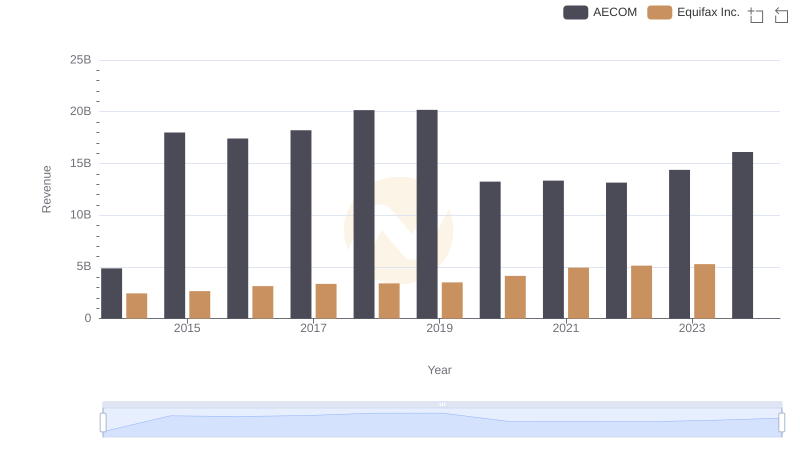

| __timestamp | AECOM | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4452451000 | 844700000 |

| Thursday, January 1, 2015 | 17454692000 | 887400000 |

| Friday, January 1, 2016 | 16768001000 | 1113400000 |

| Sunday, January 1, 2017 | 17519682000 | 1210700000 |

| Monday, January 1, 2018 | 19504863000 | 1440400000 |

| Tuesday, January 1, 2019 | 19359884000 | 1521700000 |

| Wednesday, January 1, 2020 | 12530416000 | 1737400000 |

| Friday, January 1, 2021 | 12542431000 | 1980900000 |

| Saturday, January 1, 2022 | 12300208000 | 2177200000 |

| Sunday, January 1, 2023 | 13432996000 | 2335100000 |

| Monday, January 1, 2024 | 15021157000 | 0 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. This analysis delves into the cost of revenue trends for Equifax Inc. and AECOM from 2014 to 2023. AECOM, a global infrastructure firm, consistently reported higher costs, peaking at approximately $19.5 billion in 2018. In contrast, Equifax Inc., a leading credit reporting agency, maintained a more modest cost structure, with a peak of around $2.3 billion in 2023.

The data highlights AECOM's larger scale operations compared to Equifax's more focused approach, offering insights into their respective market strategies.

Breaking Down Revenue Trends: Equifax Inc. vs AECOM

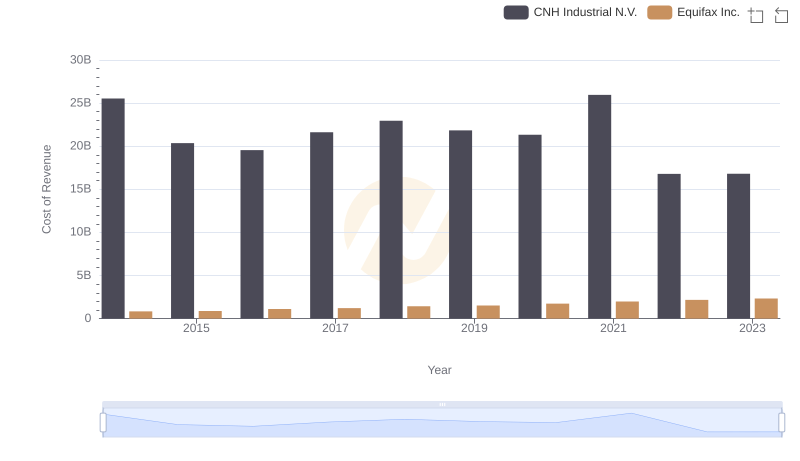

Cost of Revenue Trends: Equifax Inc. vs CNH Industrial N.V.

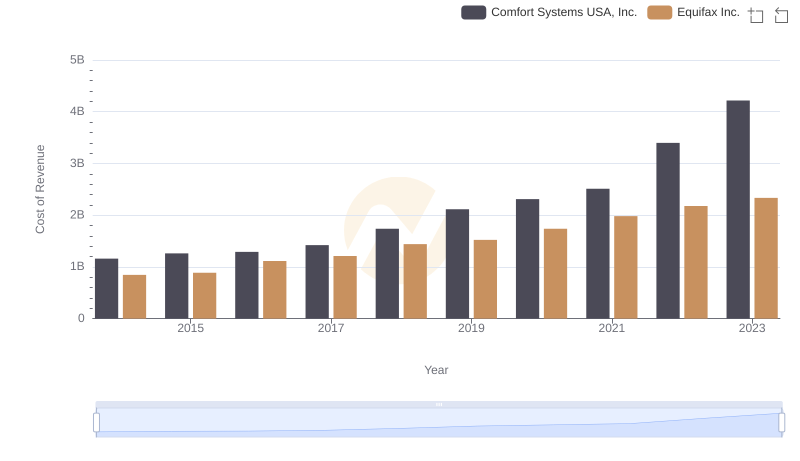

Analyzing Cost of Revenue: Equifax Inc. and Comfort Systems USA, Inc.

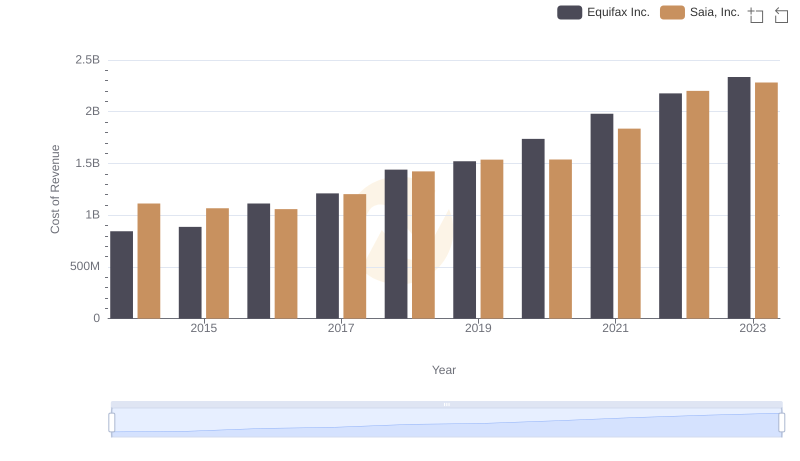

Analyzing Cost of Revenue: Equifax Inc. and Saia, Inc.

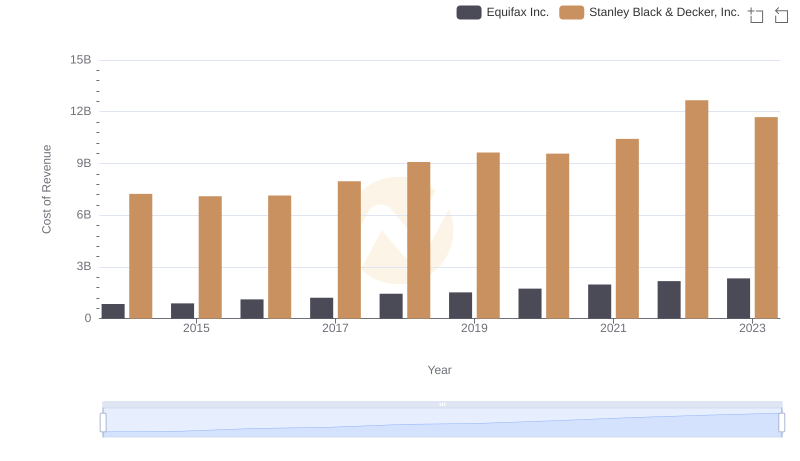

Cost of Revenue Trends: Equifax Inc. vs Stanley Black & Decker, Inc.

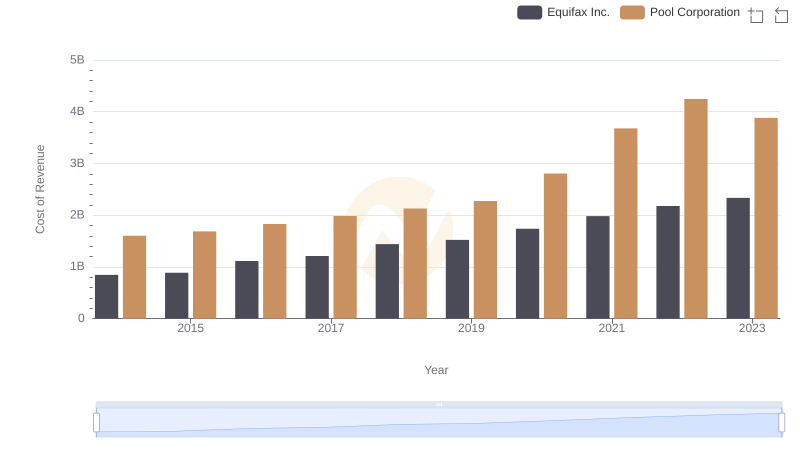

Cost of Revenue Comparison: Equifax Inc. vs Pool Corporation

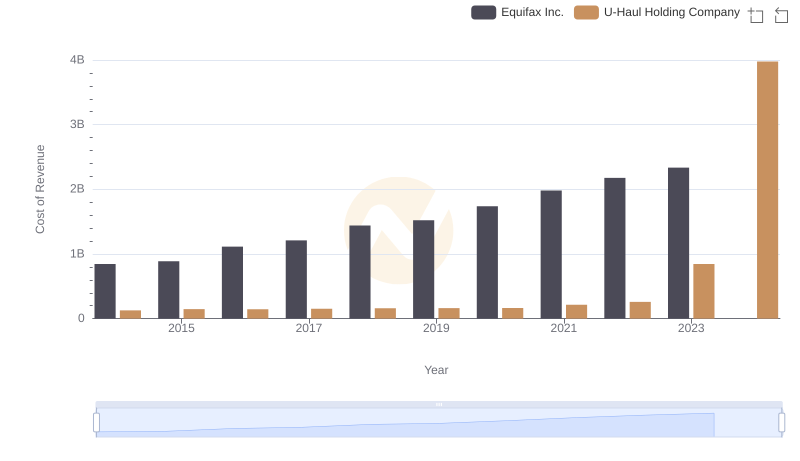

Cost of Revenue Comparison: Equifax Inc. vs U-Haul Holding Company

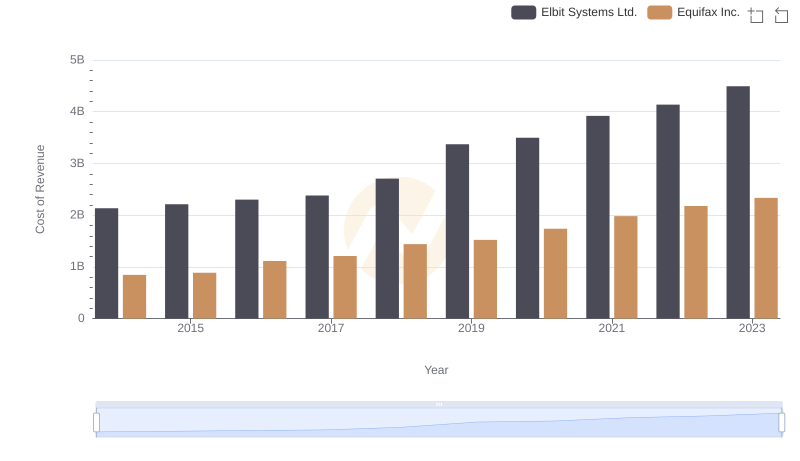

Cost of Revenue Comparison: Equifax Inc. vs Elbit Systems Ltd.

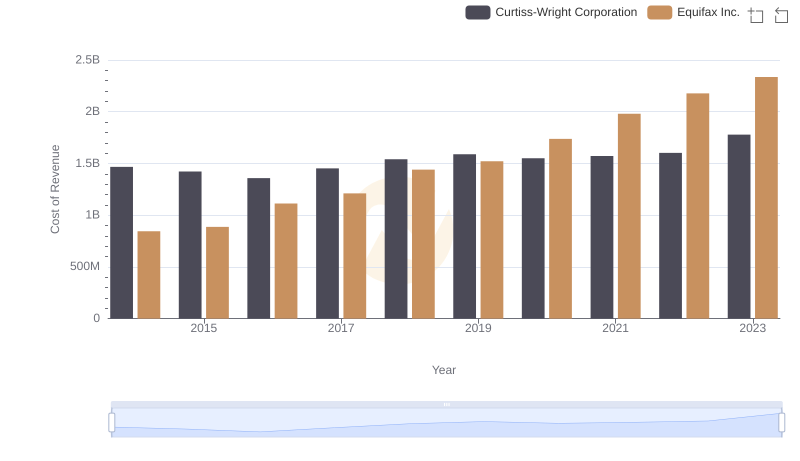

Cost of Revenue Trends: Equifax Inc. vs Curtiss-Wright Corporation

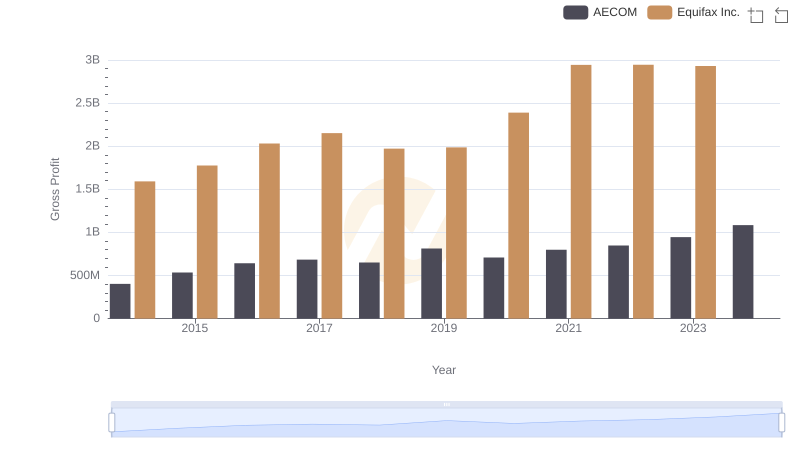

Who Generates Higher Gross Profit? Equifax Inc. or AECOM

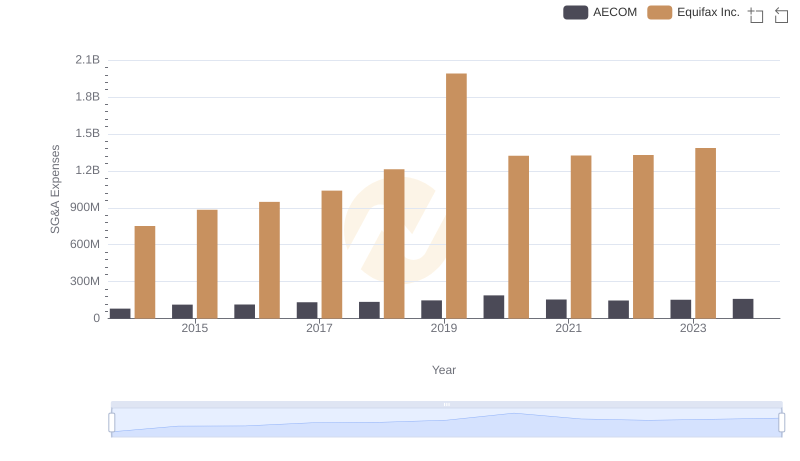

Equifax Inc. and AECOM: SG&A Spending Patterns Compared