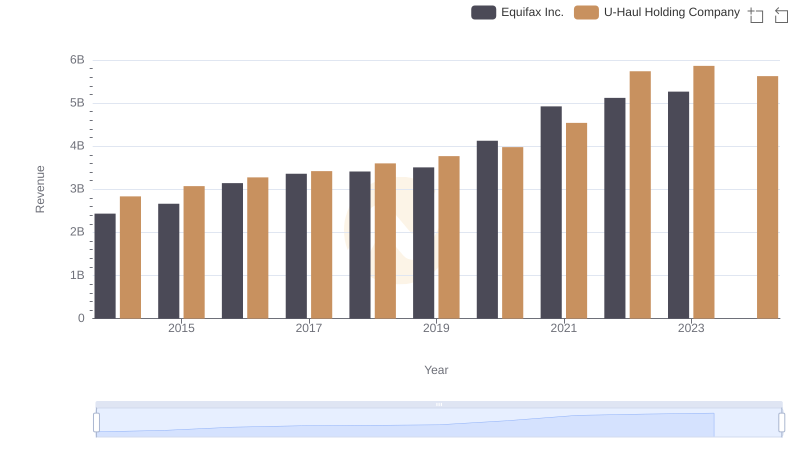

| __timestamp | Equifax Inc. | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 127270000 |

| Thursday, January 1, 2015 | 887400000 | 146072000 |

| Friday, January 1, 2016 | 1113400000 | 144990000 |

| Sunday, January 1, 2017 | 1210700000 | 152485000 |

| Monday, January 1, 2018 | 1440400000 | 160489000 |

| Tuesday, January 1, 2019 | 1521700000 | 162142000 |

| Wednesday, January 1, 2020 | 1737400000 | 164018000 |

| Friday, January 1, 2021 | 1980900000 | 214059000 |

| Saturday, January 1, 2022 | 2177200000 | 259585000 |

| Sunday, January 1, 2023 | 2335100000 | 844894000 |

| Monday, January 1, 2024 | 0 | 3976040000 |

In pursuit of knowledge

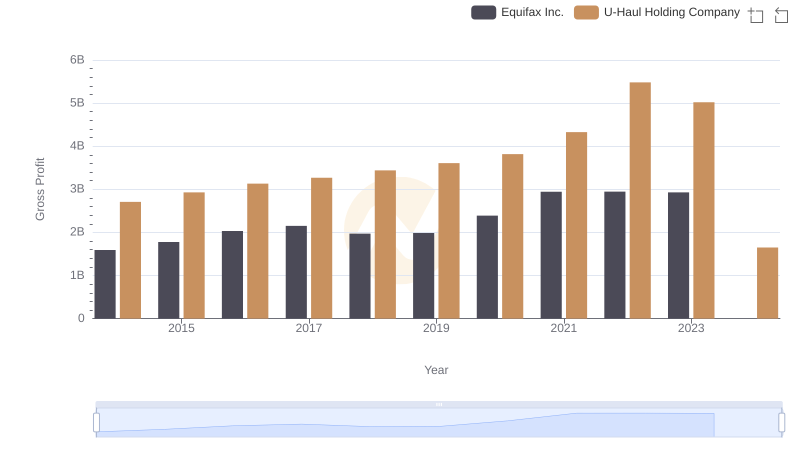

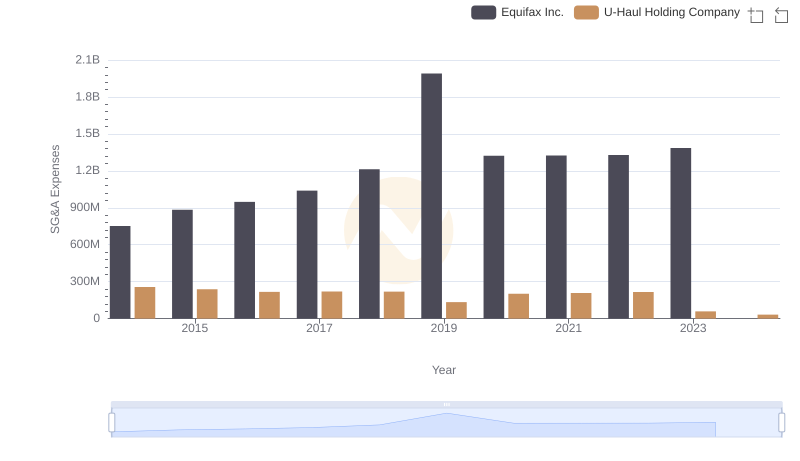

In the ever-evolving landscape of American business, Equifax Inc. and U-Haul Holding Company stand as intriguing case studies in cost management. Over the past decade, Equifax has seen its cost of revenue grow by approximately 176%, from 2014 to 2023, reflecting its expanding operations and market reach. In contrast, U-Haul's cost of revenue surged dramatically by over 600% in the same period, with a notable spike in 2024, indicating a strategic shift or expansion.

This comparison highlights the diverse strategies employed by these companies in managing their operational expenses. While Equifax's steady growth suggests a consistent scaling of operations, U-Haul's recent leap could signal a significant investment in infrastructure or services. As we look to the future, these trends offer valuable insights into the financial strategies of two major players in their respective industries.

Equifax Inc. or U-Haul Holding Company: Who Leads in Yearly Revenue?

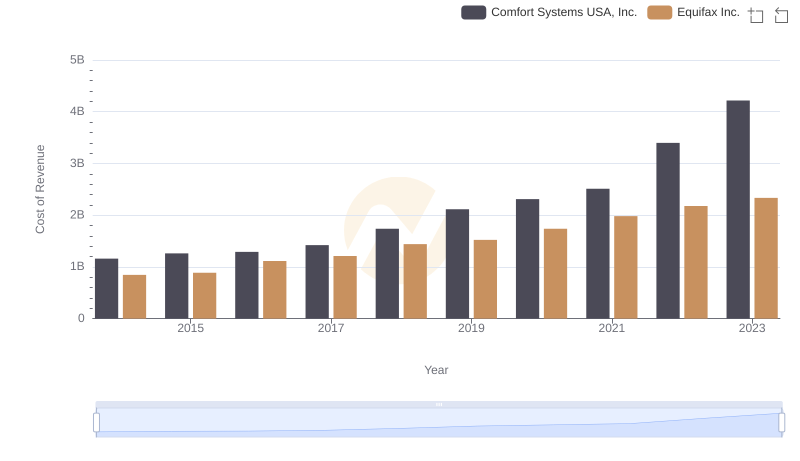

Analyzing Cost of Revenue: Equifax Inc. and Comfort Systems USA, Inc.

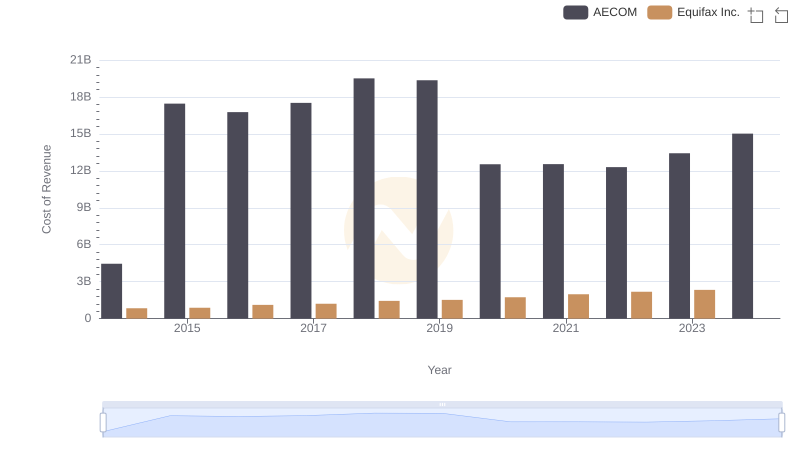

Equifax Inc. vs AECOM: Efficiency in Cost of Revenue Explored

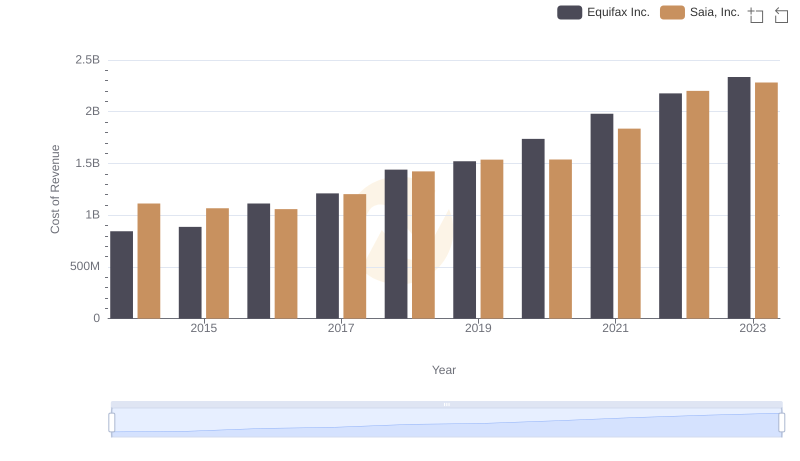

Analyzing Cost of Revenue: Equifax Inc. and Saia, Inc.

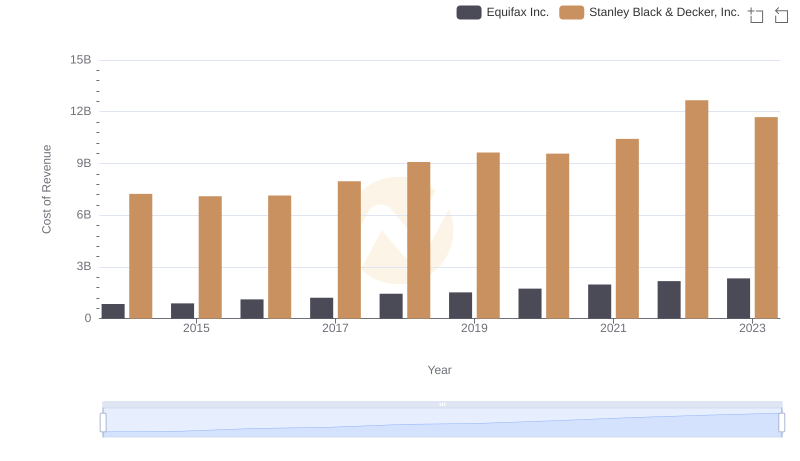

Cost of Revenue Trends: Equifax Inc. vs Stanley Black & Decker, Inc.

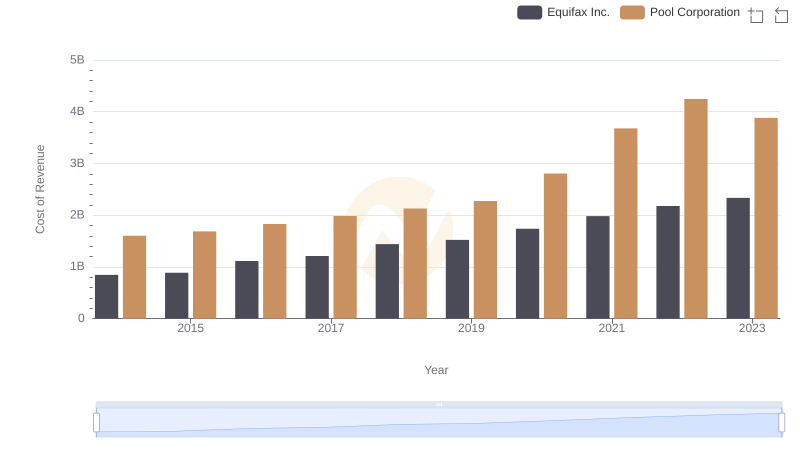

Cost of Revenue Comparison: Equifax Inc. vs Pool Corporation

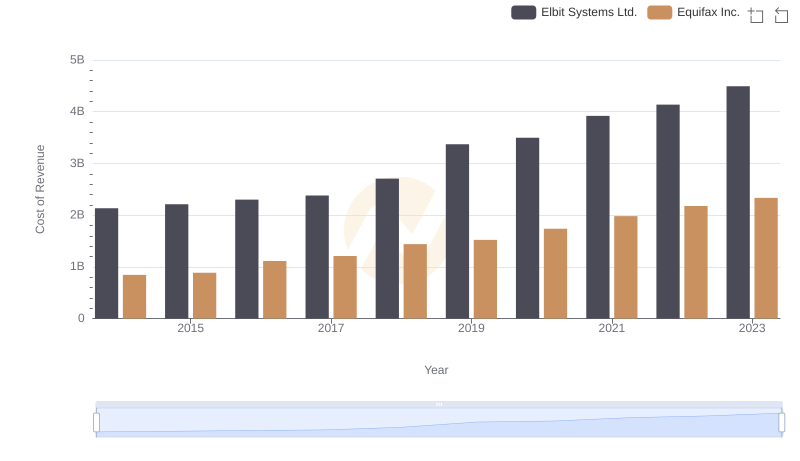

Cost of Revenue Comparison: Equifax Inc. vs Elbit Systems Ltd.

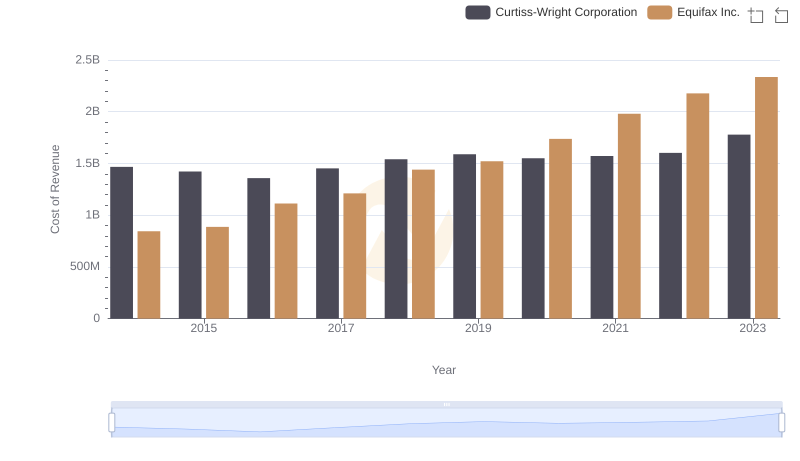

Cost of Revenue Trends: Equifax Inc. vs Curtiss-Wright Corporation

Equifax Inc. and U-Haul Holding Company: A Detailed Gross Profit Analysis

Selling, General, and Administrative Costs: Equifax Inc. vs U-Haul Holding Company