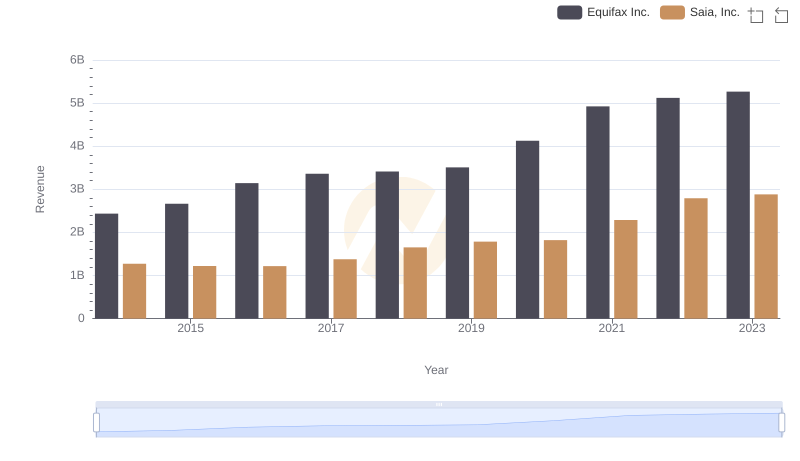

| __timestamp | Equifax Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 1113053000 |

| Thursday, January 1, 2015 | 887400000 | 1067191000 |

| Friday, January 1, 2016 | 1113400000 | 1058979000 |

| Sunday, January 1, 2017 | 1210700000 | 1203464000 |

| Monday, January 1, 2018 | 1440400000 | 1423779000 |

| Tuesday, January 1, 2019 | 1521700000 | 1537082000 |

| Wednesday, January 1, 2020 | 1737400000 | 1538518000 |

| Friday, January 1, 2021 | 1980900000 | 1837017000 |

| Saturday, January 1, 2022 | 2177200000 | 2201094000 |

| Sunday, January 1, 2023 | 2335100000 | 2282501000 |

| Monday, January 1, 2024 | 0 |

Unleashing the power of data

In the ever-evolving landscape of American business, understanding the cost of revenue is crucial for evaluating a company's financial health. This analysis delves into the cost of revenue trends for Equifax Inc. and Saia, Inc. from 2014 to 2023. Over this period, Equifax's cost of revenue surged by approximately 176%, while Saia's increased by around 105%. Notably, both companies experienced significant growth in 2022, with Equifax reaching a peak of $2.18 billion and Saia closely following at $2.20 billion. This upward trajectory highlights the dynamic nature of their respective industries, with Equifax in data analytics and Saia in transportation. As we look to the future, these trends offer valuable insights into how these companies are navigating economic challenges and opportunities. Stay tuned for more in-depth analyses of financial trends shaping the business world.

Comparing Revenue Performance: Equifax Inc. or Saia, Inc.?

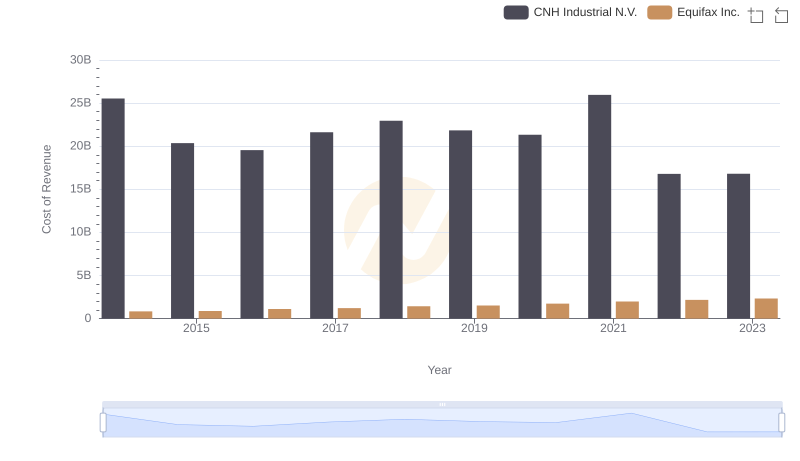

Cost of Revenue Trends: Equifax Inc. vs CNH Industrial N.V.

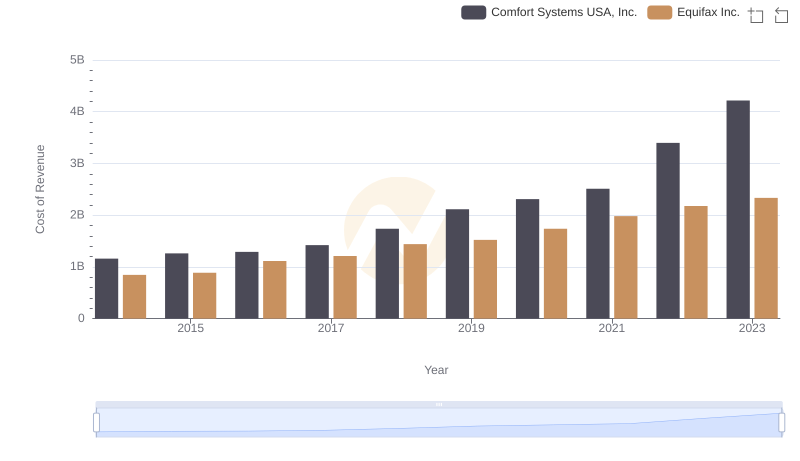

Analyzing Cost of Revenue: Equifax Inc. and Comfort Systems USA, Inc.

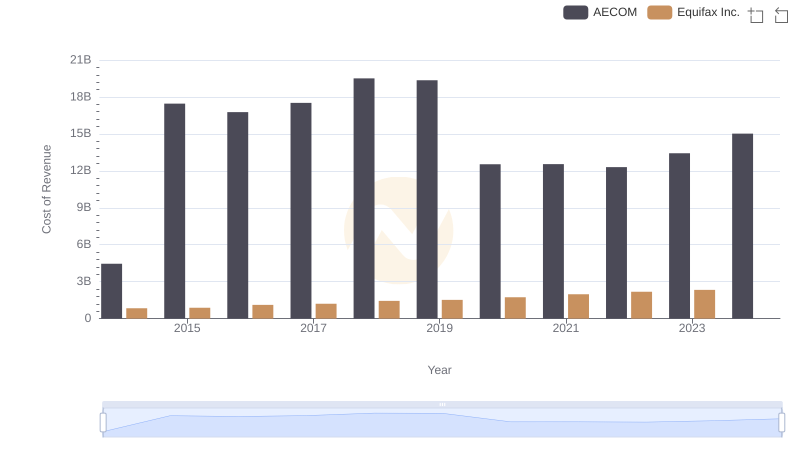

Equifax Inc. vs AECOM: Efficiency in Cost of Revenue Explored

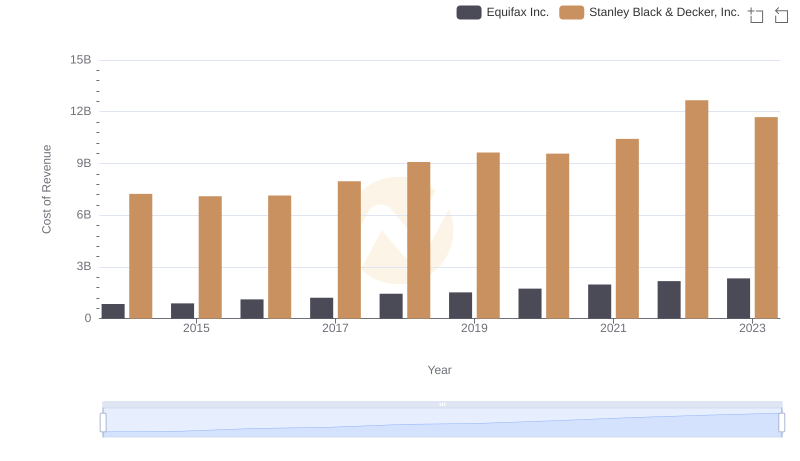

Cost of Revenue Trends: Equifax Inc. vs Stanley Black & Decker, Inc.

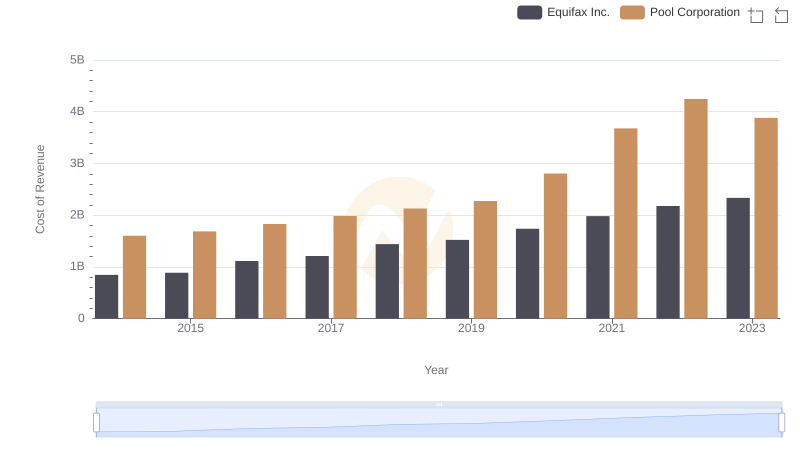

Cost of Revenue Comparison: Equifax Inc. vs Pool Corporation

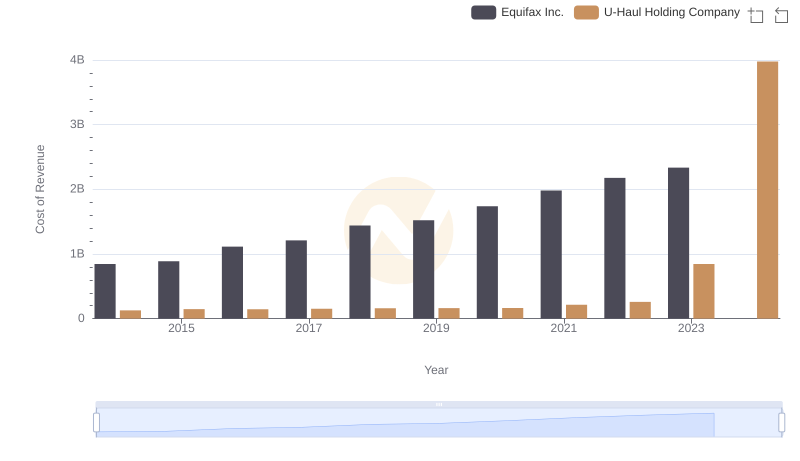

Cost of Revenue Comparison: Equifax Inc. vs U-Haul Holding Company

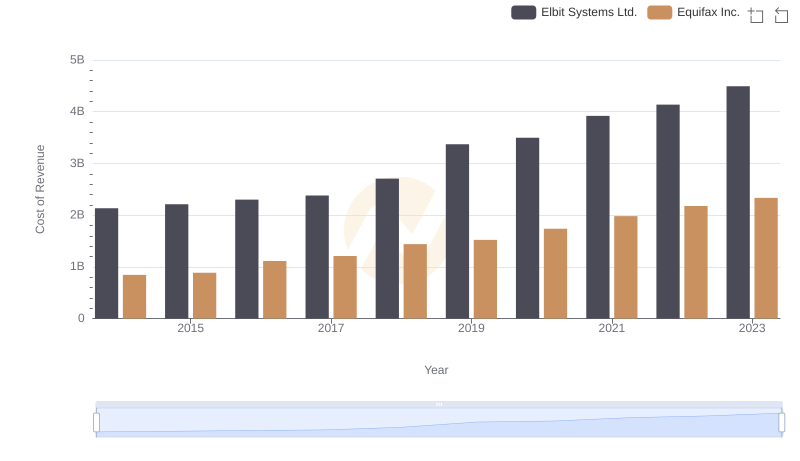

Cost of Revenue Comparison: Equifax Inc. vs Elbit Systems Ltd.

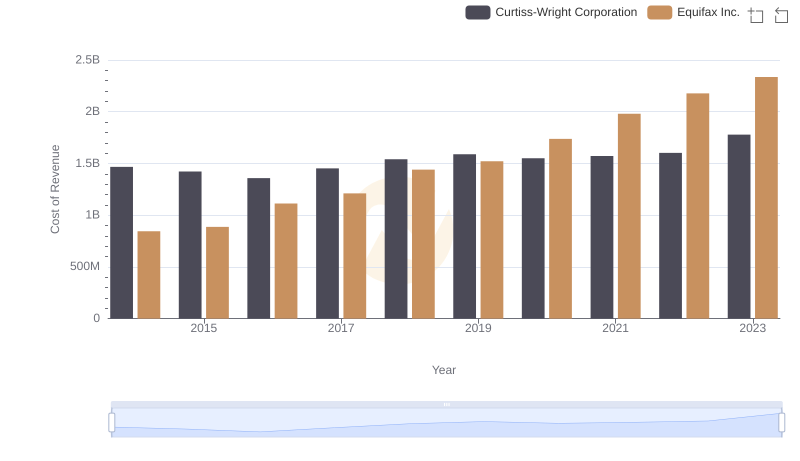

Cost of Revenue Trends: Equifax Inc. vs Curtiss-Wright Corporation

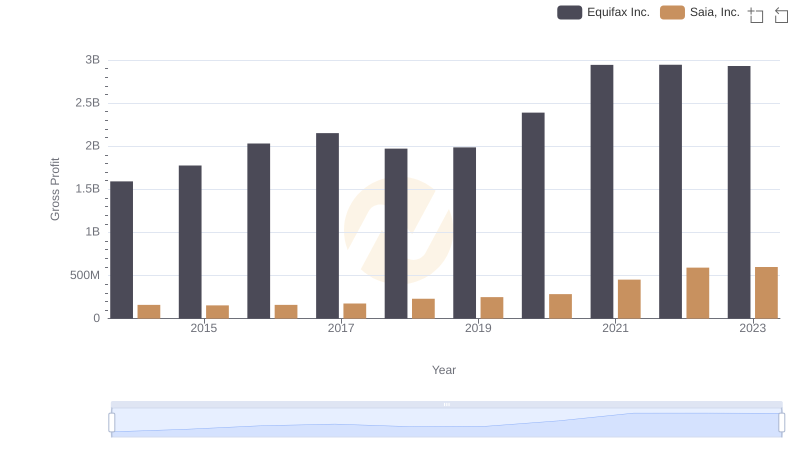

Who Generates Higher Gross Profit? Equifax Inc. or Saia, Inc.

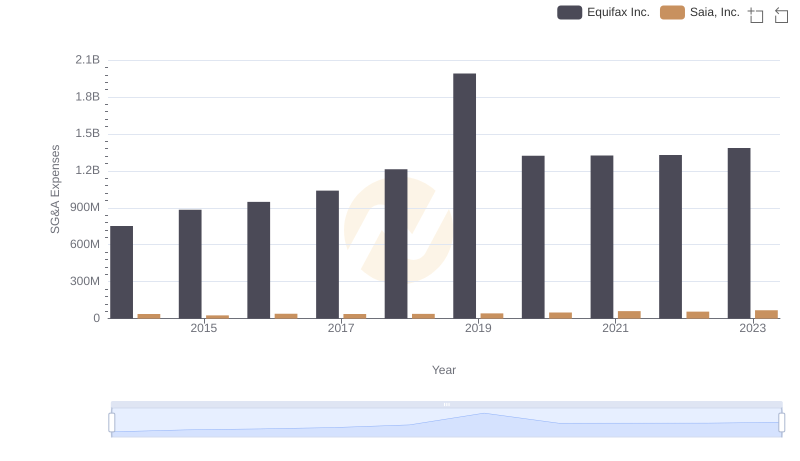

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Saia, Inc.