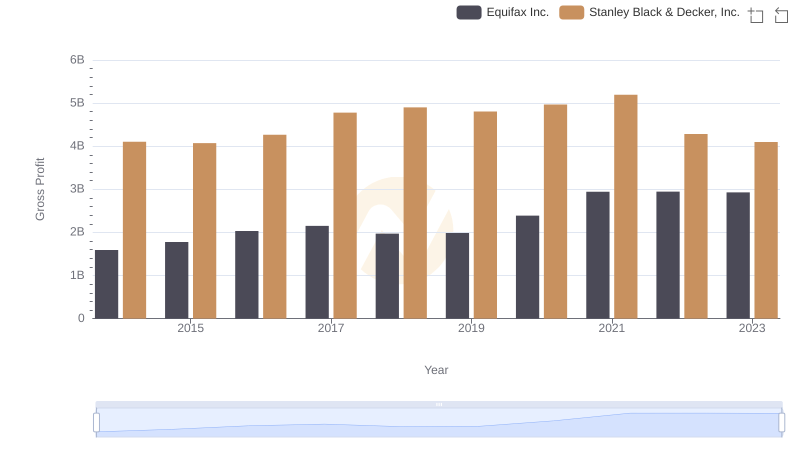

Key Insights on Gross Profit: Equifax Inc. vs Stanley Black & Decker, Inc.

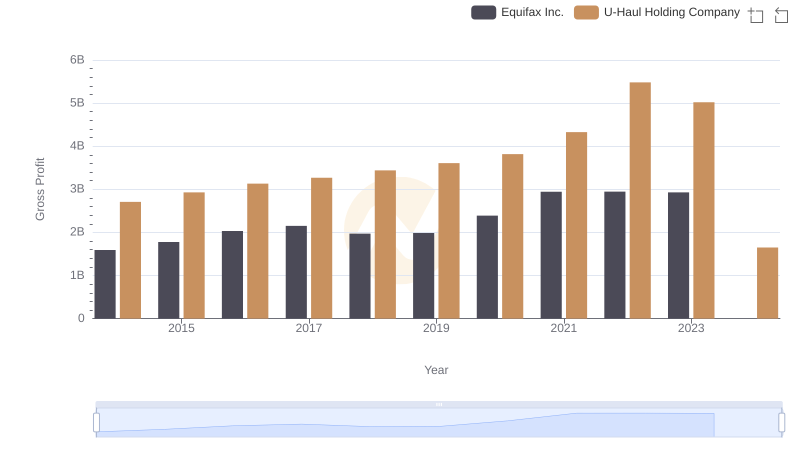

Equifax Inc. and U-Haul Holding Company: A Detailed Gross Profit Analysis

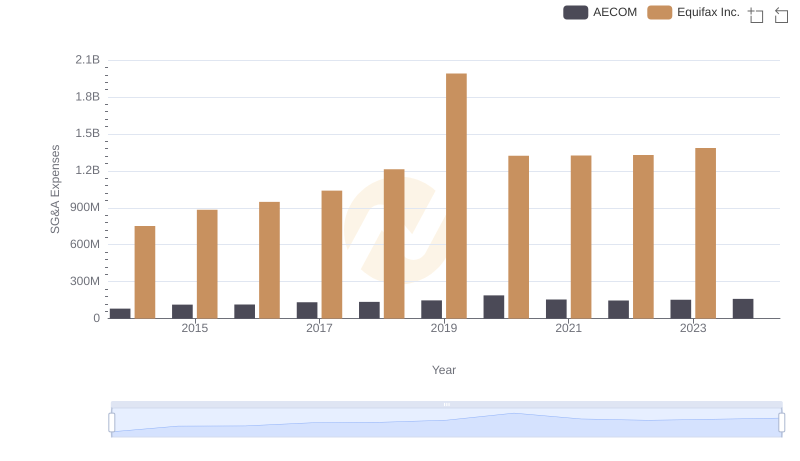

Equifax Inc. and AECOM: SG&A Spending Patterns Compared