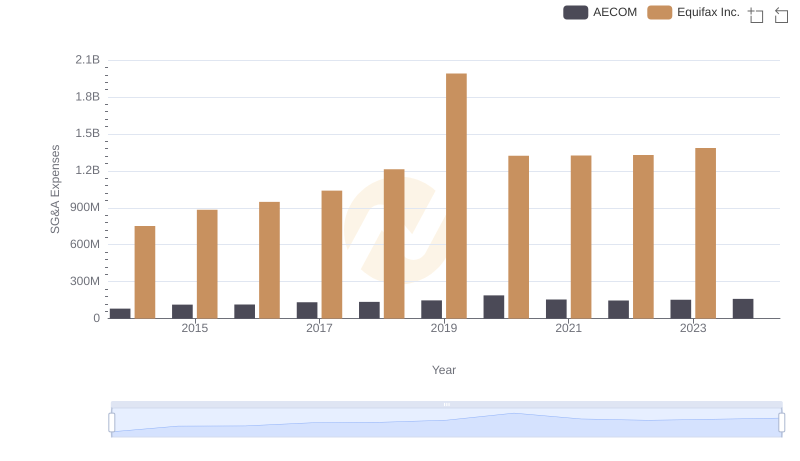

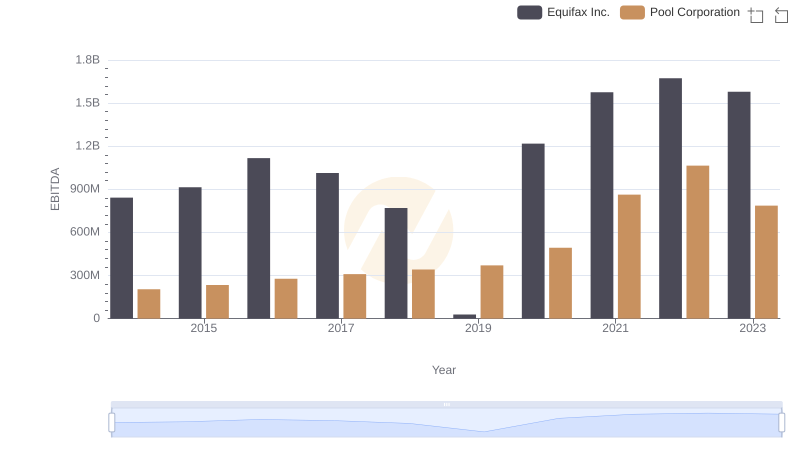

| __timestamp | Equifax Inc. | Pool Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 454470000 |

| Thursday, January 1, 2015 | 884300000 | 459422000 |

| Friday, January 1, 2016 | 948200000 | 485228000 |

| Sunday, January 1, 2017 | 1039100000 | 520918000 |

| Monday, January 1, 2018 | 1213300000 | 556284000 |

| Tuesday, January 1, 2019 | 1990200000 | 583679000 |

| Wednesday, January 1, 2020 | 1322500000 | 659931000 |

| Friday, January 1, 2021 | 1324600000 | 786808000 |

| Saturday, January 1, 2022 | 1328900000 | 907629000 |

| Sunday, January 1, 2023 | 1385700000 | 912927000 |

| Monday, January 1, 2024 | 1450500000 |

Unlocking the unknown

In the past decade, the Selling, General, and Administrative (SG&A) expenses of Equifax Inc. and Pool Corporation have shown intriguing trends. Equifax Inc. has consistently outpaced Pool Corporation, with its SG&A expenses growing by approximately 84% from 2014 to 2023. In contrast, Pool Corporation's expenses increased by about 101% over the same period, indicating a more aggressive growth trajectory.

These trends reflect strategic shifts and market dynamics, offering valuable insights for investors and analysts alike.

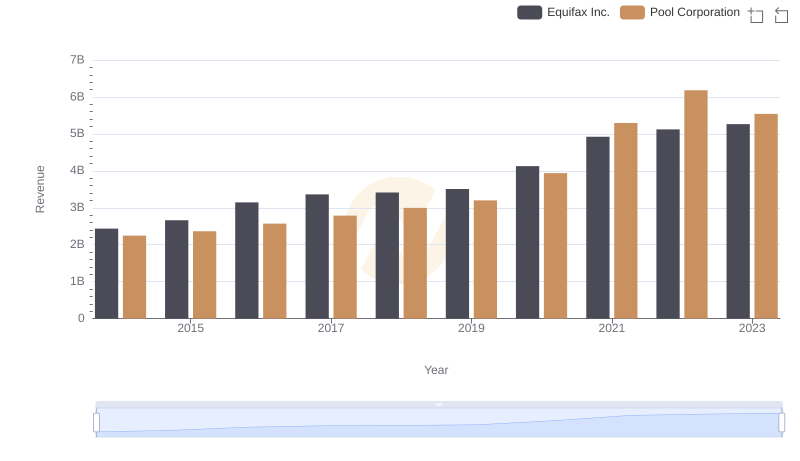

Comparing Revenue Performance: Equifax Inc. or Pool Corporation?

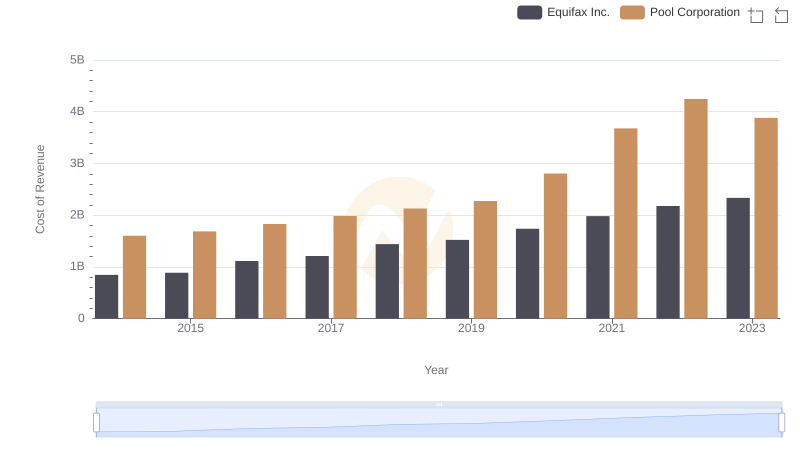

Cost of Revenue Comparison: Equifax Inc. vs Pool Corporation

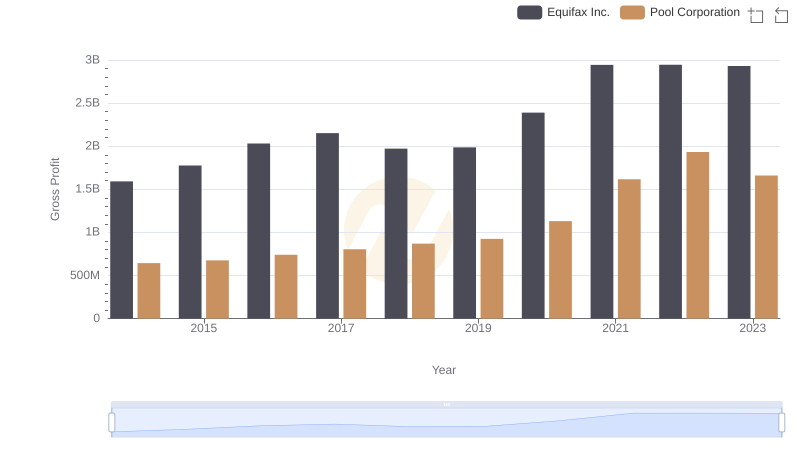

Gross Profit Comparison: Equifax Inc. and Pool Corporation Trends

Equifax Inc. and AECOM: SG&A Spending Patterns Compared

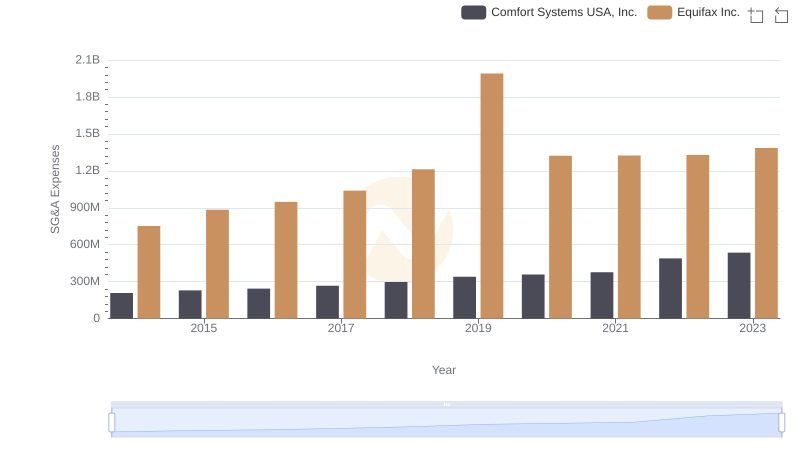

Equifax Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

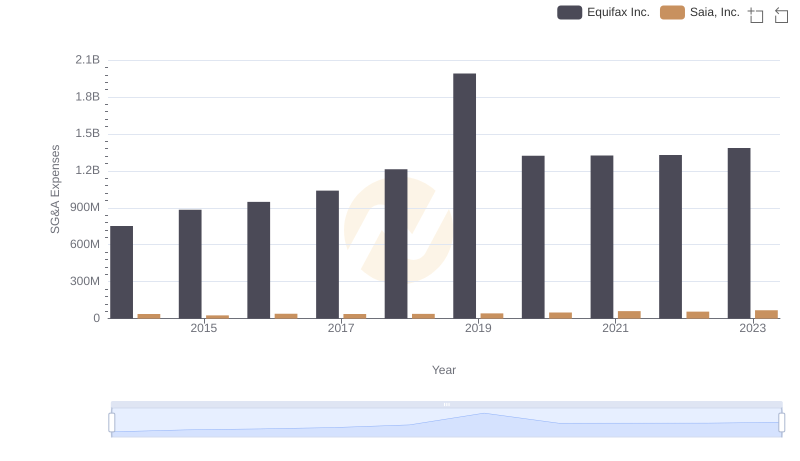

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Saia, Inc.

Equifax Inc. or Curtiss-Wright Corporation: Who Manages SG&A Costs Better?

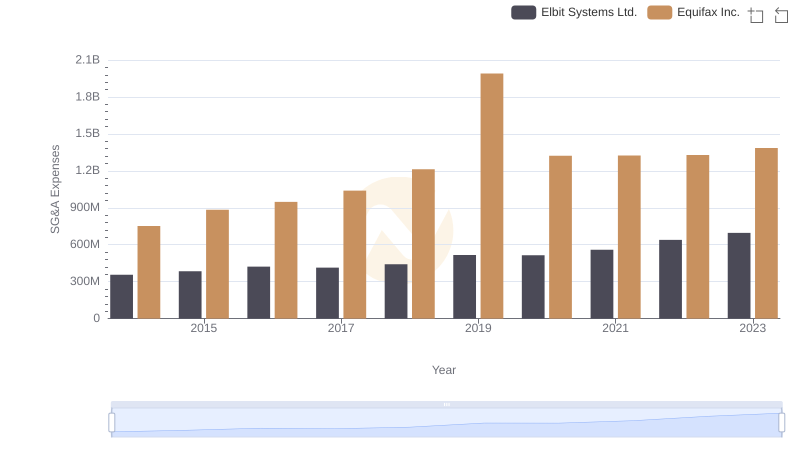

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Elbit Systems Ltd.

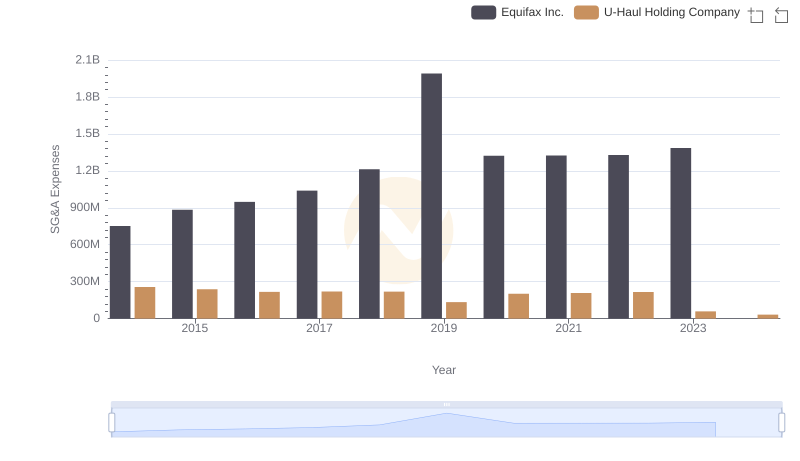

Selling, General, and Administrative Costs: Equifax Inc. vs U-Haul Holding Company

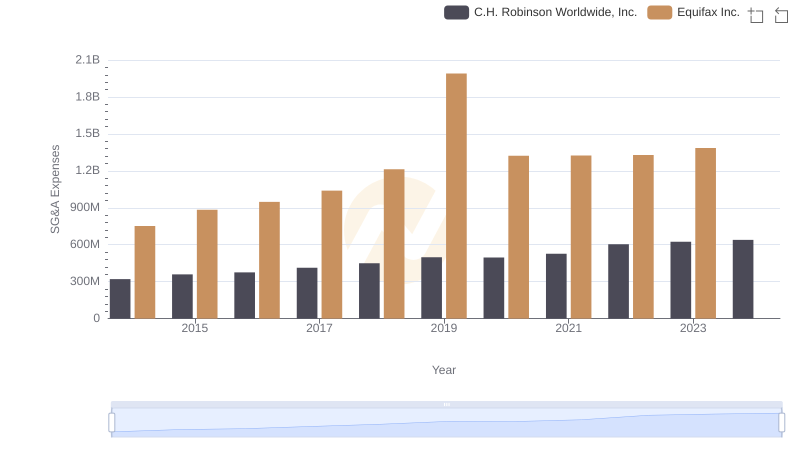

Breaking Down SG&A Expenses: Equifax Inc. vs C.H. Robinson Worldwide, Inc.

EBITDA Analysis: Evaluating Equifax Inc. Against Pool Corporation