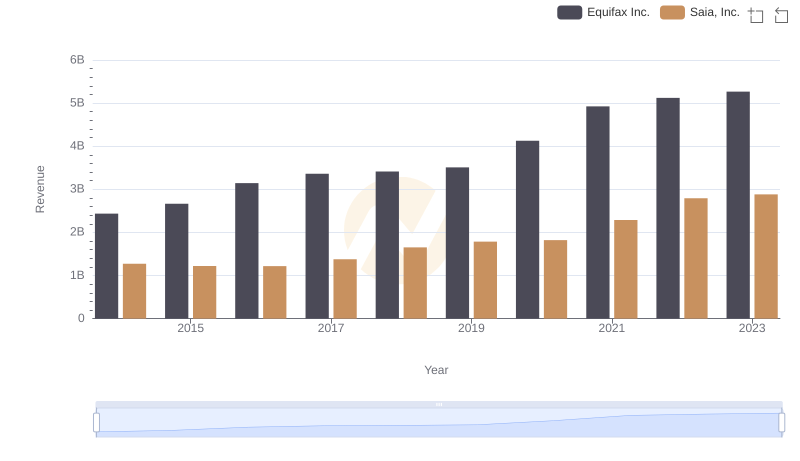

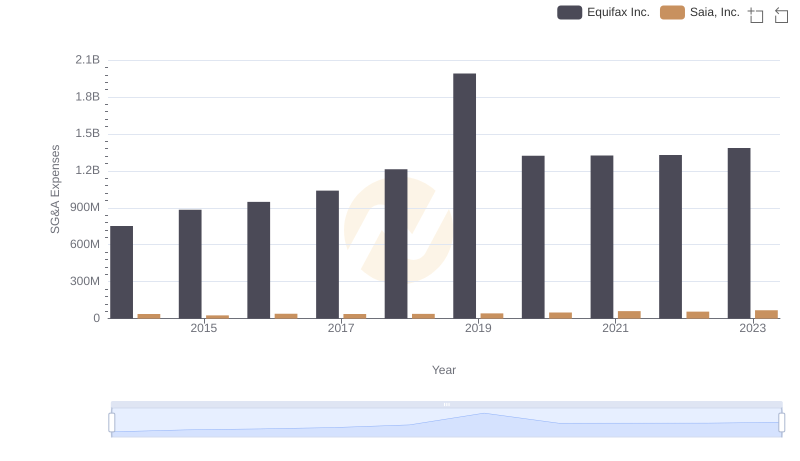

| __timestamp | Equifax Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 159268000 |

| Thursday, January 1, 2015 | 1776200000 | 154120000 |

| Friday, January 1, 2016 | 2031500000 | 159502000 |

| Sunday, January 1, 2017 | 2151500000 | 175046000 |

| Monday, January 1, 2018 | 1971700000 | 230070000 |

| Tuesday, January 1, 2019 | 1985900000 | 249653000 |

| Wednesday, January 1, 2020 | 2390100000 | 283848000 |

| Friday, January 1, 2021 | 2943000000 | 451687000 |

| Saturday, January 1, 2022 | 2945000000 | 590963000 |

| Sunday, January 1, 2023 | 2930100000 | 598932000 |

| Monday, January 1, 2024 | 5681100000 |

Igniting the spark of knowledge

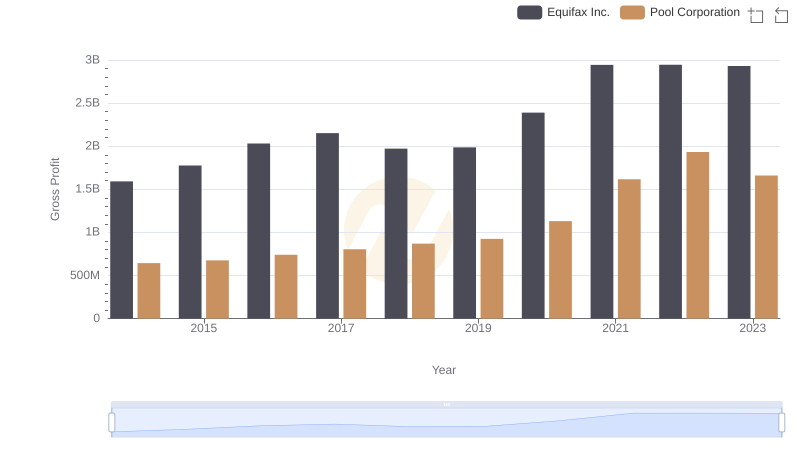

In the competitive landscape of American business, understanding which companies lead in profitability is crucial. Over the past decade, Equifax Inc. has consistently outperformed Saia, Inc. in terms of gross profit. From 2014 to 2023, Equifax's gross profit surged by approximately 84%, peaking in 2022 with a remarkable $2.94 billion. In contrast, Saia, Inc. experienced a more modest growth of around 276%, reaching its highest gross profit of nearly $599 million in 2023.

This data highlights Equifax's dominant position in the market, maintaining a gross profit that is consistently over four times that of Saia, Inc. The trend underscores Equifax's robust business model and market strategy, while Saia's growth trajectory reflects its expanding footprint in the logistics sector. As we look to the future, these insights provide a valuable perspective on the evolving dynamics of these two industry players.

Comparing Revenue Performance: Equifax Inc. or Saia, Inc.?

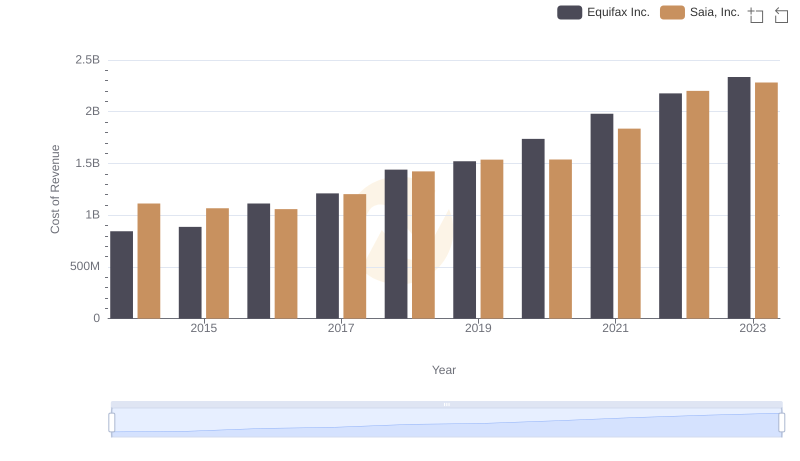

Analyzing Cost of Revenue: Equifax Inc. and Saia, Inc.

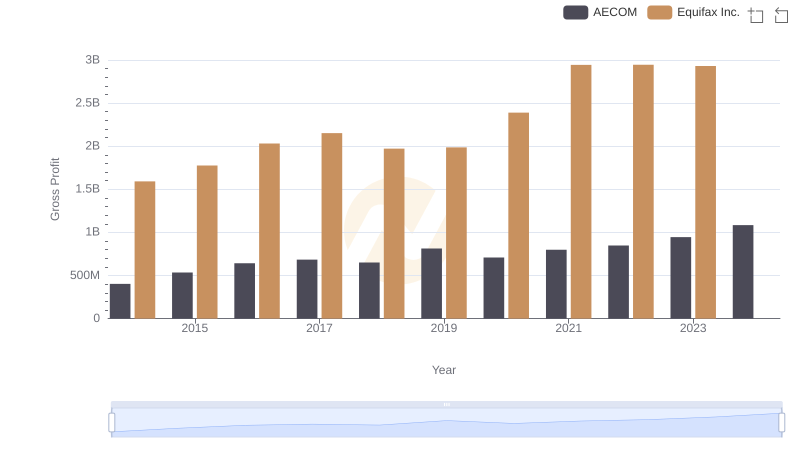

Who Generates Higher Gross Profit? Equifax Inc. or AECOM

Key Insights on Gross Profit: Equifax Inc. vs Comfort Systems USA, Inc.

Gross Profit Comparison: Equifax Inc. and Pool Corporation Trends

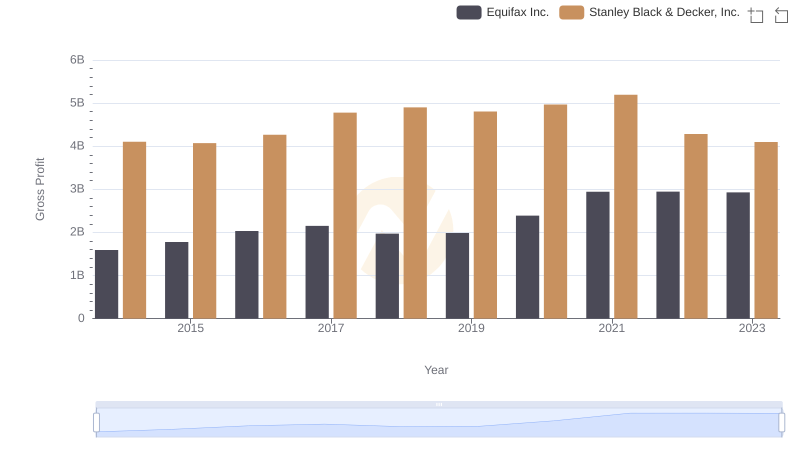

Key Insights on Gross Profit: Equifax Inc. vs Stanley Black & Decker, Inc.

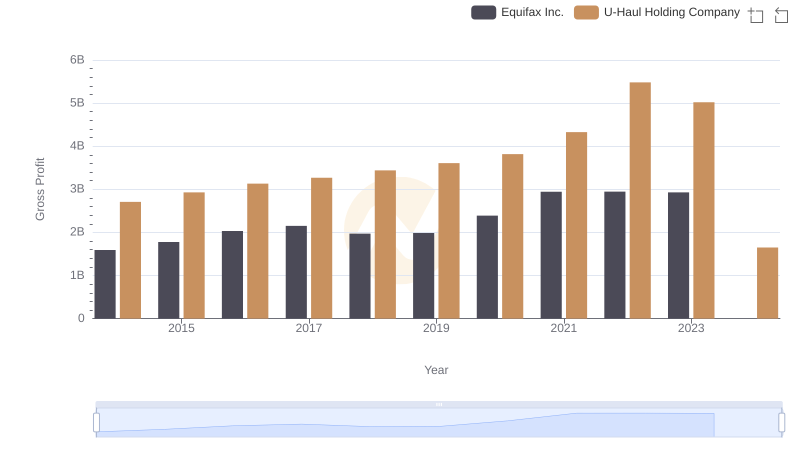

Equifax Inc. and U-Haul Holding Company: A Detailed Gross Profit Analysis

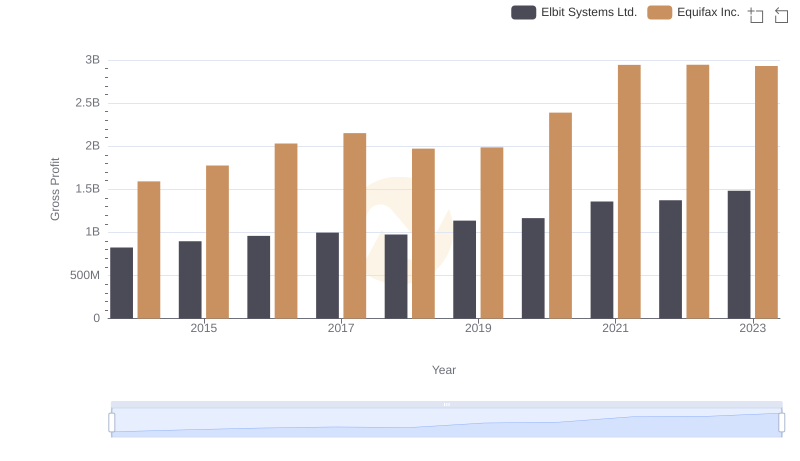

Gross Profit Analysis: Comparing Equifax Inc. and Elbit Systems Ltd.

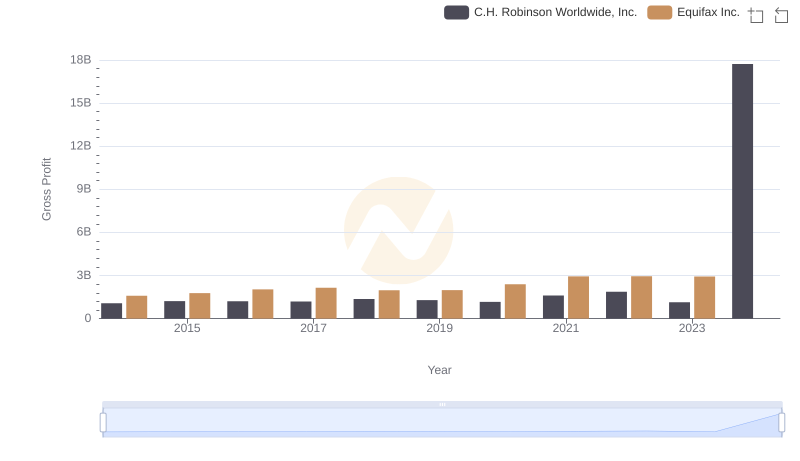

Equifax Inc. and C.H. Robinson Worldwide, Inc.: A Detailed Gross Profit Analysis

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Saia, Inc.