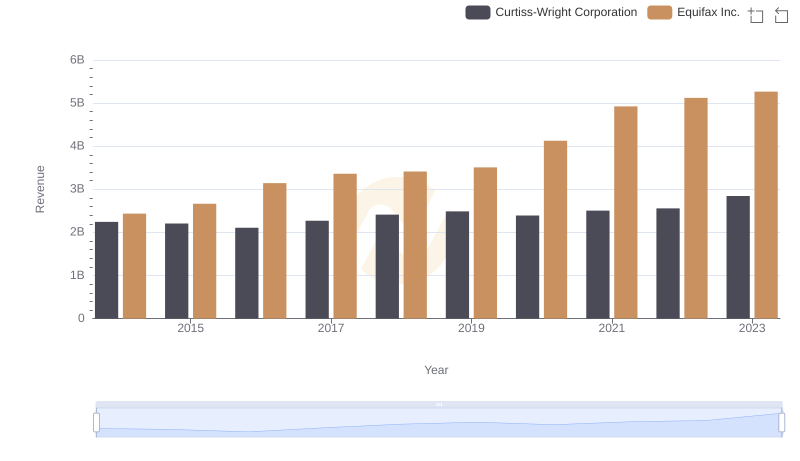

| __timestamp | Curtiss-Wright Corporation | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1466610000 | 844700000 |

| Thursday, January 1, 2015 | 1422428000 | 887400000 |

| Friday, January 1, 2016 | 1358448000 | 1113400000 |

| Sunday, January 1, 2017 | 1452431000 | 1210700000 |

| Monday, January 1, 2018 | 1540574000 | 1440400000 |

| Tuesday, January 1, 2019 | 1589216000 | 1521700000 |

| Wednesday, January 1, 2020 | 1550109000 | 1737400000 |

| Friday, January 1, 2021 | 1572575000 | 1980900000 |

| Saturday, January 1, 2022 | 1602416000 | 2177200000 |

| Sunday, January 1, 2023 | 1778195000 | 2335100000 |

| Monday, January 1, 2024 | 1967640000 | 0 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding cost structures is crucial. This analysis delves into the cost of revenue trends for Equifax Inc. and Curtiss-Wright Corporation from 2014 to 2023. Over this period, Equifax's cost of revenue surged by approximately 176%, reflecting its expanding operations and market reach. In contrast, Curtiss-Wright Corporation experienced a more modest increase of around 21%, indicating a stable cost management strategy.

Equifax Inc.: Starting at 844 million in 2014, Equifax's cost of revenue climbed steadily, peaking at 2.34 billion in 2023. This growth underscores the company's aggressive expansion and investment in data-driven services.

Curtiss-Wright Corporation: With a starting point of 1.47 billion in 2014, the company's cost of revenue reached 1.78 billion by 2023, showcasing a consistent yet controlled growth trajectory.

These trends highlight the distinct strategic approaches of these industry giants, offering valuable insights for investors and analysts alike.

Breaking Down Revenue Trends: Equifax Inc. vs Curtiss-Wright Corporation

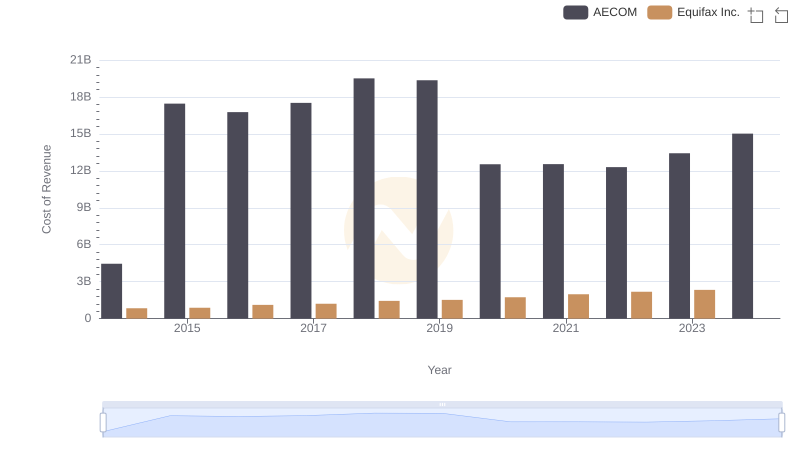

Equifax Inc. vs AECOM: Efficiency in Cost of Revenue Explored

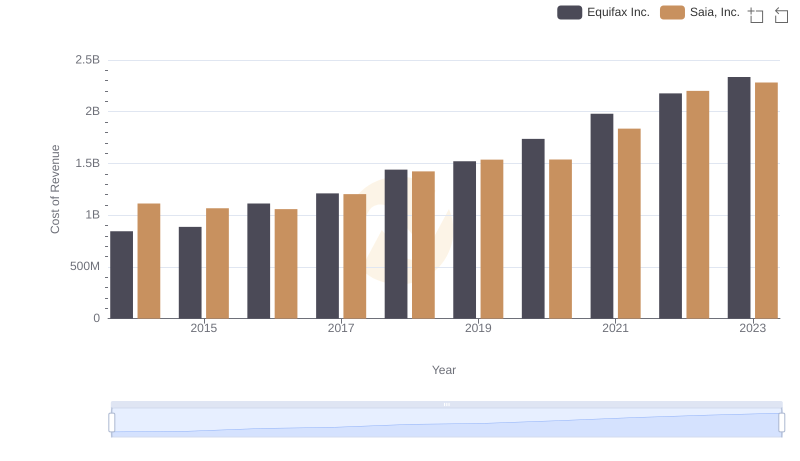

Analyzing Cost of Revenue: Equifax Inc. and Saia, Inc.

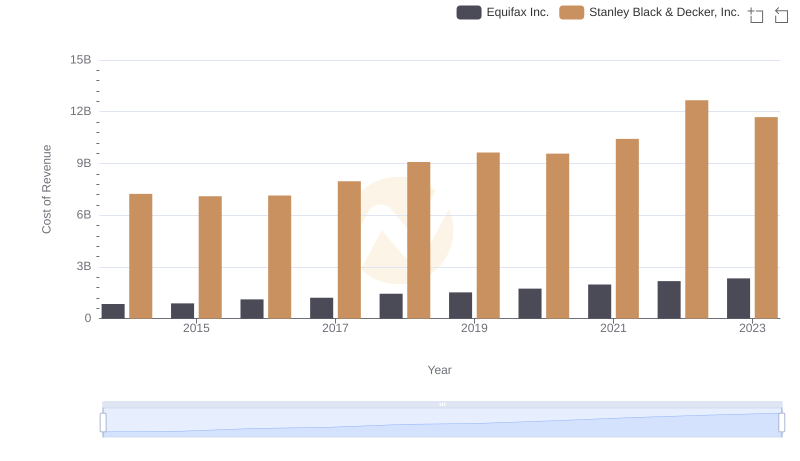

Cost of Revenue Trends: Equifax Inc. vs Stanley Black & Decker, Inc.

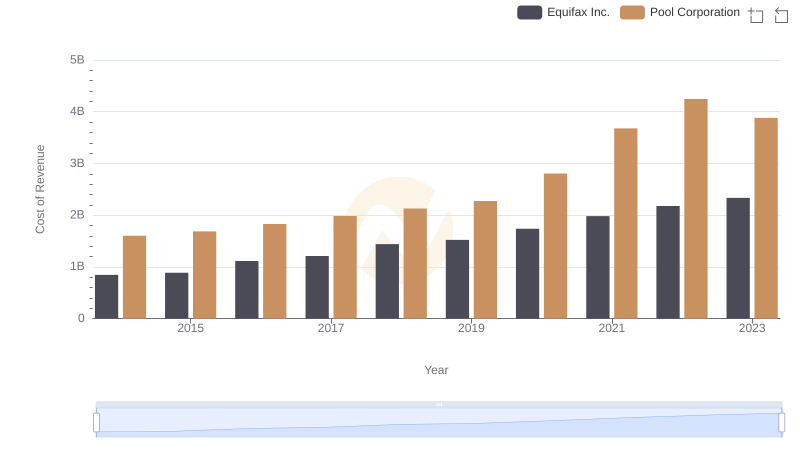

Cost of Revenue Comparison: Equifax Inc. vs Pool Corporation

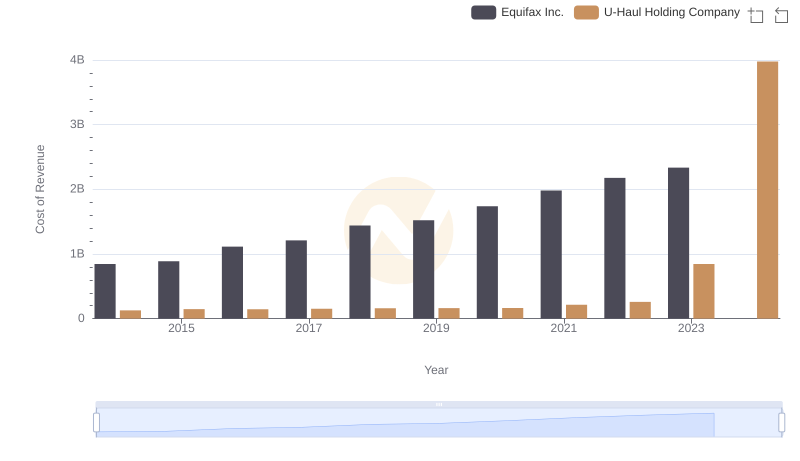

Cost of Revenue Comparison: Equifax Inc. vs U-Haul Holding Company

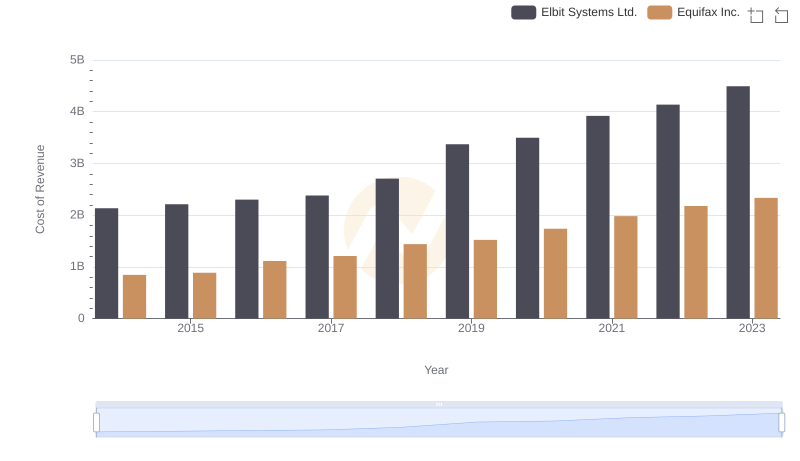

Cost of Revenue Comparison: Equifax Inc. vs Elbit Systems Ltd.

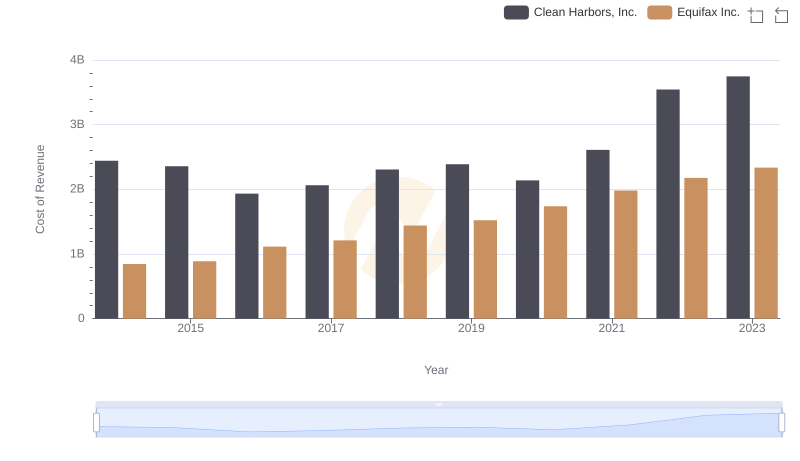

Comparing Cost of Revenue Efficiency: Equifax Inc. vs Clean Harbors, Inc.

Equifax Inc. or Curtiss-Wright Corporation: Who Manages SG&A Costs Better?