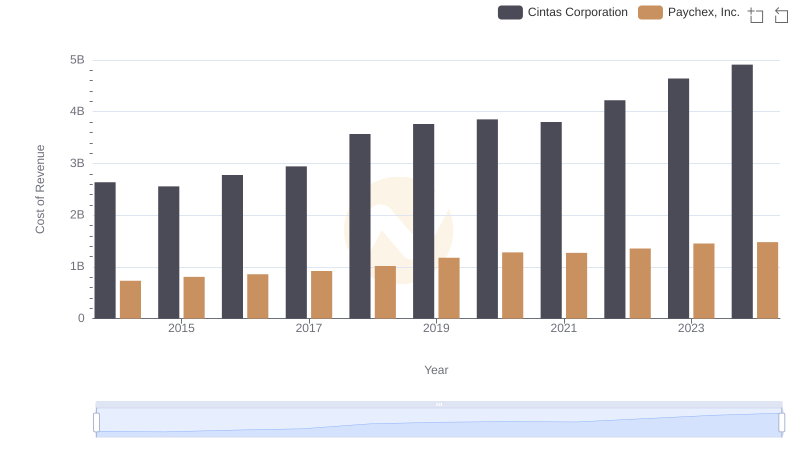

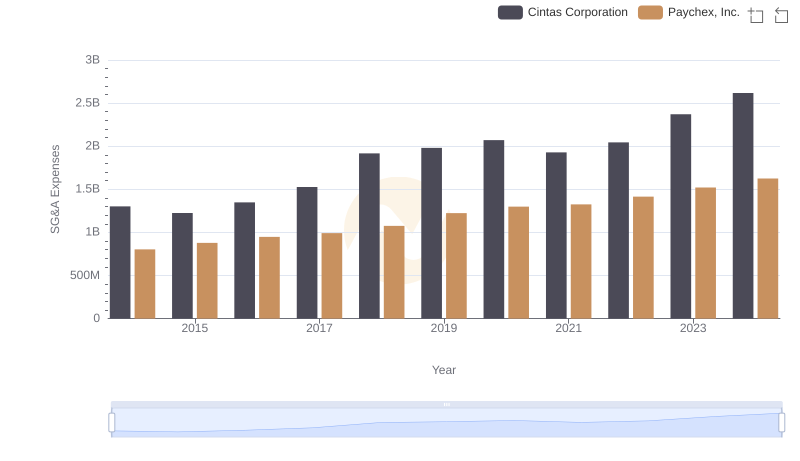

| __timestamp | Cintas Corporation | Paychex, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 1786400000 |

| Thursday, January 1, 2015 | 1921337000 | 1931600000 |

| Friday, January 1, 2016 | 2129870000 | 2094800000 |

| Sunday, January 1, 2017 | 2380295000 | 2231700000 |

| Monday, January 1, 2018 | 2908523000 | 2363100000 |

| Tuesday, January 1, 2019 | 3128588000 | 2594700000 |

| Wednesday, January 1, 2020 | 3233748000 | 2759700000 |

| Friday, January 1, 2021 | 3314651000 | 2785600000 |

| Saturday, January 1, 2022 | 3632246000 | 3255400000 |

| Sunday, January 1, 2023 | 4173368000 | 3554100000 |

| Monday, January 1, 2024 | 4686416000 | 3799000000 |

In pursuit of knowledge

In the competitive landscape of corporate America, Cintas Corporation and Paychex, Inc. have demonstrated remarkable growth in gross profit over the past decade. From 2014 to 2024, Cintas Corporation's gross profit surged by approximately 145%, while Paychex, Inc. saw an impressive increase of around 113%. This growth trajectory highlights the resilience and strategic prowess of both companies in navigating economic challenges and capitalizing on market opportunities.

Cintas Corporation: Starting with a gross profit of $1.9 billion in 2014, Cintas has consistently outperformed, reaching nearly $4.7 billion by 2024. This represents a compound annual growth rate (CAGR) of about 9%.

Paychex, Inc.: With a gross profit of $1.8 billion in 2014, Paychex has also shown robust growth, achieving $3.8 billion in 2024, reflecting a CAGR of approximately 8%.

These figures underscore the dynamic nature of the business services sector and the strategic initiatives undertaken by these industry leaders.

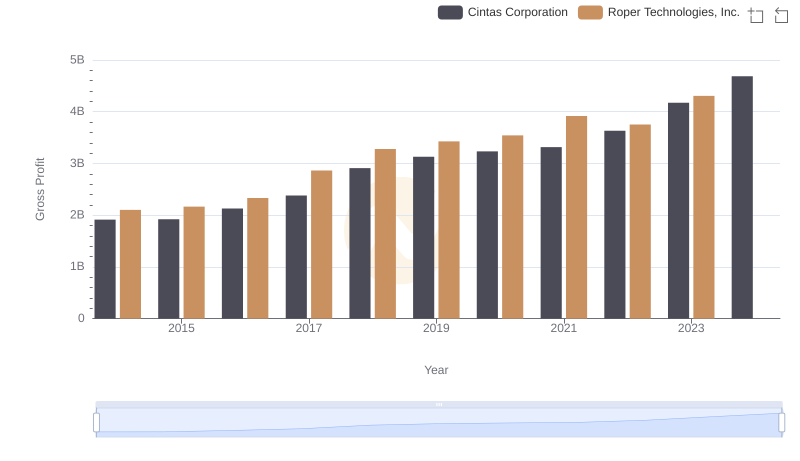

Key Insights on Gross Profit: Cintas Corporation vs Roper Technologies, Inc.

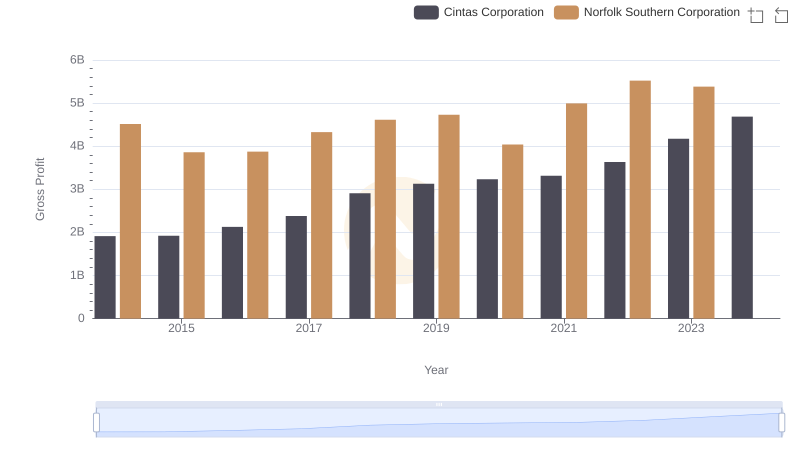

Gross Profit Analysis: Comparing Cintas Corporation and Norfolk Southern Corporation

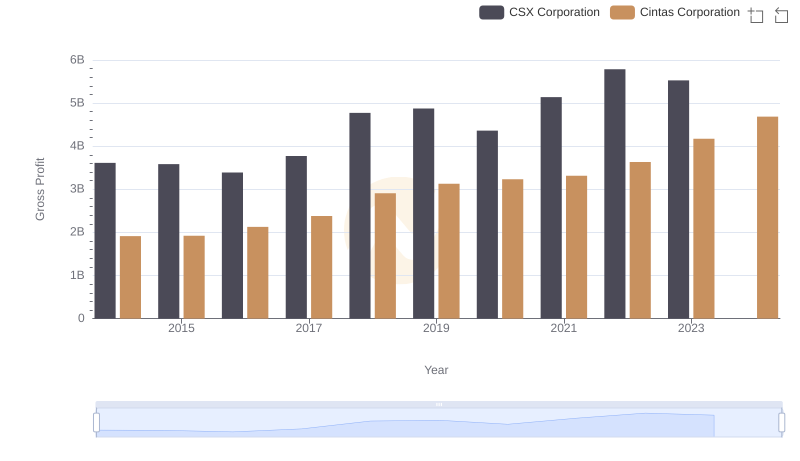

Cintas Corporation vs CSX Corporation: A Gross Profit Performance Breakdown

Cost Insights: Breaking Down Cintas Corporation and Paychex, Inc.'s Expenses

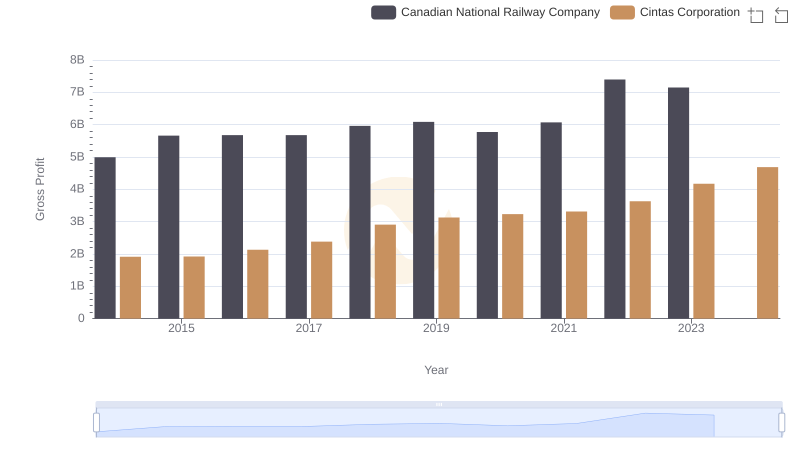

Gross Profit Trends Compared: Cintas Corporation vs Canadian National Railway Company

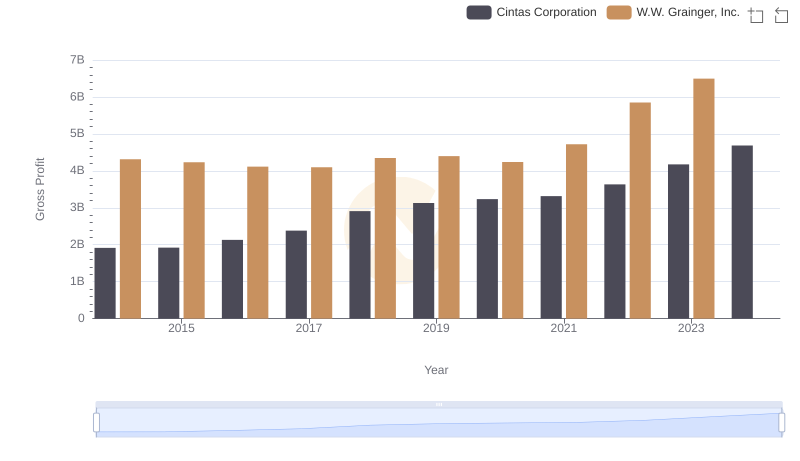

Who Generates Higher Gross Profit? Cintas Corporation or W.W. Grainger, Inc.

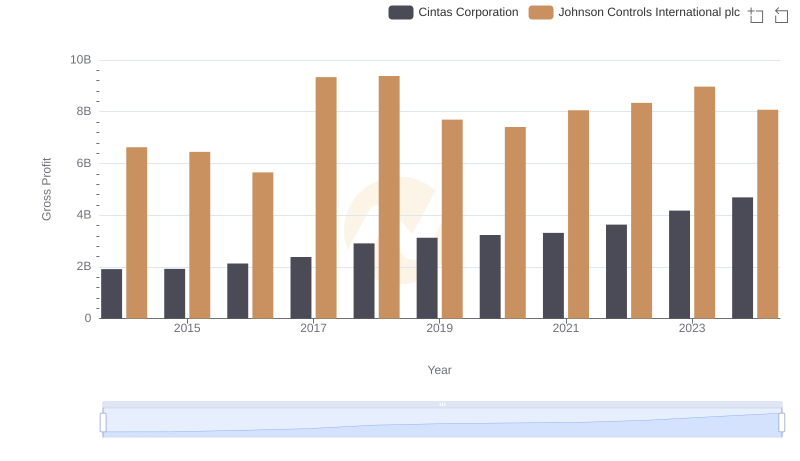

Gross Profit Trends Compared: Cintas Corporation vs Johnson Controls International plc

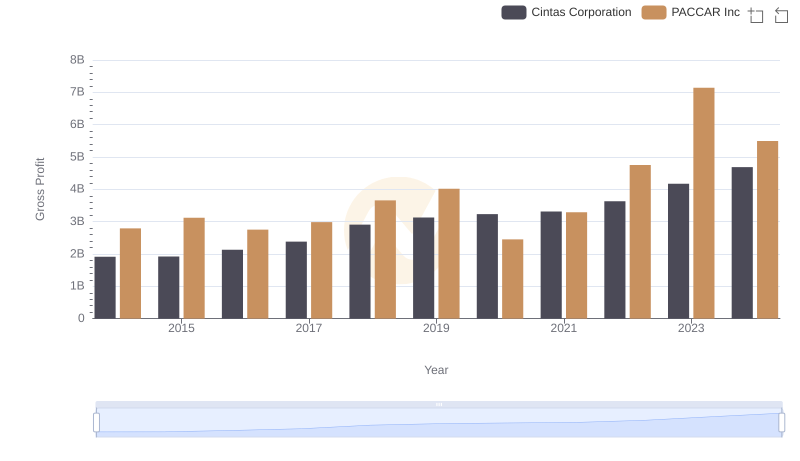

Gross Profit Comparison: Cintas Corporation and PACCAR Inc Trends

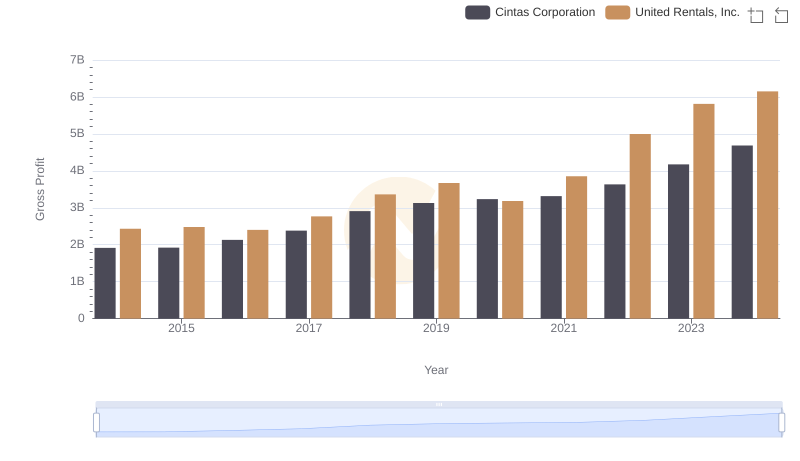

Gross Profit Analysis: Comparing Cintas Corporation and United Rentals, Inc.

Comparing SG&A Expenses: Cintas Corporation vs Paychex, Inc. Trends and Insights

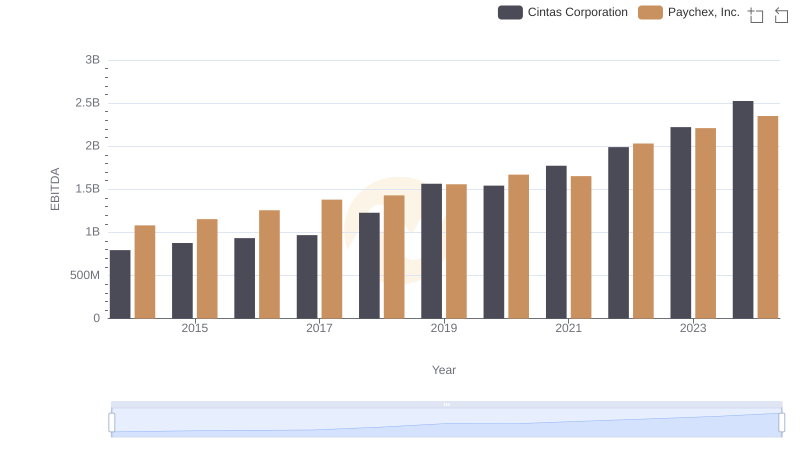

Comparative EBITDA Analysis: Cintas Corporation vs Paychex, Inc.