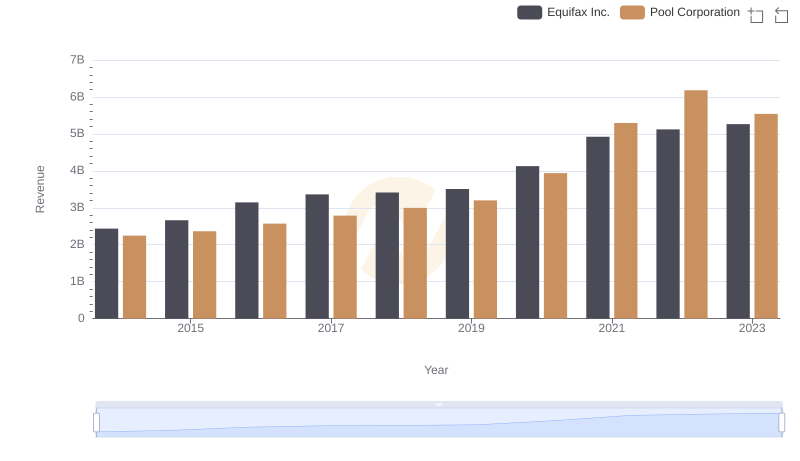

| __timestamp | Equifax Inc. | Pool Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 1603222000 |

| Thursday, January 1, 2015 | 887400000 | 1687495000 |

| Friday, January 1, 2016 | 1113400000 | 1829716000 |

| Sunday, January 1, 2017 | 1210700000 | 1982899000 |

| Monday, January 1, 2018 | 1440400000 | 2127924000 |

| Tuesday, January 1, 2019 | 1521700000 | 2274592000 |

| Wednesday, January 1, 2020 | 1737400000 | 2805721000 |

| Friday, January 1, 2021 | 1980900000 | 3678492000 |

| Saturday, January 1, 2022 | 2177200000 | 4246315000 |

| Sunday, January 1, 2023 | 2335100000 | 3881551000 |

| Monday, January 1, 2024 | 0 |

Data in motion

In the ever-evolving landscape of American business, Equifax Inc. and Pool Corporation stand as titans in their respective industries. Over the past decade, from 2014 to 2023, these companies have demonstrated remarkable growth in their cost of revenue, a key indicator of operational scale and efficiency.

Equifax Inc., a leader in consumer credit reporting, saw its cost of revenue increase by approximately 176% over this period. Starting at a modest $844 million in 2014, it reached a peak of $2.34 billion in 2023. This growth reflects Equifax's expanding data services and analytics capabilities.

Meanwhile, Pool Corporation, the world's largest wholesale distributor of swimming pool supplies, experienced a 142% rise in its cost of revenue, from $1.60 billion in 2014 to $3.88 billion in 2023. This surge underscores the booming demand for outdoor leisure products, especially during the pandemic years.

These trends highlight the dynamic nature of cost management in diverse sectors, offering valuable insights for investors and industry analysts alike.

Comparing Revenue Performance: Equifax Inc. or Pool Corporation?

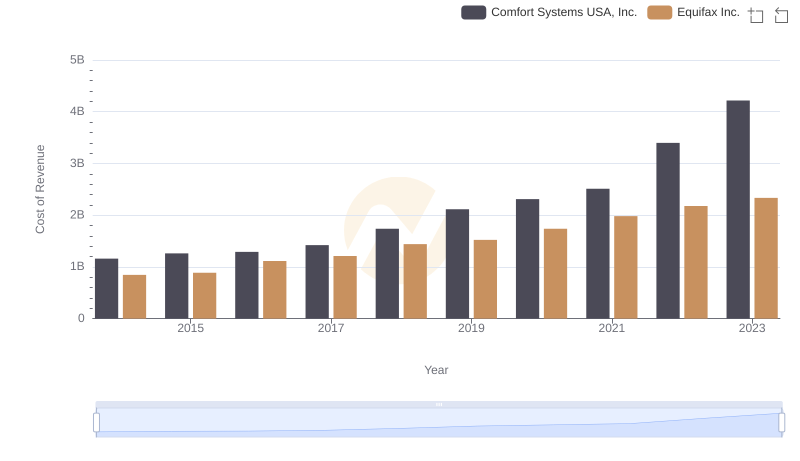

Analyzing Cost of Revenue: Equifax Inc. and Comfort Systems USA, Inc.

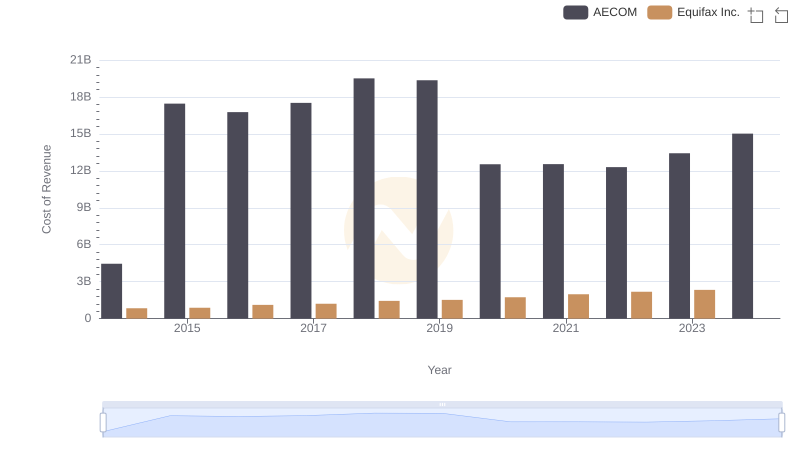

Equifax Inc. vs AECOM: Efficiency in Cost of Revenue Explored

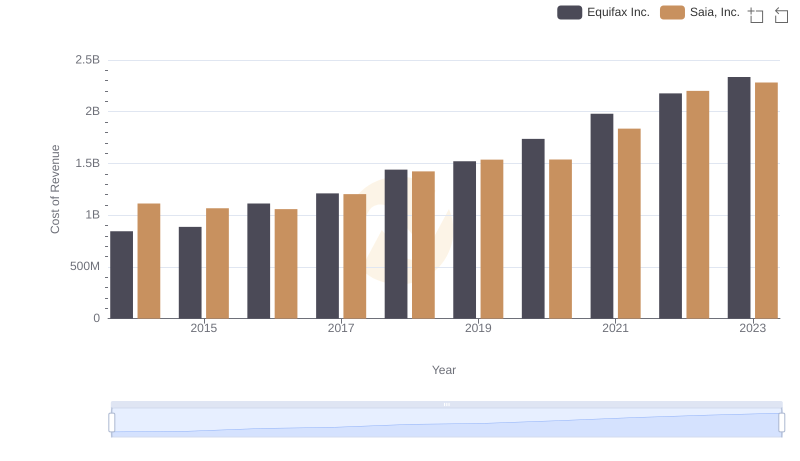

Analyzing Cost of Revenue: Equifax Inc. and Saia, Inc.

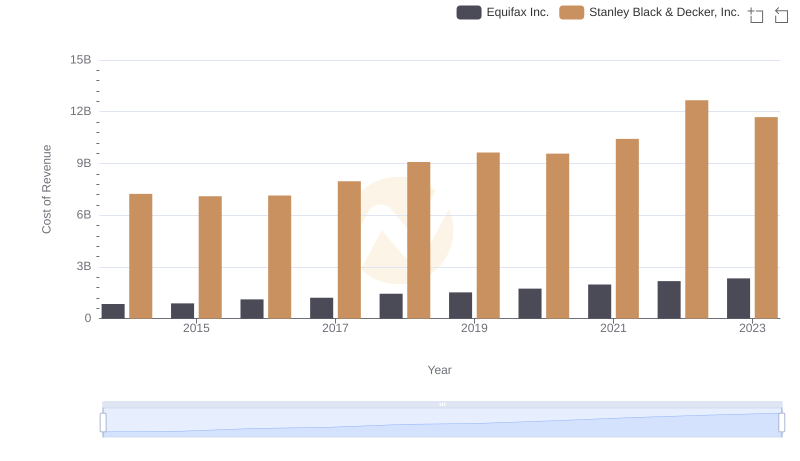

Cost of Revenue Trends: Equifax Inc. vs Stanley Black & Decker, Inc.

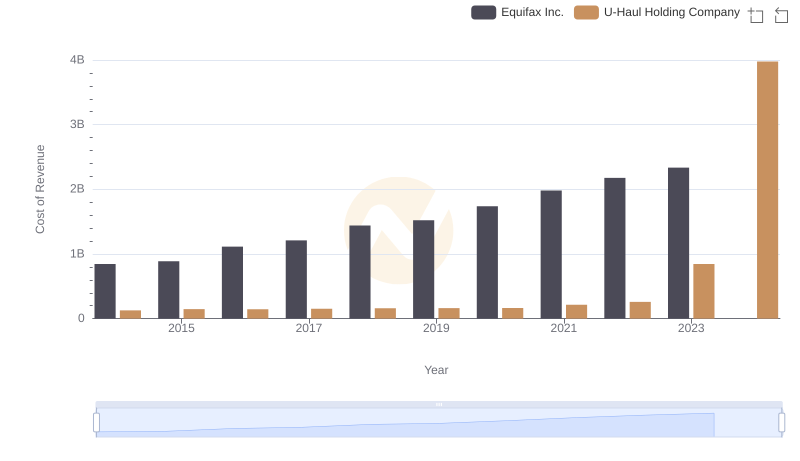

Cost of Revenue Comparison: Equifax Inc. vs U-Haul Holding Company

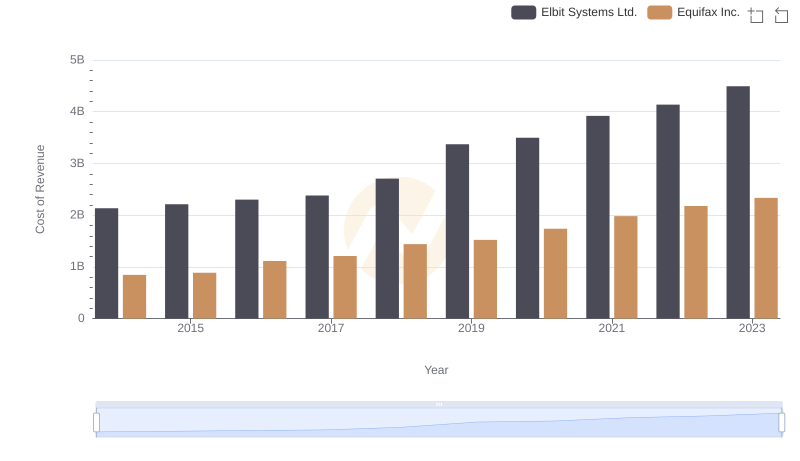

Cost of Revenue Comparison: Equifax Inc. vs Elbit Systems Ltd.

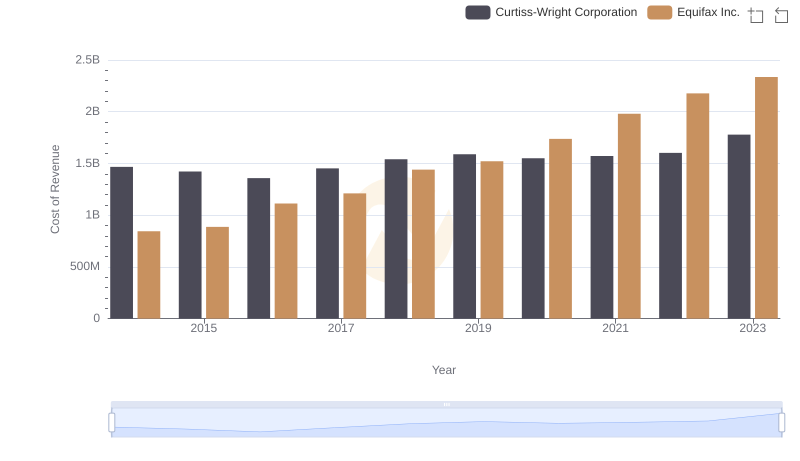

Cost of Revenue Trends: Equifax Inc. vs Curtiss-Wright Corporation

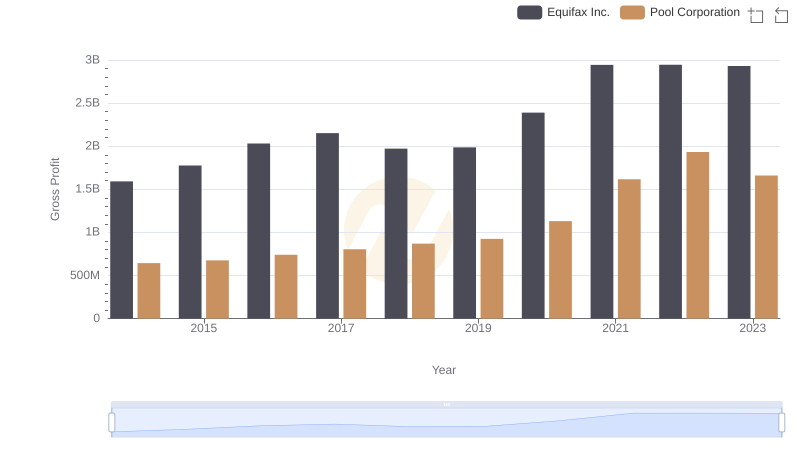

Gross Profit Comparison: Equifax Inc. and Pool Corporation Trends

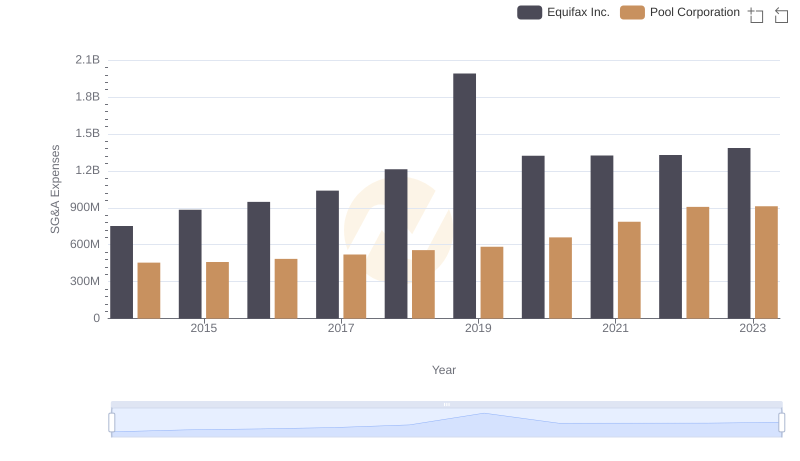

Comparing SG&A Expenses: Equifax Inc. vs Pool Corporation Trends and Insights

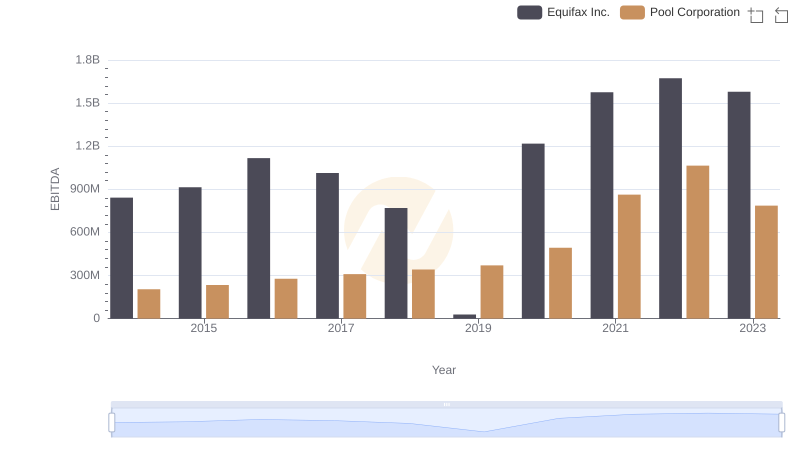

EBITDA Analysis: Evaluating Equifax Inc. Against Pool Corporation