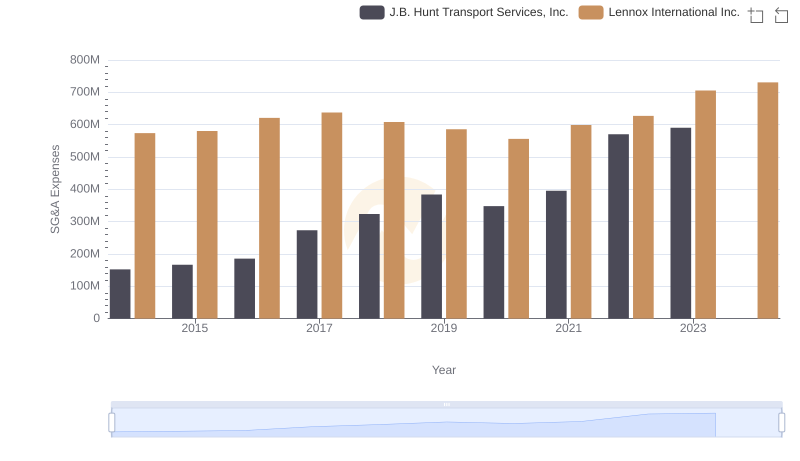

| __timestamp | J.B. Hunt Transport Services, Inc. | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 926038000 | 387700000 |

| Thursday, January 1, 2015 | 1055307000 | 423600000 |

| Friday, January 1, 2016 | 1082601000 | 490800000 |

| Sunday, January 1, 2017 | 1007307000 | 562900000 |

| Monday, January 1, 2018 | 1116914000 | 575200000 |

| Tuesday, January 1, 2019 | 1274241000 | 633300000 |

| Wednesday, January 1, 2020 | 713119000 | 553900000 |

| Friday, January 1, 2021 | 1045530000 | 652500000 |

| Saturday, January 1, 2022 | 1331553000 | 729000000 |

| Sunday, January 1, 2023 | 1738774000 | 879500000 |

| Monday, January 1, 2024 | 1034800000 |

Unleashing the power of data

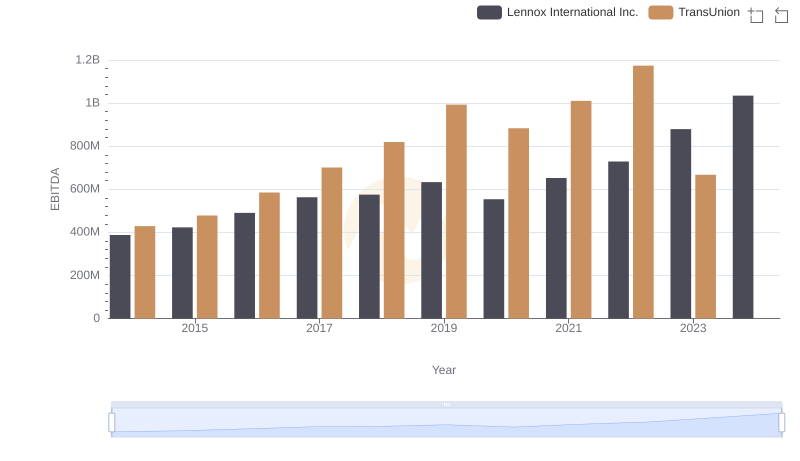

In the ever-evolving landscape of American industry, Lennox International Inc. and J.B. Hunt Transport Services, Inc. stand as titans in their respective fields. From 2014 to 2023, these companies have demonstrated remarkable financial resilience, as evidenced by their EBITDA performance.

J.B. Hunt, a leader in transportation services, showcased a robust growth trajectory, with EBITDA increasing by approximately 88% over the decade. Notably, 2023 marked a peak, with EBITDA reaching nearly 1.74 billion, a testament to their strategic expansions and operational efficiencies.

Conversely, Lennox International, a stalwart in climate control solutions, exhibited steady growth, with EBITDA rising by about 168% from 2014 to 2023. Despite a dip in 2020, Lennox rebounded strongly, culminating in an impressive 1.03 billion EBITDA in 2023.

This analysis underscores the dynamic nature of these industries and the strategic prowess of these companies.

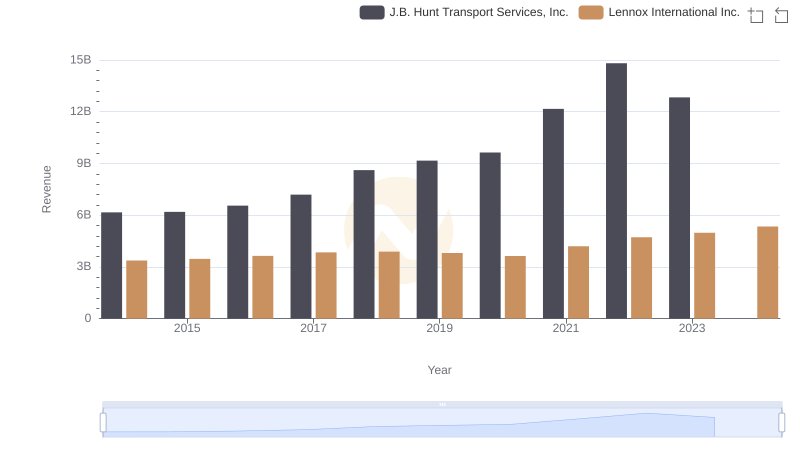

Lennox International Inc. or J.B. Hunt Transport Services, Inc.: Who Leads in Yearly Revenue?

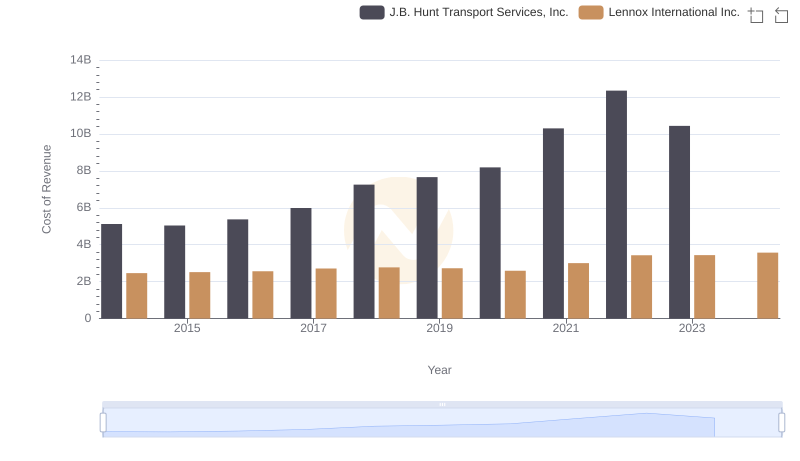

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs J.B. Hunt Transport Services, Inc.

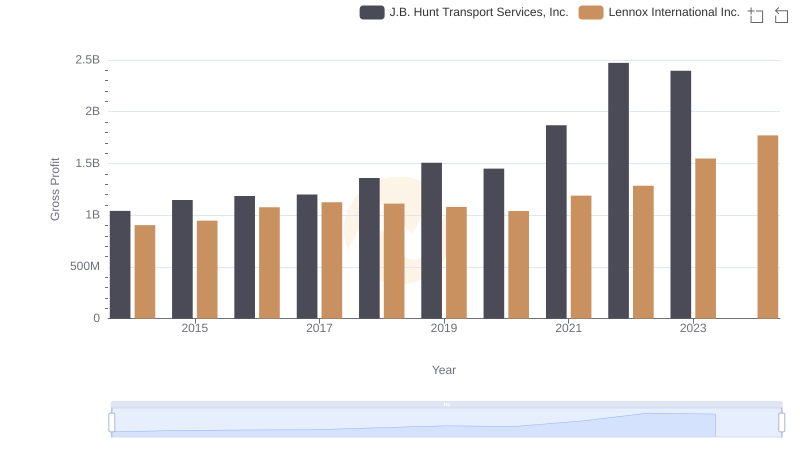

Lennox International Inc. and J.B. Hunt Transport Services, Inc.: A Detailed Gross Profit Analysis

EBITDA Performance Review: Lennox International Inc. vs TransUnion

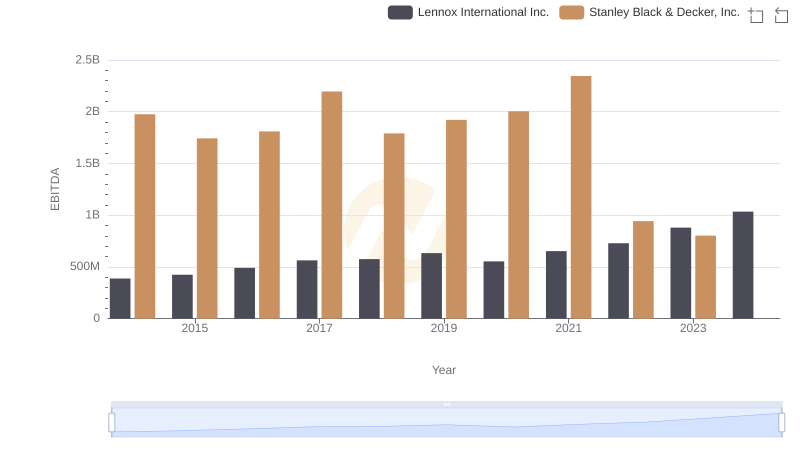

A Professional Review of EBITDA: Lennox International Inc. Compared to Stanley Black & Decker, Inc.

SG&A Efficiency Analysis: Comparing Lennox International Inc. and J.B. Hunt Transport Services, Inc.

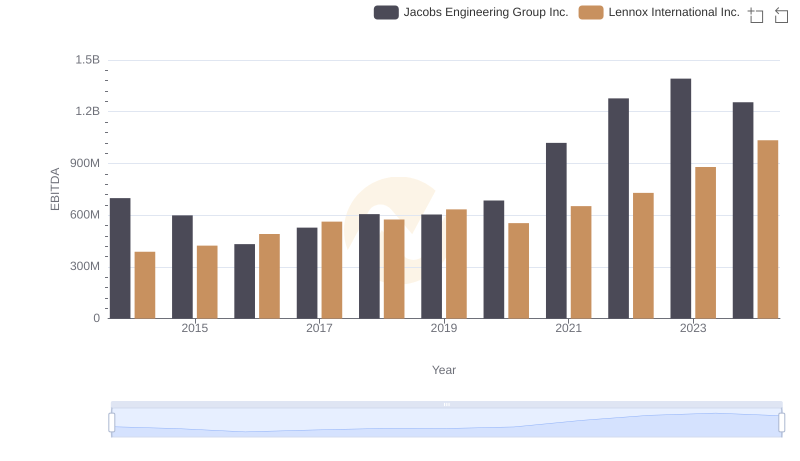

Lennox International Inc. and Jacobs Engineering Group Inc.: A Detailed Examination of EBITDA Performance

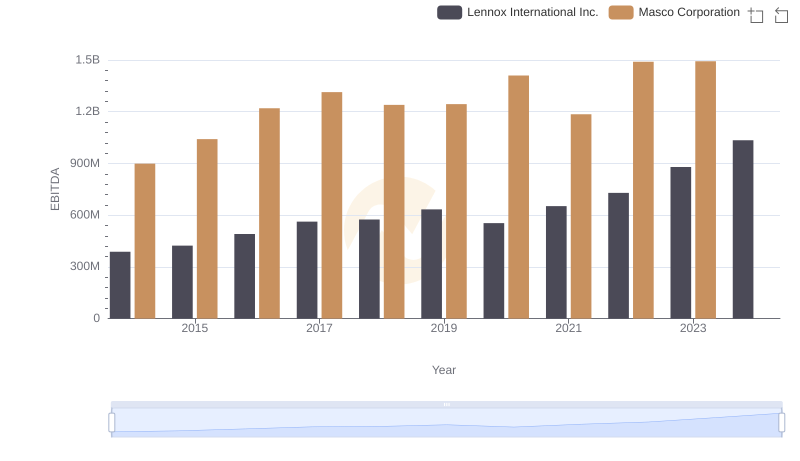

Comprehensive EBITDA Comparison: Lennox International Inc. vs Masco Corporation

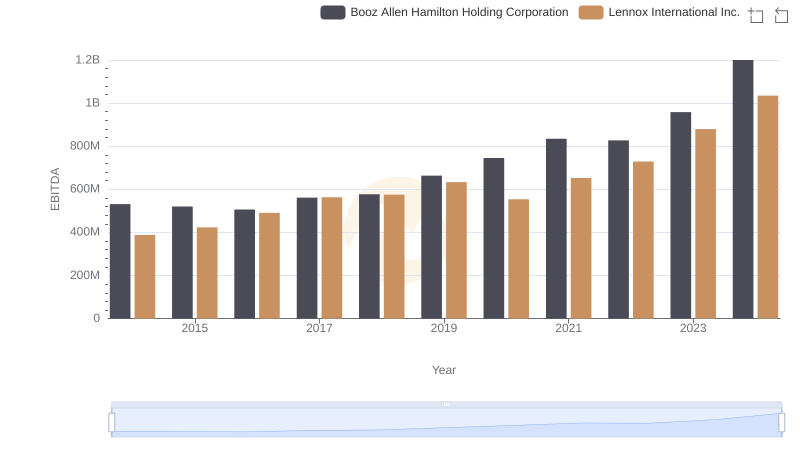

A Side-by-Side Analysis of EBITDA: Lennox International Inc. and Booz Allen Hamilton Holding Corporation

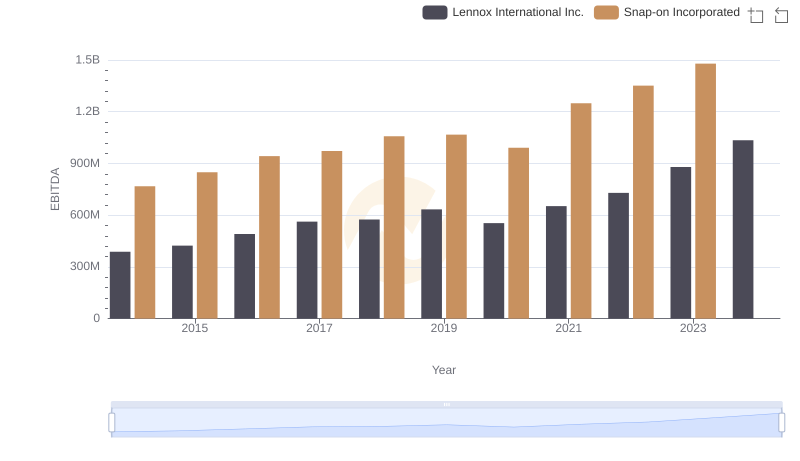

Lennox International Inc. and Snap-on Incorporated: A Detailed Examination of EBITDA Performance

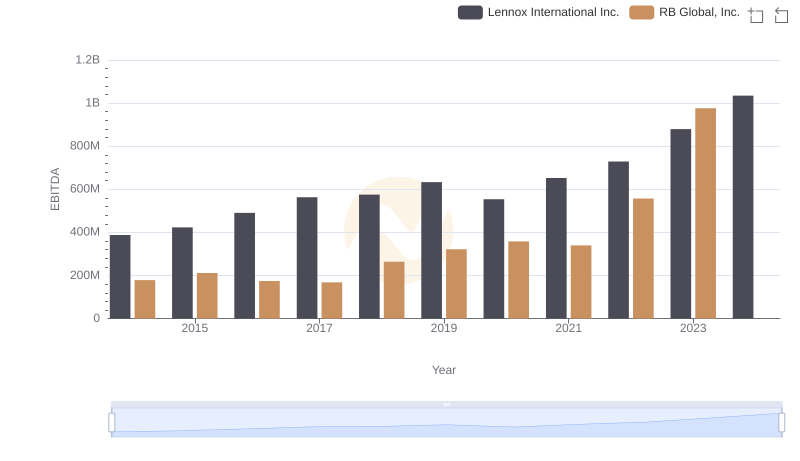

Lennox International Inc. and RB Global, Inc.: A Detailed Examination of EBITDA Performance

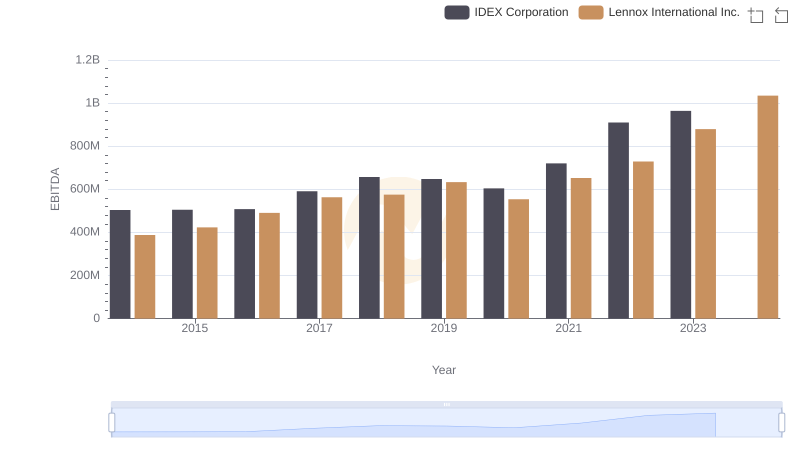

A Professional Review of EBITDA: Lennox International Inc. Compared to IDEX Corporation