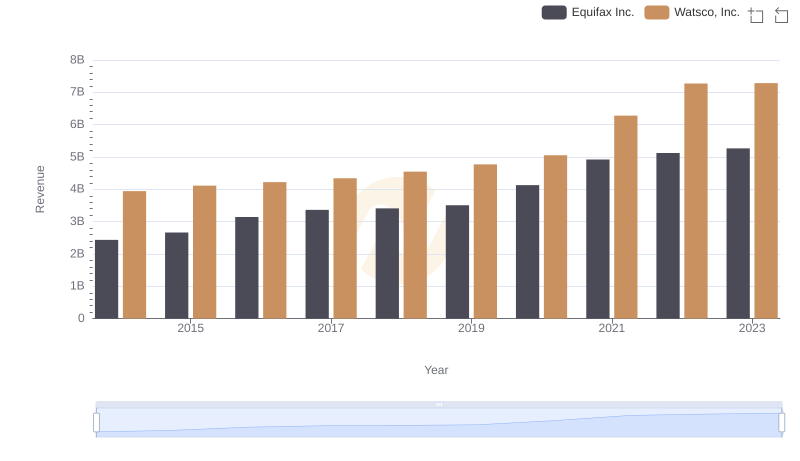

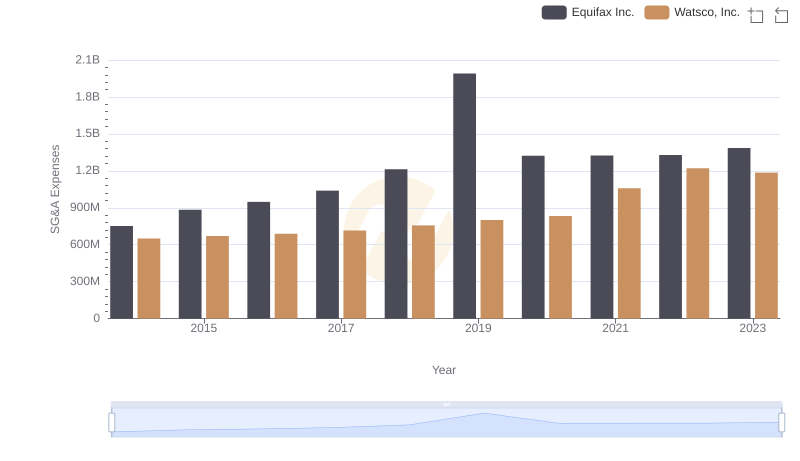

| __timestamp | Equifax Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 956402000 |

| Thursday, January 1, 2015 | 1776200000 | 1007357000 |

| Friday, January 1, 2016 | 2031500000 | 1034584000 |

| Sunday, January 1, 2017 | 2151500000 | 1065659000 |

| Monday, January 1, 2018 | 1971700000 | 1120252000 |

| Tuesday, January 1, 2019 | 1985900000 | 1156956000 |

| Wednesday, January 1, 2020 | 2390100000 | 1222821000 |

| Friday, January 1, 2021 | 2943000000 | 1667545000 |

| Saturday, January 1, 2022 | 2945000000 | 2030289000 |

| Sunday, January 1, 2023 | 2930100000 | 1992140000 |

| Monday, January 1, 2024 | 5681100000 | 2044713000 |

Unleashing insights

In the ever-evolving landscape of the financial sector, Equifax Inc. and Watsco, Inc. have demonstrated remarkable resilience and growth over the past decade. From 2014 to 2023, Equifax's gross profit surged by approximately 84%, peaking in 2022 with a staggering $2.95 billion. This growth trajectory underscores Equifax's robust market strategies and adaptability in a competitive environment.

Conversely, Watsco, Inc. has also shown impressive growth, with its gross profit increasing by over 108% during the same period. The company reached its zenith in 2022, recording a gross profit of $2.03 billion. This performance highlights Watsco's strategic expansion and operational efficiency.

Both companies have navigated economic fluctuations with strategic foresight, making them formidable players in their respective industries. As we look to the future, their financial narratives offer valuable insights into sustainable growth and market leadership.

Equifax Inc. or Watsco, Inc.: Who Leads in Yearly Revenue?

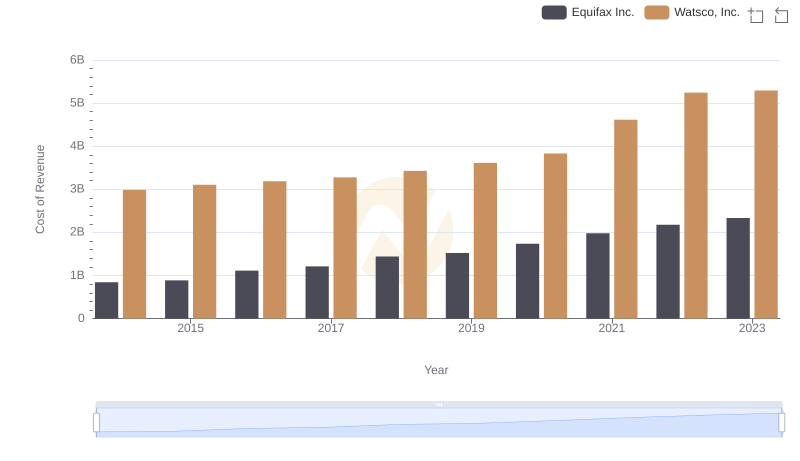

Cost of Revenue: Key Insights for Equifax Inc. and Watsco, Inc.

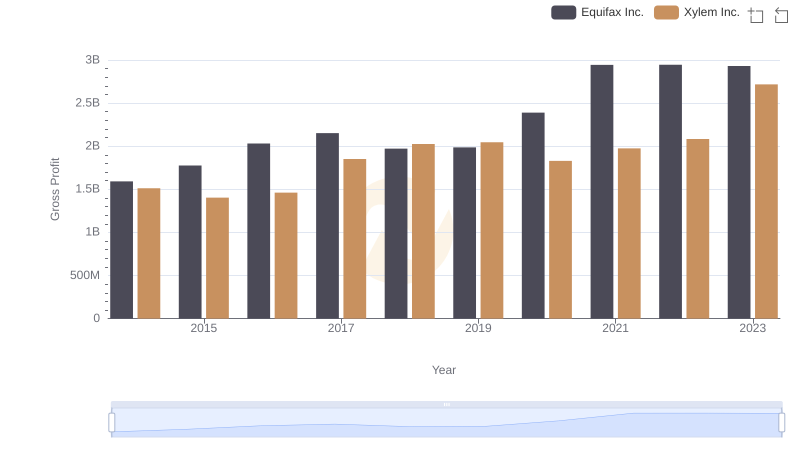

Gross Profit Trends Compared: Equifax Inc. vs Xylem Inc.

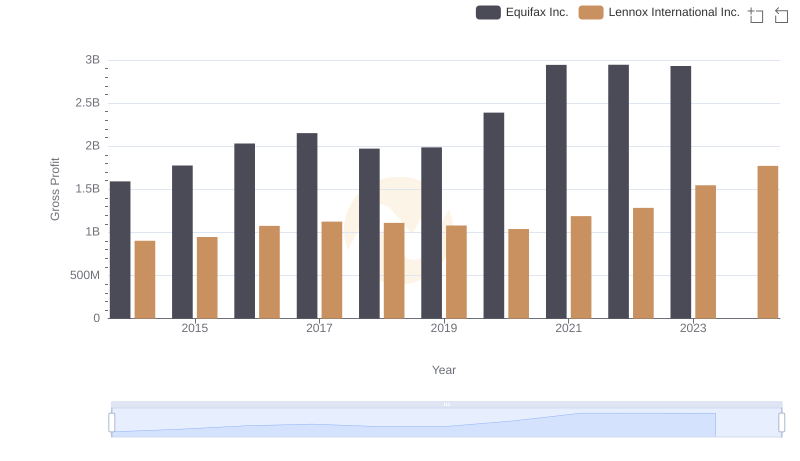

Equifax Inc. vs Lennox International Inc.: A Gross Profit Performance Breakdown

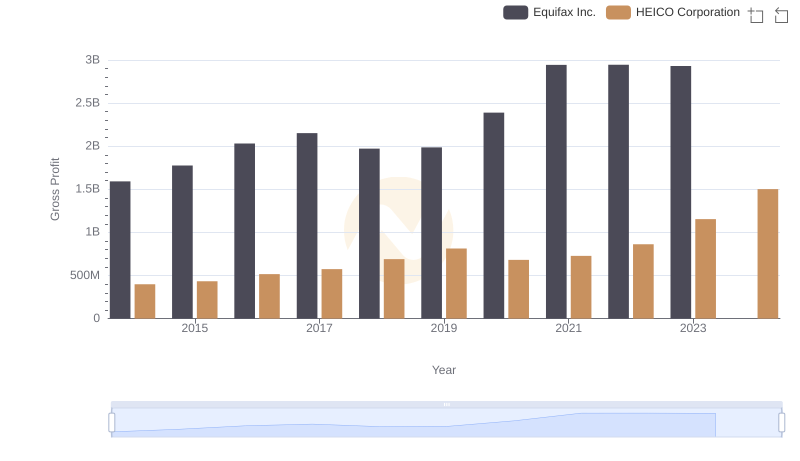

Gross Profit Comparison: Equifax Inc. and HEICO Corporation Trends

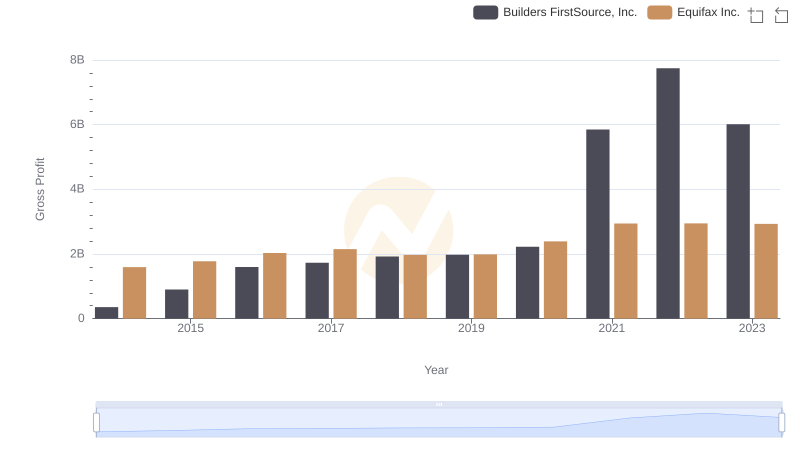

Key Insights on Gross Profit: Equifax Inc. vs Builders FirstSource, Inc.

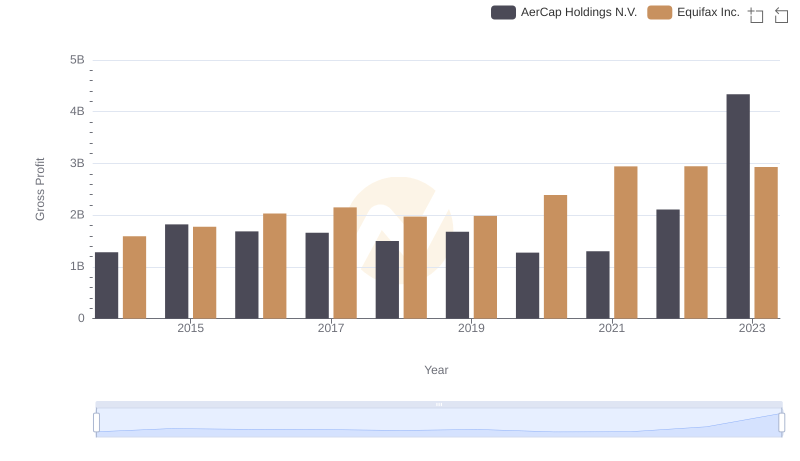

Key Insights on Gross Profit: Equifax Inc. vs AerCap Holdings N.V.

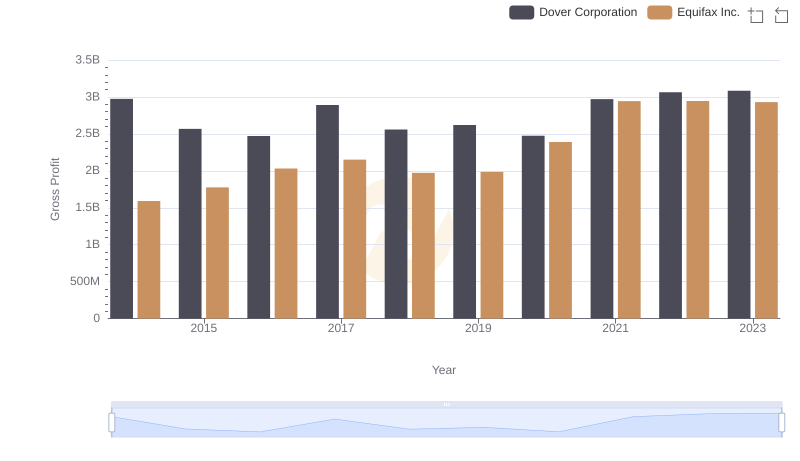

Equifax Inc. vs Dover Corporation: A Gross Profit Performance Breakdown

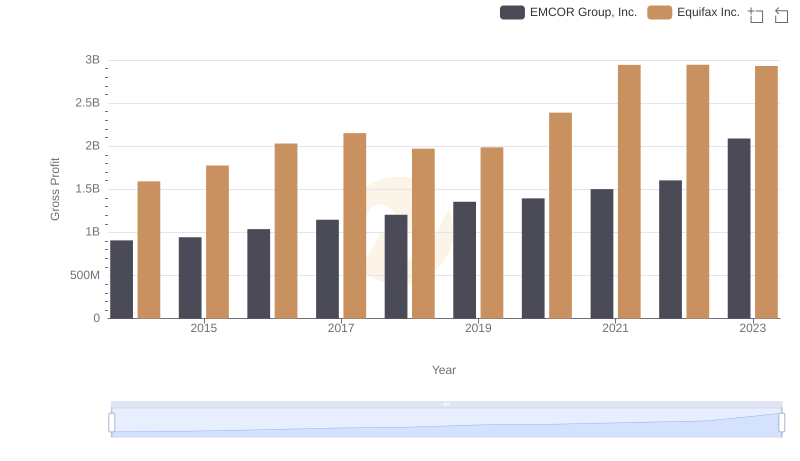

Key Insights on Gross Profit: Equifax Inc. vs EMCOR Group, Inc.

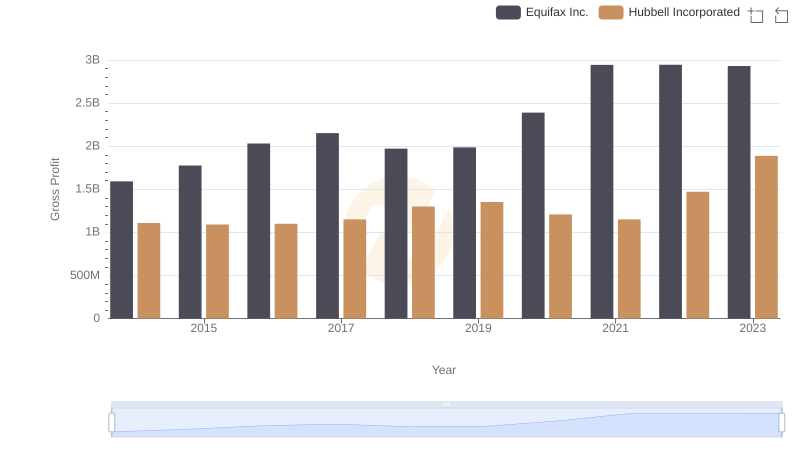

Equifax Inc. vs Hubbell Incorporated: A Gross Profit Performance Breakdown

Cost Management Insights: SG&A Expenses for Equifax Inc. and Watsco, Inc.