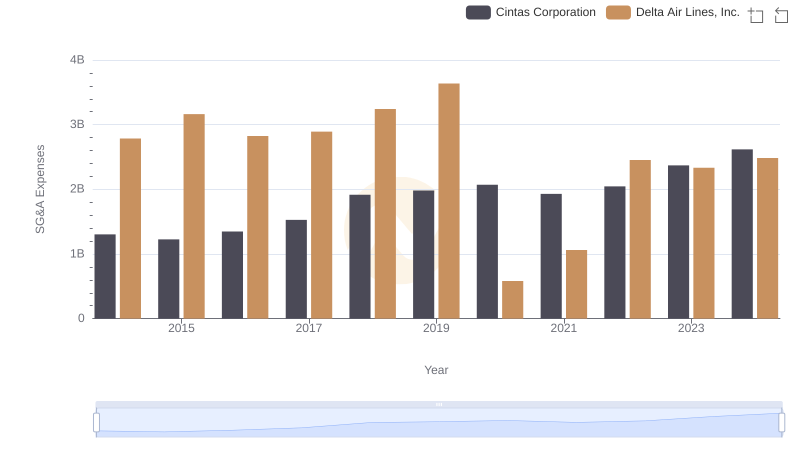

| __timestamp | Cintas Corporation | PACCAR Inc |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 561400000 |

| Thursday, January 1, 2015 | 1224930000 | 541500000 |

| Friday, January 1, 2016 | 1348122000 | 540200000 |

| Sunday, January 1, 2017 | 1527380000 | 555000000 |

| Monday, January 1, 2018 | 1916792000 | 644700000 |

| Tuesday, January 1, 2019 | 1980644000 | 698500000 |

| Wednesday, January 1, 2020 | 2071052000 | 581400000 |

| Friday, January 1, 2021 | 1929159000 | 676800000 |

| Saturday, January 1, 2022 | 2044876000 | 726300000 |

| Sunday, January 1, 2023 | 2370704000 | 784600000 |

| Monday, January 1, 2024 | 2617783000 | 585000000 |

Igniting the spark of knowledge

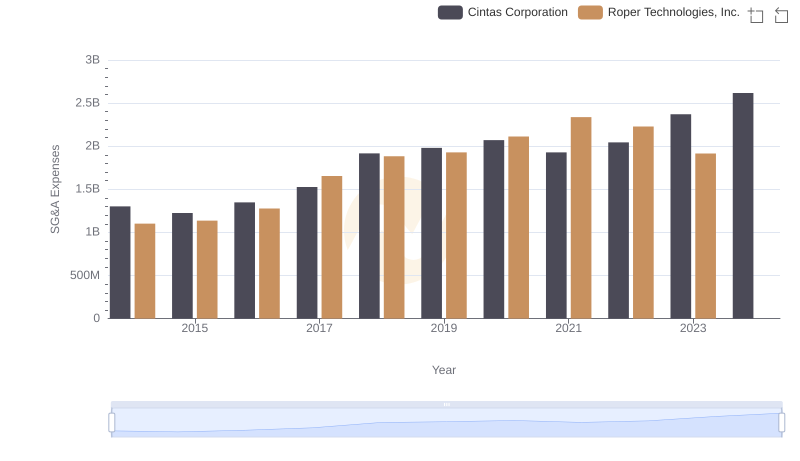

In the ever-evolving landscape of corporate finance, effective cost management is pivotal. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Cintas Corporation and PACCAR Inc from 2014 to 2024. Over this decade, Cintas Corporation has seen a remarkable 100% increase in SG&A expenses, reflecting its strategic investments and expansion efforts. In contrast, PACCAR Inc's expenses have grown by approximately 4%, indicating a more conservative approach to cost management.

Cintas Corporation's SG&A expenses surged from 2014 to 2023, peaking in 2024, showcasing its aggressive growth strategy. Meanwhile, PACCAR Inc maintained a steady trajectory, with a notable peak in 2023. This divergence highlights the distinct financial strategies of these industry leaders, offering valuable insights into their operational priorities and market positioning.

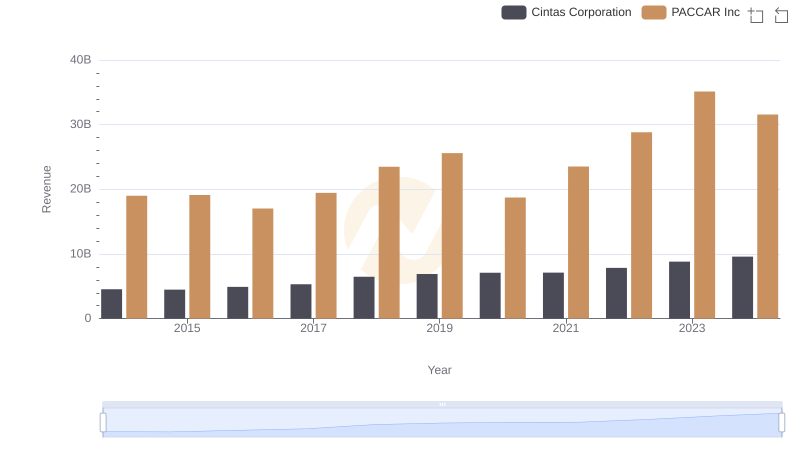

Who Generates More Revenue? Cintas Corporation or PACCAR Inc

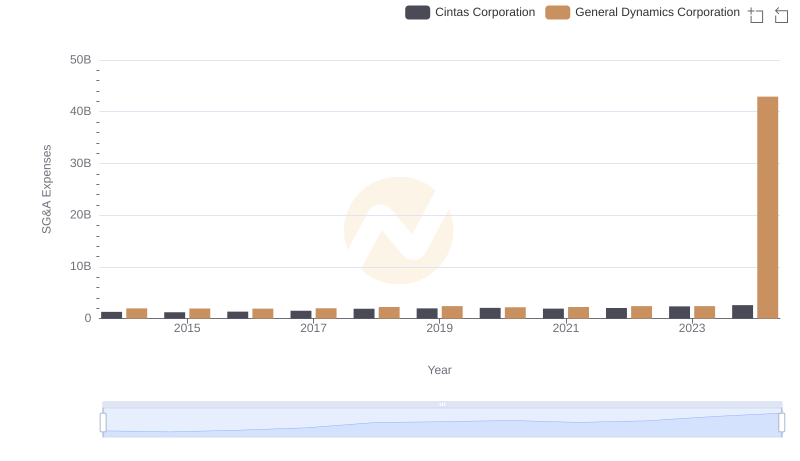

Comparing SG&A Expenses: Cintas Corporation vs General Dynamics Corporation Trends and Insights

Comparing SG&A Expenses: Cintas Corporation vs Roper Technologies, Inc. Trends and Insights

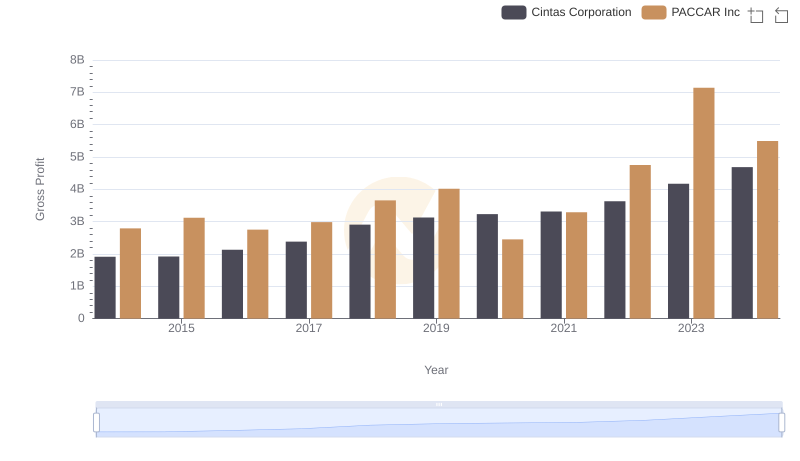

Gross Profit Comparison: Cintas Corporation and PACCAR Inc Trends

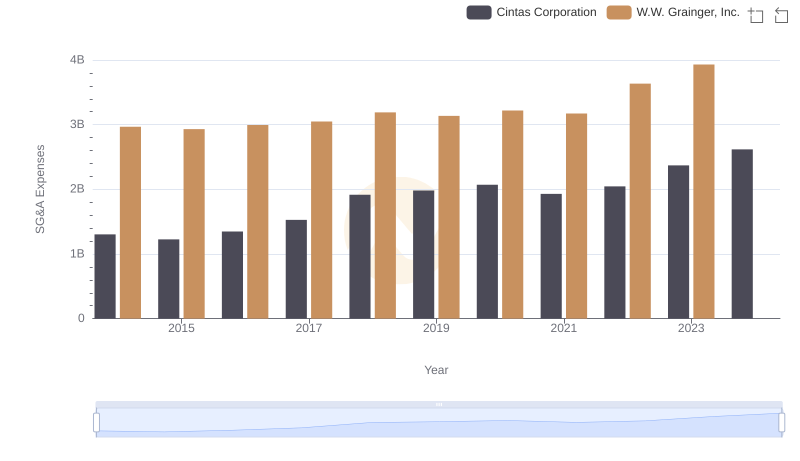

Cintas Corporation vs W.W. Grainger, Inc.: SG&A Expense Trends

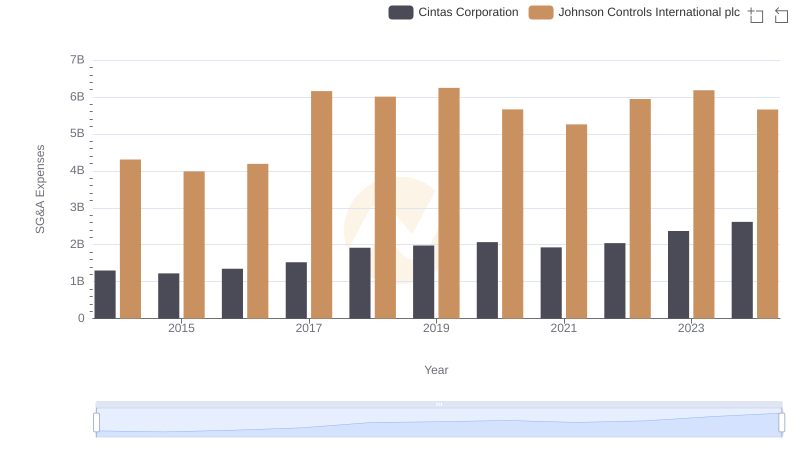

Cintas Corporation and Johnson Controls International plc: SG&A Spending Patterns Compared

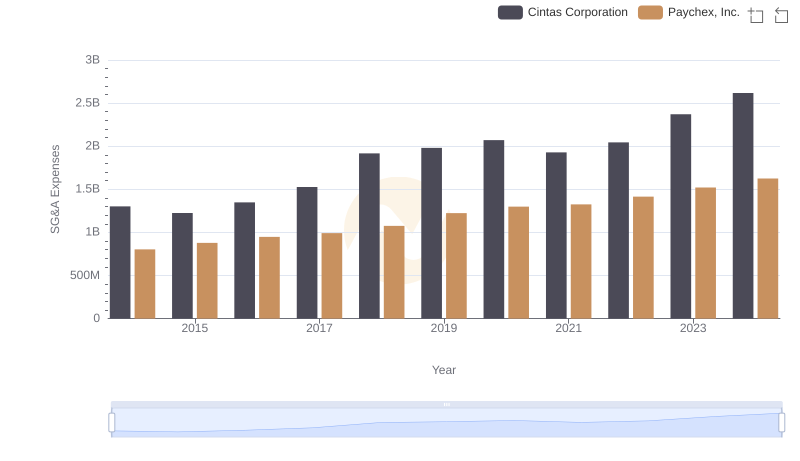

Comparing SG&A Expenses: Cintas Corporation vs Paychex, Inc. Trends and Insights

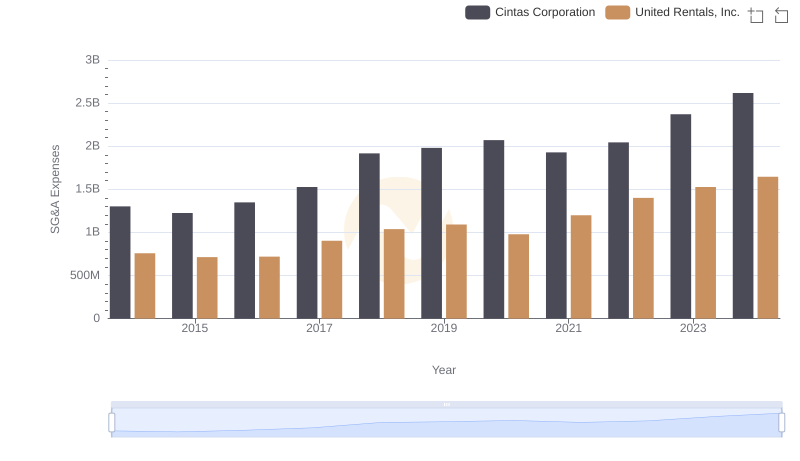

Cost Management Insights: SG&A Expenses for Cintas Corporation and United Rentals, Inc.

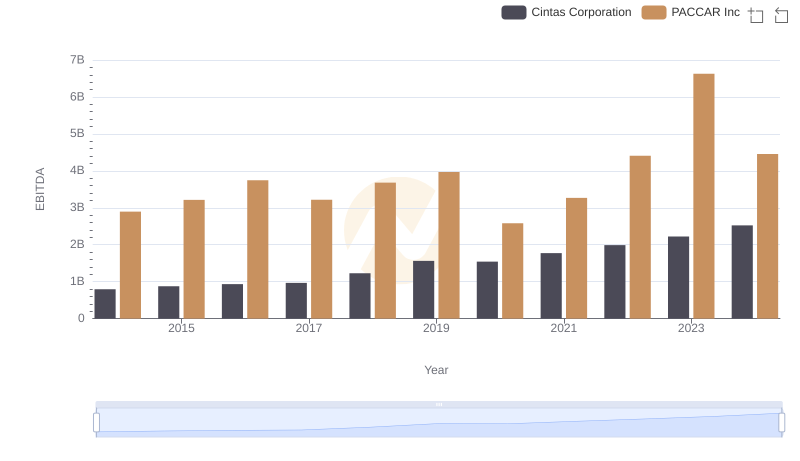

Cintas Corporation vs PACCAR Inc: In-Depth EBITDA Performance Comparison

Cost Management Insights: SG&A Expenses for Cintas Corporation and Delta Air Lines, Inc.