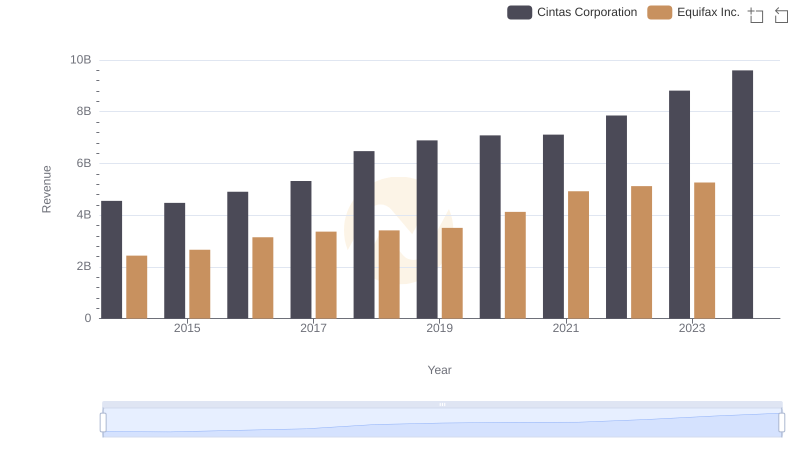

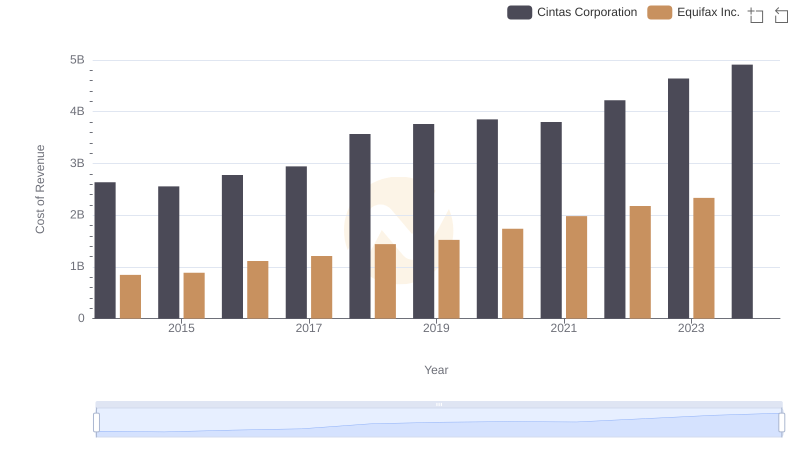

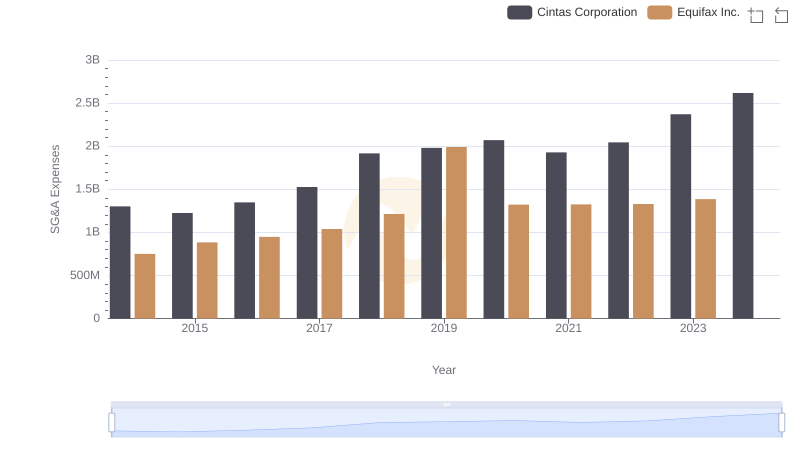

| __timestamp | Cintas Corporation | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 1591700000 |

| Thursday, January 1, 2015 | 1921337000 | 1776200000 |

| Friday, January 1, 2016 | 2129870000 | 2031500000 |

| Sunday, January 1, 2017 | 2380295000 | 2151500000 |

| Monday, January 1, 2018 | 2908523000 | 1971700000 |

| Tuesday, January 1, 2019 | 3128588000 | 1985900000 |

| Wednesday, January 1, 2020 | 3233748000 | 2390100000 |

| Friday, January 1, 2021 | 3314651000 | 2943000000 |

| Saturday, January 1, 2022 | 3632246000 | 2945000000 |

| Sunday, January 1, 2023 | 4173368000 | 2930100000 |

| Monday, January 1, 2024 | 4686416000 | 5681100000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate America, Cintas Corporation and Equifax Inc. have emerged as formidable players. Over the past decade, Cintas has consistently outperformed Equifax in terms of gross profit, showcasing a remarkable growth trajectory. From 2014 to 2023, Cintas saw its gross profit soar by approximately 145%, while Equifax experienced a more modest increase of around 84%.

The data for 2024 remains incomplete, leaving room for speculation on future trends. As these industry titans continue to evolve, their financial narratives offer valuable insights into the dynamics of corporate growth.

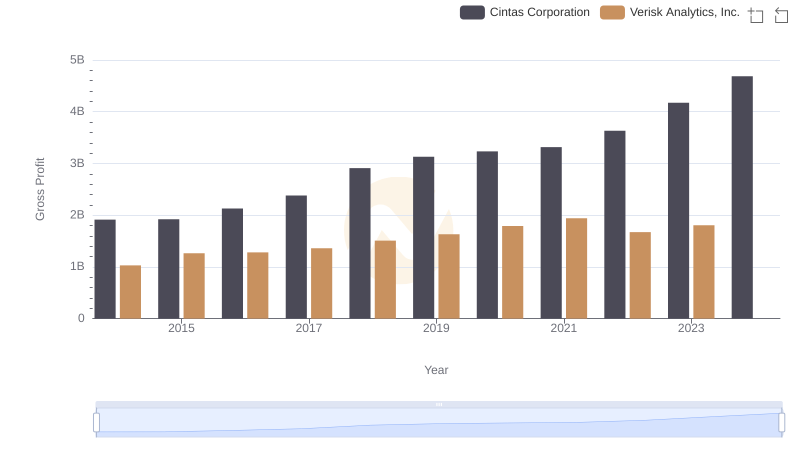

Cintas Corporation and Verisk Analytics, Inc.: A Detailed Gross Profit Analysis

Cintas Corporation vs Equifax Inc.: Examining Key Revenue Metrics

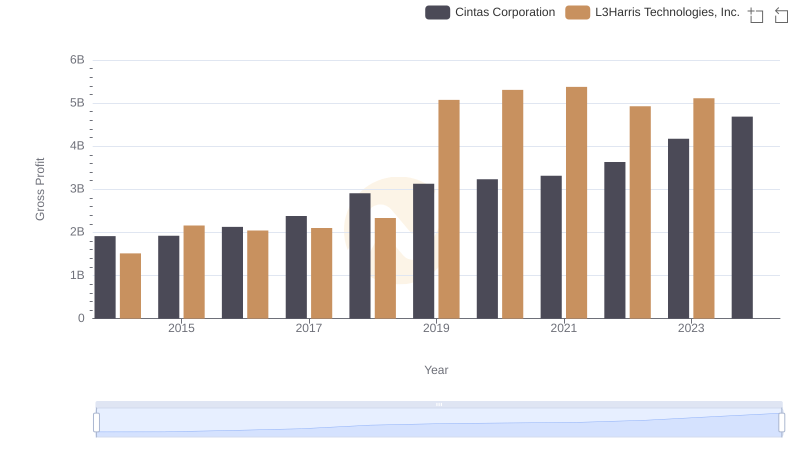

Gross Profit Trends Compared: Cintas Corporation vs L3Harris Technologies, Inc.

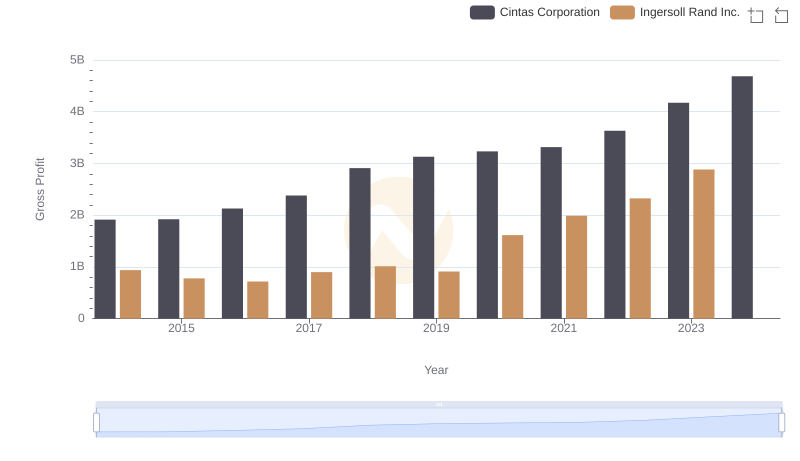

Gross Profit Trends Compared: Cintas Corporation vs Ingersoll Rand Inc.

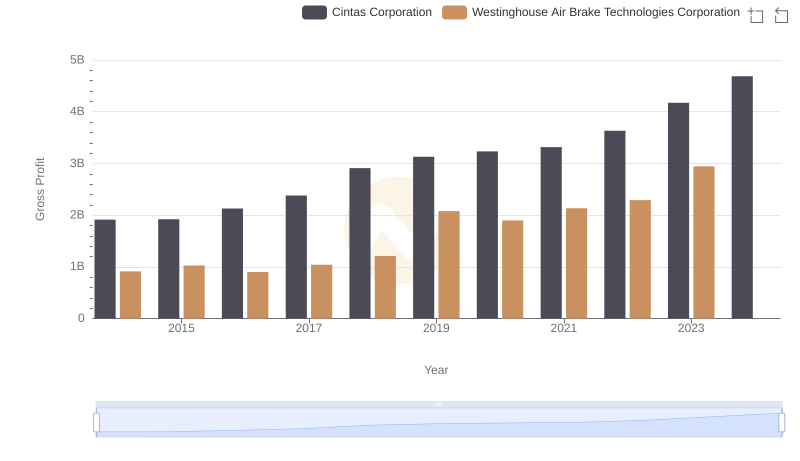

Who Generates Higher Gross Profit? Cintas Corporation or Westinghouse Air Brake Technologies Corporation

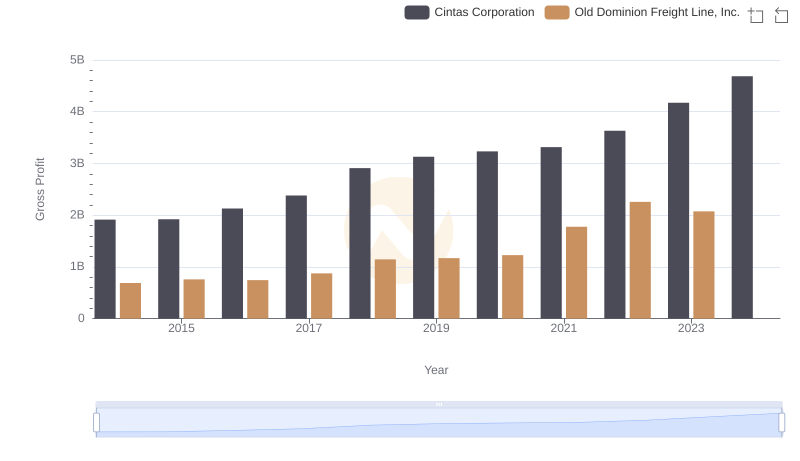

Gross Profit Analysis: Comparing Cintas Corporation and Old Dominion Freight Line, Inc.

Cost of Revenue Trends: Cintas Corporation vs Equifax Inc.

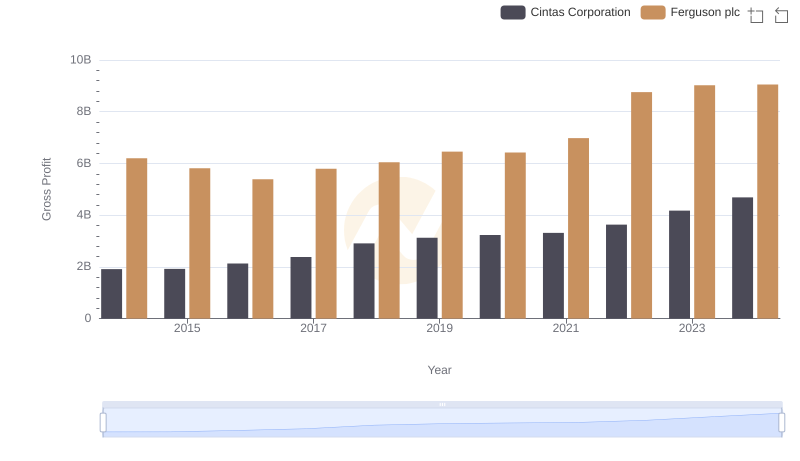

Gross Profit Trends Compared: Cintas Corporation vs Ferguson plc

Breaking Down SG&A Expenses: Cintas Corporation vs Equifax Inc.

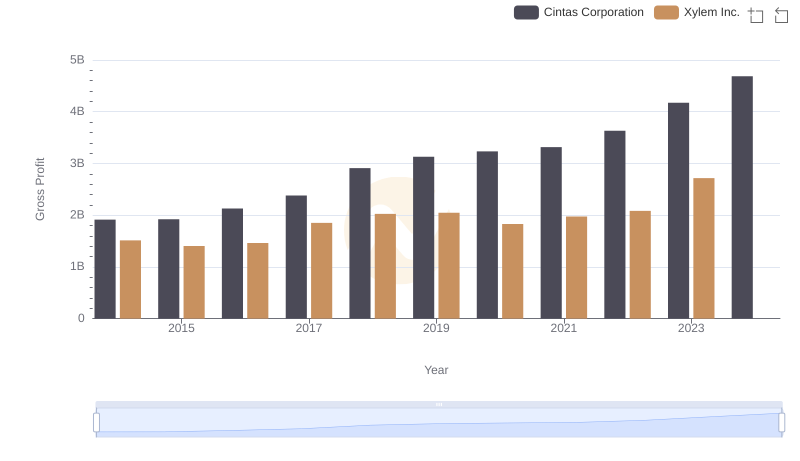

Gross Profit Analysis: Comparing Cintas Corporation and Xylem Inc.

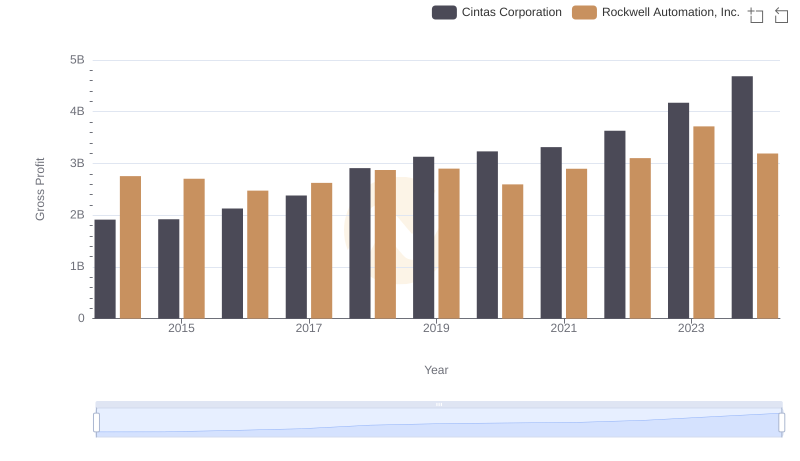

Who Generates Higher Gross Profit? Cintas Corporation or Rockwell Automation, Inc.

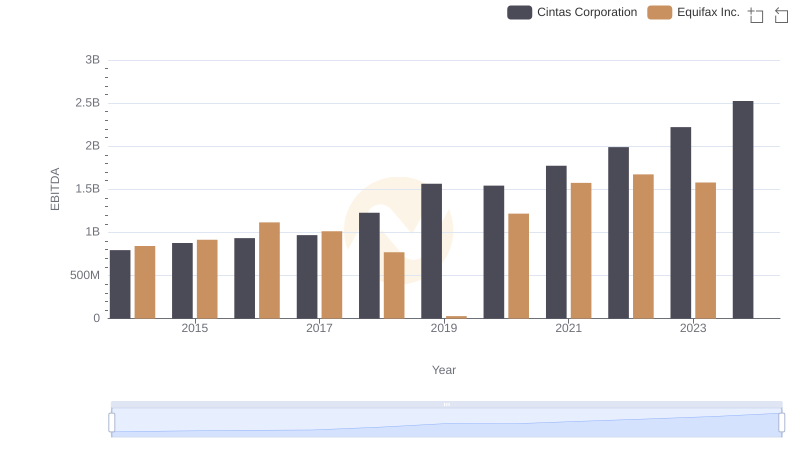

A Professional Review of EBITDA: Cintas Corporation Compared to Equifax Inc.