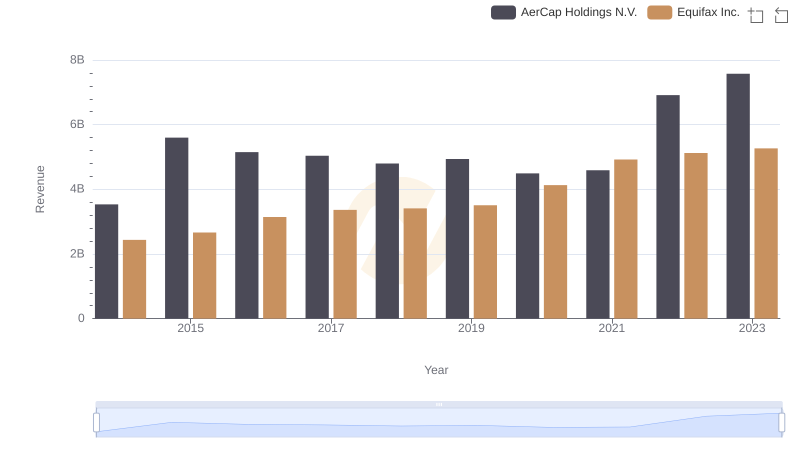

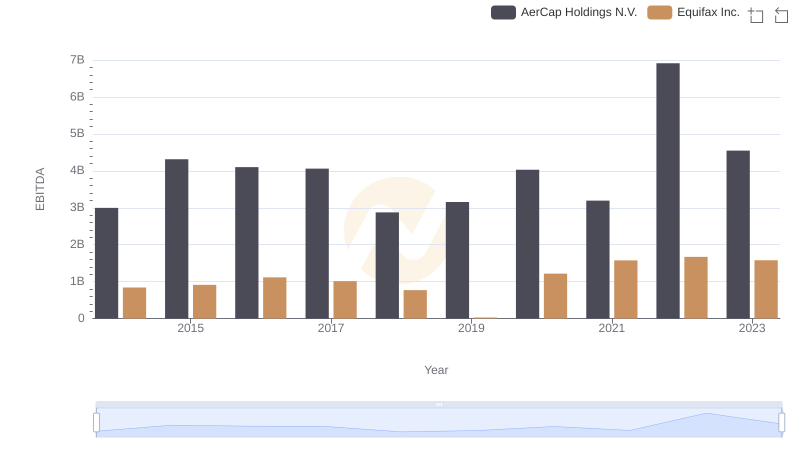

| __timestamp | AerCap Holdings N.V. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1282919000 | 1591700000 |

| Thursday, January 1, 2015 | 1822255000 | 1776200000 |

| Friday, January 1, 2016 | 1686404000 | 2031500000 |

| Sunday, January 1, 2017 | 1660054000 | 2151500000 |

| Monday, January 1, 2018 | 1500345000 | 1971700000 |

| Tuesday, January 1, 2019 | 1678249000 | 1985900000 |

| Wednesday, January 1, 2020 | 1276496000 | 2390100000 |

| Friday, January 1, 2021 | 1301517000 | 2943000000 |

| Saturday, January 1, 2022 | 2109708000 | 2945000000 |

| Sunday, January 1, 2023 | 4337648000 | 2930100000 |

| Monday, January 1, 2024 | 5681100000 |

Unleashing insights

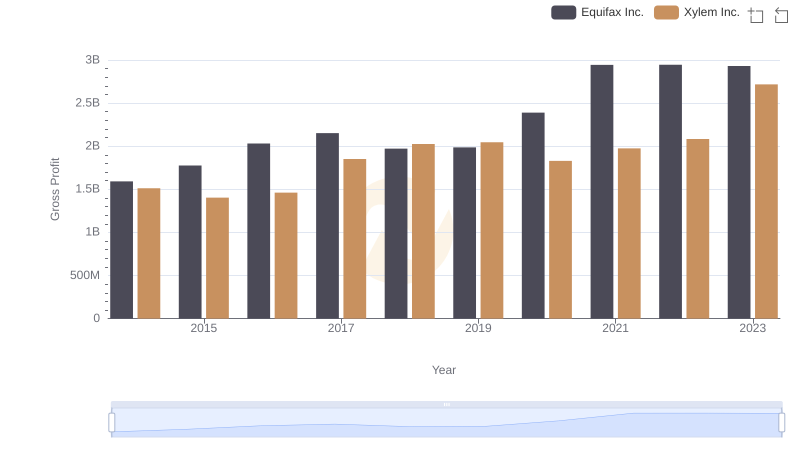

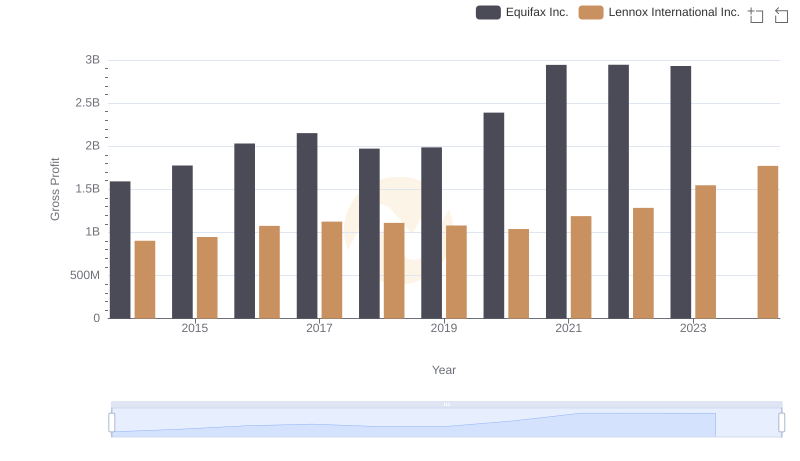

In the ever-evolving landscape of global finance, Equifax Inc. and AerCap Holdings N.V. stand as titans in their respective industries. Over the past decade, these companies have showcased remarkable resilience and growth. From 2014 to 2023, Equifax's gross profit surged by approximately 84%, peaking in 2022 with a 2.95 billion mark. Meanwhile, AerCap Holdings experienced a staggering 238% increase, culminating in a record-breaking 4.34 billion in 2023.

These trends underscore the dynamic nature of the financial sector, where strategic foresight and adaptability are paramount for sustained success.

Revenue Showdown: Equifax Inc. vs AerCap Holdings N.V.

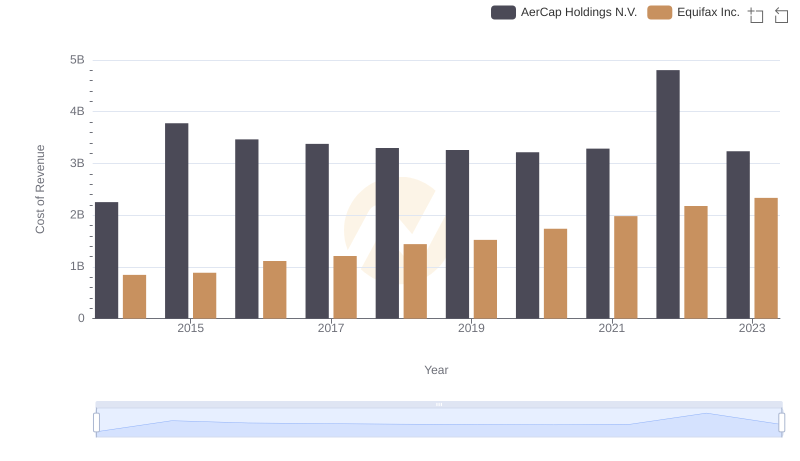

Analyzing Cost of Revenue: Equifax Inc. and AerCap Holdings N.V.

Gross Profit Trends Compared: Equifax Inc. vs Xylem Inc.

Equifax Inc. vs Lennox International Inc.: A Gross Profit Performance Breakdown

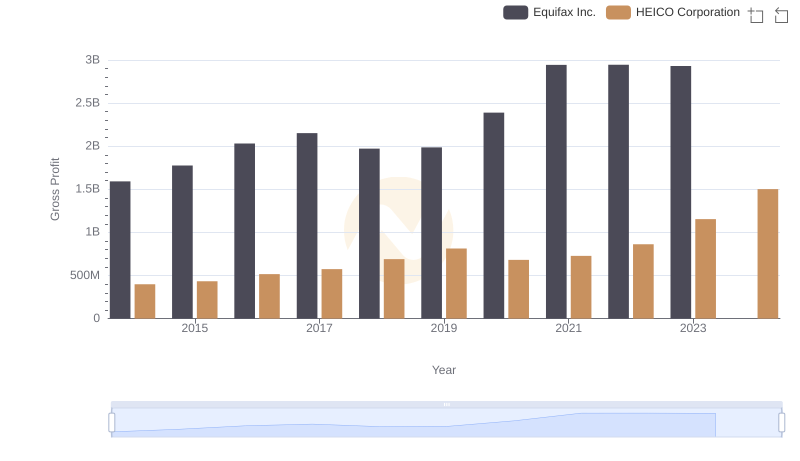

Gross Profit Comparison: Equifax Inc. and HEICO Corporation Trends

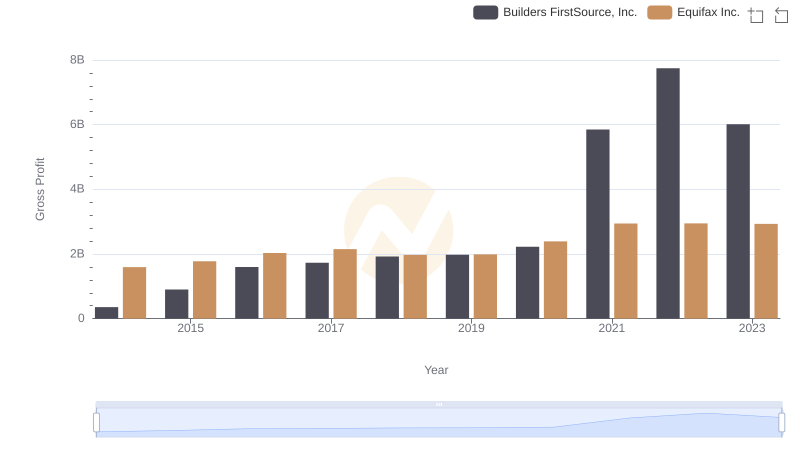

Key Insights on Gross Profit: Equifax Inc. vs Builders FirstSource, Inc.

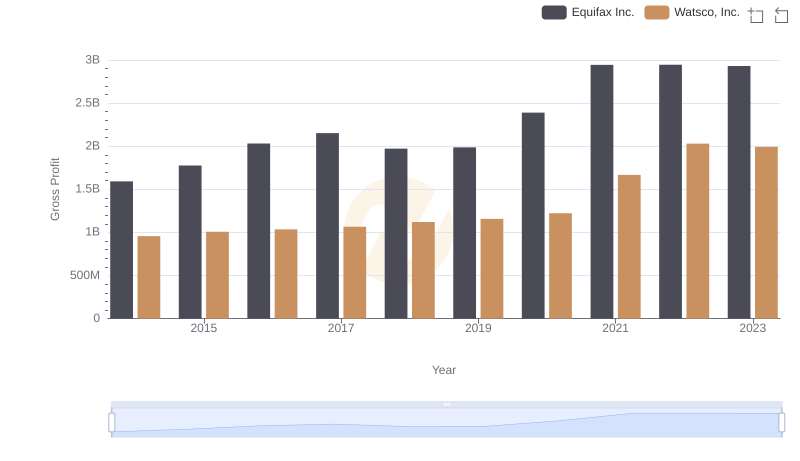

Equifax Inc. vs Watsco, Inc.: A Gross Profit Performance Breakdown

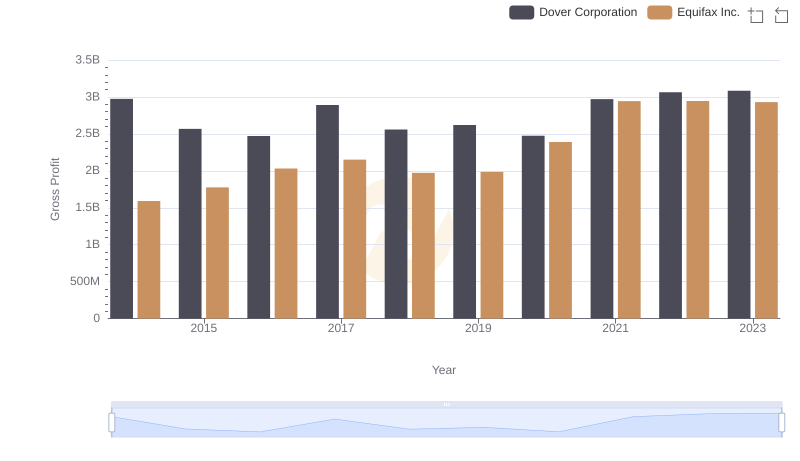

Equifax Inc. vs Dover Corporation: A Gross Profit Performance Breakdown

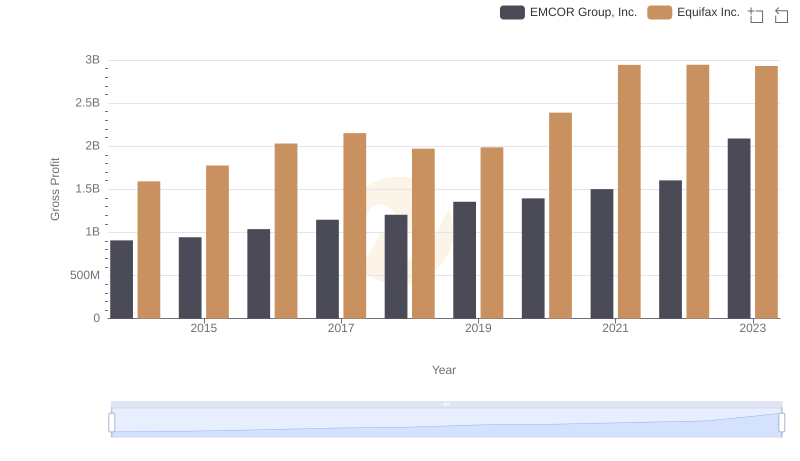

Key Insights on Gross Profit: Equifax Inc. vs EMCOR Group, Inc.

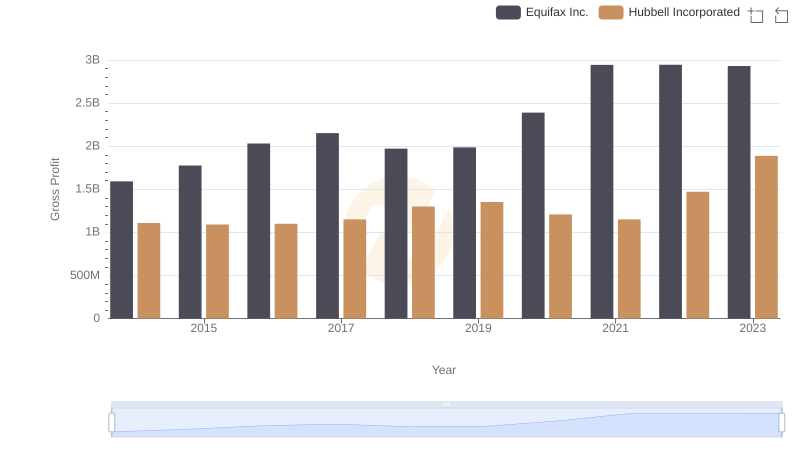

Equifax Inc. vs Hubbell Incorporated: A Gross Profit Performance Breakdown

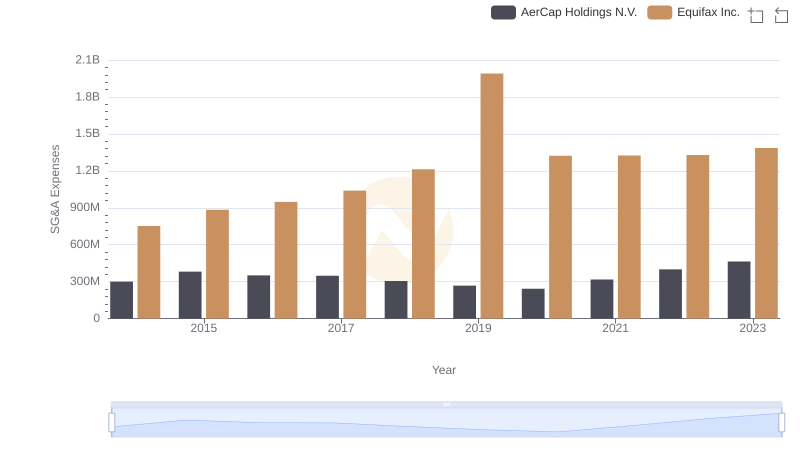

Comparing SG&A Expenses: Equifax Inc. vs AerCap Holdings N.V. Trends and Insights

A Side-by-Side Analysis of EBITDA: Equifax Inc. and AerCap Holdings N.V.