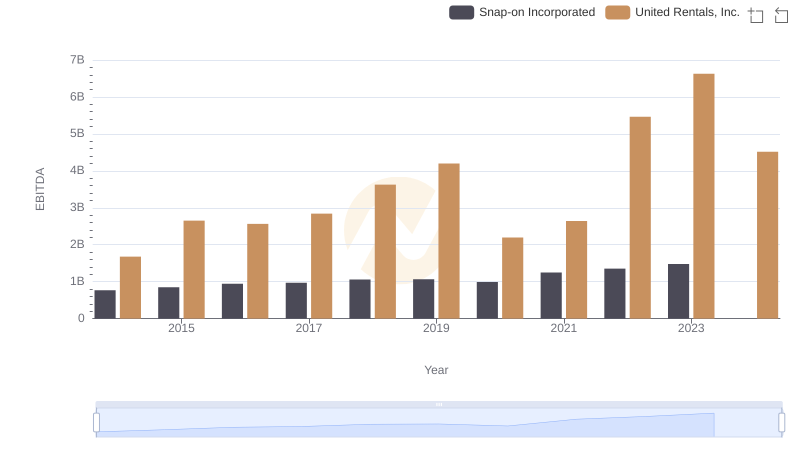

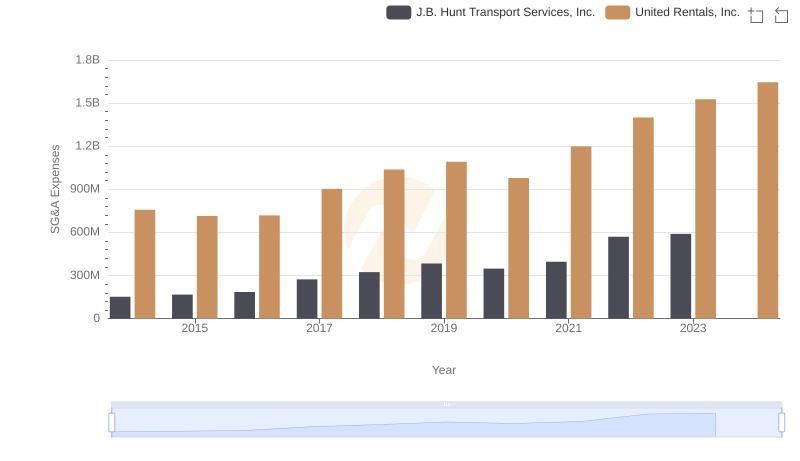

| __timestamp | J.B. Hunt Transport Services, Inc. | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 926038000 | 1678000000 |

| Thursday, January 1, 2015 | 1055307000 | 2653000000 |

| Friday, January 1, 2016 | 1082601000 | 2566000000 |

| Sunday, January 1, 2017 | 1007307000 | 2843000000 |

| Monday, January 1, 2018 | 1116914000 | 3628000000 |

| Tuesday, January 1, 2019 | 1274241000 | 4200000000 |

| Wednesday, January 1, 2020 | 713119000 | 2195000000 |

| Friday, January 1, 2021 | 1045530000 | 2642000000 |

| Saturday, January 1, 2022 | 1331553000 | 5464000000 |

| Sunday, January 1, 2023 | 1738774000 | 6627000000 |

| Monday, January 1, 2024 | 4516000000 |

Infusing magic into the data realm

In the ever-evolving landscape of American industry, United Rentals, Inc. and J.B. Hunt Transport Services, Inc. have emerged as titans in their respective fields. Over the past decade, United Rentals has consistently outperformed J.B. Hunt in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, United Rentals' EBITDA surged by nearly 295%, peaking in 2023, while J.B. Hunt's EBITDA grew by approximately 88% during the same period. This stark contrast highlights United Rentals' strategic prowess in capitalizing on market opportunities. Notably, 2020 marked a challenging year for both companies, with J.B. Hunt experiencing a dip to its lowest EBITDA in the decade. As we look to 2024, United Rentals continues to demonstrate resilience, although data for J.B. Hunt remains elusive. This analysis underscores the dynamic nature of the industrial sector and the importance of strategic agility.

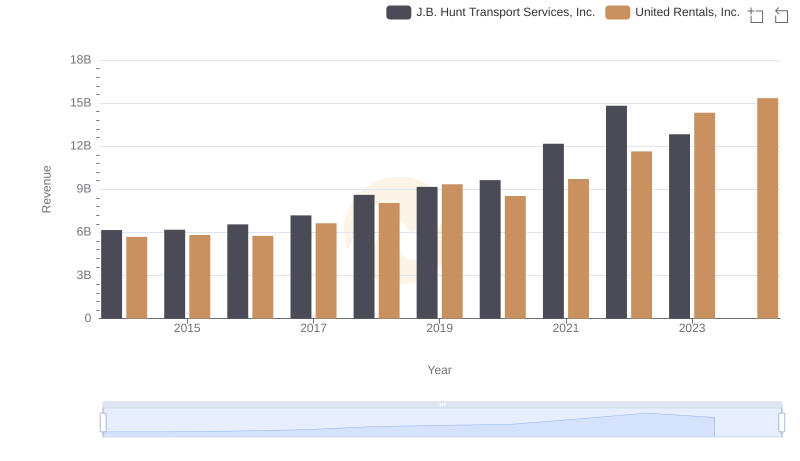

United Rentals, Inc. vs J.B. Hunt Transport Services, Inc.: Examining Key Revenue Metrics

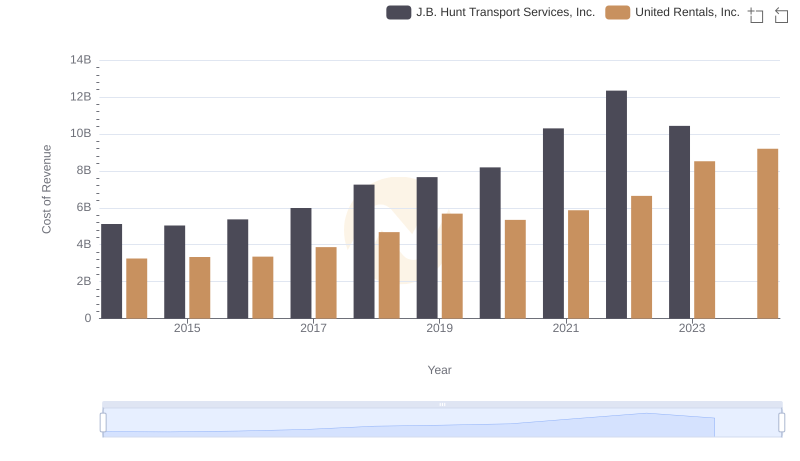

Cost of Revenue Comparison: United Rentals, Inc. vs J.B. Hunt Transport Services, Inc.

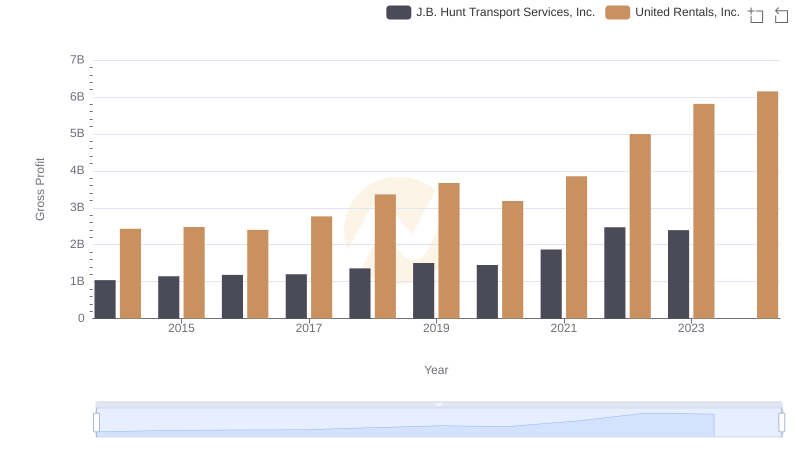

Gross Profit Comparison: United Rentals, Inc. and J.B. Hunt Transport Services, Inc. Trends

Comparative EBITDA Analysis: United Rentals, Inc. vs Snap-on Incorporated

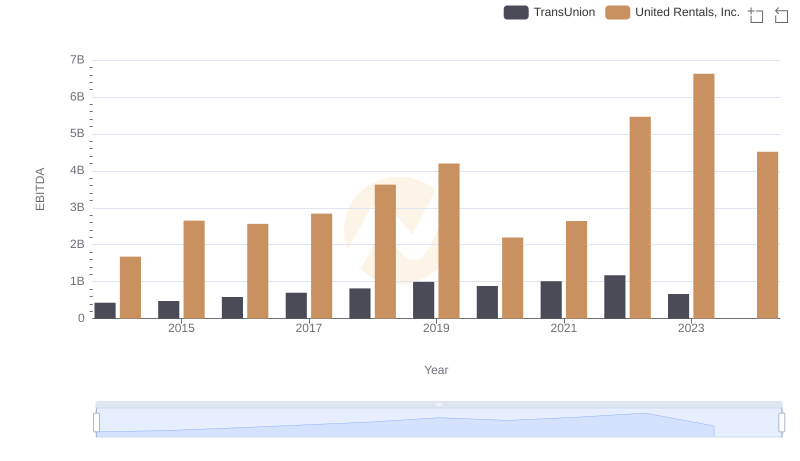

EBITDA Performance Review: United Rentals, Inc. vs TransUnion

Breaking Down SG&A Expenses: United Rentals, Inc. vs J.B. Hunt Transport Services, Inc.

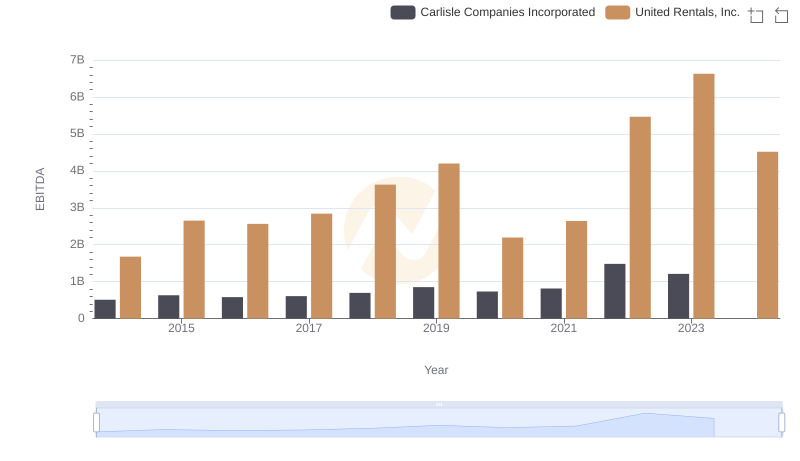

EBITDA Analysis: Evaluating United Rentals, Inc. Against Carlisle Companies Incorporated

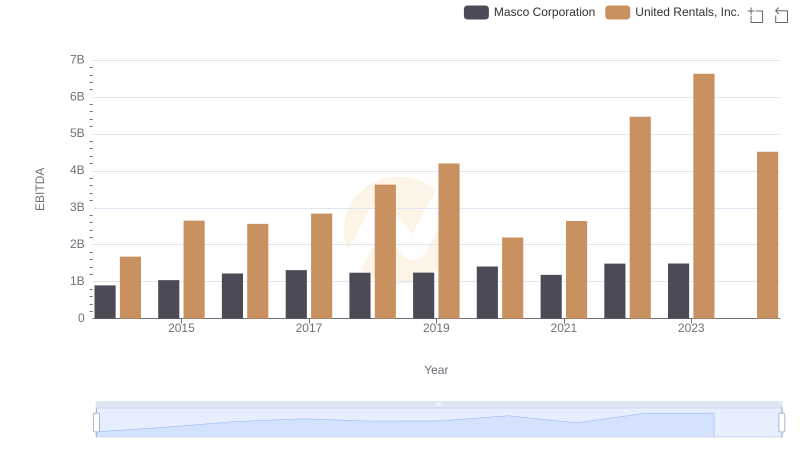

United Rentals, Inc. and Masco Corporation: A Detailed Examination of EBITDA Performance

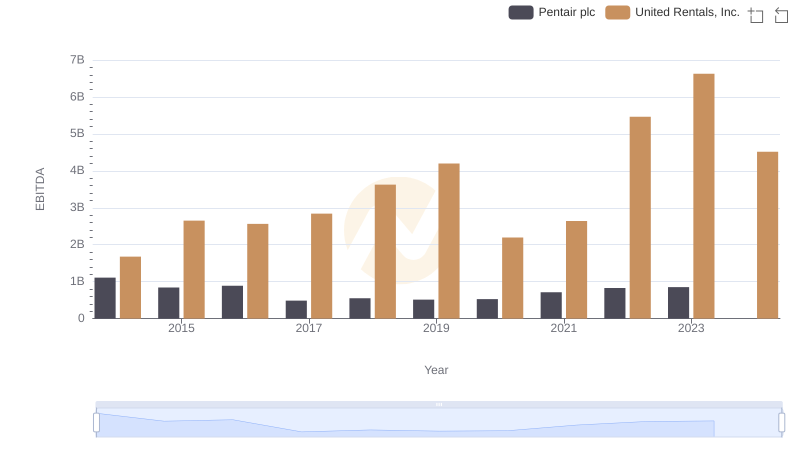

Comprehensive EBITDA Comparison: United Rentals, Inc. vs Pentair plc

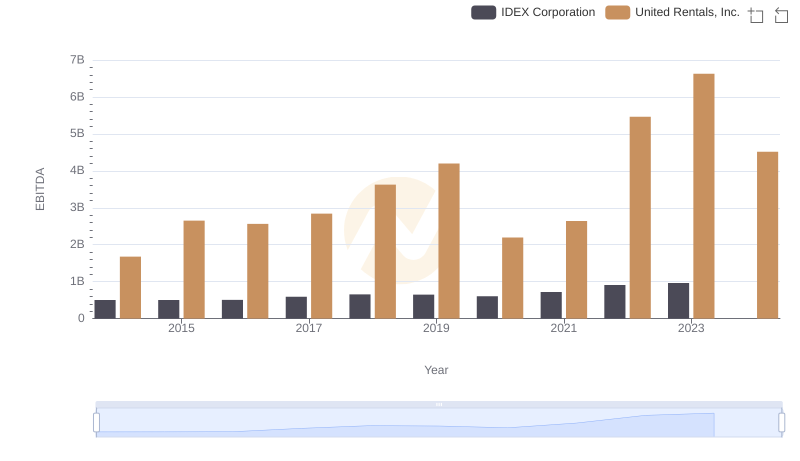

Comparative EBITDA Analysis: United Rentals, Inc. vs IDEX Corporation

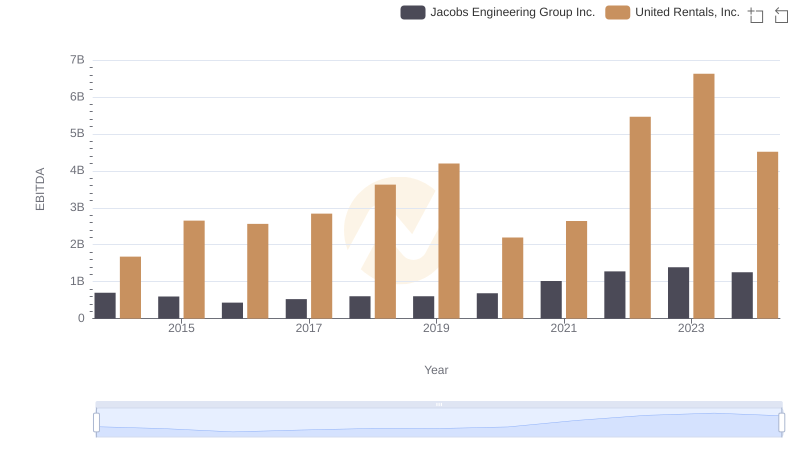

EBITDA Performance Review: United Rentals, Inc. vs Jacobs Engineering Group Inc.