| __timestamp | Cintas Corporation | Ferguson plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 6203188666 |

| Thursday, January 1, 2015 | 1921337000 | 5816457079 |

| Friday, January 1, 2016 | 2129870000 | 5389727937 |

| Sunday, January 1, 2017 | 2380295000 | 5793596551 |

| Monday, January 1, 2018 | 2908523000 | 6044000000 |

| Tuesday, January 1, 2019 | 3128588000 | 6458000000 |

| Wednesday, January 1, 2020 | 3233748000 | 6421000000 |

| Friday, January 1, 2021 | 3314651000 | 6980000000 |

| Saturday, January 1, 2022 | 3632246000 | 8756000000 |

| Sunday, January 1, 2023 | 4173368000 | 9025000000 |

| Monday, January 1, 2024 | 4686416000 | 9053000000 |

Infusing magic into the data realm

In the competitive landscape of corporate finance, understanding gross profit trends is crucial for investors and analysts alike. This article delves into the annual gross profit performance of two industry giants: Cintas Corporation and Ferguson plc, from 2014 to 2024.

Over the past decade, Cintas Corporation has demonstrated a remarkable growth trajectory, with its gross profit increasing by approximately 145% from 2014 to 2024. Starting at $1.9 billion in 2014, Cintas reached an impressive $4.7 billion by 2024. This consistent upward trend highlights Cintas's robust business model and strategic market positioning.

Conversely, Ferguson plc, a leader in the plumbing and heating sector, showcased a steady growth of around 46% over the same period. From $6.2 billion in 2014, Ferguson's gross profit climbed to $9.1 billion by 2024, underscoring its resilience and adaptability in a dynamic market.

While both companies have shown significant growth, Ferguson's gross profit remains consistently higher, reflecting its larger market share and diversified portfolio. However, Cintas's rapid growth rate suggests a potential for future market expansion.

This analysis provides valuable insights into the financial health and strategic direction of these corporations, offering investors a clearer picture of potential investment opportunities.

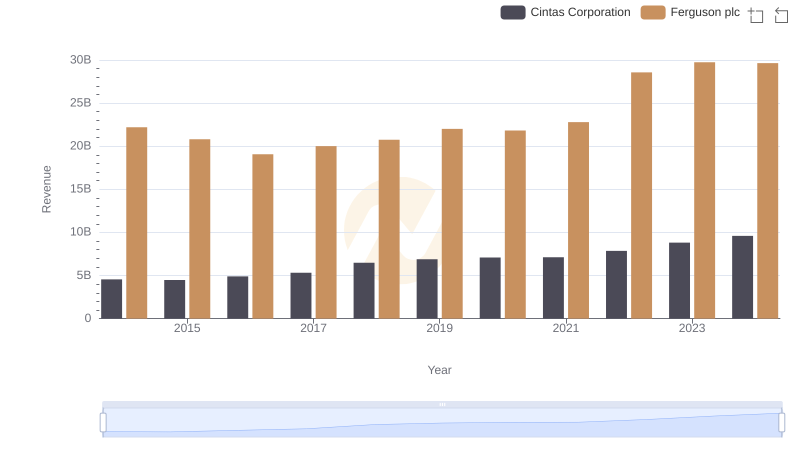

Who Generates More Revenue? Cintas Corporation or Ferguson plc

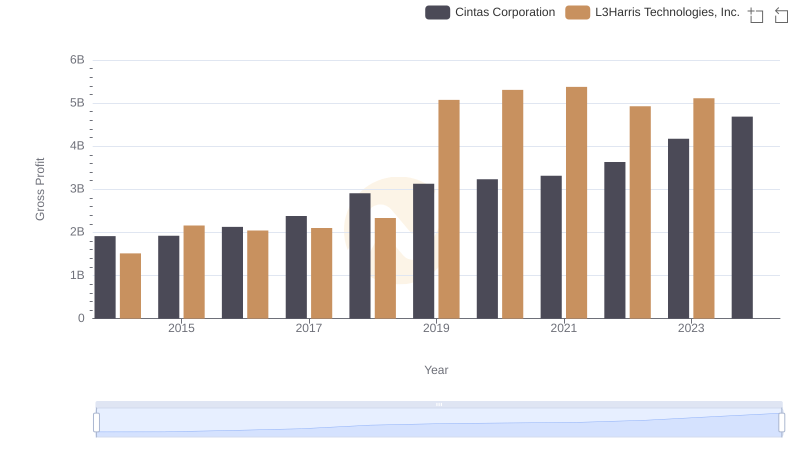

Gross Profit Trends Compared: Cintas Corporation vs L3Harris Technologies, Inc.

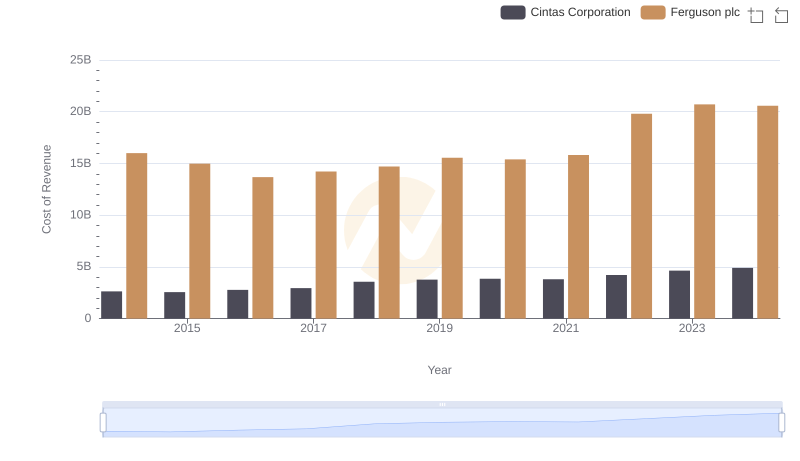

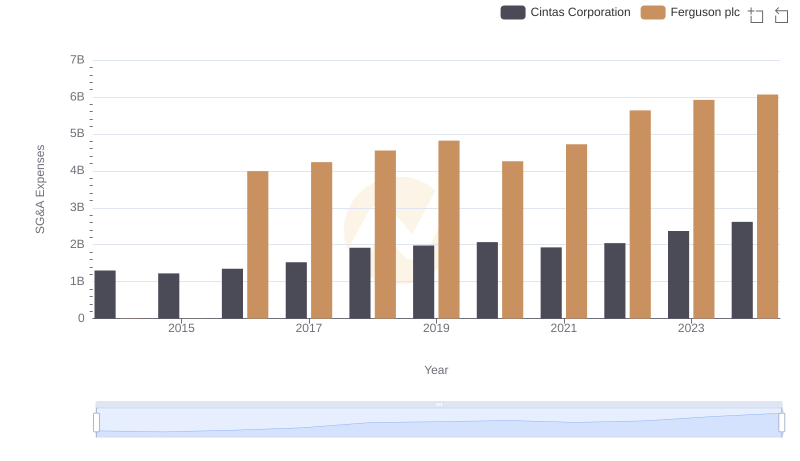

Cost Insights: Breaking Down Cintas Corporation and Ferguson plc's Expenses

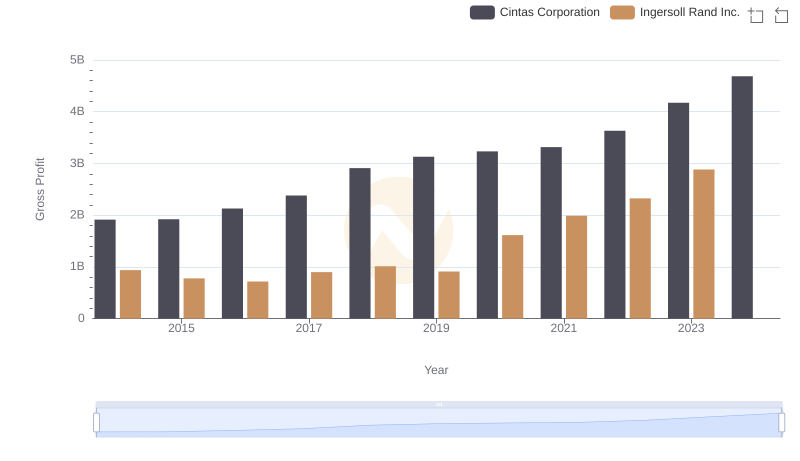

Gross Profit Trends Compared: Cintas Corporation vs Ingersoll Rand Inc.

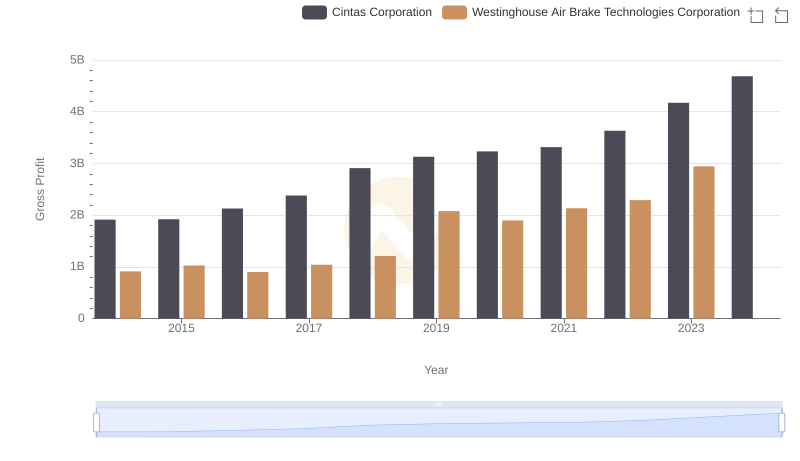

Who Generates Higher Gross Profit? Cintas Corporation or Westinghouse Air Brake Technologies Corporation

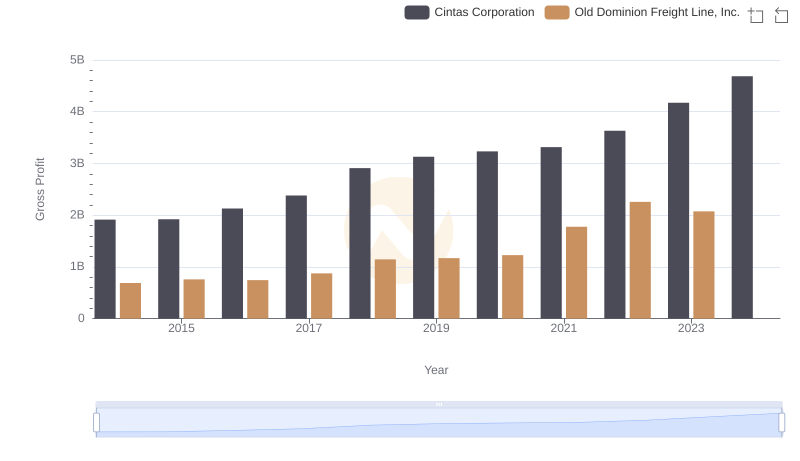

Gross Profit Analysis: Comparing Cintas Corporation and Old Dominion Freight Line, Inc.

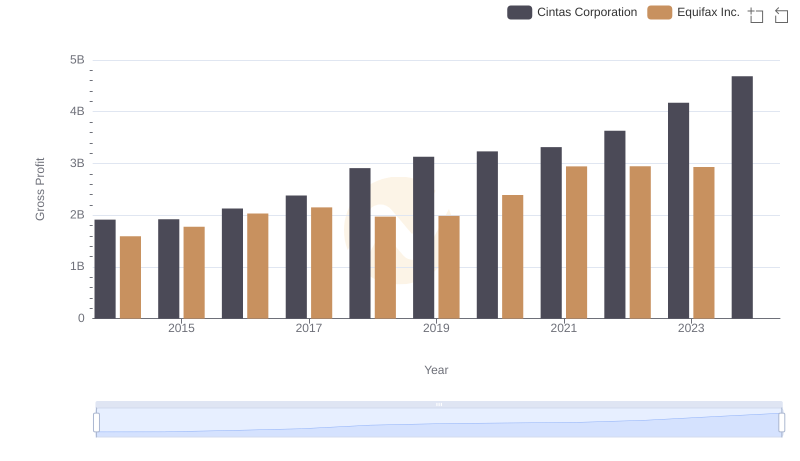

Gross Profit Comparison: Cintas Corporation and Equifax Inc. Trends

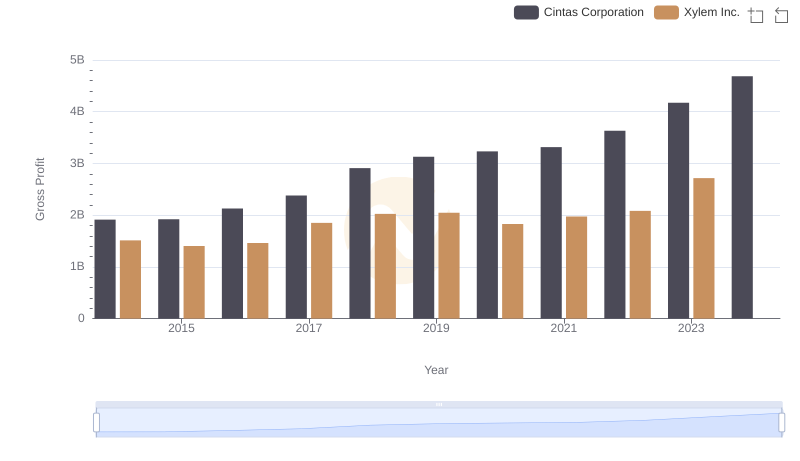

Gross Profit Analysis: Comparing Cintas Corporation and Xylem Inc.

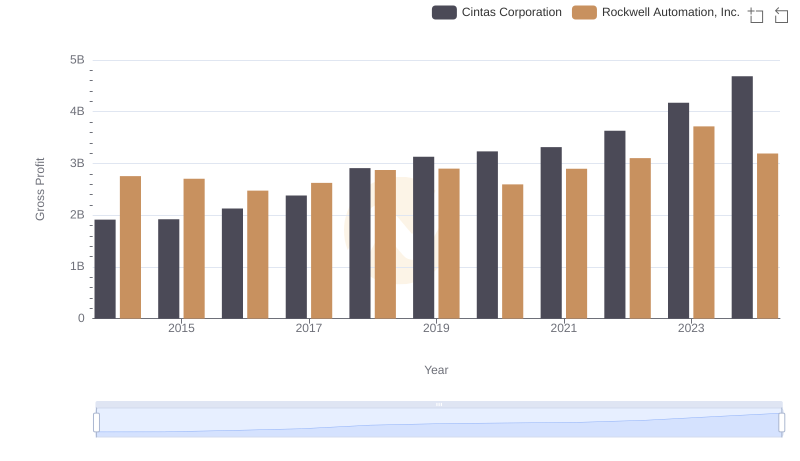

Who Generates Higher Gross Profit? Cintas Corporation or Rockwell Automation, Inc.

Selling, General, and Administrative Costs: Cintas Corporation vs Ferguson plc

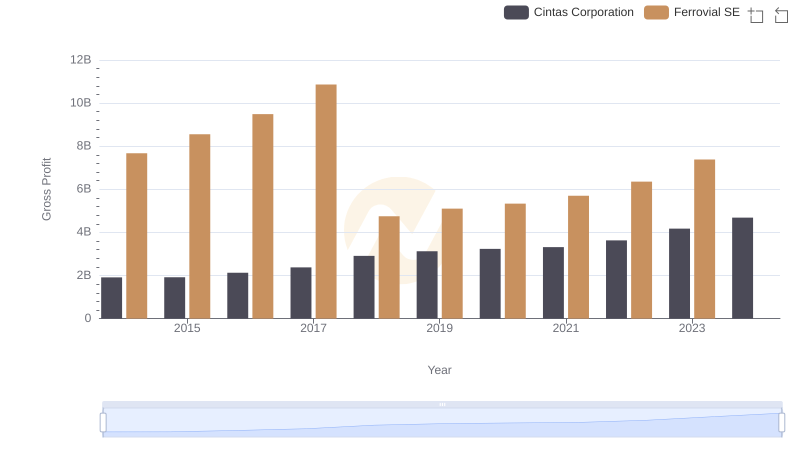

Key Insights on Gross Profit: Cintas Corporation vs Ferrovial SE

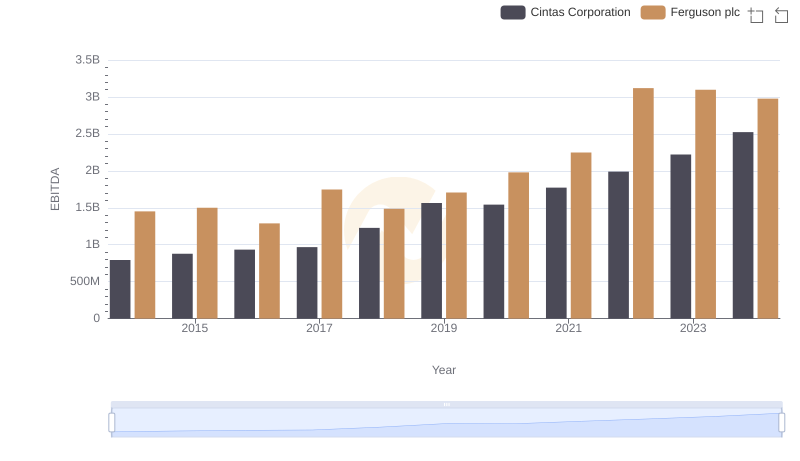

A Professional Review of EBITDA: Cintas Corporation Compared to Ferguson plc