| __timestamp | Cintas Corporation | PACCAR Inc |

|---|---|---|

| Wednesday, January 1, 2014 | 4551812000 | 18997000000 |

| Thursday, January 1, 2015 | 4476886000 | 19115100000 |

| Friday, January 1, 2016 | 4905458000 | 17033300000 |

| Sunday, January 1, 2017 | 5323381000 | 19456400000 |

| Monday, January 1, 2018 | 6476632000 | 23495700000 |

| Tuesday, January 1, 2019 | 6892303000 | 25599700000 |

| Wednesday, January 1, 2020 | 7085120000 | 18728500000 |

| Friday, January 1, 2021 | 7116340000 | 23522300000 |

| Saturday, January 1, 2022 | 7854459000 | 28819700000 |

| Sunday, January 1, 2023 | 8815769000 | 35127400000 |

| Monday, January 1, 2024 | 9596615000 | 31564300000 |

Unleashing the power of data

In the competitive landscape of American industry, Cintas Corporation and PACCAR Inc have been vying for revenue supremacy over the past decade. From 2014 to 2024, PACCAR Inc consistently outperformed Cintas Corporation, generating nearly three times the revenue on average. In 2023, PACCAR Inc reached a peak with a staggering 35% increase from its 2014 figures, while Cintas Corporation saw a robust 94% growth over the same period.

PACCAR Inc, a leader in the design and manufacturing of premium trucks, has maintained its dominance, reflecting the strength of the automotive sector. Meanwhile, Cintas Corporation, specializing in corporate identity uniforms and related business services, has shown impressive growth, nearly doubling its revenue since 2014. This data highlights the resilience and strategic prowess of both companies in their respective industries, offering valuable insights into their financial trajectories.

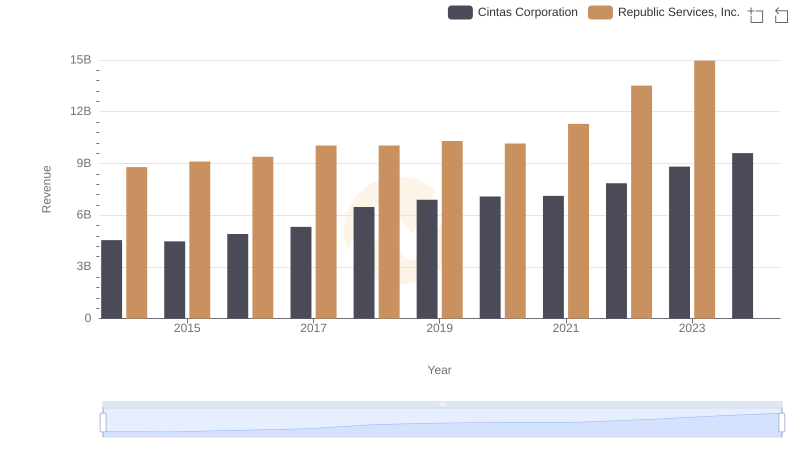

Cintas Corporation or Republic Services, Inc.: Who Leads in Yearly Revenue?

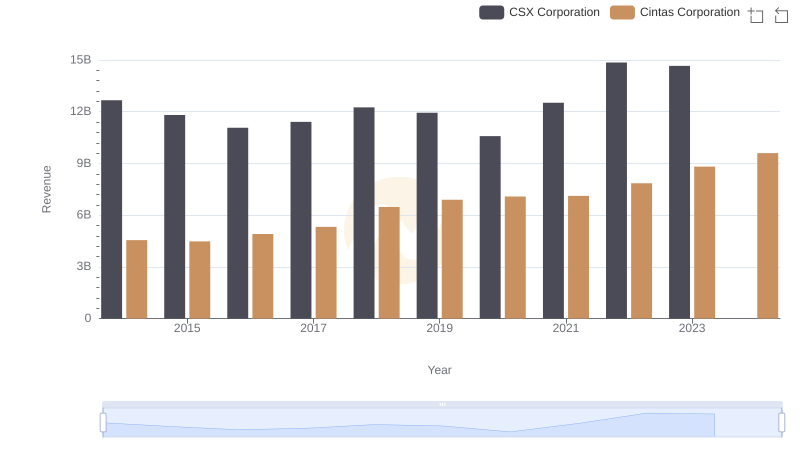

Revenue Insights: Cintas Corporation and CSX Corporation Performance Compared

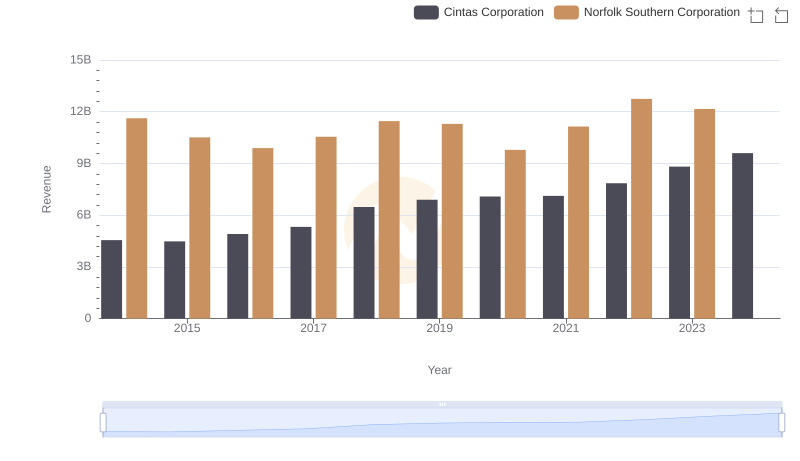

Cintas Corporation or Norfolk Southern Corporation: Who Leads in Yearly Revenue?

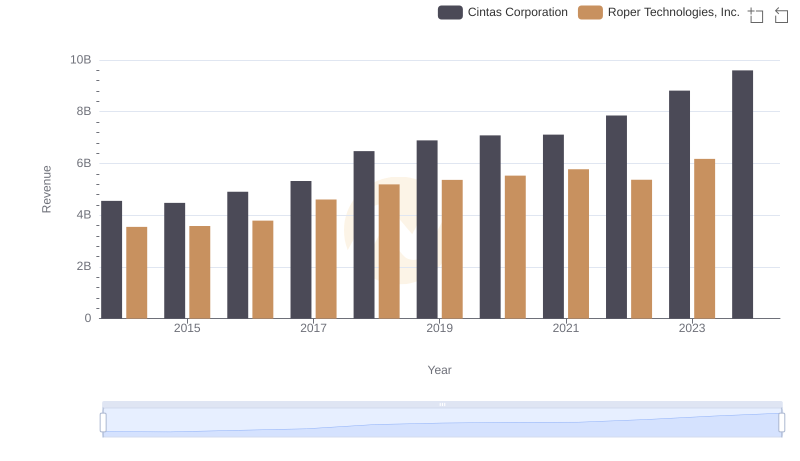

Comparing Revenue Performance: Cintas Corporation or Roper Technologies, Inc.?

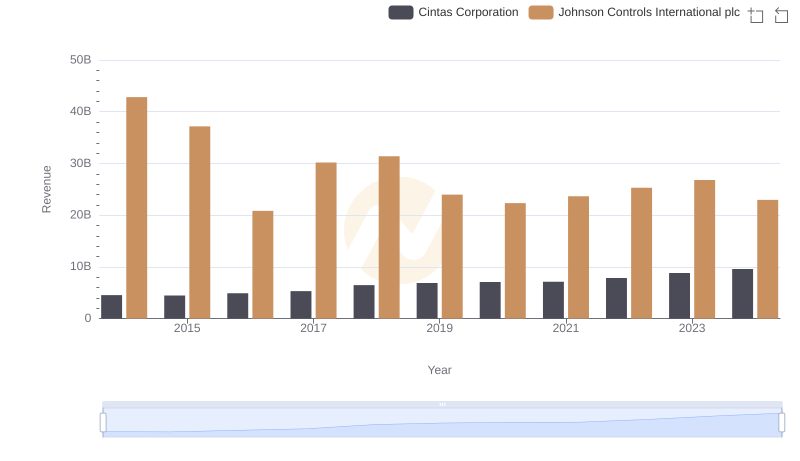

Comparing Revenue Performance: Cintas Corporation or Johnson Controls International plc?

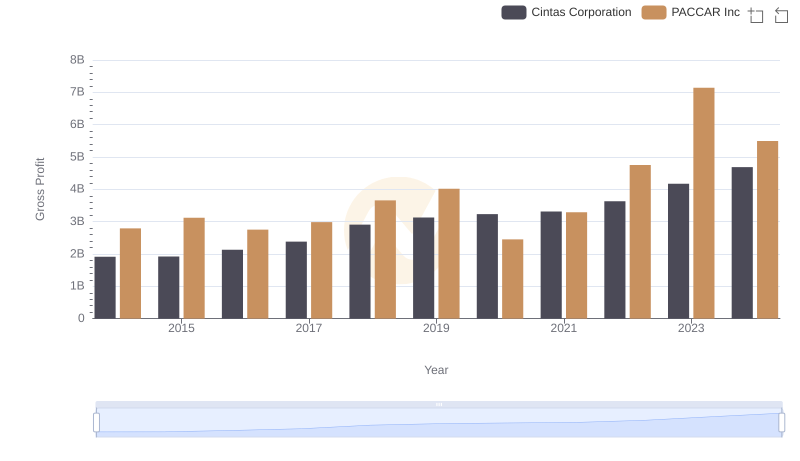

Gross Profit Comparison: Cintas Corporation and PACCAR Inc Trends

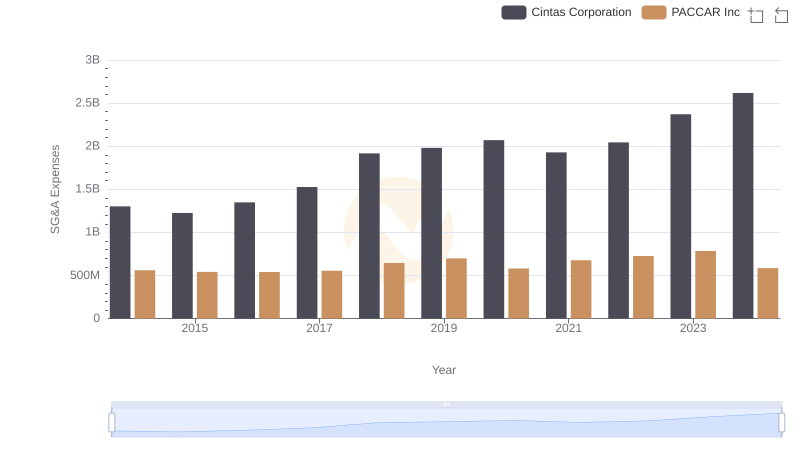

Cost Management Insights: SG&A Expenses for Cintas Corporation and PACCAR Inc

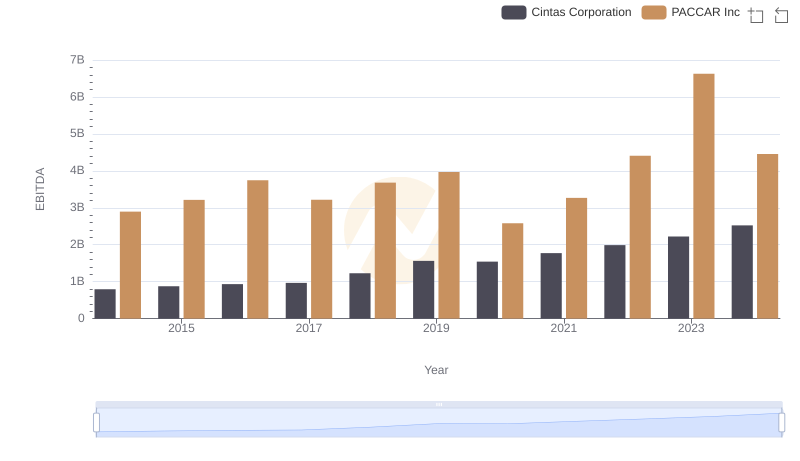

Cintas Corporation vs PACCAR Inc: In-Depth EBITDA Performance Comparison