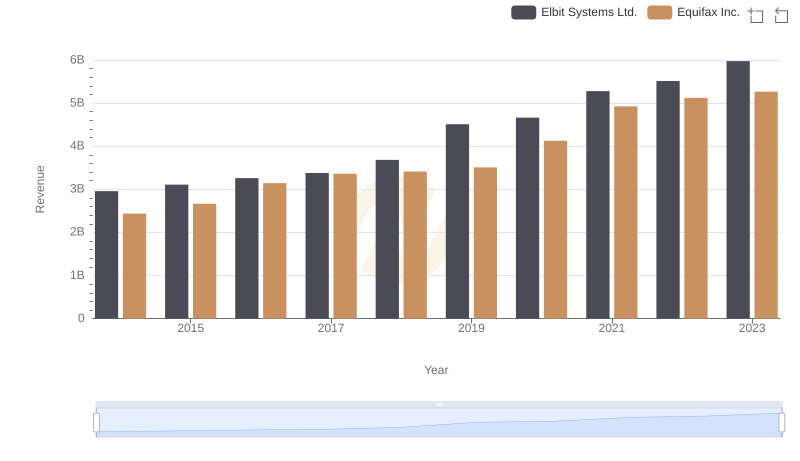

| __timestamp | Elbit Systems Ltd. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2133151000 | 844700000 |

| Thursday, January 1, 2015 | 2210528000 | 887400000 |

| Friday, January 1, 2016 | 2300636000 | 1113400000 |

| Sunday, January 1, 2017 | 2379905000 | 1210700000 |

| Monday, January 1, 2018 | 2707505000 | 1440400000 |

| Tuesday, January 1, 2019 | 3371933000 | 1521700000 |

| Wednesday, January 1, 2020 | 3497465000 | 1737400000 |

| Friday, January 1, 2021 | 3920473000 | 1980900000 |

| Saturday, January 1, 2022 | 4138266000 | 2177200000 |

| Sunday, January 1, 2023 | 4491790000 | 2335100000 |

| Monday, January 1, 2024 | 0 |

Unlocking the unknown

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's efficiency and profitability. This comparison between Equifax Inc. and Elbit Systems Ltd. offers a fascinating glimpse into their financial journeys from 2014 to 2023.

Equifax, a leader in consumer credit reporting, has seen its cost of revenue grow steadily, increasing by approximately 176% over the decade. This growth reflects its expanding operations and investments in data security and analytics.

Meanwhile, Elbit Systems, a prominent player in defense electronics, has experienced a 110% rise in its cost of revenue. This increase underscores its strategic expansions and technological advancements in defense solutions.

While both companies have shown significant growth, Elbit Systems consistently maintains a higher cost of revenue, highlighting its larger scale of operations compared to Equifax. This data provides valuable insights for investors and analysts alike, offering a window into the financial health and strategic priorities of these industry leaders.

Equifax Inc. or Elbit Systems Ltd.: Who Leads in Yearly Revenue?

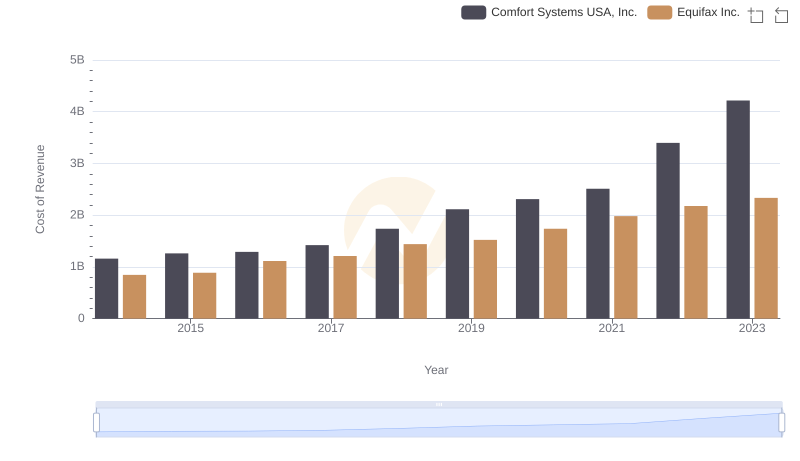

Analyzing Cost of Revenue: Equifax Inc. and Comfort Systems USA, Inc.

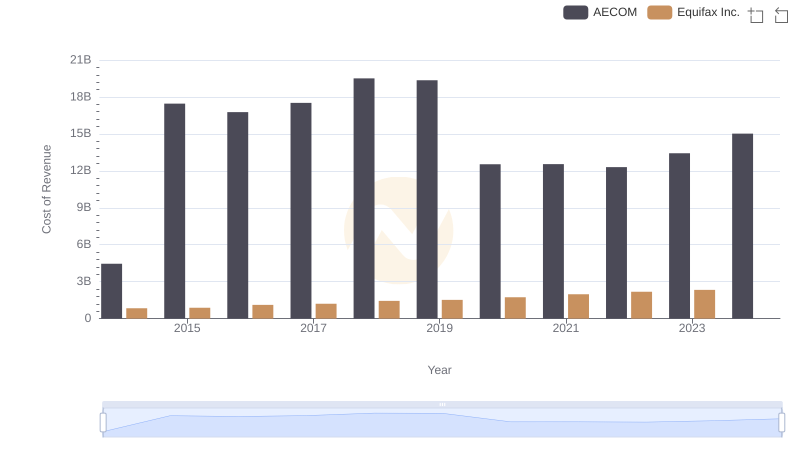

Equifax Inc. vs AECOM: Efficiency in Cost of Revenue Explored

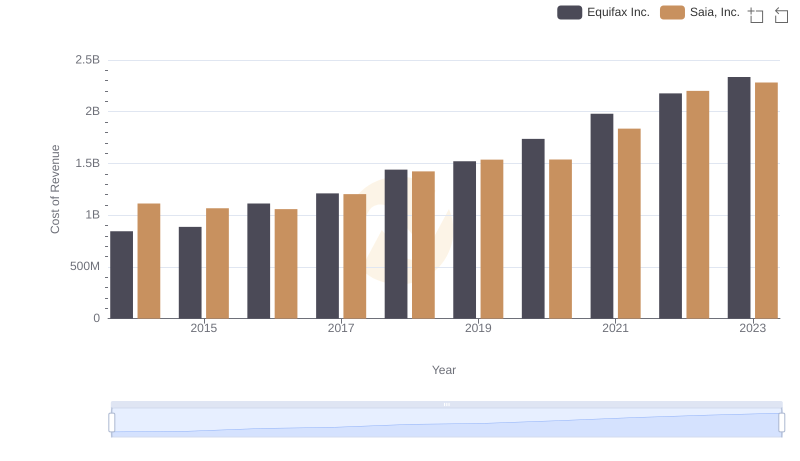

Analyzing Cost of Revenue: Equifax Inc. and Saia, Inc.

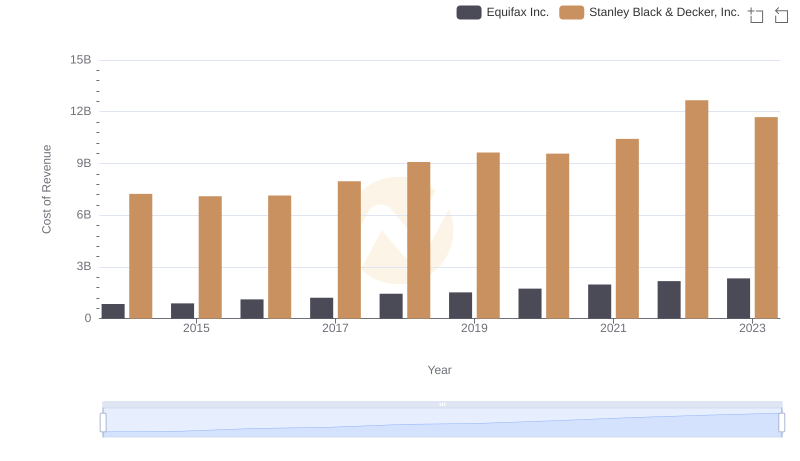

Cost of Revenue Trends: Equifax Inc. vs Stanley Black & Decker, Inc.

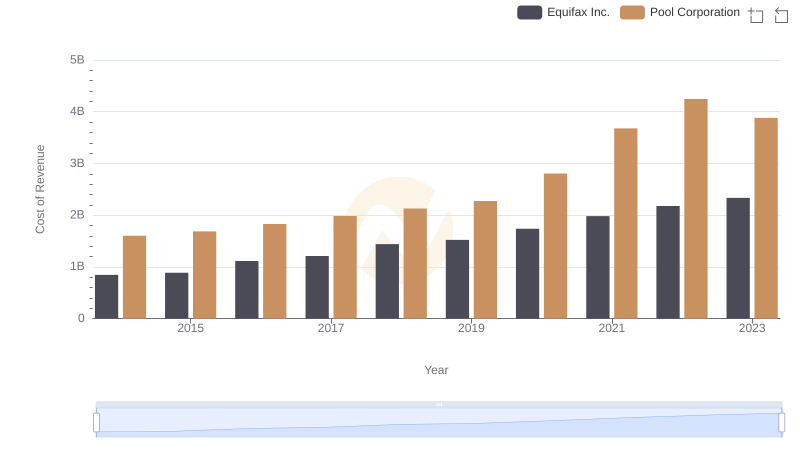

Cost of Revenue Comparison: Equifax Inc. vs Pool Corporation

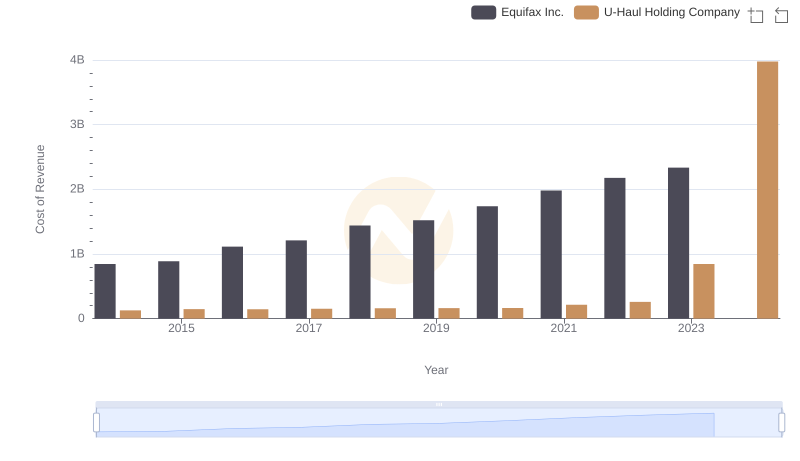

Cost of Revenue Comparison: Equifax Inc. vs U-Haul Holding Company

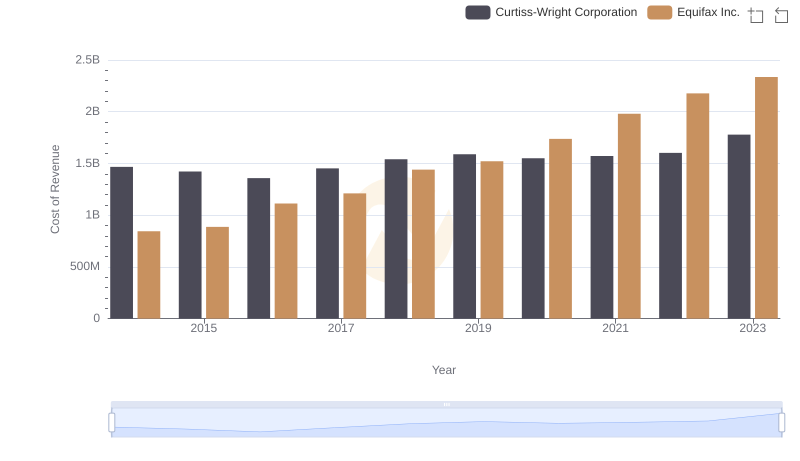

Cost of Revenue Trends: Equifax Inc. vs Curtiss-Wright Corporation

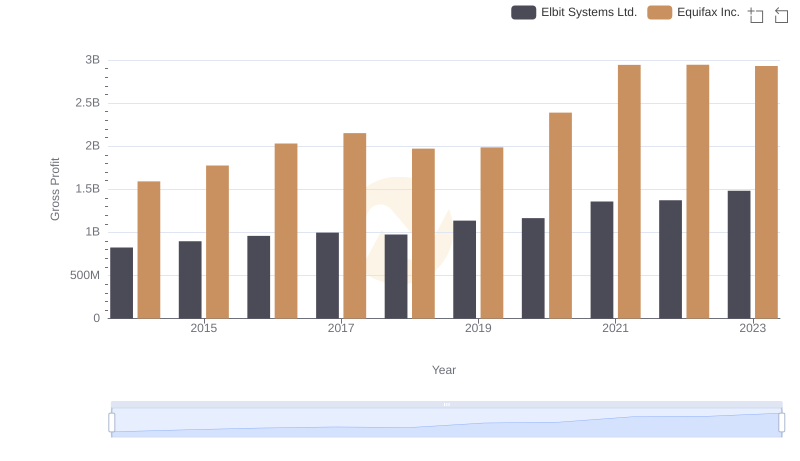

Gross Profit Analysis: Comparing Equifax Inc. and Elbit Systems Ltd.

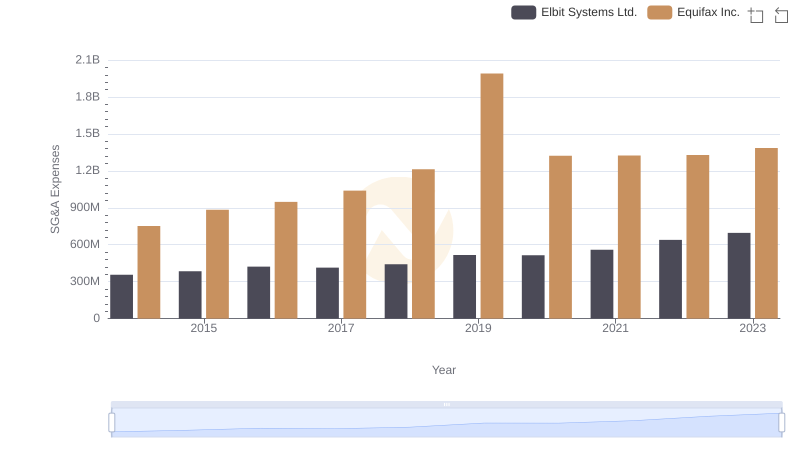

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Elbit Systems Ltd.

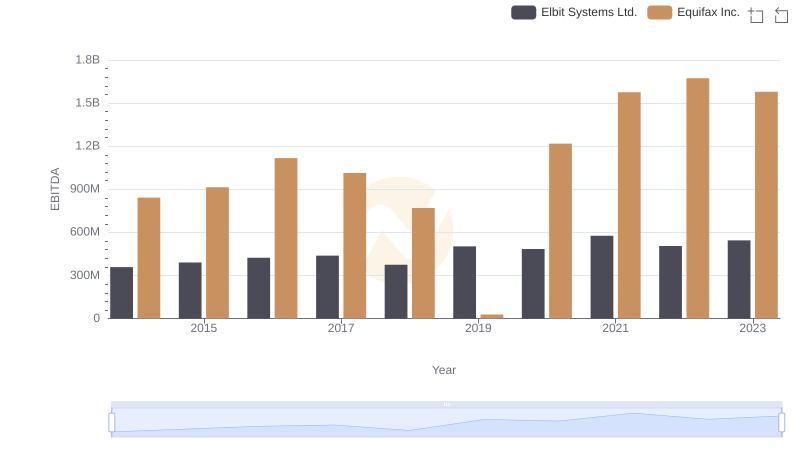

Comparative EBITDA Analysis: Equifax Inc. vs Elbit Systems Ltd.