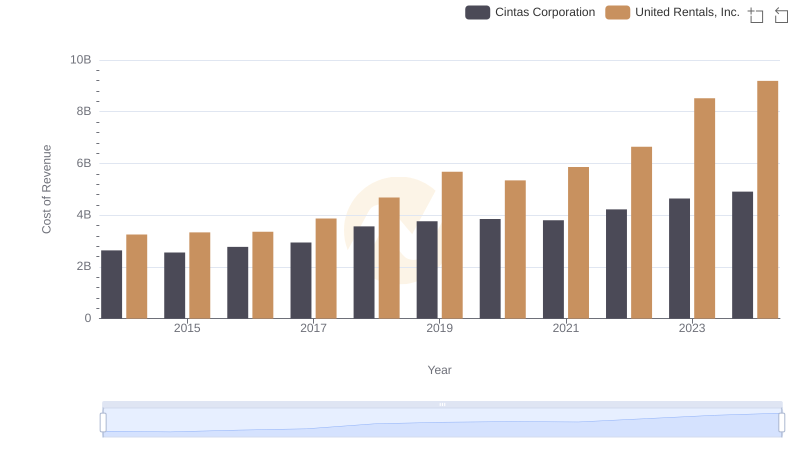

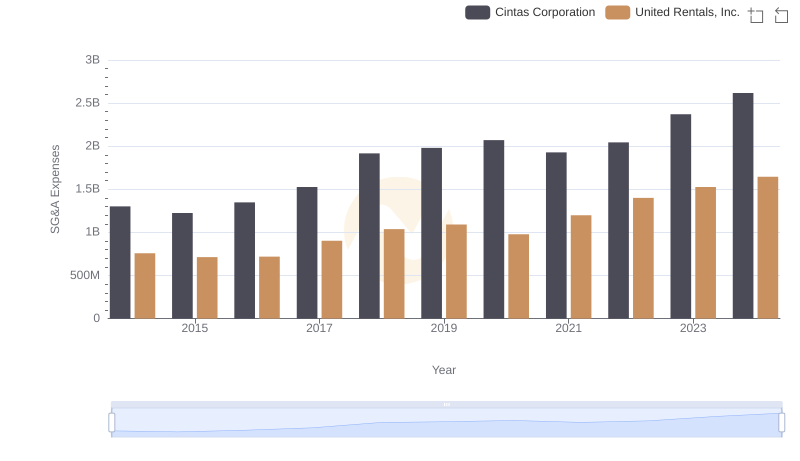

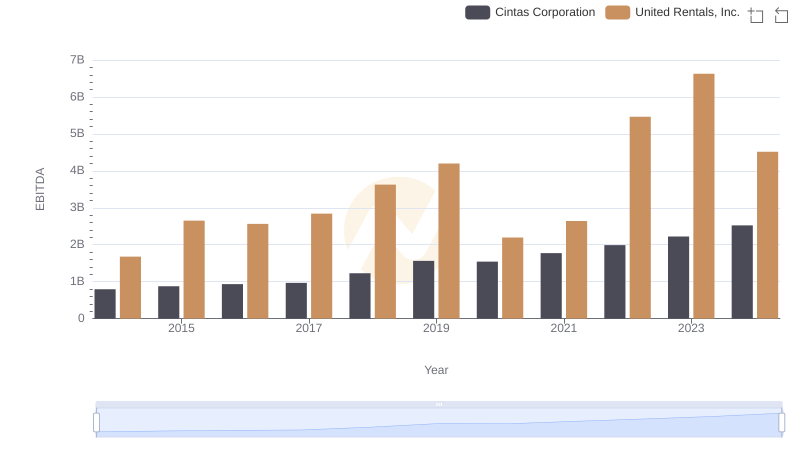

| __timestamp | Cintas Corporation | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 2432000000 |

| Thursday, January 1, 2015 | 1921337000 | 2480000000 |

| Friday, January 1, 2016 | 2129870000 | 2403000000 |

| Sunday, January 1, 2017 | 2380295000 | 2769000000 |

| Monday, January 1, 2018 | 2908523000 | 3364000000 |

| Tuesday, January 1, 2019 | 3128588000 | 3670000000 |

| Wednesday, January 1, 2020 | 3233748000 | 3183000000 |

| Friday, January 1, 2021 | 3314651000 | 3853000000 |

| Saturday, January 1, 2022 | 3632246000 | 4996000000 |

| Sunday, January 1, 2023 | 4173368000 | 5813000000 |

| Monday, January 1, 2024 | 4686416000 | 6150000000 |

Igniting the spark of knowledge

In the competitive landscape of the U.S. corporate sector, Cintas Corporation and United Rentals, Inc. have showcased remarkable growth in gross profit over the past decade. From 2014 to 2024, Cintas Corporation's gross profit surged by approximately 145%, while United Rentals, Inc. saw an impressive increase of around 153%. This growth trajectory highlights the robust financial health and strategic prowess of both companies.

Starting in 2014, Cintas reported a gross profit of $1.9 billion, which steadily climbed to $4.7 billion by 2024. Meanwhile, United Rentals began with $2.4 billion and reached $6.15 billion in the same period. This consistent upward trend underscores their ability to adapt and thrive in a dynamic market environment.

The data reveals that United Rentals consistently outperformed Cintas in terms of gross profit, maintaining a lead of about 20% on average. This insight provides a valuable perspective for investors and industry analysts alike.

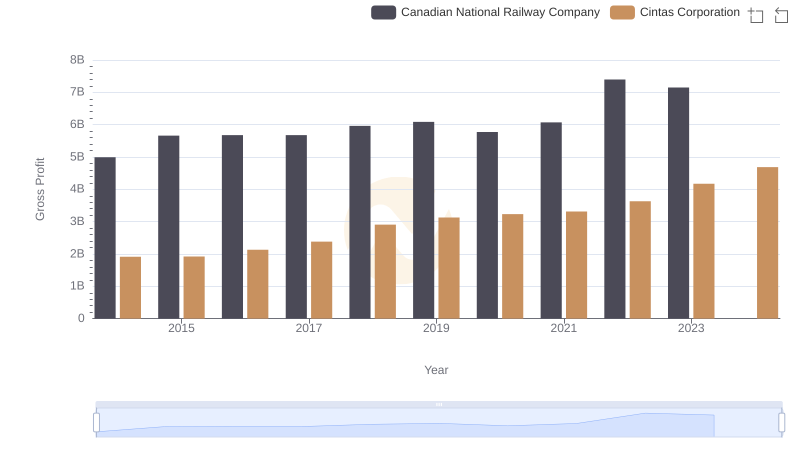

Gross Profit Trends Compared: Cintas Corporation vs Canadian National Railway Company

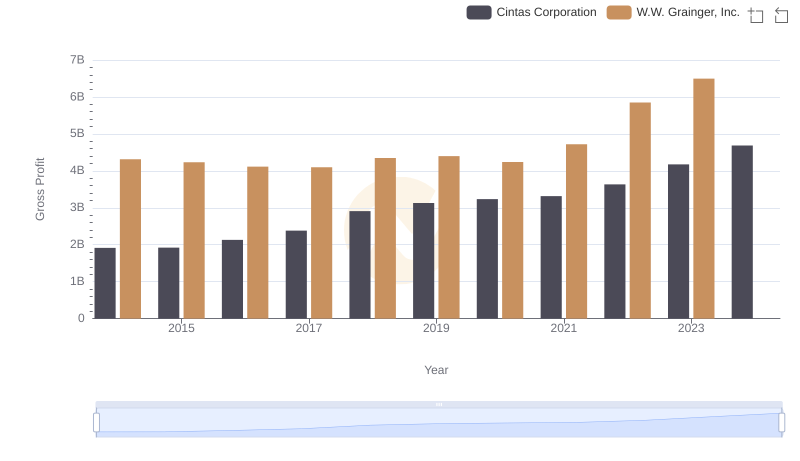

Who Generates Higher Gross Profit? Cintas Corporation or W.W. Grainger, Inc.

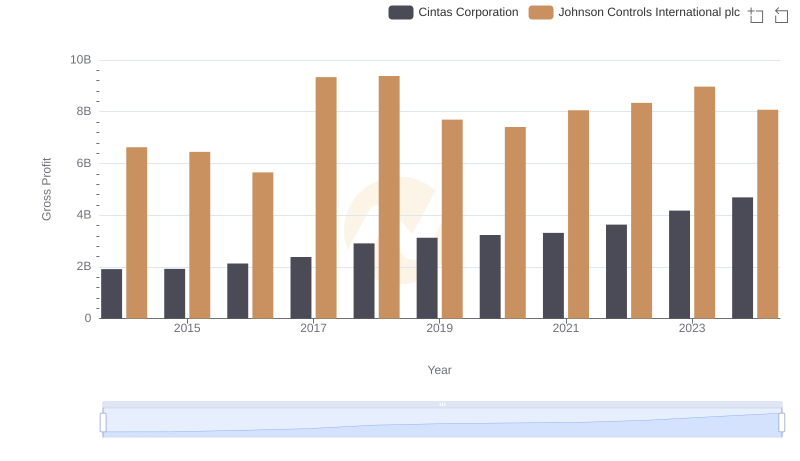

Gross Profit Trends Compared: Cintas Corporation vs Johnson Controls International plc

Comparing Cost of Revenue Efficiency: Cintas Corporation vs United Rentals, Inc.

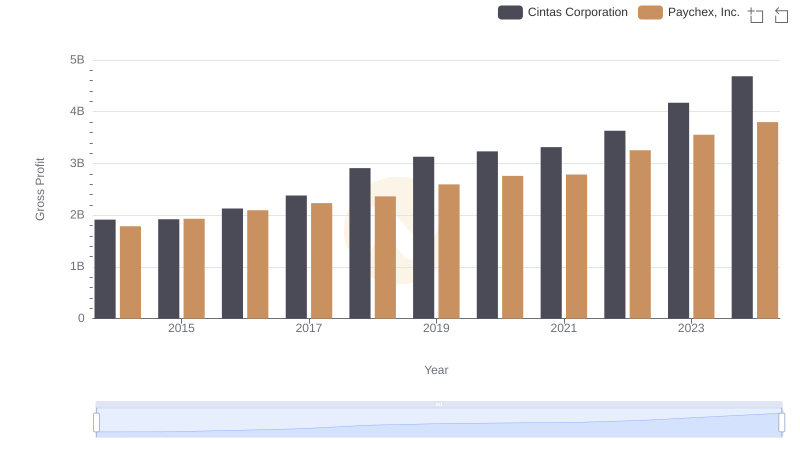

Key Insights on Gross Profit: Cintas Corporation vs Paychex, Inc.

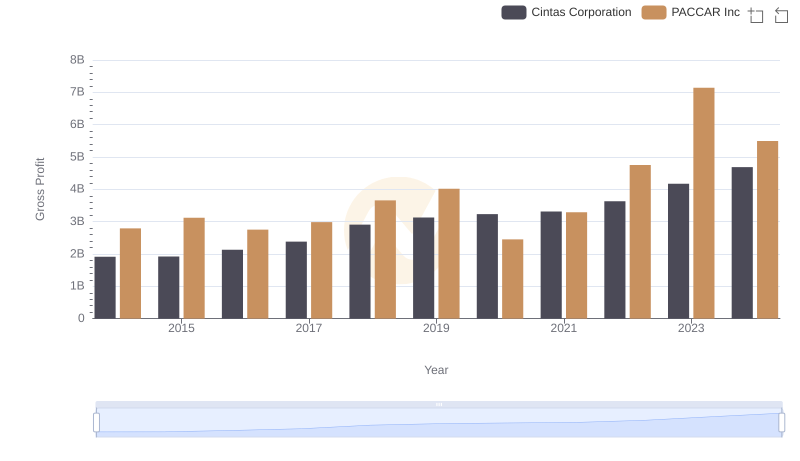

Gross Profit Comparison: Cintas Corporation and PACCAR Inc Trends

Cost Management Insights: SG&A Expenses for Cintas Corporation and United Rentals, Inc.

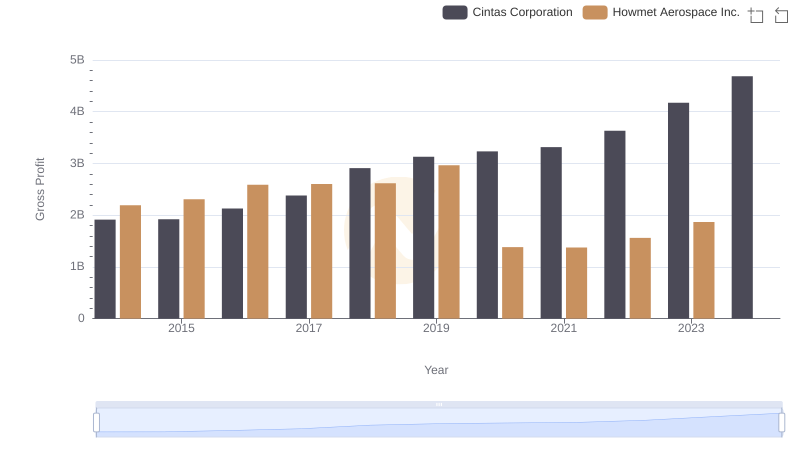

Who Generates Higher Gross Profit? Cintas Corporation or Howmet Aerospace Inc.

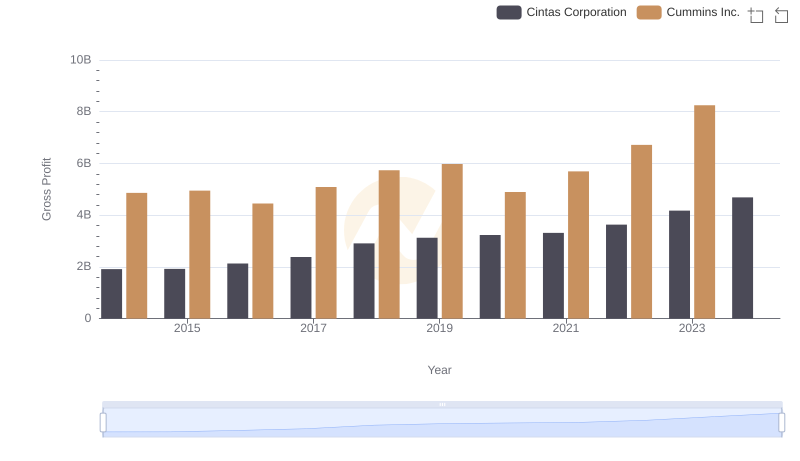

Gross Profit Trends Compared: Cintas Corporation vs Cummins Inc.

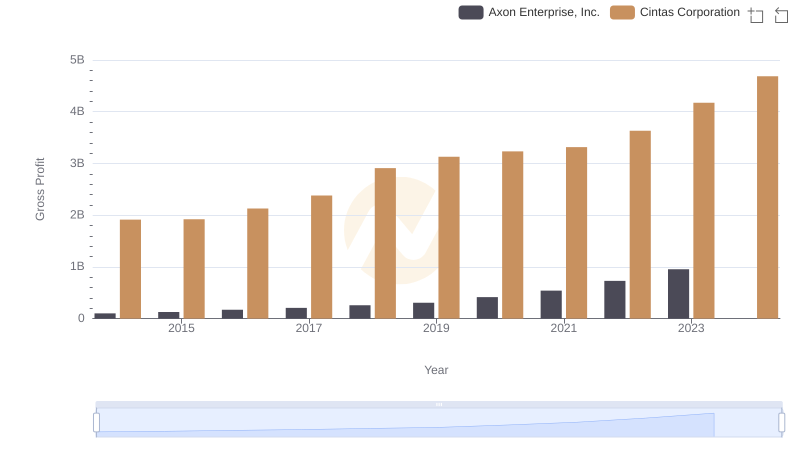

Key Insights on Gross Profit: Cintas Corporation vs Axon Enterprise, Inc.

Comprehensive EBITDA Comparison: Cintas Corporation vs United Rentals, Inc.