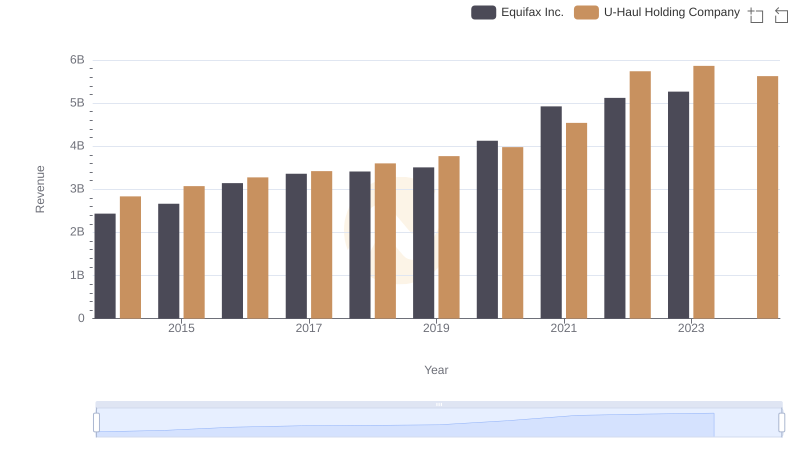

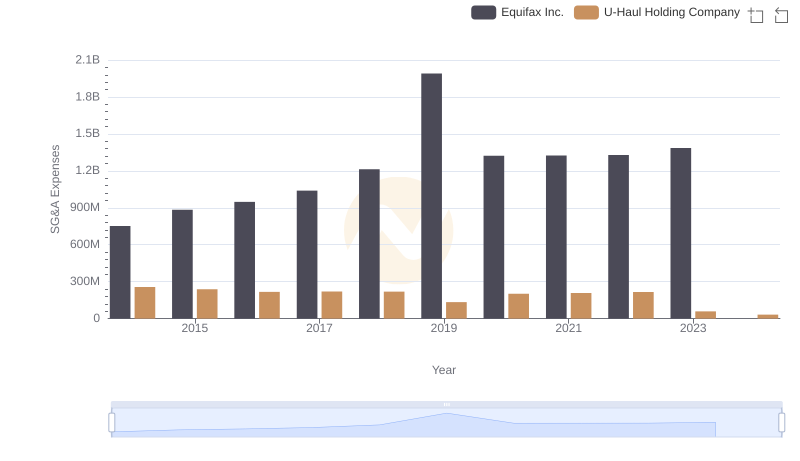

| __timestamp | Equifax Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 2707982000 |

| Thursday, January 1, 2015 | 1776200000 | 2928459000 |

| Friday, January 1, 2016 | 2031500000 | 3130666000 |

| Sunday, January 1, 2017 | 2151500000 | 3269282000 |

| Monday, January 1, 2018 | 1971700000 | 3440625000 |

| Tuesday, January 1, 2019 | 1985900000 | 3606565000 |

| Wednesday, January 1, 2020 | 2390100000 | 3814850000 |

| Friday, January 1, 2021 | 2943000000 | 4327926000 |

| Saturday, January 1, 2022 | 2945000000 | 5480162000 |

| Sunday, January 1, 2023 | 2930100000 | 5019797000 |

| Monday, January 1, 2024 | 5681100000 | 1649634000 |

Unleashing the power of data

In the ever-evolving landscape of American business, Equifax Inc. and U-Haul Holding Company stand as titans in their respective industries. From 2014 to 2023, these companies have showcased intriguing trends in gross profit, reflecting their strategic maneuvers and market dynamics.

Equifax Inc., a leader in consumer credit reporting, saw its gross profit grow by approximately 84% from 2014 to 2023, peaking in 2022. This growth underscores its resilience and adaptability in a data-driven world. Meanwhile, U-Haul Holding Company, a household name in moving and storage, experienced a remarkable 86% increase in gross profit over the same period, with a notable surge in 2022, highlighting its robust expansion strategy.

While Equifax's data for 2024 remains elusive, U-Haul's figures suggest a potential recalibration. These insights offer a window into the strategic priorities shaping these industry giants.

Equifax Inc. or U-Haul Holding Company: Who Leads in Yearly Revenue?

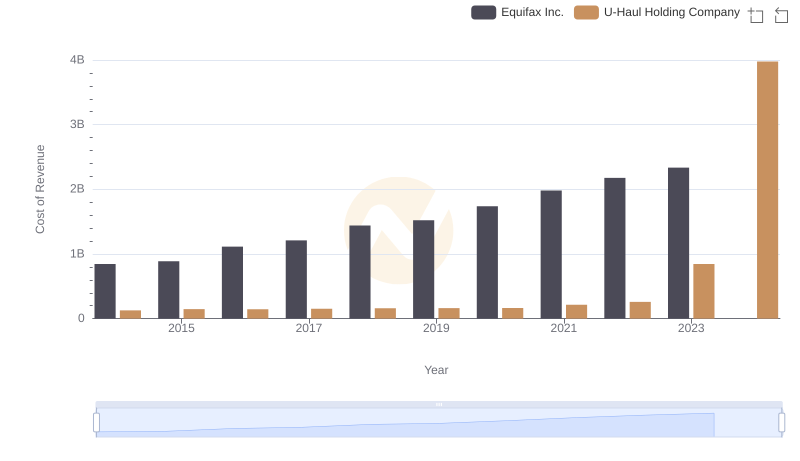

Cost of Revenue Comparison: Equifax Inc. vs U-Haul Holding Company

Key Insights on Gross Profit: Equifax Inc. vs Comfort Systems USA, Inc.

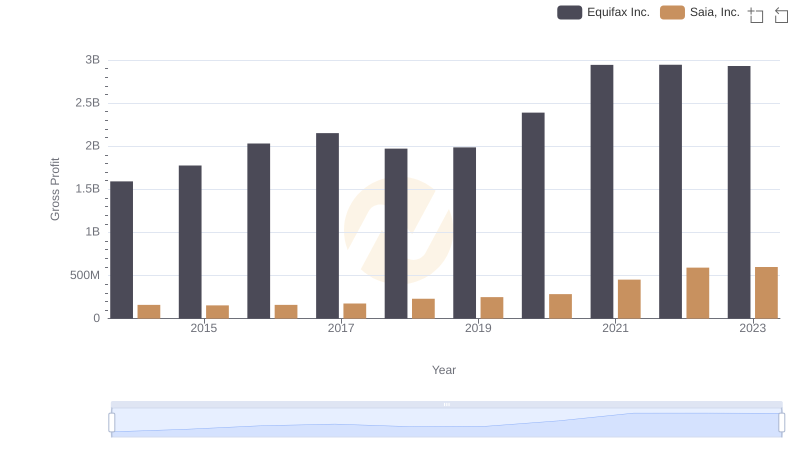

Who Generates Higher Gross Profit? Equifax Inc. or Saia, Inc.

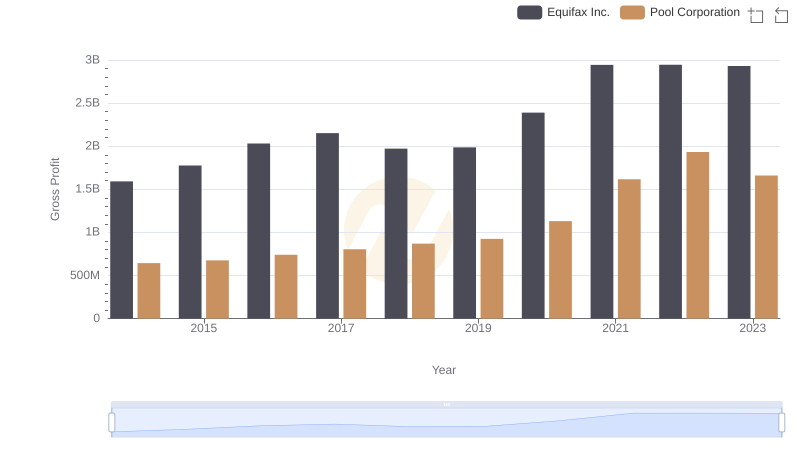

Gross Profit Comparison: Equifax Inc. and Pool Corporation Trends

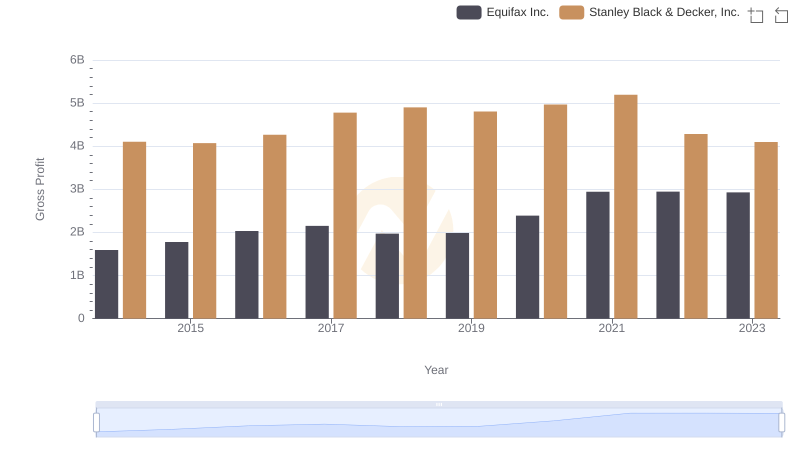

Key Insights on Gross Profit: Equifax Inc. vs Stanley Black & Decker, Inc.

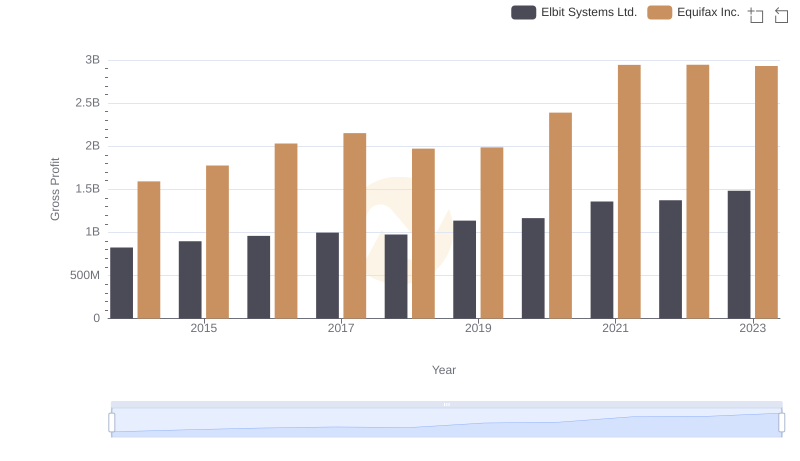

Gross Profit Analysis: Comparing Equifax Inc. and Elbit Systems Ltd.

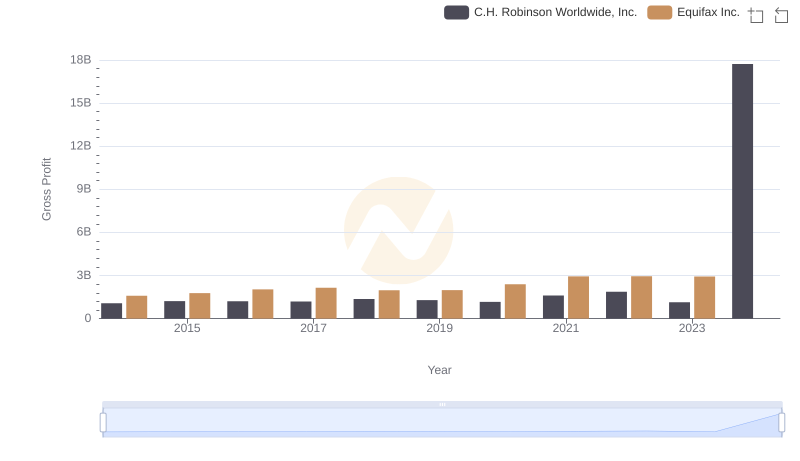

Equifax Inc. and C.H. Robinson Worldwide, Inc.: A Detailed Gross Profit Analysis

Selling, General, and Administrative Costs: Equifax Inc. vs U-Haul Holding Company