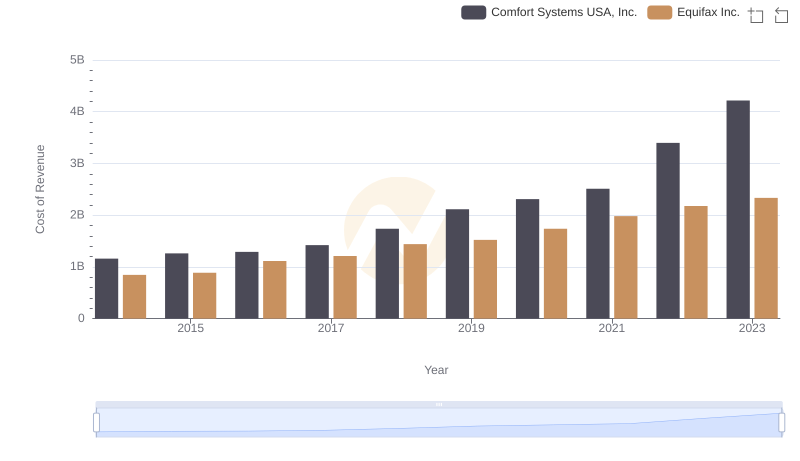

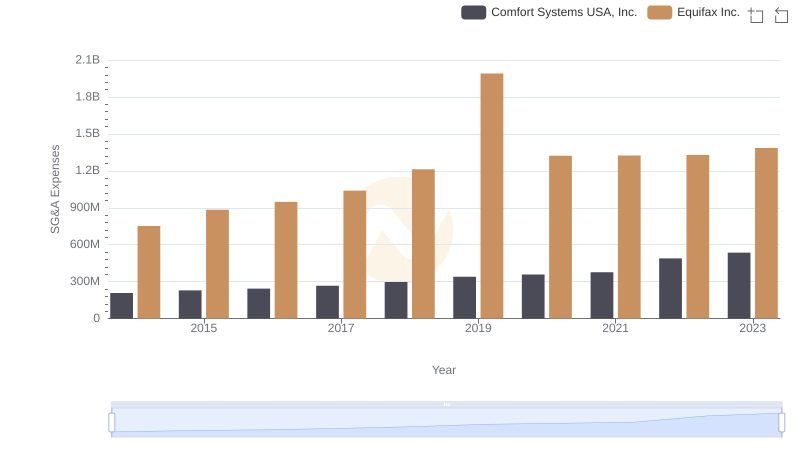

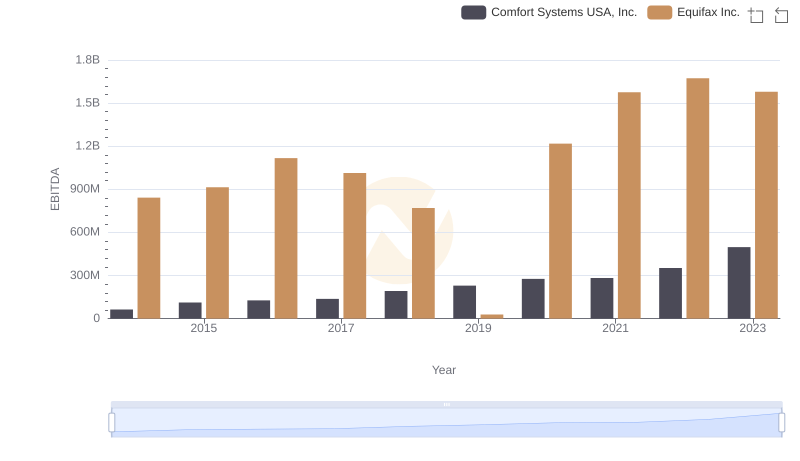

| __timestamp | Comfort Systems USA, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 249771000 | 1591700000 |

| Thursday, January 1, 2015 | 318129000 | 1776200000 |

| Friday, January 1, 2016 | 344009000 | 2031500000 |

| Sunday, January 1, 2017 | 366281000 | 2151500000 |

| Monday, January 1, 2018 | 446279000 | 1971700000 |

| Tuesday, January 1, 2019 | 501943000 | 1985900000 |

| Wednesday, January 1, 2020 | 546983000 | 2390100000 |

| Friday, January 1, 2021 | 563207000 | 2943000000 |

| Saturday, January 1, 2022 | 741608000 | 2945000000 |

| Sunday, January 1, 2023 | 990509000 | 2930100000 |

| Monday, January 1, 2024 | 5681100000 |

Unleashing insights

In the competitive landscape of the U.S. stock market, Equifax Inc. and Comfort Systems USA, Inc. have shown distinct trajectories in their gross profit over the past decade. From 2014 to 2023, Equifax Inc. consistently outperformed Comfort Systems USA, Inc., with gross profits peaking at approximately $2.9 billion in 2022. This represents an impressive 85% increase from their 2014 figures. Meanwhile, Comfort Systems USA, Inc. demonstrated a robust growth trajectory, with gross profits surging by nearly 300% over the same period, reaching close to $990 million in 2023.

This data highlights the resilience and growth potential of both companies, albeit at different scales. Equifax's steady climb underscores its strong market position, while Comfort Systems' rapid growth reflects its expanding footprint in the industry. These insights offer valuable perspectives for investors and market analysts alike.

Analyzing Cost of Revenue: Equifax Inc. and Comfort Systems USA, Inc.

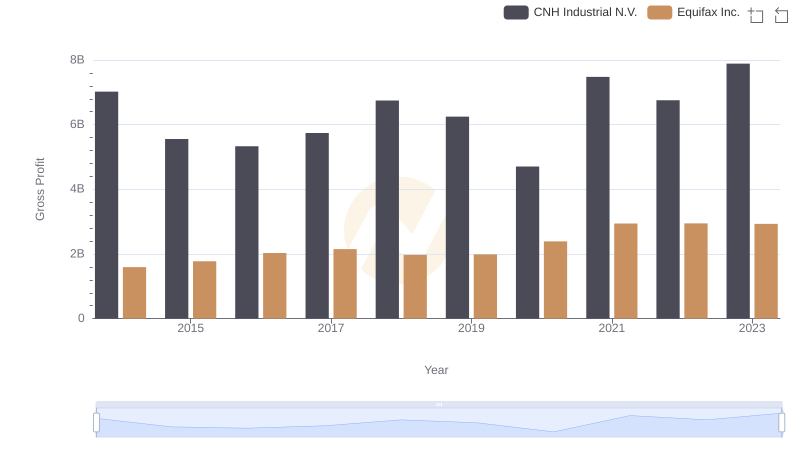

Gross Profit Analysis: Comparing Equifax Inc. and CNH Industrial N.V.

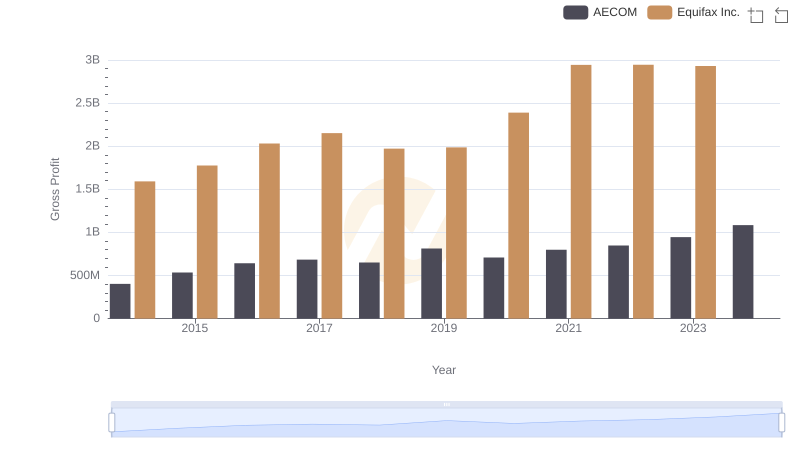

Who Generates Higher Gross Profit? Equifax Inc. or AECOM

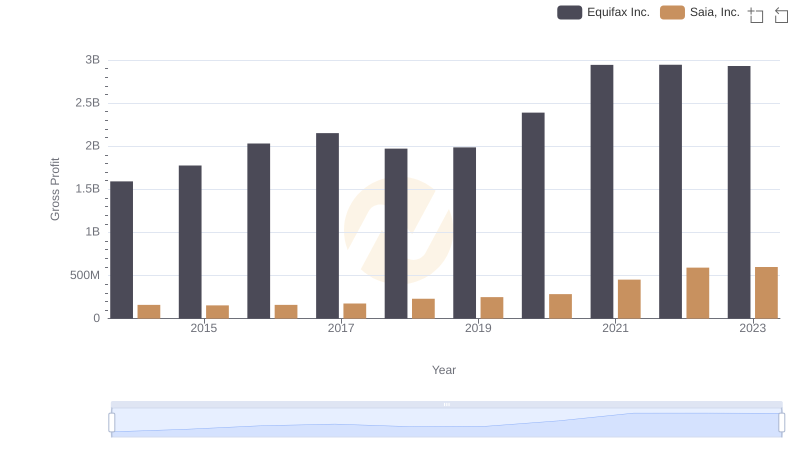

Who Generates Higher Gross Profit? Equifax Inc. or Saia, Inc.

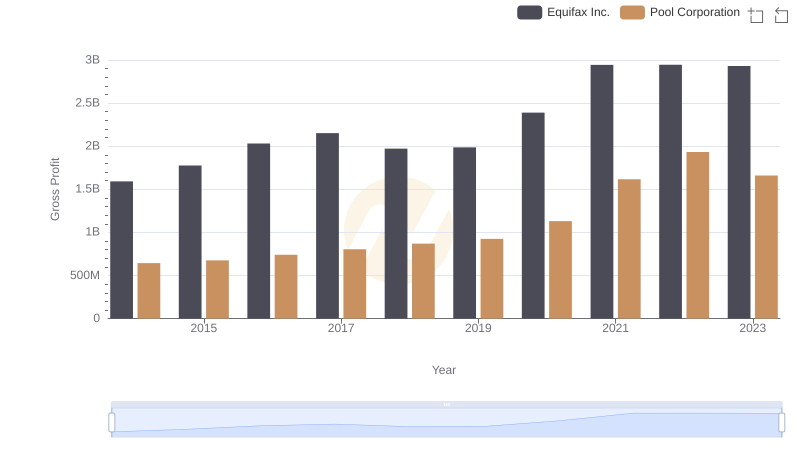

Gross Profit Comparison: Equifax Inc. and Pool Corporation Trends

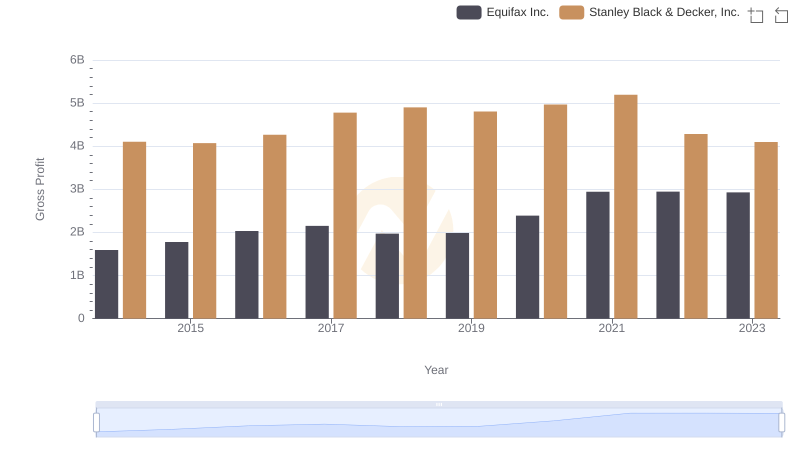

Key Insights on Gross Profit: Equifax Inc. vs Stanley Black & Decker, Inc.

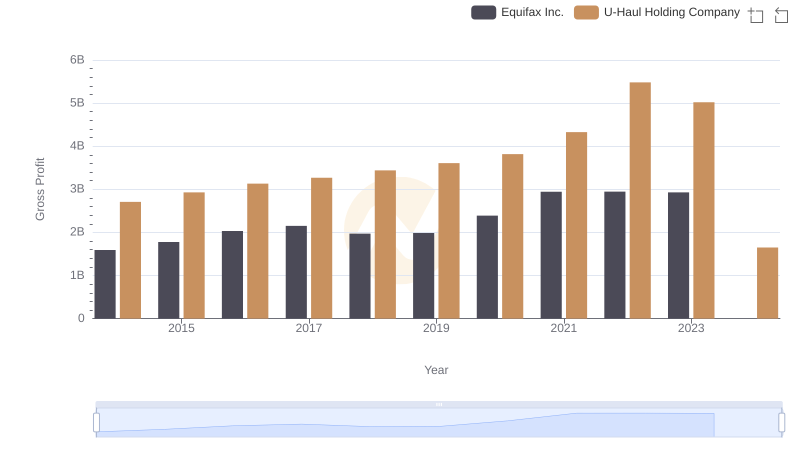

Equifax Inc. and U-Haul Holding Company: A Detailed Gross Profit Analysis

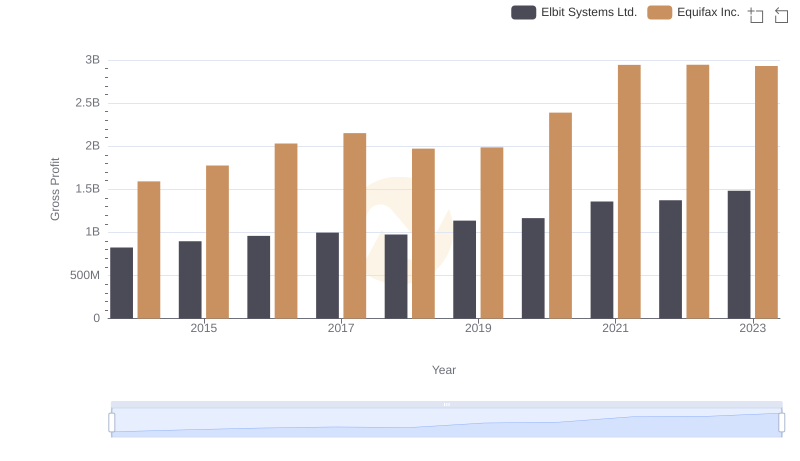

Gross Profit Analysis: Comparing Equifax Inc. and Elbit Systems Ltd.

Equifax Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

EBITDA Analysis: Evaluating Equifax Inc. Against Comfort Systems USA, Inc.