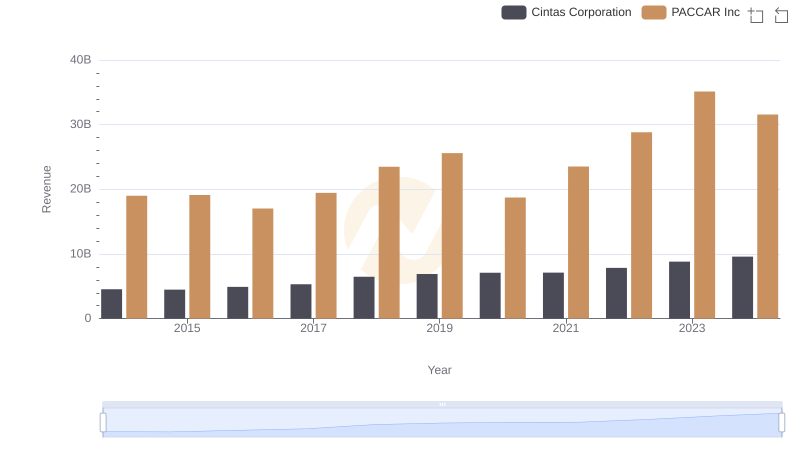

| __timestamp | Cintas Corporation | PACCAR Inc |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 2793200000 |

| Thursday, January 1, 2015 | 1921337000 | 3121300000 |

| Friday, January 1, 2016 | 2129870000 | 2753200000 |

| Sunday, January 1, 2017 | 2380295000 | 2985600000 |

| Monday, January 1, 2018 | 2908523000 | 3655800000 |

| Tuesday, January 1, 2019 | 3128588000 | 4015400000 |

| Wednesday, January 1, 2020 | 3233748000 | 2452000000 |

| Friday, January 1, 2021 | 3314651000 | 3291900000 |

| Saturday, January 1, 2022 | 3632246000 | 4751600000 |

| Sunday, January 1, 2023 | 4173368000 | 7141900000 |

| Monday, January 1, 2024 | 4686416000 | 5494700000 |

In pursuit of knowledge

In the ever-evolving landscape of American industry, Cintas Corporation and PACCAR Inc have emerged as significant players, each carving out a niche in their respective sectors. Over the past decade, from 2014 to 2024, these companies have demonstrated remarkable growth in gross profit, reflecting their strategic prowess and market adaptability.

Cintas Corporation, a leader in corporate identity uniforms and facility services, has seen its gross profit soar by approximately 145%, from $1.9 billion in 2014 to an impressive $4.7 billion in 2024. This growth underscores Cintas's ability to expand its market share and enhance operational efficiency.

Meanwhile, PACCAR Inc, a heavyweight in the design and manufacture of premium trucks, has experienced a 97% increase in gross profit, peaking at $7.1 billion in 2023 before adjusting to $5.5 billion in 2024. This fluctuation highlights the cyclical nature of the automotive industry and PACCAR's resilience in navigating economic shifts.

These trends not only reflect the companies' individual strategies but also offer insights into broader economic patterns, making them a compelling study for investors and industry analysts alike.

Who Generates More Revenue? Cintas Corporation or PACCAR Inc

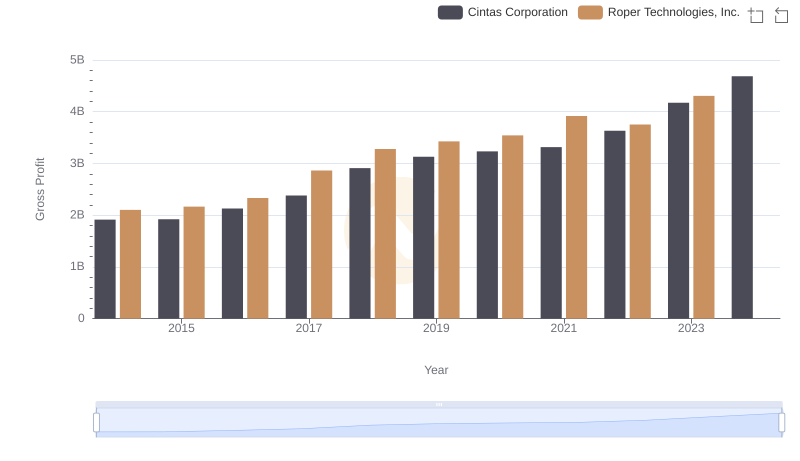

Key Insights on Gross Profit: Cintas Corporation vs Roper Technologies, Inc.

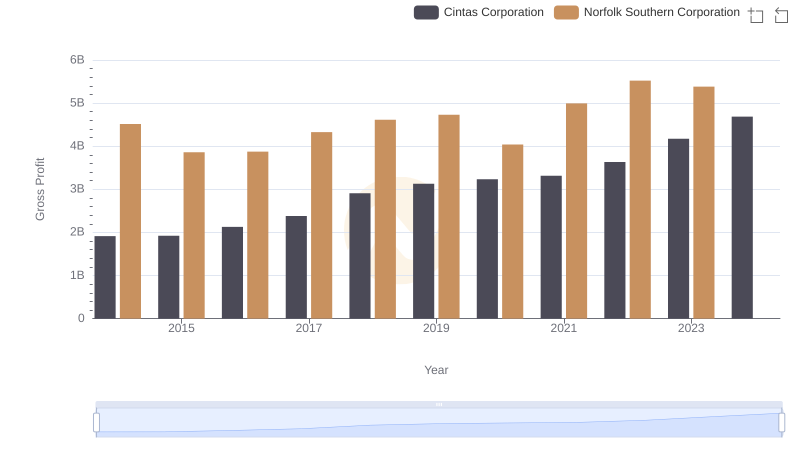

Gross Profit Analysis: Comparing Cintas Corporation and Norfolk Southern Corporation

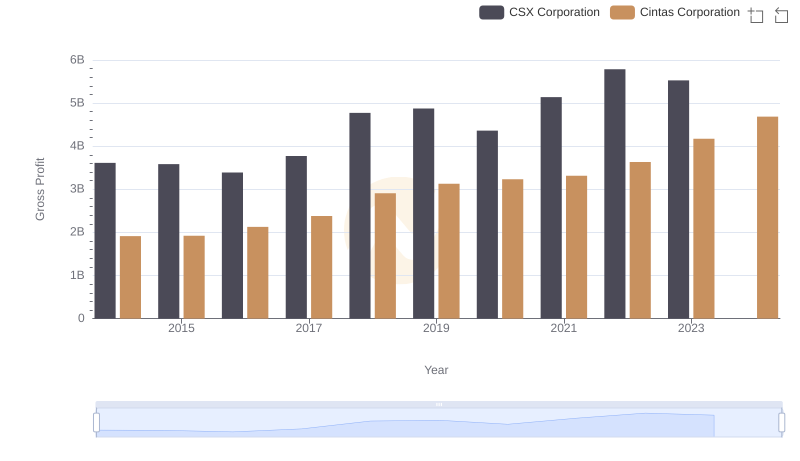

Cintas Corporation vs CSX Corporation: A Gross Profit Performance Breakdown

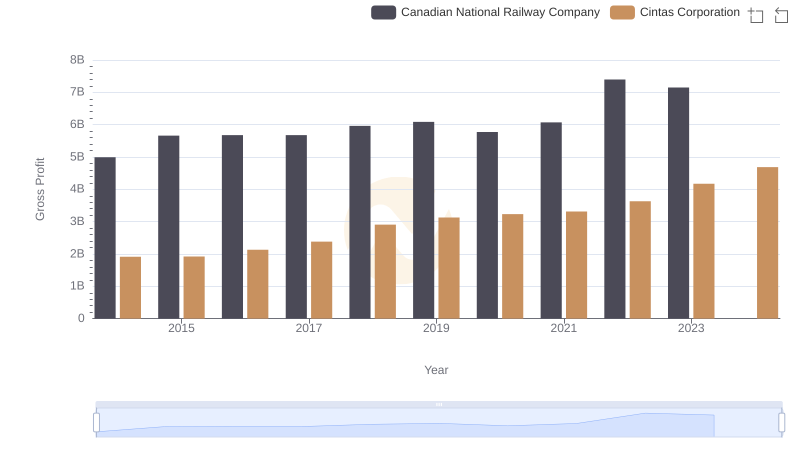

Gross Profit Trends Compared: Cintas Corporation vs Canadian National Railway Company

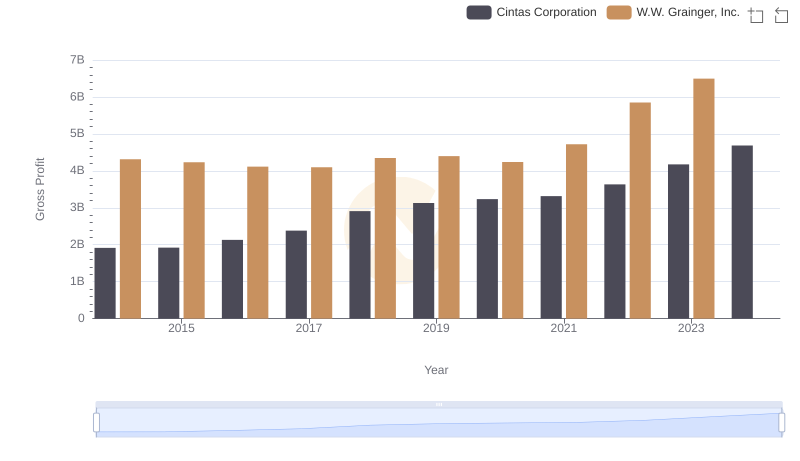

Who Generates Higher Gross Profit? Cintas Corporation or W.W. Grainger, Inc.

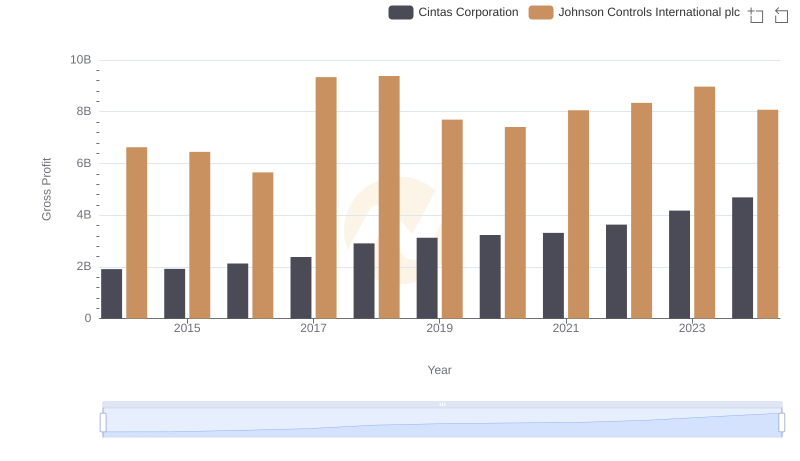

Gross Profit Trends Compared: Cintas Corporation vs Johnson Controls International plc

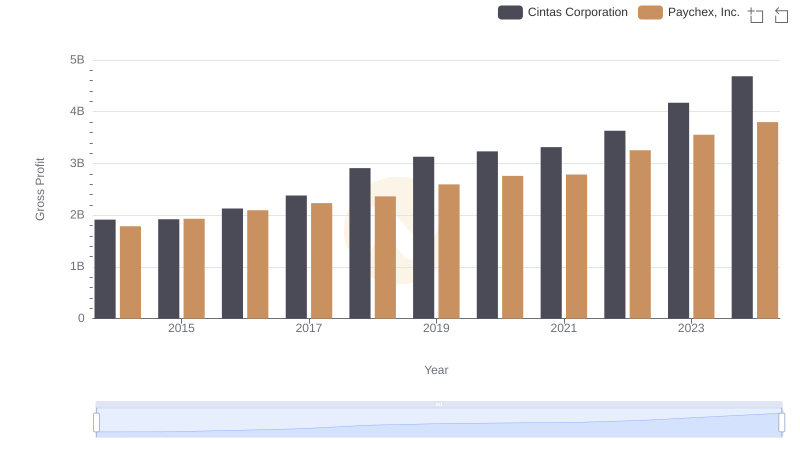

Key Insights on Gross Profit: Cintas Corporation vs Paychex, Inc.

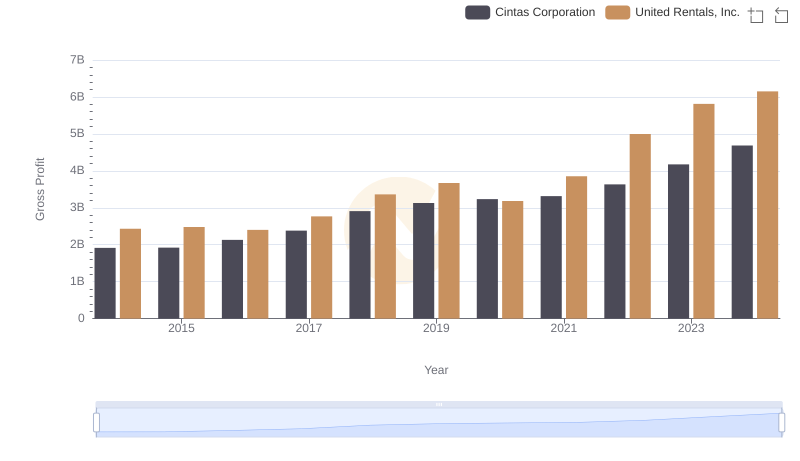

Gross Profit Analysis: Comparing Cintas Corporation and United Rentals, Inc.

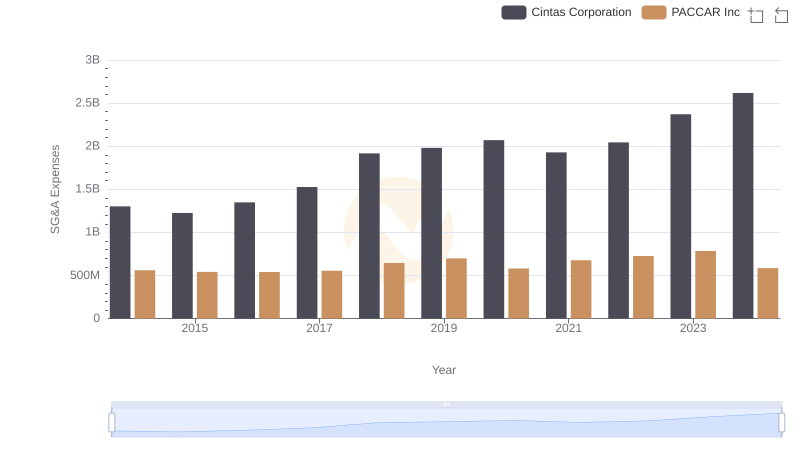

Cost Management Insights: SG&A Expenses for Cintas Corporation and PACCAR Inc

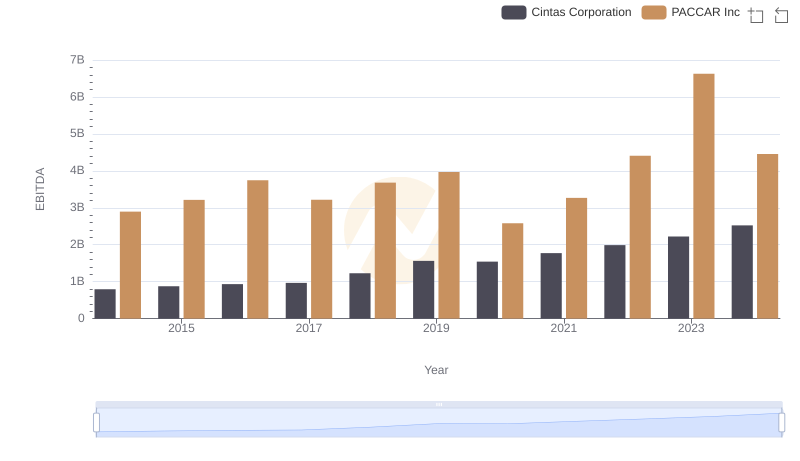

Cintas Corporation vs PACCAR Inc: In-Depth EBITDA Performance Comparison